NOTICE: This post references card features that have changed, expired, or are not currently available

One of my favorite tricks for saving money while increasing credit card spend is to buy gift cards at OfficeMax using one of my American Express business cards. Amex business cards come with a perk called OPEN Savings. With this program, you automatically receive rebates in the form of statement credits when using your card at certain merchants. With OfficeMax, you currently get back 5% of any purchases of $100 or more (see image).

I regularly stop by my local OfficeMax to buy gift cards totaling $100 or more. If you can find gift cards you can really use, this can be a big win. Even $200 Visa gift cards with $6.95 fees are a decent deal: After 5% cash back, you end up with 1.7% in savings.

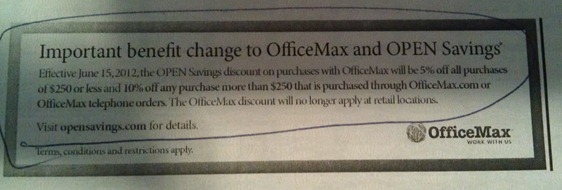

Sadly, though, this deal is coming to an end. A friend who goes by the handle greek2me sent me this notice that he received in the mail with his SPG card bill:

Starting June 15th, in store purchases won’t count! Since OfficeMax doesn’t sell gift cards online (other than their own), this will effectively kill the gift card gravy train.

On the other hand, they will start giving 10% back for purchases greater than $250 made online. This could be quite lucrative if/when OfficeMax carries Free After Rebate products, especially if we stack this discount with points or cash back from a shopping portal. Also, OfficeMax frequently sells items with 100% back in rewards. Any time they have enough of these to total $250, I’ll let you know!

I also wonder what would happen if we bought OfficeMax gift cards online and then used them in store. Would they allow purchase of other gift cards using their gift card? It’s unlikely, but you never know. I guess it’s time to add new experiments to the Frequent Miler Laboratory to-do list!

Stay informed:

Follow me on Twitter / Like me on Facebook / Join the Club

If you’re new to Frequent Miler, please start here

MaskofZor: interesting! The new rules are clearly written on the Amex OPEN site, but maybe they’re not enforced yet.

I bought GC’s at OM on 06/26 and can confirm that I did receive the 5% CB on my Amex Premier Gold business card. Have they not pulled the plug on this yet?

Hello FrequentMiler,

Firstly, glad to know that the “Notify of new posts by email” feature is added to this post 🙂

Secondly, I would like to know if you (or anyone you know) had success in buying gift cards (amazon/ebay/visa/amex..any) at Officemax using Officemax gift cards??

Srini: I’m glad to have the notify feature too! Yes, one reader reported success in using OfficeMax gift cards to buy other gift cards. I haven’t yet tried it myself, but I hope to soon.

Thank you, @FM.

I’m planning to try my luck in a week…will keep you posted..in the meanwhile, I will like to hear from you about your experience, if there are any updates.

Thanks,

Srini

Edward: UR points can be transferred to United miles, but not to AA miles. Yes, it is free to do that transfer, but you must have an Ink Bold or Sapphire Preferred card to do the transfer

@edward, what is your source for saying that Chase UR points can be exchanged for advantage miles (which I assume means American Airlines Aadvantage miles)? I didn’t know that.

Oh nooooooooooooooooooooooooo! I have already maxed out my INK office supply category 5x spending for the year, so I was using this deal instead. But no more. Nooooooooooooooooooooooooo!

I have an Amex Gold Business Card. My wife has the Amex Pt Business Card.

Haven’t seen anything yet on our cards (!) that indicates OPEN changes, re: Office Max.

i have about 224k advantage miles and 56k united miles.

i will soon have 90k chase UR points which i know is transferable to both united & advantage miles without any fees, right? no fee to transfer right? I am not sure if i will transfer my chase points to any of those airline account but if it is the best thing i could do, i would do it.

my main question is WHICH OF THE 2 IS MORE VALUABLE? united miles or advantage miles?

i found out that value for flights within US is same thing which is 12.5k miles for one way, 25k miles for roundtrip, united or advantage.

which one i should value more and when i get my 90k points this month, what should i do? transfer to airline account , if so, which one?

i have 80k priority points also which i dont like cos with miles you can stay at 3 star for less than 10k miles but with hotel points it is mostly above 20k points.

thanks

edward: The best use is to use them for hotel stays. An excellent alternate use is to transfer them to high value airline miles (such as United)

today i received the 2 16k or total of 32,000 wyndham rewards points for last month’s DAILY GATEWAY super8 motel or whatever deal that was. paid total of $99 with amex.

What’s the best use of this 2 16k points?

The online 10% cashback will not be stackable with other cashback or mileage malls, at least not if it’s structured the same way that Amex Link, Like, Love promos are.

Krushal: Thanks for the heads up about OM! I’ll update the Laboratory page and move that experiment to the completed section.

Ford: Yep, Amex bluecash preferred is pretty awesome with its 6% cash back. However, if you value miles at at least 1 cent each, then using another card like SPG business at OfficeMax is at least as good as 6% cash back (you get 5% cash back plus the 1 point per dollar).

edward: SP gives 2X for travel and dining, not for gas. Ink Bold gives 2X for gas. I understand not wanting to pay annual fees, but if you spend a decent amount it is often worth it. Take the bluecash preferred, for example. It is $75/year and earns 6% at grocery stores. Compare that to 3% for the no annual fee bluecash everyday card. Since you earn 3% more at grocery stores with the preferred, you would only have to spend $50 per week on groceries in order to come out ahead with the preferred card! Similar arguments could be made in favor of the Ink Bold, which doesn’t have the problem of being an Amex card. Even better, there are two variations on the Ink Bold that have no annual fee: the Ink Cash and the Ink Classic. Both have 5X at office supply stores!

HansGolden: I think it will be stackable. The OPEN Savings program works automatically without registration and without having to go through any particular links. I’ve stacked UR Mall points with OPEN Savings many times (via Barnes & Noble, for example)

i wanted to apply for amex blue cash preferred card instead of the boa visa cash card but since the local grocery stores we frequent to DON’T ACCEPT AMEX, I went for boa visa cash card.

i have the amex simply cash card, the silver color and am sure it is a biz card.

I HAVE BEEN USING IT VERY EXTENSIVLY for the last 4 yrs at gas stations and to pay my cell phone bill. i get 3% credit on gas and 5% credit for cell phone bills.

it used to be 5% back on gas but they changed it to only 3% in 2008. it has no annual fee so it is a great card but now since i have the chase ink bold 5 UR points on cell phone bill, and the chase SP with 2 UR points per dollar on gas. I might be using the ink bold only for cell phone bill and chase sp for gas but the annual fee on these 2 cards from next year will be a BIG TURN OFF for me. I also have the BOA visa cahs card that gives me 3% cash back on gas and 2% back on grocery always.

whats your thoughts here?

There wasn’t much reason for me to use this feature since I have Amex bluecash preferred and can snag an extra point on gift cards @ grocery stores. Upping it online is possibly interesting, though I was just looking a few days ago and lamenting the lack of any gift cards other than Office Max’s. I also was wondering why they didn’t do nice FAR deals like Staples, I look forward to some posts on it!

OM used to allow buying gcs with gc in stores. But last year I found out that some of the stores have started implementing alerts when buying gcs with gc. Its not allowed any more. I have tried 4 different stores close by. I am sure you will get 10% back when buying OM gc worth 250.