Update 5/20/25: Well, that was short-lived. Unfortunately, Bilt has let us know that it will soon be reducing the earnings potential that Visa, Mastercard, and Discover cards have when paying rent. Currently, all three earn 1 point per dollar, while Amex cards earn 1 point per $2. Starting 7/21, that will change, and all cards (except for the Bilt Mastercard) will earn the same 1 point/$2 rate on rent payments. Given the 3% fee that’s applied to the service, this will make it much less appealing, although it still might be worth it for some when meeting the minimum spend on a welcome offer or when using a 2.5-3% cashback card.

The Alaska card is currently the one non-Bilt card with a different setup on rent payments, as it earns 3x miles but no Bilt points (with the same 3% fee). Bilt says that soon, some of its other travel partners will gain the same functionality with their co-branded cards. Effectively buying points for 1 cent each could be appealing for certain partners, like Hyatt or Japan Airlines, but would be much less noteworthy for easily-acquired currencies like Avianca LifeMiles or Air France / KLM Flying Blue miles. I’ll be interested to see who gets involved.

~~~ Original Post Follows ~~~

Bilt Rewards first made waves a couple of years ago, primarily as a way to earn fee-free points when paying rent. Until recently, that was primarily limited to folks who had the Bilt Mastercard, as they can earn up to 100,000 Bilt points per year through paying rent as long as they make at least five monthly transactions on the card.

Bilt expanded that ability to earn rewards with rent last year when it added Alaska Airlines as a transfer partner. Now, folks can earn 3 Alaska miles per dollar when paying rent with their consumer Alaska credit card…with a 3% fee. This means that you can effectively buy Alaska miles for 1 cent each, which is worth it for some non-Bilt cardholders.

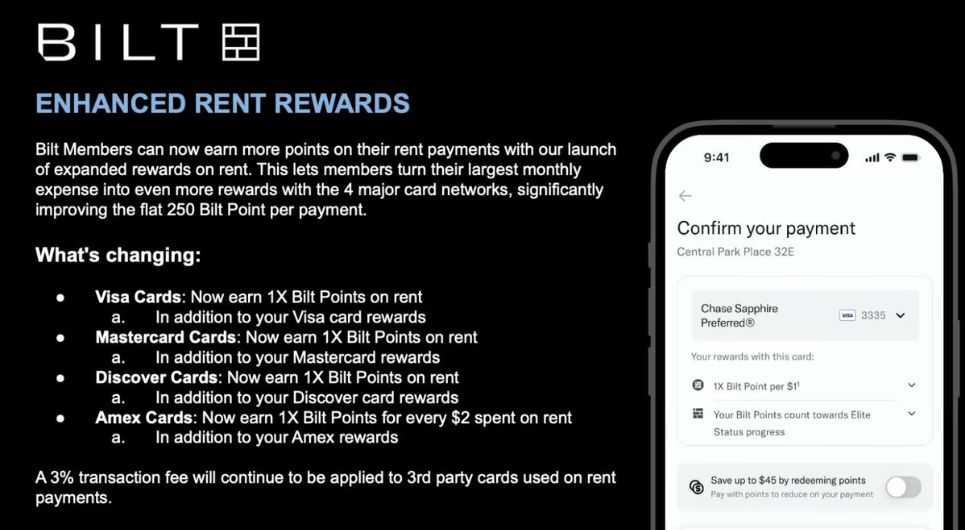

Now, the ability to earn Bilt points when using a credit card to pay rent through Bilt has been significantly expanded:

Rent payments made via a Visa®, Mastercard®, or Discover® credit card will earn 1 Point per $1 spent on rent paid through the Bilt App or website. Rent payments made via an American Express® credit card will earn 1 Point per $2 spent on rent paid through the Bilt App or website.

Effectively, almost anybody with a credit card can now earn 1 point/mile per dollar when paying rent via Bilt, in addition to credit card rewards, but with the same 3% fee that you pay when using the Alaska card.

Is that worth it?

The Deal

- Bilt Rewards has expanded the ability to earn Bilt points when paying rent through the Bilt app or website:

- Rent payments made via a Visa, Mastercard, or Discover credit card will earn 1 Point per $1 spent (starting 7/21/25, these cards will earn 1 points per $2 on rent payments).

- Rent payments made via an American Express® credit card will earn 1 Point per $2 spent.

