NOTICE: This post references card features that have changed, expired, or are not currently available

The Citi ThankYou Rewards program is weird, but in a good way — sort-of. If you have multiple ThankYou cards, you can keep your points separate by card or you can pool your points together. Chase, on the other hand, keeps all Ultimate Rewards points separate by card, but they let you freely move points from one card to another. Amex works the opposite way: all Membership Rewards points are automatically pooled together.

With both Citi and Amex, the advantage of pooling points together is that you automatically get the best redemption value that is available across cards you own. For example, the Premier card offers 1.25 cents per point value towards travel awards (flights, hotels, cruises, car rentals, etc.) whereas the Prestige card offers that value only for flights (and the ThankYou Preferred card offers at most 1 cent per point value anywhere). When your points are pooled together, though, you automatically get the 1.25 cents per point value for travel even if points were earned on your Preferred or Prestige card.

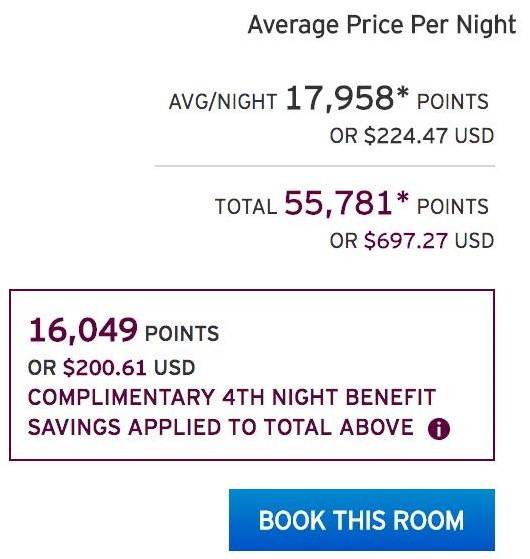

With the Prestige card, you can now book 4th Night Free hotels online (but you may not always want to). And, you can now pay with ThankYou points. If you also happen to have a Premier card, and you have the Prestige and Premier cards pooled together, you’ll get better value by paying with points. In this rare situation, you get the best value from both cards: 4th Night Free + 1.25 cents per point hotel award redemptions. These combine into a theoretical top per point value of 1.67 cents per point.

I’ve previously argued against pooling points with Citibank (see: Should you avoid pooling ThankYou accounts?). If you have this combo, though, it may be worth accepting the downsides of pooling points.

Scenario 1: $300 per night hotel. No taxes or fees

In this theoretical scenario, Citi’s online hotel search offers the best price you can find anywhere and this hotel somehow has no taxes or up-front fees. Let’s look at the value of ThankYou points when used to book a 4th Night Free reservation with and without the Premier card:

Without Premier Card

- 4 night stay would cost $1200

- Cost after 4th Night Free: $900

- Points required: 90,000

- Per point value: $1200 / 90,000 = 1.33 cents per point

With Pooled Premier Card

- 4 night stay would cost $1200

- Cost after 4th Night Free: $900

- Points required w/ Premier card: 90,000 / 1.25 = 72,000

- Per point value: $1200 / 72,000 = 1.67 cents per point

For the same reservation, cards that offer 1.5 cents per point value towards travel (e.g. US Bank Altitude Reserve, Chase Sapphire Reserve) would charge 80,000 points. The Prestige + Premier combo charges 72,000, which amounts to 10% fewer points. That said, the US Bank and Sapphire Reserve cards have no restrictions on number of nights booked in order to get 1.5 cents per point value. The Prestige + Premier combo requires booking exactly 4 nights to get this ideal 1.67 cents per point value.

Scenario 2: $300 per night after 15% taxes

In this more realistic scenario, Citi’s online hotel search offers the best price you can find anywhere and the hotel charges 15% in taxes. That means that this hotel’s rate, before taxes, is $261.

Without Premier Card

- 4 night stay would cost $1200

- Cost after 4th Night Free: $1200 – $261 = $939

- Points required: 93,900

- Per point value: $1200 / 93,900 = 1.28 cents per point

With Pooled Premier Card

- 4 night stay would cost $1200

- Cost after 4th Night Free: $939

- Points required w/ Premier card: 93,900 / 1.25 = 75,120

- Per point value: $1200 / 75,120 = 1.6 cents per point

1.6 cents per point value is still pretty darn good. That equals the best value we used to get with the Prestige card when using points to book American Airlines airfare (now all fight awards get only 1.25 cents per point value).

Wait, isn’t the value really just 1.25 cents per point?

If you compare the points paid to the amount that would be charged to your Prestige card, you get 1.25 cents per point value with a pooled Premier card and just 1 cent per point value without it. But if you compare the points paid to the amount you would have paid without the 4th Night Free benefit, you get the inflated point values show above. Which is correct?

