The year 2025 will go down as the year of the ultra-premium credit card. I can’t recall a year where we’ve seen such a shake-up in the ultra-premium credit card space. In just the past two months, we’ve seen the lukewarm launch of the newly-couponized Sapphire Reserve cards, learned that the Altitude Reserve will be nerfed, seen the launch of the Strata Elite card and the Alaska Atmos Summit card, have caught wind of the rumored launch of new higher-end Amex Marriott business cards and rumored changes coming to the Amex Platinum cards and we have been told to expect the new Bilt $495 card soon. The market for ultra-premium cards has become white-hot, but I think I’m reaching my melting point.

When the year started, I was looking to trim my ultra-premium card collection. Now, we recently added the Strata Elite to our household, upgraded a Business Gold to Business Platinum, and I find myself intrigued by the Alaska premium card. I have to wonder what Bilt has up its sleeve to compete and we probably can’t drop my wife’s Sapphire Reserve this year since she’ll be charged the old $550 annual fee upon her upcoming renewal (and we’ll get access to the new coupon benefits in late October as pre-June 23rd cardholders). We can’t keep all of these high-end cards long term, so I really need to create a game plan for late 2025 and 2026 renewal decisions.

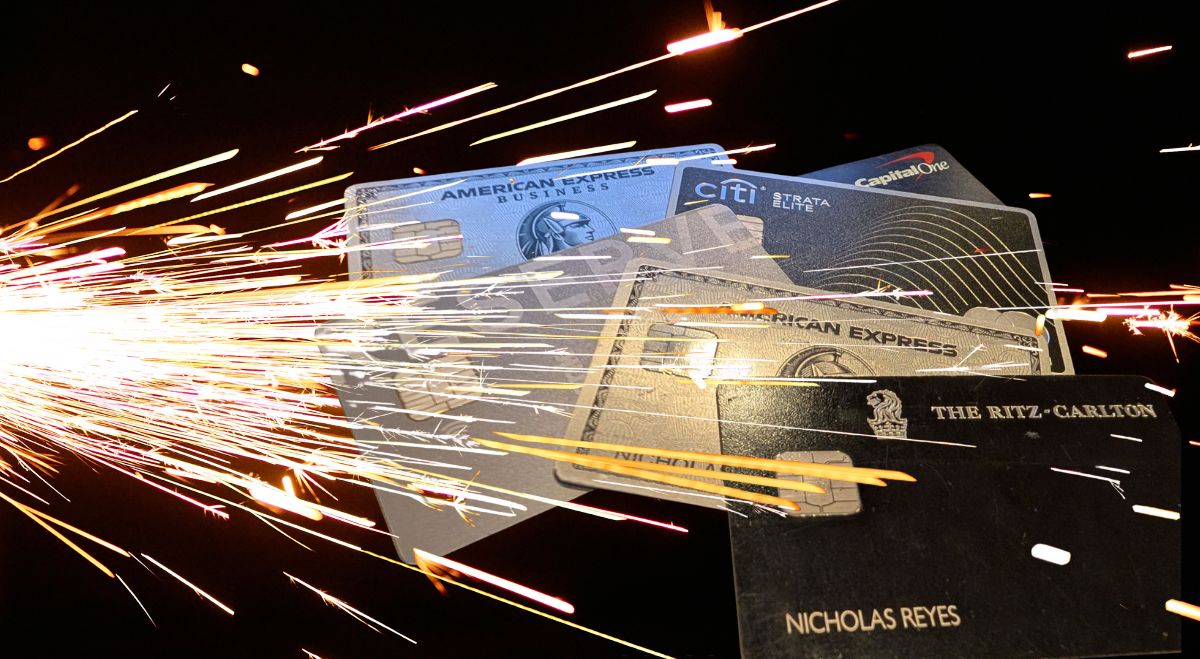

My ultra-premium card collection is officially out of control

Over the years, we have added numerous ultra-premium cards to our household collection. With the annual fee creep that we have seen in recent years, things have really started to spiral out of control on that front.