- A 3% fee will apply when using a non-Bilt card to pay rent via Bilt.

- The same 100K yearly maximum earning limit will apply across all payment methods.

- The Alaska credit card continues to earn 3x Alaska miles per dollar, but DOES NOT earn additional Bilt points.

When is it worth it to use a credit card to pay rent with Bilt?

Note that the examples below become much less attractive once Bilt cuts all earnings to 1 point per $2 starting 7/21/25.

Previously, using a non-Bilt or non-Alaska credit card to pay rent through Bilt only got you a flat 250 points…hardly worth it given the 3% fee. Now, you can get 1x Bilt points on Visa, MC and Discover cards in addition to whatever rewards your credit card earns.

Essentially, you can look at it as through you’re buying points for 3 cent per dollar. In most normal cases, that won’t be worth it. However, there are several where it could be.

Meet minimum spend on a welcome offer for a 3% fee minus value of Bilt points

Let’s use the current Chase Sapphire Preferred 100K offer as an example. The required spend is $5,000. If you used rent payments for the entire $5K, you’d spend $150 in fees and end up with 105,000 Chase points and 5,000 Bilt points. We value Chase Ultimate Rewards at 1.5 cents each and Bilt points at 1.55 cents each, so you’d be earning ~$1,600 in points for $150 in fees…which is a marvelous deal.

Use a 2x everywhere card to earn a total of three points per dollar

Both the Citi Double Cash and the Capital One Venture cards earn 2 points per dollar everywhere. Using any of those means that you’re paying a penny each for 2 Citi ThankYou points or Capital One Miles and 1 Bilt point. Based on our Reasonable Redemption Values of ~1.5 cents per point for each of them, that could be worth it for some folks, although you’d need to be using the points to transfer to travel partners for high value awards. If you cash them out or use them for travel, you’ll just be breaking even.

Buy Bilt points for 0.38 cents each using the Bank of America Platinum Preferred Honors

Bank of America offers a bonus of up to 75% on credit card earnings for those with Bank of America “Preferred Honors.” If you have $100K in a mix of cash and investments with Bank of America, Merrill Edge, or Merrill Lynch and apply for Preferred Honors, you can earn 75% more credit card rewards on Bank of America-branded credit cards like the Bank of America Premium Rewards card or the Bank of America Unlimited Cash Rewards card. Both of those normally earn 1.5% cashback everywhere, but the 75% uplift turns them unto 2.625% everywhere cards…which comes close to paying for the entire 3% rent fee through Bilt.

Use Robinhood Gold for free Bilt Points

Online brokerage Robinhood has a waitlist for a credit card that offers a flat 3% back on most purchases (and 5% back on purchases made through the Robinhood travel portal). The card has been invitation-only for a year now and rollout has been uneven, to say the list. However, if you have it or get it, the cashback would completely pay for the 3% credit card fee and you’d essentially be getting Bilt points free by using it to pay rent.

Use the old version of the US Bank Smartly Visa for free Bilt Points and free money

Late last year, US Bank launched the Smartly credit card which earned 4% cashback everywhere if you had $100,000+ deposited in US Bank checking, savings or retirement accounts. That was quickly maximized by enterprising folks and, as a result, US Bank recently nerfed the card by capping the 4%, excluding categories and requiring that the $100K be in a checking account that earns no interest. However, people with the old version of the card could use it to pay rent and earn 1% AND 1 Bilt point per dollar spent.

Quick Thoughts

Although 3% seems like a substantial cost to pay rent with a credit card (and it is), Bilt allowing 1x earnings in addition to credit card rewards makes it much more palatable. I don’t pay rent, but if I did, I’d now look at it as potential spend toward new card welcome offers.

If my rent was $1,500/month, I’d be trying to get a new card every 2-3 months and use it to pay rent. There are numerous cards out there that earn 10-12x on the welcome offer spend, so 3% quickly becomes quite reasonable if it allowed me to increase the number of new cards I could acquire each year.

Outside of that, I’d probably still be more tempted by signing up for the Bilt Mastercard and earning points without paying the fee (unless I had the original version of the US Bank Smartly card or the Robinhood card).

If you rent, it’s certainly worth taking some time to look at your options through Bilt and see if there might be untapped potential for you to get some additional points and miles goodness.