Ultimately it depends on whether you compare the point price to the original hotel price or to the price after the 4th Night Free. If you compare to the former, then your pooled points are worth up to 1.67 cents each. If you compare to the latter, then they are worth exactly 1.25 cents each with the Premier card.

In other words, if you take it as a given that you are using the 4th Night Free benefit and you’re simply trying to decide whether to use points or pay with your Prestige card, then your points are worth 1.25 cents each with a pooled Premier card.

On the other hand, if you are trying to decide which points to use for a hotel stay, and if all paid price options are equal, the 1.6 to 1.67 per point value is accurate since you can’t use other point currencies to book 4th Night Free stays.

Is it worth having both cards?

The Prestige card costs $350 to $450 per year and offers $250 in annual airline credits. The Premier card costs $95 per year. And their benefits overlap: both cards offer 3X for airfare, hotels, and travel agencies and 2X for dining and entertainment. And both cards offer 1.25 cents per point value towards airfare, but the Premier card also offers 1.25 cents per point for all travel bookable through the ThankYou portal (Prestige offers only 1 cents per point for travel other than airfare). The Prestige card, though, additionally offers Priority Pass lounge membership, global entry fee reimbursement, and best in class trip delay insurance. And the Premier card offers 3X rewards for all travel (not just airfare, hotels & travel agencies) and 3X rewards for gas.

My guess is that for most people it doesn’t make sense to pay both annual fees. That said, some would clearly do very well. Those who spend a lot on gas, for example, can may justify the Premier card’s annual fee from it’s 3X gas station earnings alone. And, anyone who regularly uses the Prestige card’s 4th Night Free benefit (regardless of whether they pay with points or not) can easily justify the annual fee on that card.

If you’re thinking about getting either card, keep in mind Citi’s 24 month rule:

Bonus ThankYou® Points are not available if you have had a ThankYou Preferred, ThankYou Premier or Citi Prestige card opened or closed in the past 24 months.

If you’re starting from scratch and would like both cards you won’t be able to get the signup bonus for both. If, on the other hand, you already have one of the cards and you are within 24 months of opening or closing a ThankYou card, keep in mind that getting a new one will reset your 24 month clock even if you’re OK going without the signup bonus.

Other Considerations

Keep in mind that many hotels offer discounts that are not available through the ThankYou Rewards online reservation system. You can usually get these discounts by calling or emailing the Prestige Concierge to book your 4th Night Free reservation, but then you wouldn’t be able to redeem ThankYou points for that stay. In situations like this, having a pooled Premier card doesn’t help at all.

Also, a couple of people have reported that they are not seeing 1.25 cents per point value online when booking 4th Night Free reservations even though they have pooled their Premier card with their Prestige card. My assumption is that they’ve either encountered a software bug or maybe there’s something weird about the way their accounts are pooled.

Related Info

Here are a number of related posts that you may find useful:

- Should you avoid pooling ThankYou accounts?

- Should you book Prestige 4th Night Free online?

- Complete Guide to Citi Prestige 4th Night Free

- How to know if or when your ThankYou points expire

- Cancelling your Prestige or Premier card? Here’s how to keep your ThankYou points alive

- Citi Prestige Card (details and current signup offer)

- Citi Premier Card (details and current signup offer)

[…] Premier card’s 20% point discount on travel stacks with the Prestige card’s 4th night free. These combine to give you up to 1.67 cents per point value, or a 40% point discount if you prefer to think of it that […]

[…] for elite credit or elite benefits, so this option may not be valuable in many instances. See: Up to 1.67 cents per point value from ThankYou points and our Complete Guide to the Citi Prestige 4th Night Free for more […]

[…] response to my recent post “Up to 1.67 cents per point value from ThankYou points,” some accused me of publishing junky and screwed up math. I answered those accusations in […]

[…] 4th night free benefit and the best ways to take advantage of it — whether you’re leveraging Citi points pooled with your Premier or soaking up sun after stacking with an all-inclusive Hyatt 4th-night-free promo. Speaking of […]

[…] Up to 1.67 cents per point value from ThankYou points by Frequent Miler. Nice combo, wonder if Citi will kill this or they will be OK with it as I imagine they want people holding two cards with annual fees? […]

I was reading your old posts about why pooling is dangerous and how to check on point expiration. I tried and realized that I can only see the details of one of my thank you accounts, even though I can see the points balance for each on the main screen. Citi help said I have to combine the thank you accounts to see the details online. Is that something different than pooling the accounts?