In my household, we currently have at least one of each of the following cards:

- American Express Platinum Card for Schwabm: $695 annual fee (rumored to increase to $895 in September)

- The Business American Express Platinum Card®: $695 annual fee (rumored to increase to $895 in September)

- Chase Sapphire Reserve® Card: $795 annual fee (though we’ll pay $550 at next renewal, which happens before 10/26)

- Capital One Venture X Rewards Card: $395 annual fee

- U.S. Bank Altitude Reserve: $400 annual fee. Note that this card is no longer available to new applicants.

- Citi Strata Elite℠ Card: $595 annual fee

- Hilton Honors American Express Aspire Card: $550 annual fee

- Marriott Bonvoy Brilliant® American Express® Card: $650 annual fee

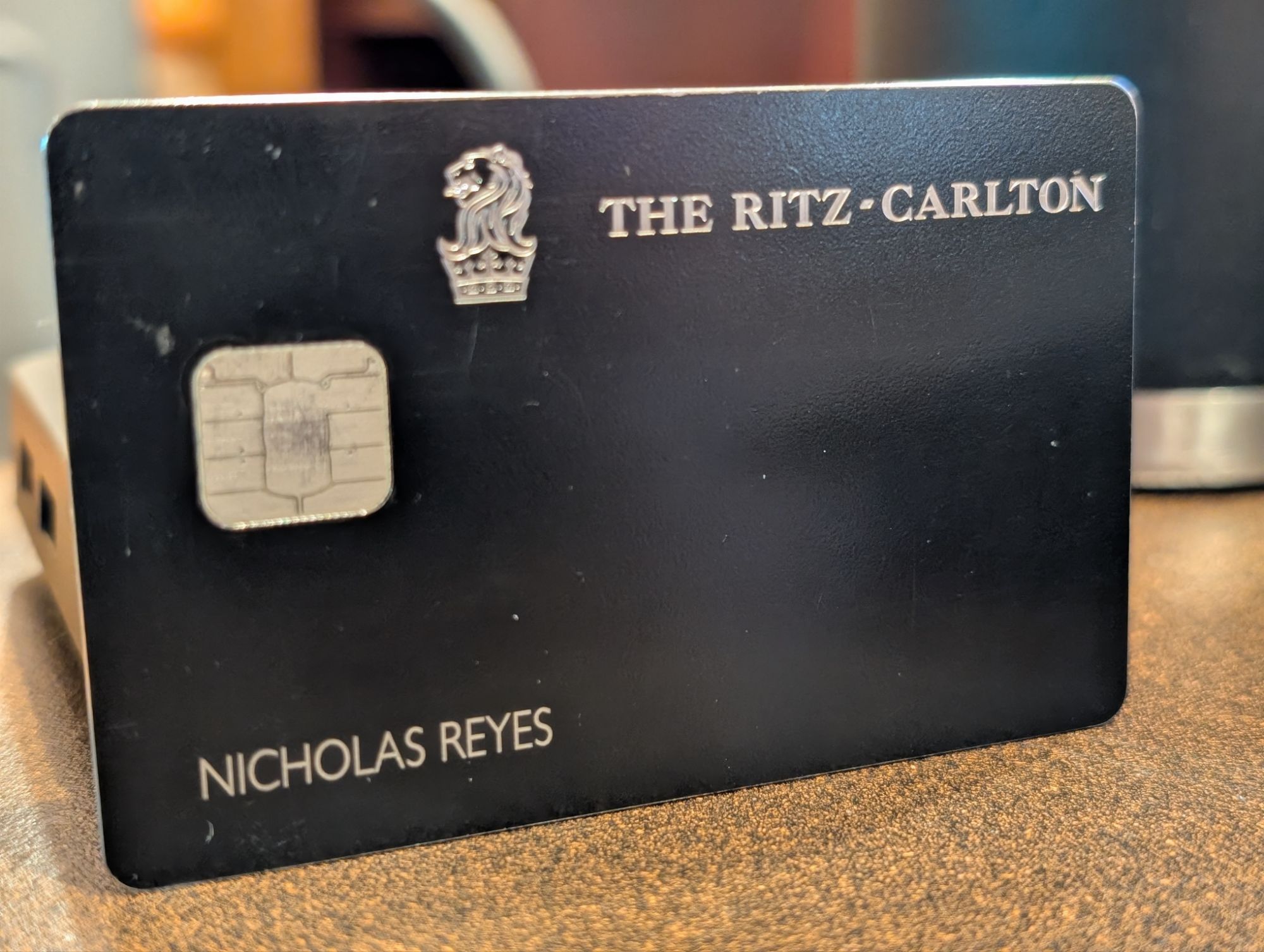

- Chase Ritz-Carlton Visa Infinite: $450 annual fee. Note that this card is no longer available to new applicants, but it may be possible to product change from another Chase Marriott card.

