| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

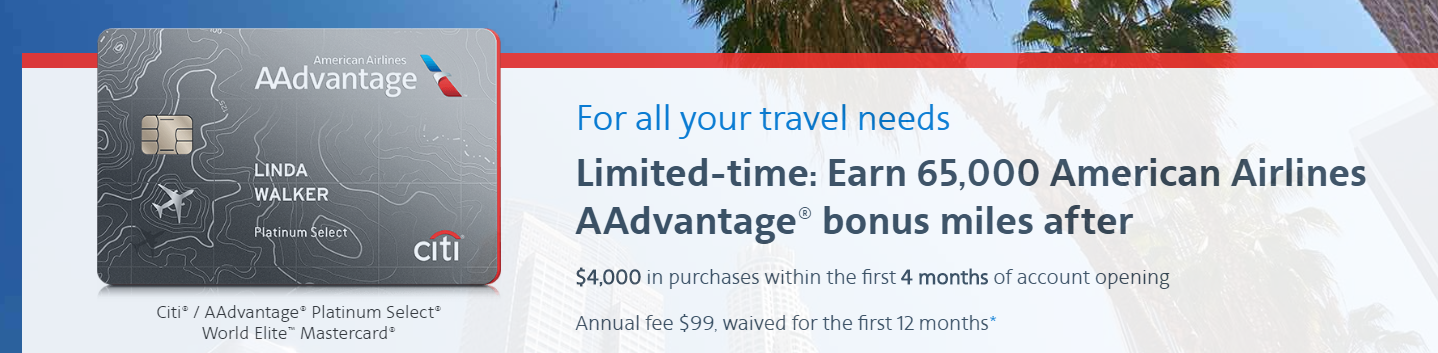

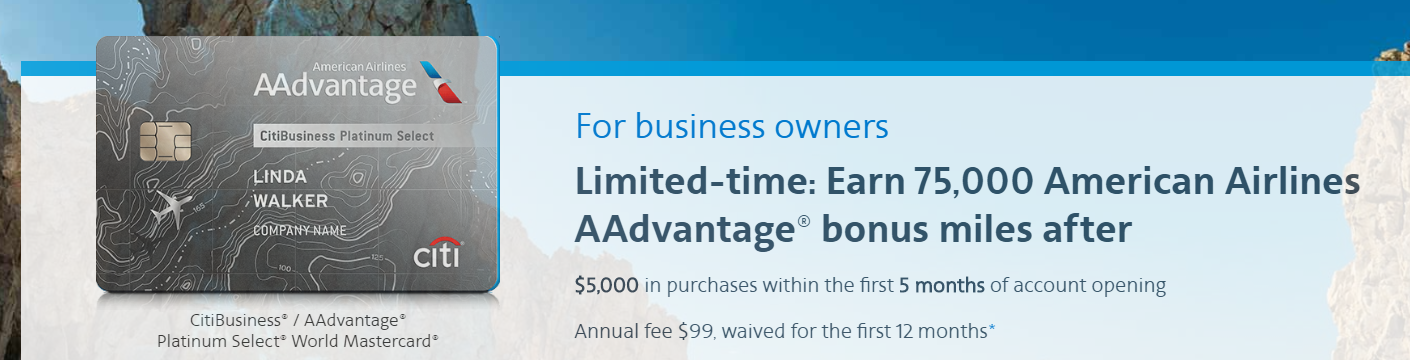

Citibank is out with new improved offers for their American Airlines cards. These are great offers: lots of miles + first year annual fee waived.

Note that the current affiliate offers are not as good. As a result, many websites are currently promoting inferior offers for these cards. As always, we only list the best public offers that we’re aware of even if it means we won’t earn any commission from our readers.

Here are the offers (click through to our card pages for the non-affiliate application links):

| Card Offer and Details |

|---|

75K miles ⓘ Non-Affiliate 75K miles after $5K spend in first 5 months$0 introductory annual fee for the first year, then $99 Alternate Offer: There is an alternative offer of 30K + $400 credit that can be found when doing a dummy booking on aa.com. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card usually has a great welcome bonus, but if you're looking for a card to keep long term, you'll find better options. Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

60K Miles ⓘ Non-Affiliate 60K miles after $3,000 spend in first 3 months$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent choice for a great intro bonus. Plus it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: $125 AA Flight Discount with $20K membership year spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight food and beverage purchases |

Eligibility

Keep in mind these application rules…

AAdvantage Platinum Select: “American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than an AAdvantage MileUp℠ or CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.”

CitiBusiness AAdvantage Platinum Select: This card is not available if the business already has a CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® card. Bonus miles are not available if you have had any CitiBusiness® / AAdvantage® card opened or closed in the past 24 months.

[…] 75K and 65K AA offers (non-affiliate) […]

[…] Update: The new supply is 65ok. HT: FM. Don’t neglect to attempt to ask on-line chat representatives to match 75ok […]

Thanks for sharing these increased offers. I applied for the personal card today and was instantly approved. They pulled Experian and Equifax. I was at 10/24 when I applied.

[…] 2019.4 Update: The new supply is 75okay. HT: FM. […]

*Sort of off topic* Now with United’s dynamic pricing and loss of chart, wondering if American is fattening us up for the kill 🙁 Maybe it’s time for an update on how to best use Delta skypesos and how we can best approach United…?

LOL, could be. Good ideas for future posts.

I currently hold AA personal card (opened 2/17). Can I apply for second personal card and be eligible for sign up bonus if I’m approved?

I got BOTH last year and Got the Points and spent 1/2.

CHEERs

I received an email today for the 75K business. Why do they send this to me when I have opened/closed a card within the past 24 months? I wish these targeted offers would override the general Citi credit card application rules.

[…] Note that the current affiliate offers are not as good. As a result, many websites are currently promoting inferior offers for these cards. As always, we only list the best public offers that we’re aware of even if it means we won’t earn any commission from our readers.LEARN MORE! […]

Does anyone know if Citi business cards count against the Chase 5/24?

Business-no

But it does require 5 year of credit history

I got the Bus card 6/2019 will cancel 6/2019 they checked credit sent me a card really rough .

CHEERs

Does anyone know whether you can qualify for the Biz card bonus if you have two businesses (same social but different EINs) and one of them received the bonus within 24 months but not the other?

I would like to know this as well 🙂

I don’t know. Doctor of Credit lists one data point but it was reported almost 3 years ago and so the actual applications may have been much older than that. So I’m not sure it’s still relevant. Here’s the DoC post: https://www.doctorofcredit.com/can-get-business-credit-card-multiple-times-different-businesses/#Citi

[…] It looks like there is a better offer for these cards outside of the affiliate channel. We still like the cards for the reasons we’ve listed in the post, but if you decide to apply […]

I have the personal Citi AA cards opened or closed in past 2 years but not any Citi biz card. I can’t apply cos I know I can’t meet the high spend requirement!

Prepay ur Taxes ,Ins. I got 9k points in Jan.the most ever in one month . The one time I brought a GC to get the points laid there for years .

Love AA points .

CHEERs

Do we know when these offers will expire?

No, I don’t know when these offers will end

Any idea how “limited” this offer will be?

Will City match if I just recently applied for their 60K tiered Business card offer?

I believe so