NOTICE: This post references card features that have changed, expired, or are not currently available

Earlier this week, Nick pondered which ultra-premium credit card he should keep. Ultra-premium cards typically offer terrific benefits in exchange for terrifically high fees (typically around $450 per year). Often the value of the benefits far outweigh those fees, but not always. Nick’s post generated a lot of discussion in which people sometimes asserted that Nick was wrong about how much he values various card benefits. But, that was exactly the point of his post: credit card benefits offer different value to different people depending upon their travel style, which airports and airlines and hotels they frequent, and more.

Most ultra-premium cards are worth signing up for because they have good to excellent signup bonuses that are worth more than the first year’s annual fee. That’s not the question. The question is whether the cards are worth keeping past the first year. When the second year annual fee comes due, do you keep or cancel?

Do the card’s benefits outweigh the annual fee? Each person should conservatively estimate the value of each benefit to them to figure this out. In most cases, I recommend trying to estimate how much you’d be willing to pay for this feature if it was available stand-alone as a subscription. For example, if a card offers free checked bags, you could save hundreds of dollars if you use that benefit often enough. But how much would you pay for an annual subscription to get free checked bags? That answer should be substantially lower than the amount that you think you’ll save. Otherwise, why prepay for that benefit?

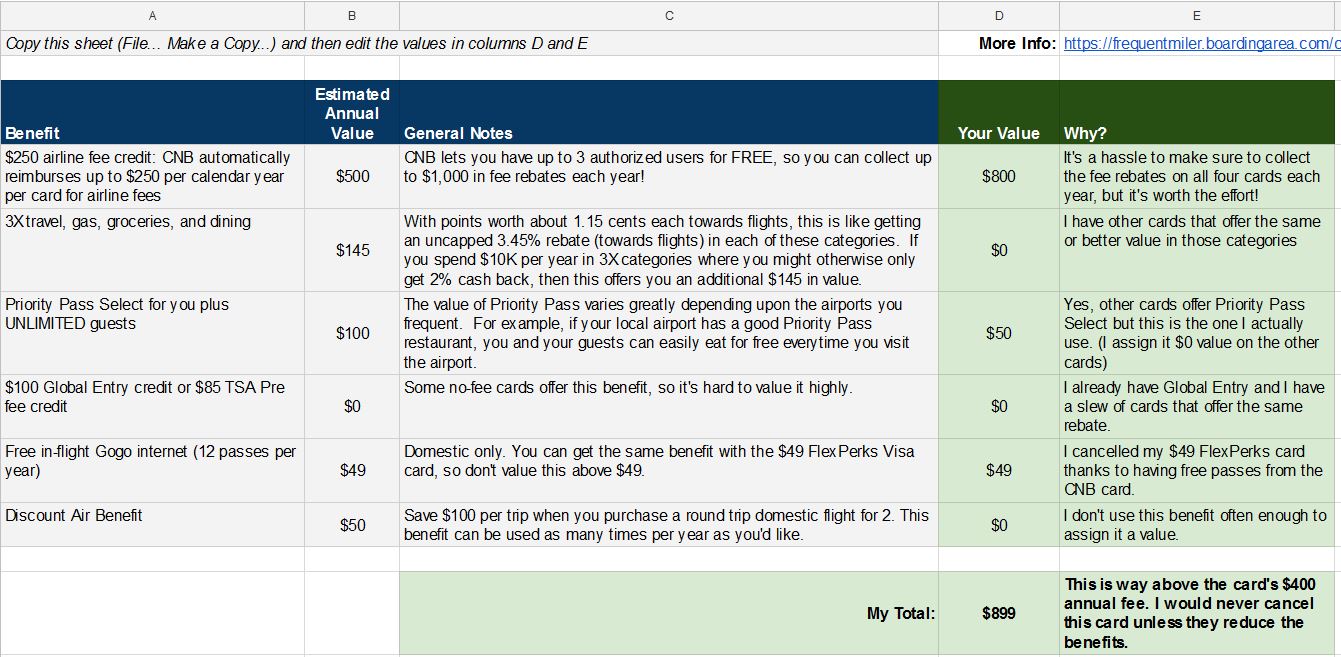

To help you come up with your own estimates, I created a Google Doc spreadsheet with tabs for each of the common ultra-premium cards. Click here to open the spreadsheet.

The spreadsheet currently includes general estimates of how much each major card benefit may be worth, along with my own personal valuation to give you an idea of how I think about each.

To use the spreadsheet, create a copy of it and then overwrite the values in columns D and E on each tab with your own value estimates.