There is something different you need to do, but it’s not called combining. ThankYou.com calls each account a “Sponsor account”. The trick is to find the section that lets you add a credit card as a sponsor account. From my browser, here’s the URL (you’ll probably have to log in before trying to use this URL): https://www.thankyou.com/addSponsorAccountPage.jspx

I think I must be doing something wrong, or not understanding something. I’ve got two thank you cards, an AT&T and a Premier (and soon a Prestige as well). When I go through the normal way of clicking on the thank you link next to my points balances, it brings me to a screen to select one of my thank you accounts. Regardless of which I choose, it takes me to the balance and history of my AT&T card.

Now when I use the link that you gave (while already logged in) it takes me to a similar looking screen to choose which account I want. When I choose one (say the AT&T) it then takes me to a screen that says “add a citi account” and has a field for my account number. I put in the Premier card number and I get a “We don’t recognize your Sponsor Account number” message. If I try it with the AT&T account number, I get the same error, although not until the confirmation step.

Is it safe to ask Citi how to resolve, or is there a risk of them actually combining the accounts, therefore triggering a 90 day expiration of some of the points?

I don’t think there’s any danger in calling. If your points get pooled that won’t cause them to expire.

[…] Pooling points can get you a lot of value, see how that happens with Citi Thank You points. […]

Greg, if I pool my Prestige and Premier points, doesn’t Citi only give you 90 days to redeem those points before they expire? And in order to take advantage of the 1.67 redemption rate, do you transfer from the Premier to the Prestige, or vice-versa?

The 90 day limit is when you move points from one card to another. Pooling doesn’t affect the expiration date. When you pool, all of the points show up together. That’s what you need to get the 1.25 cent redemption rate applied to the 4th Night Free.

Thanks Greg, as a follow up to that question, after I pool the points, if I then choose to close one of those cards, would the 90 day expiration clock start? I have the Thank you Premier, and am probably going to apply for the Prestige September 1 (exact same scenario as your wife, applied for the Premier August 2015), but I doubt I will keep the Prestige for more than 1 year.

That’s my understanding, which is kind of annoying. I don’t mind the Citi transfer partners but I don’t like any of them as places to transfer points without a specific redemption in mind.

Yes, IF you cancel the 90 day expiration clock would start. Better bet is to downgrade to the no-fee ThankYou Preferred card so that the points stay alive.

Greg, great point about downgrading the Prestige card versus cancelling it, since there is a chance the 24 month clock doesn’t reset if the card number stays the same. Thank you so much for the advice, I feel like I finally have my mind wrapped around a good strategy now!

Thanks for laying this out in such detail. Wasn’t how we were expecting people to use their points.

We’ll get right on it.

This math is screwed up IMO. You’re bundling two independent events.

First you make a decision which card you will charge your stay to. Say Citi Prestige gives you the best price when utilizing the 4th Night benefit. At that point you’re set on the price point and you’re facing decision whether to charge to your card or use TY points. And the value you get per point is 1 cent or 1.25 cents and not any higher than that.

I addressed that question in the section titled “Wait, isn’t the value really just 1.25 cents per point?”

Edited to add:

I agree with you for the most part, but as I pointed out in that section, it depends what your starting point is. If you’re comparing different point currencies then I think the up to 1.67 value is the right one to use.

>If you’re comparing different point currencies then I think the up to 1.67 value is the right one to use.

Not at all. Factoring in the dollars saved from 4th night free is worthwhile in determining whether to keep the Prestige. It’s not at all useful in determining the value of TYP, nor does it change the redemption value.

If I’m comparing different point currencies, then you use 1.25 cpp, not 1.67. Suppose Citi comes out with a new card with a 10k TYP bonus. Suppose Chase also comes out with a card with a 10k UR bonus. Assume you already hold both the Prestige and the CSR.

Do you derive more value from the TYP than redeeming UR at 1.5cpp? No. As you already hold the Prestige, your 4th night free applies to either cash or points. You’re getting a hotel room that would have otherwise been 1.25 cents per point out of pocket.

What would make a difference is if Citi DID NOT allow you to pay cash for your 4th Night Free. Then you would actually be getting 1.67 cents per point, as you’d be getting the sticker price of the hotel at a discount. But because you always have the option to pay cash for the discounted room, the value of points can’t be more than what you would have paid absent the points.

As I said, if you take the Prestige 4th Night free as a given, then the value is 1.25.

Take another example: Suppose you have the Prestige and the Premier and your wife has the Sapphire Reserve. Now you want to book a 4 night stay and you’d like to pay with points. And also imagine that both Citi and Chase see the same prices for the hotel. If you use your pooled Prestige and Premier cards and pay with points you’ll pay fewer ThankYou points than the number of Ultimate Rewards points that your wife would have to pay for the exact same stay even though Chase offers 1.5 cents per point value.

I agree with this. You’re paying $900 or 90,000 points. You’re not paying 1200.

