NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

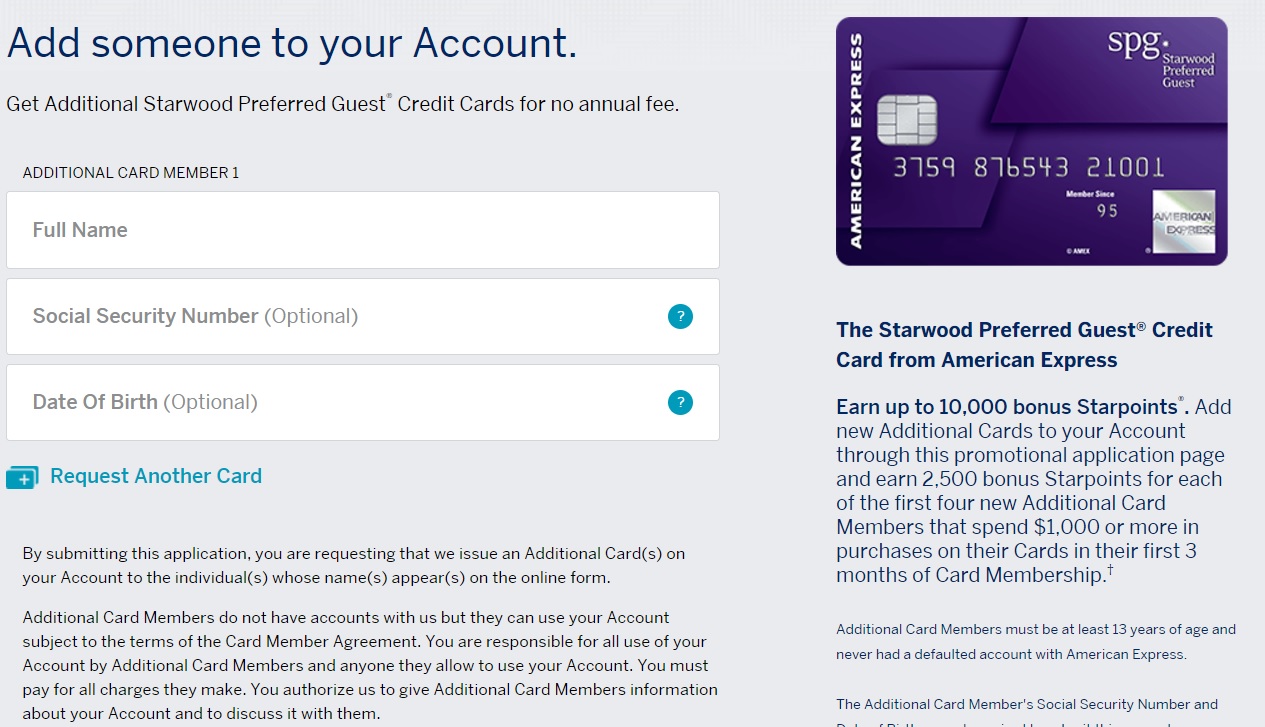

Amex is out with a targeted promotion to earn up to 10,000 bonus Starpoints for adding authorized users to your Amex SPG personal card when each authorized user also makes $1,000 in purchases on the card within the first 3 months. That’s fantastic considering the fact that the signup bonus is usually only 25,000 Starpoints (and considering the fact that 10K Starpoints could get you up to 5 weekend nights in Category 1 properties).

The Deal

- Earn 2,500 Starpoints for each authorized user you add to your Amex SPG personal card that makes $1,000 in purchases within 3 months of adding that user (the spend must be made on that AU’s card)

- Earn up to 10,000 points through this promotion (4 bonus offers per account)

- Direct link to see if you’re targeted (you will be prompted to log in)

Key Details

- The promotion appears to be targeted, but I did not receive an email and the link still worked

- Authorized users must be 13 years of age or older and never had a defaulted account with Amex

- Must add the authorized users by 9/30/17

- The 3 month clock begins the day you add the user (which will be before you receive the card)

- According to the terms, eligible purchases do not include: “interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.”