Tips for using the spreadsheet effectively

- Be conservative with your estimates. Enter values that you would pay for a subscription for that benefit rather than the amount you expect to save.

- Consider other factors not listed. Most of the benefits of my Sapphire Reserve card are available through other cards, but I love the fact that this single card gives me best in class earnings on travel & dining, best in class travel insurance, and increases the value of my Chase points earned on other cards. There’s something great (to me) about having a single card to turn to for all travel & dining spend.

- Once you identify cards that you know that you’ll keep year after year (like my CNB card pictured above), make sure to consider that when evaluating overlapping benefits on other cards. For example, I get 12 Gogo internet passes from my CNB card each year (really 48 passes since I get 12 from each CNB card), so I don’t value the same benefit on the Altitude Reserve card.

- You’re allowed to make irrational decisions if you can afford it. My personal valuation of the Altitude Reserve card comes out a bit higher than the card’s annual fee. But, even if it came out lower, I would consider keeping the card simply because I like it. I love knowing that I get good value from Apple Pay purchases. And I love getting 1.5 cents value per point through Real Time Mobile Rewards (and no, I do not earn an affiliate commission for this card).

The Card Roundup

At the time of this writing, the spreadsheet includes the following cards…

Bank Cards

Card Name w Details & Review (no offer)

Airline Cards

Card Name w Details & Review (no offer)

Hotel Cards

Card Name w Details & Review (no offer)

My Personal Keepers

Here’s where I landed after analyzing each card:

To understand the above results, keep in mind the following dependencies:

- The CNB card is an obvious no-brainer since it offers up to $1,000 per year in airline fee credits for $400. As a result, other cards that offering duplicative benefits were not valued as highly. For example, I don’t value getting Priority Pass from any of the other cards since this one gives me Priority Pass with unlimited guests.

- After analyzing both the consumer and business versions of the Amex Platinum card, I realized that the business card made more sense to me, so I zeroed out the duplicate benefits on the consumer spreadsheet. For example, there’s no advantage to having two cards that offer Emergency medical evacuation.

- Similarly, the values I assigned to the Delta Reserve business card assume one already has the consumer card, so some of the card’s benefits were zeroed out.

Also keep in mind:

- I live near a Delta hub (Detroit) and like to use Delta credit cards to manufacture high level elite status for both me and my wife.

- I rarely fly AA or United

- I’ve gotten very good at getting full value from credit card travel credits, so my net cost on many of these cards is far less than it appears.

Currently, I have all of the above cards except for the Platinum Business card, United Club, AA Executive, SPG Luxury Card, and Hilton Aspire. Based on the analysis, I should think about cancelling my consumer Platinum card when the annual fee comes due and upgrading my business Green to the Platinum Business card. And, I should consider getting the Hilton Aspire if I can ever free up credit card slots in my Amex portfolio.

My wife currently has the Amex Platinum Business card, Sapphire Reserve, both Delta cards, and the SPG Luxury card. We’ll probably drop her Sapphire Reserve card and add her as an AU on my account. And we’ll consider getting her a Hilton Aspire card at some point in the future. With her SPG Luxury card we’ll probably downgrade her to the regular $95 SPG card when the second annual fee comes due unless we decide that the 50K free night certs are worth that much more than the 35K certs.

Jesus Christ! As a grad student, I can’t even fathom how much you spend on credit card fees. Guess I’ll be back here in 20 years.

For me, the Amex Platinum Schwab is a keeper. After all credits, the annual fee is only $50… $550 AF – $200 airline incidentals credit – $200 uber credit (which inclides uber eats) – $100 saks credit. Having the card lets you cash out membership rewards points at 1.25 cents per point which means even as cash you can earn 6.25% cash back on airfare and hotels, and combined with the new amex gold card, 5% cash back on Dining and Groceries, and with the Blue Business Plus, 2.5% cash back on all other spending. Basically thats your minimum value as cash. The gold card is also only $30 annual fee after credits… So if you earn at least $80 in cash back, the annual fee just paid for itself. Just considering the 5% cash back on groceries on the Gold Card alone, thats only $1600 in grocery spending and the Amex Schwab Platinum + Amex Gold cards have already paid for the annual fee. Thats about 2 month of grocery spend…

[…] post inspired Greg to make an awesome spreadsheet for evaluating your ultra-premium cards (See: Your turn: Which Ultra Premium Cards are Keepers?). I initially set out this week to do a similarly mathematical analysis of my current collection of […]

I just applied for the CNB Card today in person. They needed w-2 along with 2 forms of ID. Question is they underwrite every card. What is likeliness of getting approved? Score is around 780 as recently got Amex Aspire.