I agree. If you take the 4th Night Free benefit as a given then the ThankYou point redemption gives you 1 or 1.25 cents per point value.

But If you are trying to decide which points and/or credit card perks to use for a stay, then the combination of Prestige + Premier gives you up to 1.67 cents value compared to the other alternatives.

For example, if your other options are Arrival Plus or Venture Rewards points, then the 4 night stay would cost 120,000 points with those cards (1 cent per point value). With Prestige + Premier, the same stay costs 72,000 points.

Your math is a little junky.

With the Prestige alone, you could pay for the stay with the card, EARN points, then use TYP as a statement credit. I can’t think of a reason you WOULDNT do that

If you do it that way, you’ll end up with fewer points.

Let’s take an example of a hotel that charges exactly $100 per night:

Your way:

– Pay $400 at check-out, Get $100 Back later

– Earn 3X x $400 = 1,200 points (assuming they don’t claw back the points on the $100 rebate)

– Cover $300 statement charge with 30,000 points

Your final cost: 30,000 – 1,200 = 28,800 points

Pooled w/ Premier, book online:

– Citi charges $300 for $400 stay

– Pay 24,000 points for the entire stay (thanks to Premier 1.25 value)

You paid an extra 4,800 points

I was commenting on “Prestige alone.” Not using Premier as well. Not sure why someone with Prestige would even have Premier.

In my case, the only reason I have Premier is cultural events. I attend a lot of theater and concerts. Between 2-3 theatre subscriptions, a couple NYC trips a year and always offering to buy everyone’s tax for events, I more than cover the $95.

I agree that the Prestige has a ton of value. Even if I use the 4th night free once per year then I generally make back my annual fee and then some. This year I already used it twice so I’m already way ahead. Plus I earned SPG points as well so that was a nice double dip.

With that said, the recent TY devaluation has me thinking about how I should be using my points going forward. The double and triple points are nice for category bonuses, but the value per point of 1.25 cents per pt is disappointing compared to other UR and MR rewards. For a restaurant, 2.5 cents equivalent isn’t really enticing me to want to spend on it. However, the 3 hour trip delay protection is a bonus that might come in handy someday so using these Thank You points is essentially factored into it.

However, I really expect that cc rewards will start reverting back to the norm. I just don’t think the current rates are sustainable so I feel like the recent Citi Thank You pt devaluation is sort of the new normal and that the others will devalue within the next year to end up in the same place. I just don’t see how Chase CSR can afford to give out 4.5% equivalent when they’re getting a max of 3% from the restaurant. I expect the UR pts to be the next devaluation. Amex already devalued, Citi just devalued so Chase is the last one who hasn’t announced anything yet. I bet with the 1 year expiration of the 100k sign up offer, they’ll start to make some big changes.

Greg, are you sure Prestige does not earn 1.25X on hotel bookings? It earns 3X for Hotels for sure, so does not make sense.

I also read somewhere that you get 3X for the first 3 nights if booking with points still, but not the free night, if booking online. Normally if booking over the phone and getting statement credit later, you get 3X for all 4 nights.

Could use clarification here.

The Prestige does earn 3X on hotel bookings. I think you meant to ask if I’m sure that it only gets 1 cent per point value when using points to book hotels. Yes I’m sure.

Premier gets 1.25 cents value for airfare, hotels, cars, cruises, etc. (all travel booked through ThankYou Rewards)

Prestige gets 1.25 cents value ONLY for airfare booked through ThankYou Rewards.

If you have the two pooled together you get the better 1.25 rate.

You are right, meant to write “are you sure Prestige does not redeem at 1.25X on hotel bookings.” Pretty weird and excellent observation.

Related question – Do you have or know of any data points on the Citi 24 month rule being effected by product conversions, within the TY points family of cards or outside. You blogged “conjecture” before.

For example, if you have no Thanks you bonuses the past 24 months BUT did a product change 12 months ago from Premier to ATT Access More, will you get a sign up bonus for new application?

[…] Greg the Frequent Miler had an idea — what if you had both the Prestige and Premier cards. Do the 4th night free (from the Citi Prestige) and the 1.25 cents per point on hotel bookings (from the Citi Premier) stack up? […]

Personally, I get quite a bit of value from the Prestige with their industry leading travel delay protection and 4th night free benefit. It saves me considerably more than the $200/year net annual fee!

This!! I pay $350 AF and with the $250 credit it is like paying $100 a month. It is my least expensive high end card and the one that gets me the most “money back” Not in terms of points (although with the 7x travel points retention offer I got 35k points) but in terms of money from hotel stays. And the travel protection is MUUUUUUUUUCH better than any other card. You are much more likely to have a 4 hour delay than a 9 or 12 hour delay…