Add to that list the fact that I want the Alaska Atmos Summit card. It is enough to make even my head spin.

Greg maintains an excellent spreadsheet for determining which cards to keep and which to cancel (See: Which premium credit cards are keepers?). The spreadsheet is very useful in determining whether I think I can get more value out of the benefits than the cost of the annual fee for each of the cards we hold. Still, I’m finding myself at a difficult crossroads: even though the spreadsheet offers the chance to value some benefits at $0 since they are redundant with other cards you’ll keep, I could still make a marginal case for keeping any one of the cards above in conjunction with one or two of the others.

However, zooming out to look at the big picture, if we had one of each of the cards above in our household (and no other cards!), our collective annual fees would total $5,625 (more than $6K if we got the Alaska Atmos Summit card!). In reality, my wife and I have some duplicates in the list above, so the true total climbs even higher. Furthermore, we have lots of other cards. If you asked me if I’d pay $5,000 or $6,000 per year for a single card that combined the benefits of all of the cards above, I don’t think I’d be willing to pre-pay that much money on all of the collective benefits.

That suggests that I should go back to Greg’s spreadsheet and be a little more conservative with my perk valuations. That’s probably a good idea. However, I wanted to walk myself through my ultra-premium card collection, considering which are definite keepers, which are definitely going, and which are on the borderline in 2026.

Definite keepers

I would without a doubt keep the following cards for years to come for the reasons listed here:

- Chase Ritz-Carlton Visa Infinite

- The unlimited Priority Pass with unlimited guests and unlimited Sapphire Lounge access with unlimited guests aren’t available on any other card.

- The $300 in annual airline incidental credits are really easy to use (we’ve seen all sorts of things work for this)

- The annual 85K Free Night Certificate gives me the opportunity for a really nice Marriott night each year

- I can easily justify spending $450 on the above combination. I’ve consistently used the free night certificate on a stay that would have otherwise cost more than $450. The travel credits and Priority Pass make this very easy to justify.

- One of our household Ritz cards is grandfathered at a $395 annual fee, which is an even better deal yet.

- Amex Hilton Aspire

- At a $550 annual fee, this card’s benefits easily outweigh the fee.

- We’ve been using the annual free night certificate for nights that would cost well over $550

- We have no difficulty using the card’s $50 quarterly airline credits ($200 total each year).

- Even if we only used the free night and the airline credits, we’d feel good about the trade for the annual fee. If we use even one of the $200 resort credits, we’ll feel comfortably ahead. Writing this made me realize that we should be using this card for CLEAR membership, taking one thing away from our Platinum cards (which is what we currently use for CLEAR).

- Capital One Venture X

- Between $300 in annual travel discounts through the Capital One portal and the 10,000 anniversary miles, I’m satisfied that this is an easy no-effort trade in exchange for the $395 annual fee. The Hertz President’s Circle status and Primary CDW insurance contribute further value to make this an easy keeper card (note that while the Ritz card has primary CDW for most cardholders, its coverage is only secondary for me as a New York Resident, so the Venture X holds appeal for me).

Out of the above three keepers, the Venture X and Ritz card each have a single $300 “coupony” benefit that can potentially be used in one shot each year. I love that simplicity.

The Aspire card ramps up a bit in couponiness, but the coupons are easy enough to use. I appreciate that those coupons are not split into tiny monthly increments that require more time/effort than the amount of value they provide. Further, the annual free night certificate makes it easier to justify a little bit of coupon effort.

It is worth mentioning that the above card combination gives me a pretty comprehensive list of core ultra-premium benefits apart from the hotel free night certificates:

- Great lounge access with the Ritz card.