I don’t know the likelihood of getting approved. They will take into account not just your credit score but also your income and other assets.

great post.

i would discount some of those valuations even more because of the time, hassle and meticulousness needed to harvest the value from some of the features.

This is amazing, Greg! Thank you! Must have taken you lots of time, but now that you’ve outdone yourself, it would be so awesome if you made separate spreadsheets for all hotel cards, all airline cards, etc. Just sayin’! 🙂 From a grateful PointsGuy convert!

LOL, thanks! You’re right that it would be good to have one for the rest of the rewards cards, but you’re also right that this took a long time to put together. I hope to do more cards eventually but I’m going to take some time off from it for now 🙂

Thanks for creating and sharing the spreadsheet! GREAT JOB!!!

Although I am all about spreadsheet models, and I loved your Hyatt points/cash/cash+points decider spreadsheet, I don’t need one to determine which premium cards I should keep.

Paying a 2nd AF on any Amex Plat is ridiculous, there is always a new flavor to get bonus for, or worst case churn the Ameriprise.

CSR to me is not worth net (generously) $150. I’d rather put spend towards new MSR than get 3x. The ability to transfer is pretty much all there is, so I preemptively transferred my UR to Hyatt, then downgraded. I plan to upgrade later when my UR balance warrants it.

The only cards I will every pay high AF on is Amex Aspire and CIti Prestige. Aspire is an easy keeper, and Presige I have at $350 AF, and I make extensive use of 4NF.

The only ultra-premium card we own is the Hilton Aspire. It is definitely worth it. Last year we used the $250 resort credit within a month of getting the card, and even though I hate AmEx’s restrictive ‘Airline Incidentals Credit’ we are going to use all of them by the calendar year end. That puts us $50 ahead even without the free night. Oh and Diamond status has already meant about $180 in free breakfast credits and an additional 8500 points (over gold). The only downside is that my wife holds the card and doesn’t value the lounge access, so no lounge assess for me.

The AmEx incidental restrictions make the credit close to valueless after the 1st card. I can jump through their hoops to get close to $250 value from one credit, but getting another $250 is just not worth it. That greatly reduces the value of having more than one AmEx ultra-premium.

American Express Platinum would only be worthwhile in a year when we would put huge spend on airlines. I don’t do uber, and I discount very substantially a credit that requires that I make a change that I wouldn’t otherwise. I’m 5/24’d from Chase, and Citi doesn’t seem to be making offers for the Prestige. The major benefit of the Delta Reserve seems to me to be the 1st class companion fare, and I don’t value that very highly even though I live in a Delta semi hub. The Ritz and SPG luxury would be worthwhile if they earned what the SPG regular card earned before August, or if you could stack the status nights. It’s mostly academic anyway since I would have to upgrade to the SPG card at 15K points instead of 100,000. No thanks.

So, in conclusion it looks as if I won’t even get any of the other ultra-premium for the 1st year, yet alone keep them after the 1st year.

There aren’t really many hoops to jump through for using the Amex credits. If you live in a Delta semi-hub I would think it would be pretty easy for you to get nearly full value out of the credit….or know someone who would be happy to help you use it. See this page for what works:

https://frequentmiler.com/amex-airline-fee-reimbursements-still-works/

You don’t even mention the rebate for booking with AMEX miles on the Business Platinum card……..that is a big oversight you should correct soon!

I am using those Uber credits on the AMEX personnel card and Uber is getting a lot more of my business as a result……..

Citi Prestige 4th night pays for itself in one trip on the countryside in France where brand hotels are nowhere to be seen…….but the Small Luxury Hotels alliance with Hyatt is going to change my life and may mean the Citi Prestige no longer has luxury value per se…….

SPG is so yesterday………just have to figure out if Alaska miles are worth the squeeze now and how to get Japan Air miles…….

RITZ card design is made up by a bunch of liars and scam artists that make the upgrades and other perks somewhat meaningless unless you are booking rack rates……….and they can’t answer their phones or complete a merger…….what a TOTAL UTTER DISGRACE to their customers…………they are the middle class version of Motel 6…….if you are stuck in middle class then this new version of Motel 6 is perfect for you……………

Airline cards????? ARE YOU KIDDING?????? USA flag carriers are so broke…….why does anyone choose to fly on them unless absolutely necessary and then you use AMEX miles to fly First……..

For all the millennials who still scream across the table at each other and scare us affluent old people off I say “God bless you and keep chasing those US carriers deals………I won’t be getting in your way young lady or young man!