Quick Thoughts

This is a great offer for adding authorized users. I was thrilled to see I was targeted even though I haven’t received an email. It’s well worth logging in just to see if you’re targeted.

Amex is also currently offering a targeted bonus for adding authorized users to the Amex Hilton cards (See: Surprise: No email, still targeted for 10K per AU), but I think this Starpoints offer is a lot better. First, Starpoints are significantly more valuable than Hilton points — according to our Reasonable Redemption Values, the 10K total possible bonus is worth about $208, though you can certainly get a lot more value than that with the right redemptions or transfer partners. The Hilton Surpass promotion is only worth about $160 if you earn the maximum number of points, and that’s assuming that Hilton doesn’t overcharge you (See: Hilton stinks at math: book award nights separately).

I’ve gotten excellent value out of 10K Starpoints in the past. For example, during our honeymoon, we spent spent 5 nights at the St. Regis Osaka. At the time, it was a Category 5 property costing 12K points per night — but with the 5th night free, we paid just 9,600 points per night. They gave us a pretty warm welcome, with a bottle of champagne, a cake, tea — and at the time I booked it, the cash rate was a sky-high $1,000+ per night (an abnormally high demand week).

On top of all that, Starpoints are one of the most difficult types of points to collect en masse. The only bonus category on the card is Starwood/Marriott spend, where you will earn 2X. With this offer, you are earning 3.5X on all spend for that first $1,000 spend for each user. That’s a great return on everyday spend.

Of course, if you do choose to add users, beware of the terms excluding the purchase of prepaid cards from the definition of “purchases”. There is plenty of debate as to how closely that is enforced, but with the relatively low spending requirement per authorized user, many people can probably meet the spend with everyday purchases.

Do you plan to add 4 AUs through this promotion?

H/T: Doctor of Credit

I’m hearing reports from others and heard this regarding myself that the reason for not getting the additional 7500 SPG bonus on the last 3 cards is because I put the same name “my own” on each of the 4 cards. That can make sense but it wont explain why then I got the promo for all four Hilton card AU promo as well. Still fighting for them…………..

[…] 10,000 Starpoints for adding authorized users [Targeted]: While some may avoid this promo if all of their possible AUs are under or soon-to-be under 5/24, I certainly intend to scoop up ten thousand easy Starpoints by adding users. […]

[…] 10,000 Starpoints for adding authorized users [Targeted]: While some may avoid this promo if all of their possible AUs are under or soon-to-be under 5/24, I certainly intend to scoop up ten thousand easy Starpoints by adding users. […]

[…] Earn up to 10,000 with SPG when adding an authorized user’s […]

[…] 10,000 Starpoints for adding authorized users [Targeted]: While some may avoid this promo if all of their possible AUs are under or soon-to-be under 5/24, I certainly intend to scoop up ten thousand easy Starpoints by adding users. […]

[…] Hat tip One Mile at a Time and Frequent Miler […]

Just added 4 AUs. Was surprised that it went pending. I don’t think I ever saw an AU app go pending before.

“We’ve received your application, but we can’t give you a decision right now. Pending personal verification of your application, the following Additional Card(s) will arrive at your primary billing address in a plain white envelope displaying the American Express Blue Box logo, addressed to each individual below, and with a return address in Omaha, Nebraska. We’ll process your application as soon as possible and send you a decision within 14 days.”

No worry. My pending status was approved just today after last Friday submission. I see zero chance Amex would reject you (because they don’t have any reason without knowing whom they are approving….)

Greg, or anyone, know the timeframe of when these AU bonuses would post? A few days after meeting spend, or after next billing statement? I seem to recall SPG posting my original sign up bonus mid-cycle when spend was completed; unsure. Just curious, as I activated 3 AUs and completed the $1k+ on each early this statement, but have not seen any bonus yet. Statement closes next week. Thanks.