- Primary CDW and rental car elite status with the Venture X

- Great travel protections (between the Venture X and Ritz card)

- CLEAR membership with the Aspire card

- Global Entry or TSA Precheck credit with the Venture X if we should ever decide that we want those

- Top-level hotel elite status with the Aspire card

The combined $1,395 in annual fees above are easy enough to justify for at least one of each card. The Ritz and Aspire cards are even relatively easy to justify in multiples (such as my wife and I each having one) given the added convenience of having two matching annual free night certificates — enough for a nice weekend away — without significant added coupon complication. That said, if I were to accept one Ritz card each + one Aspire card each + one household Venture X card, the total in annual fees would be $2,395 (actually $50 less for me since I have a grandfathered Ritz card with a lesser annual fee).

Ultra-Premium cards that I definitely plan to cancel

Several cards will feel easy to cut from my wallet at the next renewal. Here are the cards and brief explanations as to why I plan to cancel:

- Amex Bonvoy Brilliant card

- While I’m happy to use this card’s 85K free night certificate and automatic Marriott Bonvoy Platinum status for now (and load up on the Starbucks app once a month to use the dining credit), but I really hate having to remember to use the dining credit each month and I wish I didn’t have to spend $300 per year at Starbucks just to make this easy. I am 1 year of Platinum and 50 nights short of Lifetime Platinum status with Marriott. I have 8 more nights planned this year (which reduces my path to Lifetime Platinum to just 42 more nights + 1 more year of Platinum when 2026 begins), so once my elite night credits from this card (25 elite nights per year) and my Amex Bonvoy Business card (15 elite nights per year) post to my Marriott account early next year, I’ll be just 2 nights short of Lifetime Platinum, which will give me the free breakfast and 4 pm checkout that I want (at many (most?) Marriott properties). I’ll likely downgrade this to the $95 Amex Bonvoy card sometime early next year to score a prorated annual fee refund and then cancel at renewal time.

- Citi Strata Elite

- The first-year value on this card is extraordinary right now. Between the welcome offer and the relatively easy-to-use calendar-year credits that can be double-dipped (earning a slate of them this year and again next year), it just makes sense to get this card. However, I have absolutely no desire to keep it. The gimmicky Friday/Saturday night dining thing is just plain silly; the lack of other bonus categories that aren’t tied to the Citi travel booking portal will make this an easy product change to a Double Cash. We already have a Double Cash card, but we’ll product change that existing Double Cash to a Custom Cash when the time comes. We’ll keep my wife’s Citi Strata Premier to transfer to Citi partners, but I can’t see keeping the Strata Elite.

- Chase Sapphire Reserve

- I have justified keeping one of these in our household because I’m a blogger and it is useful to be able to write about ultra-premium cards, but I just don’t want to spend nearly eight hundred bucks for the headache of having to remember to use the time-limited coupon benefits. I could probably get more than $795 in value out of the card, but the invisible time and effort costs annoy me here.

I won’t lose all that much when I trim out the cards above. It is worth noting that we’ll have the Sapphire Reserve until October of next year since we won’t get hit with the new annual fee until October 2026. Once the cards above are gone, I probably won’t miss all that much.

Ultra-Premium cards that are on the fence for me

The cards that have me struggling to decide include:

- Amex Platinum (consumer or business?)

- Assuming the rumors are true that both consumer and business Platinum cards will cost $895 per year beginning next month, I can not see keeping both at a cost of $1,790 for one of each (keeping one or both for both me and my wife gets crazier yet).

- In general, I find the coupon benefits on the consumer side easier to justify, though the Uber credits have become less appealing as Uber Eats prices have continued to climb. I like the Business Platinum card’s 35% rebate when using points to book flights on your chosen airline. JetBlue’s 25 for 25 has made me revisit the fact that this 35% rebate can be excellent for domestic flights (which is the core usefulness of the benefit moving forward since the rebate will no longer be available on other airlines in business and first class from September 18, 2025 onward).

- Although I think I can probably get good use out of the rumored Fine Hotels + Resorts® or The Hotel Collection credit once per year, I won’t count on being able to use it twice per year on a single card. I don’t think we’re going to be able to justify multiple household Platinum cards in the future, so I think I’m going to need to pick a single Platinum card to keep. After using most of my wife’s Amex points stash for JetBlue 25 for 25, I’ve been building back my collection. I’ll probably keep a Platinum card in my name.