No directly related, but I wonder regarding cards that you don’t want to extend. Will you cancel/downgrade slightly before or slightly after the annual fee?

I heard different opinions about it.

I always wait until the fee shows up on my statement. That way you may have a better shot of getting a retention offer.

Many comments ignore the “convenience” factor in claiming rebates. I like the CSR, Citi Prestige, SPG Luxury, and US Bank Altitude cards because their rebates are convenient to earn – all I need to do is spend on airfare or travel. I don’t like Hilton Aspire or the Amex premium MR cards because their rebates require spending on airline fees I seldom incur or resort hotels where I seldom stay.

The Amex airline credits trigger automatically, and though excluded in the terms, in many cases an airline gift card will trigger them. In some cases, cheap flights even trigger them. See this resource page:

https://frequentmiler.com/amex-airline-fee-reimbursements-still-works/

Definitely not as easy/automatic as the others, but pretty easy, The Ritz card credits are the least convenient to use since you need to call / secure message.

Great article. That is why you guys are my only “must” read bloggers. Greg, I did a little bit of research (obviously, not as thorough as you!) and, as far as medical evacuation goes, I think Medjet is better than Amex. At the time that you may need it, I’m concerned about “loophole” language in the Amex terms. However, that might just be personally more important to me, than you, at this point. Also, Nick, You mentioned that you rarely pay for hotels and that is the same situation for my husband and I so the Hilton Aspire seems like a no-brainer-I believe the free weekend night is not generally restricted. Am I right on that one?

Apart from the fact that it can only be used on weekends and there must be “standard” room availability, no. There are a handful of places that are excluded (all-inclusive properties and a few others — though you’ll note that many of the top properties like the Conrad Maldives and Conrad Tokyo are not excluded). Here are the excluded properties:

http://hiltonhonors3.hilton.com/en/promotions/weekend-reward.html

It’s basically all-inclusives and condo-like properties that are excluded.

I’ll keep CSR and CNB since I could gain value out of it. 5X flight, $200 ubereat, $200 airline fee credit, $100 Saks are enough for me to keep Amex platinum.

Also, I’d would keep Ritz since it gives so much benefitsthat exceed annual fee: $100 visa discount air, $300 flight, unlimited priority passes for family members, free night, and it could be used to impress 19 years old cashier.

Pretty cool spreadsheet! I break even or come ahead on the Amex Plat Schwab, CSR, and Ritz, and SPG Lux (with the last two depending on how valuable the free night cert is)

That night should AT LEAST be worth $250.

YMMV. That really depends on how you use it (will you hold it and wait, hoping for a high value use and then blow it on an airport hotel at the last minute before it expires?) and on how much you would otherwise be willing to spend on a hotel night. I love staying in expensive hotels on points / certificates, but I can probably count on two hands the number I’ve lifetime nights I’ve spent in a hotel where I paid $250 or more for a night. The truth is that if I had $250 and a choice between a very nice hotel in the center of a city for $250 or a good enough hotel 15 minutes away for $150, I’d probably spend $150 on the room and throw a hundred bucks towards a great dinner. That’s why I valued the nights at $150 in my analysis — it’s not that I can’t get a much more expensive hotel out of them (and I’m sure I’ll enjoy the hunt for a great use), but $150 is a price I know I would pay a couple of times a year for a hotel if I didn’t have a free certificate. Getting to stay in the center of the city at a really nice place is something I really enjoy, so I’ll be happy to have the certs (and perhaps I should include some “enjoyment” valuation there), but I wouldn’t enjoy it enough to spend an extra hundred bucks. Truthfully, I should probably value the certificate in Ultimate Rewards points since that’s what it actually saves me 9 times out of 10.

Of course, they may well be worth at least $250 to you. You may regularly spend $300+ per night on hotels. That’s the reason for a spreadsheet like this.

Exactly! And I use points for most of my stays, so the likelihood that I am paying $250 out of pocket for a hotel night is pretty low.

I used to be just like you and save $100 at a place 15 minutes away. The problem is, does it really only “cost” 15 minutes?. What about the cost in transportation, hassle, and physical energy that has to be spent coming and going? For example I hate staying at the MGM in LV, but will stay there even though there is a place 15 minutes away that is cheaper and nicer when I have a convention at the MGM. For vacations, I am willing to pay more for a more enjoyable location and view. It’s not all about the dollars and cents, and we can be shortchanging ourselves if we don’t take other important factors into consideration. Lastly, there is no promise of tomorrow so I try to get the best experience while I still can.