[…] Bilt keeps getting worse smh: Bilt now awards points when paying rent with most credit cards (Rates for many to be cut by 50%). But hey, here is Qatar as another 1:1 transfer partner to soften the continued […]

If someone’s rent was $10k, and they wanted to use this to meet the CapOne Vx Business SUB of 150k points for $30k spend in 3 months, would the math be:

$900/150000 = $0.006 (SUB only)

$900/(150000+60000) =$0.0043 (SUB + C1 miles)

$900/(150000+60000+15000) =$0.004 (SUB + C1 miles + Bilt points)

Please correct my math or logic if its wrong.

I may have a $10k major purchase coming up, and could combine that with other spend, but would need to put some rent on the card to get to $30k.

Opening the plain vanilla BOA acct also earns an addt .10 Relationship Bonus for a ttl of 3.10 AS miles, worth it for me!

This shouldn’t be surprising, as credit card issuers don’t want cardholders to fulfill their SUB spend requirements by paying via Bilt (they likely charge Bilt lower interchange fees as a fellow financial institution). The scheme will probably work for card issuers offering relatively unattractive SUBs but charging Bilt relatively high swipe fees.

Incorrect regarding interchange fees.

Disappointing to see the rate dropping on non-AMEX cards but it probably doesn’t change a lot. For this to be worth the 3% fee you generally need to be working on a big spend bonus or SUB and I don’t think the 0.5X less return changes the math there.

The co-branded cards addition is interesting. It could be possible to earn 3X while SUB hopping between cards depending on the partners.

Typical vapor ware from Bilt

If Bilt offered 3x on partner co-branded cards for 3% and no Bilt points, I’d take it. Air France or Emirates.

Really?! That’s not a good sign imo

As y’all have correctly stated before, you are essentially paying 1.5¢/pt with a 2x earning card. This is because you could already get 1 BILT point at 0% cost using a BILT card.

With BofA you’re paying 0.37¢/pt for points you could have got for “free”? That’s a straight loss unless you can stack with other shenanigans?

anyone tries double cash?

Double Cash is fine to use.

Does the Bilt app or website allow you to use a credit card through Apple Pay?

When paying with an Alaska credit card. Do you get 3x Alaska miles via credit card plus 1x Bilt points via Bilt app?

I also want this answered by more sites. Award wallet currently says that the Alaska card will NOT earn the additional Bilt point.

This article addresses this. Read above what Tim wrote…

No. That’s the one exception where you won’t earn 1x Bilt points

NOTE: This is only available to those who pay rent via a landlord payment portal. This is not available to payment via check or via PayPal.

That’s true, but I’d guess that many/most landlords have a way to pay by ACH which you can do with this.

You can do it via Paypal or Venmo. When you add the credit card to Bilt it will generate a bank routing number. You will get the 3% fee from Bilt, but not from the Venmo transaction because it treats it as a bank account transaction. It’s not a straight forward process, but it is possible.

Will be very interested if Bilt expands this to mortgages when that capability rolls out. If you’ve considered using Plastiq to pay rent or mortgage before, this is essentially the same cost but with the added benefit of 1 Bilt point per dollar and no restriction to only Mastercards.

I’d argue it’s competitive with overpaying taxes as well. About 1.1% higher fee for 1X Bilt points extra, and you don’t have to front the money until next year’s tax filing. With the tax payment options starting to restrict use of Business cards this may also be a great option for those (unless it is restricted to personal cards?).

If your goal was spending on Hilton Surpass to achieve the 15k..would that be worth it?

Big spend bonuses and spending to loyalty seem like interesting avenues for this. Hilton FNCs are one good example, something like the Aadvantage Aviator Silver could be worth it as well. The 3% fee is close to a wash earning 1 Bilt + 3 Hilton points or 1 Bilt + 1 AA mile, then you get the big FNC or the 5K loyalty point bonus and double AA companion voucher for close to no net cost.

Do not forget that Amex only earns 0.5 Bilt point/$. So the Surpass is not quite a wash in value just for the points, but the value of the FNC is still worth considering this avenue if you do not have enough spend elsewhere.

Good point, forgot about the AMEX rate being less. Still probably worth it for how big the value is on that FNC but you lose a little on the Bilt side.

If I had to pay rent and pay taxes, I would save Amex for taxes since no difference in fees and use Visa/MC for rent with Bilt to get the better Bilt earning ratio.