- Since rumor has it that changes will be announced in mid-September, I’ll hold off on making a final decision until we have a fuller picture of the refreshed benefits. At this point, I am leaning slightly toward keeping a single Business Platinum card if the prepaid hotel credits end up matching those on the consumer side.

- If new benefits are not compelling enough, I may consider instead keeping a Business Gold card with a thought toward a strategic upgrade if and when I want the ancillary Amex Platinum card benefits.

- U.S. Bank Altitude Reserve

- I have become so accustomed to tapping my phone to pay everywhere and have gotten my wife used to the same! I’ll be really sad to see this card change drastically in December. The drop from 1.5c per point to 1c per point for travel redemptions stings.

- On the other hand, I’m really curious to see what U.S. Bank’s transfer partner program will include. If they end up with a solid set of transfer partners, I could see keeping this card as our default warehouse club & Walmart card. During most months, we wouldn’t exceed $10K in purchases even if we continued to use this as our default in-person payment method, so if the transfer partners are good, I could see keeping this for what will essentially be 3x almost everywhere we pay in-person (since the card earns 3x on mobile wallet payments like Apple Pay, Google Pay, and Samsung Pay).

- If the transfer partners are not compelling, I will let this card go (while probably holding on to my disappointment for a long time). With the Venture X offering a $300 travel portal credit and 10,000 miles per year and offering rental car status and a good transfer partner program, I’m just not sure that it is worth also paying for this card to earn 3x instead of 2x on in-person spend unless U.S. Bank offers something compelling on the transfer partner side.

- This card does not come with any compelling side benefits like elite status or other credits that make it more appealing.

- Atmos Rewards Summit Visa Infinite

- We don’t yet have this card, but I am very much intrigued by the combination of benefits. We discussed the card and why I find it so interesting on this week’s coffee break. See: Alaska’s intriguing premium rewards card | Coffee Break Ep68 | 8-26-25.

- Bilt’s Premium card

- We don’t yet know anything at all concrete about this card other than the fact that it is expected to be issued by Cardless and carry a $495 annual fee.

- Bilt has said that they did not want to follow the coupon book model. I expect that we’ll see some unique benefits on the card, but I can’t yet imagine what they will be.

- Many Cardless cards have featured lukewarm welcome offers, so I don’t have high hopes for a great welcome offer. However, I’m leaving room for Bilt to innovate something that makes me want the card. Given that I do love Bilt’s transfer partners, I’m keeping my eye out here.

At most, I think I can justify two of these ultra-premium cards. Will it be Atmos + Business Platinum? Will U.S. Bank surprise us with a killer transfer partner program? Can Bilt offer something that kicks out one of the others here? I’m still undecided.

I could even imagine a scenario where I dumped both the Altitude Reserve and the Platinum card or one where I decide not to pursue status with Alaska, which could make me eliminate all three of those cards. The Bilt card could have zero appeal for me — I won’t know until we hear more.

In reality, it will be hard for me to imagine dropping the Platinum card from a professional standpoint (since the card has so many solid travel benefits that we write about), but I’m definitely feeling the coupon fatigue.

Bottom line

I’m currently paying north of $6,000 in annual fees for ultra-premium credit cards alone. Examining these cards on the whole, I think I could be happy with halving my annual fee outlay. I could still have a pretty solid three-card ultra-premium combination for just $1400 for one player (and I’ll consider spending the additional $1,000 to double up on hotel free night certificates. Maybe I’ll add up to another ~$1400 in fees with the cards from the fence. That would still be a lot of money spent on ultra-premium cards, but it would represent a significant reduction in total cost. Now to trim the rest of the collection a little bit . . .

[…] Frequent Miler: The white-hot ultra premium credit card market is making me melt (on Nick’s mind) […]

“My ultra-premium card collection is officially out of control”. Oh my goodness truer words have never been spoken [written]. I am retiring at the end of this year and the $7k+ in annual fees we are now paying has to stop – besides 2 AMEX plats, 2 Aspires, a CSR and a Ritz, I am currently working on SUBs for an Atmos Summit, Strata Elite, and Bonvoy Bevy. I appreciate you setting the table for my decision-making process over the next 12 months. Clearly at least one AMEX Plat has to go, but the others still hold a lot of value to me. It’s gonna be tough! And made potentially tougher if AMEX dangles a juicy retention offer at us…

At first I was thinking you have some form of obsessive mental illness carrying all of these cards. Then it occurred to me that this is your line of work and I’m quite sure you’re writing off all of these outrageous fees. For a normal person, paying all of these ridiculous fees would necessitate a psychological and/or financial intervention. Haha.