I don’t know how it’s supposed to work, but I just checked my account and found that I’ve only received the 2,500 points for one AU even though I signed up (and met the spend req) for 4. Will have to follow up with Amex

Does anyone have new update? I saw only one 2500 bonus posted til now though all 4 AU cards spending over $1000 almost same time.

Sorry, I know this is an old post, but I was just recalling my SPG bonuses never posted for this promo — went back through my statements and cannot find any 2500 posts for any of the (3) AU cards I added and spent $1k+ on… just curious Greg, if you see this, if you followed up with Amex and they added the points.

I’d like to follow up, but don’t really want to get attention to either of my SPG cards (presonal/biz) that have been heavily (40k+) used on GC deals in the last 6 months or so.

Thanks.

I’m somewhat an Amex newbie – while I have 3 Amex cards, I’ve never added any AUs to avoid family, mainly my wife, to be subject to more inquiries (assumption). I followed the link and added 4 legimate family member names for 4 AU cards but left all 4 (optional) socials blank…. I got a “decision in 14 days” message. Would these likely be denied? Is the social and any other info beyond a name required? I went for it regardless but just curious now. I have $8-10k expenses coming up in a couple weeks and should be able to use these easily, so might as well give it a go. Any input on this is appreciated, Thanks.

I got the same message. I think it might be caused by the fact that we added four AUs, which triggered a manual review request. But without SSN and DOB, I really don’t see how a human representative can reject it. At most, he/she will review your account and see if everything is fine. According to the data point I found online, it would be fine. If they want to reject you, it most likely happen at immediately after your submission.

BTW, the downside of adding AU is that the AU got a “new account” open record. It is good for someone without credit history, but could complicate their qualification on Chase’s 5/24 rule (which is the only downside I see). It won’t result in a hard pull, it won’t disqualify them to get sign-up bonus for the same card on their own.

Data point update:

4 AU requests submitted on 8/25 (Friday), resulting in a pending status. Today (8/28) received the paper letter showing they have been all proved. Considering the USPS speed, it is likely that they immediately approve them behind the scene and mail out the letters then. No idea why they would take this hassle.

Slight clickbait headline.

Should read: “Up to 10,000 Starpoints for adding authorized users”.

2500 SPG points (aka ~$50) probably isn’t worth your while, especially in the 5/24 era…

A fantastic offer? C’mon now. It’s a good offer, sure. But let’s look at what we’re also giving up here in opportunity cost.

– Possible minimum spend to go elsewhere

– At minimum $20 in cashback equivalent.

– Having more AU added to the credit reports of whomever these are used for

– Risking the eyes of amex on duplicate cards to more than one person

With that said I’m not saying this is bad or that anyone is stupid for following through with this. It really just depends on how much you value SPG and the impact of AU cards. I was targeted for this offer but personally I prefer less impact to AU and at $30 opportunity cost (Alliant 3% cc) per card it’s just not worth it for me. I’m sure there’s going to be people who completely disagree with me, and that’s fine. To each their own though and if it works for you then great more power to you.

How do I know if I will get bonus? If I log in and shows me on bottom of application page even though I didn’t receive email?

When you log in, you’ll see the page that I have pictured near the top of this post. It shows the 10000 Starpoints total and explains all of the terms.

Actually it’s 3.5x for the first $1,000. The 2,500 bonus +1,000 SPG points for the spend itself = 3,500 points or 3.5x.

It sure is! Fixed, thanks!

Had thought it was 10K per AU. It turns out to be 2.5K per AU and up to four AUs. Very lukewarm particularly consider it might lead to a denial of Chase due to 5/24 rule (even though you may call in and argue to remove AU account). Pass.

Good point on Chase 5/24. Some readers are probably well beyond 5/24 or may be adding children who aren’t yet going to qualify for a credit card of their own anyway, but for those who are considering adding AUs who are not under 5/24, this is an important consideration.

If one does not add the AU DOB and SS# on the request form (its optional), then how would the credit bureaus be able to identify the AU for a new account?

The AU must provide SS within 60 days.

I need a bigger family.

Damn all my kids are under 13.