Nick, you are closing your Amex Platinum or downgrading to what?

I want a $1,495 Amex Delta card that slots above Reserve and is the only Amex (Amex Delta or Amex non-Delta) way to get lounge visits. Tired of the hoi polloi in the Delta lounges.

That is all.

I was in a Delta lounge this afternoon and it was absolutely fine. As well as a few times a month. Only on rare occasions have I seen poor habits displayed. And, never could not get in due to over-crowding.

I’ve had to wait in line once, which was annoying. Granted, only once.

KLM international lounge AMS was just AWFUL AWFUL AWFUL. All Americans, too. I suspect on Delta tickets via Amex Platinum, but I’m totally making that up and don’t know if it works that way.

The domestic Delta lounges are getting a bit more crowded than I’d like, though. I’d like to thin out the herds a bit — 20-30%. I’m worried it’s only going to get worse.

We’ve had problems finding two seats together at times. As it is, I’ve started flying on Sat nites to avoid issues. (This is SEA.)

Delta One in JFK was just awful as to how crowded it was. Delta One in SEA was a DREAM OTOH.

But overall, I do agree with you. With one exception. Business people roaming around talking loudly on the AirPods. And older people (I’m older, so I feel I can denigrate my fellow olds) talking on FaceTime via speaker loudly.

When did this become socially acceptable?

Air France and KLM Schengen area lounges are a dream by comparison. Quiet hushed phone convos.

Except for the young Spanish couple having a VERY LOUD fight that I would pay good money to see every time. Pass the popcorn. It was better than any movie I’ve watched recently. And my Spanish comprehension is limited.

Excellent article!! Appreciate your honest thoughts on these cards – makes me less sad that Amex has me in POP…..

To paraphrase one reader, as a seasoned hobbyist, I *can* zero out the annual fee on each of these cards. Even turn a profit. But, do I want to? And, the answer is that I don’t. At this stage of the game, I want the path of least resistance to 1) the level of points I want to earn and 2) the key benefits I want to receive. Which really means the fewest number of cards to get the job done (with reasonable backup for contingencies).

Yes, I will leave money on the table. But, if it’s no longer fun . . .

Agreed. The more cards I have the less time I want to spend on each one.

Let’s not forget the $495 Jet Blue Premier World Elite Mastercard launched this year.

On second thought let’s forget it.

I feel like my wife and I will probably settle on (in addition to having no-brainer Ritz + Venture X + Aspire cards) having 1 personal platinum card and 1 business platinum card between the two of us.

The Platinum has somewhat broader lounge access (compared to say, Chase with their Sapphire lounges or Capital One with their lounges) due primarily to the Delta Skyclub visits you get each year, which fill in a lot of gaps for us in airports where there isn’t a credit-card-based lounge on trips where we aren’t flying business class. So it’s nice to have if possible, and we would need 1 each per person.

We can make reasonably good use of one personal platinum’s coupons (Uber and airline credit are near-cash for me, I actually use HBO Max obtained via an add-on to a $1/mo Hulu subscription that utilizes the entertaiment credit, a Walmart+ membership is surprisingly not useless, … though Saks/Clear/FHR credits are near worthless), and you can get into a lucrative “downgrade and then accept upgrade offer” cycle (and we typically like to have one Gold card to get 4x points on our hefty grocery spend).

And the business platinum credits are “ok” (airline and wirelss are like cash, while Hilton and Dell a bit less useful) while effectively giving us a floor CPP of ~1.54 cents for flights on our selected airline, while being in many ways churnable (can get a new signup bonus even if you previously had the card).

So we’ll probably get into a cycle of one person downgrading their personal Platinum to Gold while applying for a business Platinum… while the other upgrades their Gold to a personal Platinum and cancels their business platinum. Then swap places every ~13 months.

Hi Nick, just wanted to say this article was one of the most useful things I’ve read on these kinds of points-and-travel blogs. So many posts are only designed to blindly cheer on every new premium credit card and their ever-increasing fees and luxury “discounts,” but it was refreshing to read something like this that actually put some thought (and doubt) into what these changes are actually worth. Also enjoying the comments section, too.

I’ve got nowhere near the amount of cards that you do (“just” the Cap1 VentureX, CSP, AMEX Gold, Citi Premier, Alaska, and in the future maybe Citi Strata Elite or Atmos Summit), and am already feeling overwhelmed, lol.

The explosion of travel portal and completely unrelated credits is going to drive a reduction in cards we’re all carrying. In some cases it may stop us from churning the card at all, as you are investing a significant sum just in the annual fee that you need to be certain you can make work. I know I can get way more in value than the new $795 fee on the CSR if I were to sign up, but I have to work at it and be certain I have uses for the credits within the next 12 months. If I find I’m making totally unnecessary bookings on The Edit and their dining program or just let those go to waste, the annual fee is so high it starts to struggle offsetting the amount of points I’d get back on spend. 125K – 50K (to cover the net $495 annual fee after the $300 travel credit) = 75K, which is just another Ink or CSP bonus at that point. I’d rather do one of those other cards with far less mental load.

Where we do have to jump through the credit hoops I much prefer the general travel portal booking as opposed to FHR/The Edit credits. The more restrictive the credit becomes – only usable on hotels, only usable on luxury hotels, etc. – the less value it carries. VentureX shines here. It might be the one thing that could save the USB AR, though I am sad to see that card likely sailing off into the sunset.

The brand specific ultra-premium cards seem to be the ones offering the most clear value proposition now without having to jump through too many extra hoops. Ritz Carlton and Hilton Aspire offer a ton of value and the Atmos Summit (Alaska) card is very interesting. I’m interested in the rumored Bonvoy Brilliant Business card which could pair nicely with a Ritz. Note that the VentureX is the only flexible points ultra-premium card not on Nick’s potential chopping block. I feel like more of the travel brand cards lean in better to use at their own hotel/airline and so you know right away either the card will be valuable or is a bad fit for you, with only a few exceptions (looking at you AAdvantage Executive card).

Very interesting article – lots of food for thought these days with premium cards. I’m surprised by how many are saying canceling the CSR due to the changes is a no brainer. In my situation, I feel like I’m paying less out of pocket with the new AF. Under the old $550 AF, I was out of pocket $250 as the $300 travel credit was the only easy thing to reduce the AF and I always thought about whether or not the card was worth keeping. With the new benefits, $795 goes to $495 with the travel credit but I no longer have to pay for Apple TV ($120) and I’ll use the new $300 dining benefit without thinking about it as we go to many of the restaurants on the list on occasion (certainly will hit 1-2 of them every 6 months) so that takes it down to $75 out of pocket without changing behavior or chasing coupons in any way. It also helps that we are in San Diego and the new Sapphire Lounge is the best lounge option at our home airport. I can see less appeal for those outside major cities, but I would still think the AMEX Platinum would be higher on the “no brainer cancel” list, particularly after they increase the AF in the next few months. I’ve never really understood the appeal of that card as a keeper at all.

It’s all relative to what you naturally spend on. AMEX Platinum is a much better fit for our family since we already subscribe to Disney+ anyway (family with kids), but I’ve never cared to watch Apple TV so that credit on the CSR has zero value. And as annoying as the Uber Eats orders once a month are that is much easier to use than the CSR dining credit where I’ve been to only a handful of places in our state that are eligible, and don’t have a burning desire to go back.

At $895 the AMEX Platinum may also be gone next refresh for me – we could pay for Disney+ at a discount on the BCE easy enough and I don’t want to force $500+ in FHR stays every year to make the card “work”. But with all these premium card fee hikes it goes back to the question of “what do you naturally spend on?”

It definitely depends on spending patterns. I don’t have much use for The Edit or the CSR restaurant credits but do often use the Amex streaming credits and Uber credits. And flying out of ATL the Amex card gives me access to like 47 Delta lounges in the Atlanta airport alone.

Similar story to other responses for me. I’m not at Apple user at all (and truthfully, I don’t watch much entertainment that isn’t on YouTube these days – I love movies, but I’ve probably streamed two this year total and I can’t recall the last time I watched a TV show). I already subscribe to Spotify and I’m not rebuilding all my playlists to move to Apple music (especially as an non apple user).

I don’t live anywhere near any of the eligible restaurants for the dining credit. I might be able to make use of that benefit now and then when I travel, but then I’ve got to remember to search for an opportunity and tailor where I want to eat based on the credit, which I’ve already struggled with this last month traveling and looking for a use of the Amex Gold Resy credit (in fairness, traveling with young kids makes that harder than it would be for two adults).

Don’t get me wrong, I’m sure we’ll use the StubHub benefit and the travel credit and maybe I’ll find a use for The Edit credits, but I am starting to get to the point where I don’t want to have to make my travel plans around so many travel credits that limit my accommodation options. I’ve literally spent the entire month of August traveling and haven’t had a good use of the Amex FHR credit on this trip as it is.

If I subscribed to the Apple services and if I lived in a city with both qualifying restaurants, I’d probably be much more interested in keeping it. Being in a city with a Sapphire Lounge wouldn’t make any difference in the math for me though since the Ritz card is a no brainer keep card for me and that already provides better Sapphire Lounge access (with unlimited guests).

It’s definitely a different strokes situation, but I think I’m leaning against the effort to maximize the CSR.

Main reason I had the Chase Reserve was for the guaranteed 1.5 rate on redemptions which put getting good value for my points on easy mode. Since the benefits aren’t things we use, and it would take real effort to force value out of the card, it’s no longer worth the time for me. If they’d kept the 1.5 rate, or if it turns out the high redemption rates are so universal and easy to use it doesn’t matter, I might change my mind. But without that I’ll be cancelling once all my 1.5 points are used up. Will transfer points to partners for use going forward, which I don’t need a Reserve to do.

My CSR fee is due in Dec, at which point I will product change, probably to Freedom Flex. I have seen language that Chase reserves the right to claw back credits used within 90 days of cancelling a card, which would limit my ability to use the new credits before December. I am hoping this would not apply to product change but I am not sure.

Not intending to contradict you — you have seen what you have seen — but I find this surprising. If canceling after only the first year? Or maybe within the first 90 days of getting the card (as folks used to do with the 100K AA miles Citi AA Executive or whatever it was called, to get the AF back after pocketing the miles)? But, if, in general — and in particular with a card that is automatically scrubbing travel expenses through $300 — … I mean, you couldn’t cancel such a card without limiting your use of it for 90 days in advance?

Maybe I am not understanding.

I’m not sure I understand the implications of the language either, but here is what it says in the Chase terms and conditions: “We may reverse statement credits if an eligible purchase is returned, canceled, or modified or if you close your account within 90 days of receiving a statement credit.” This language occurs for the $300 travel credit, the Edit credit, the restaurant credit, and the StubHub credit. Whether this also applies to a downgrade I don’t know.

I have seen lots of folks planning to max out credits just before closing but this makes me nervous (which, I suspect, is the intent). I have a couple of months I could use the restaurant credit before I close my card, but they aren’t restaurants I would go to otherwise. Just be aware that you might be stuck if you don’t use your credits at least 90 days before you close the card. Or at least, that is how I interpret it.

Another huge consideration/offset is which lenders are predictably the most generous with retention/AF spending offers for reducing said fees? I’ll leave it at that, but 5-10 minutes/year on each AF card effectively cuts my fees in half+ (& my family’s gross total is more than Nick’s!). Time & effort also must go into the maintenance of cards (not just hitting a terrific initial SUB) for the numbers to work out in the cardholder’s favor.

I think I’ll adopt a methodology that allows at most counting 20% value for monthly coupons and 60% for semi-annual coupons. Maybe even just $0 for the monthly ones, and I’ll consider any benefit I get there as a non-quantifiable “plus”.

I’ve zeroed out monthly credits in my valuation now. I hate things that try to change my behavior. I’m not inclined to use uber/doordash/etc….nevermind they are overpriced.

A generic $25 Bonvoy Brilliant dining credit isn’t hard to use. I’ll tolerate that for now.

It’s the specific ones that are undesirable.