NOTICE: This post references card features that have changed, expired, or are not currently available

The points parade marches on.

I was going through credit card statements the other night when I realized that the annual fee posted on my wife’s Platinum card. In late 2020, she had opened the vanilla Platinum card via the 100K + 10x offer that we wrote about extensively (long since expired, but even better you can get 125K + 15x at the time of writing – details here). Yesterday morning, she chatted to see if there were any retention offers available and that worked out very well. If you opened a Platinum card around a year ago (many readers did), it is well worth chatting before closing to see what they can do.

Too many Platinums

Between my wife and I, we currently have four Platinum cards open (three personal and one business). That’s a lot of annual fees for benefits that overlap in many ways.

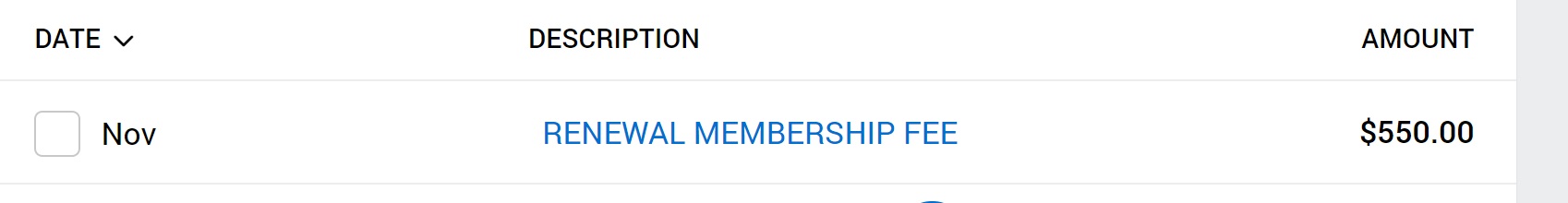

It therefore made sense to consider dropping one of the Platinum cards. Which one to drop and when is sort of an interesting question because while the annual fee on the Platinum card increased to $695 earlier this year, the new fee only kicks in on renewals as of January 1, 2022. That means when my wife’s annual fee posted late last month, it was “only” $550.

That lower fee makes it slightly easier to justify keeping the card, but only slightly when considered in the larger context of the the barn full of ultra-premium credit card studs in our stable. Dropping the recently-renewed Platinum card now might make sense.

That’s why my wife chatted for a retention offer. Sure, we can eke some value out of the annual credits and I’m happy to buy myself something I don’t need at Saks now and then, but to justify keeping the card we’d need something more.

Asking for a retention offer via online chat

I’ve written in the past that Amex retention specialists are available via the chat function during weekday business hours (I believe from 9am to 5:30pm Monday through Friday). You can of course call and speak to a retention person, but if you’re like me you may appreciate something that can be done with half a brain while you are multi-tasking.

My wife logged in to her account and pulled up the chat tool in the bottom right corner. She told the automated chat responder that she wanted to speak to a representative and then wrote that the annual fee on her Platinum card recently posted and she hasn’t been traveling because the kids can’t yet get vaccinated (true) and that she was leaning toward cancelling that Platinum card unless there are any offers that make it more attractive to keep.

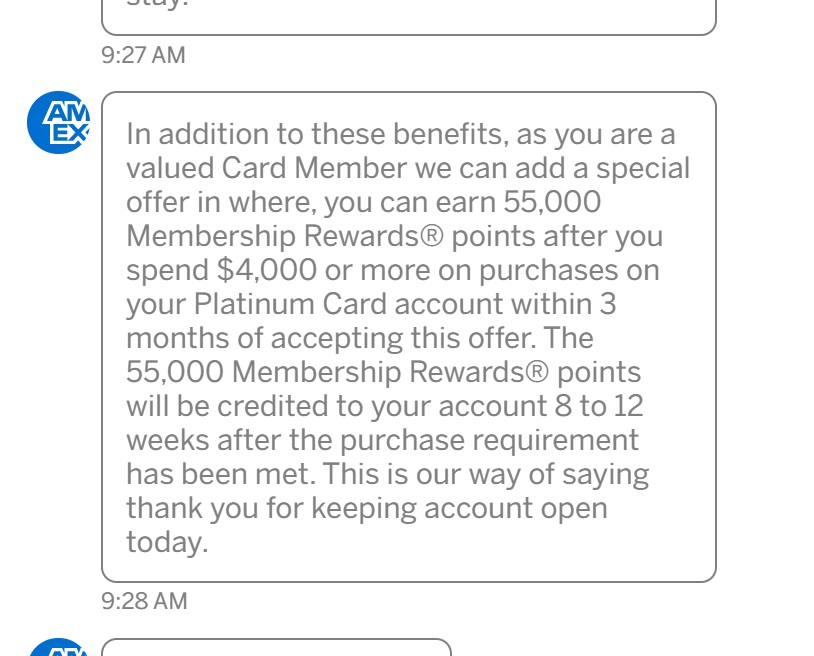

The initial rep who picked up the chat had to transfer the chat to a retention specialist. That specialist asked whether my wife was familiar with the newly-enhanced benefits as of July 1st. Before my wife even finished typing a response to say that she was aware and it wasn’t tipping the balance for her, the rep came out swinging with an offer for 55K points after $4K spend within 3 months of accepting the offer.

That sounded great — 55K after $4K in purchases is more like a new card welcome offer — in this case without opening a new account. At a base level, the points are worth $605 to her since she also has the Schwab Platinum card and can redeem for deposits to her brokerage account at a value of 1.1c per point. She gladly accepted.

The representative sent through some disclosures about how my wife was accepting an offer to keep her account open and how the long claw of the Amex rewards abuse team would find her even in the darkest hiding places if she tried to close this account before 12 months pass (in hindsight, I guess that whole bit about the claw was just implied). My wife agreed to keep the account open and the offer was activated.

I’ve noted this in the past with other issuers, but for those who might wonder I’ll add that you do not need to have paid your balance to zero to discuss closing the account and retention. I used to think that a retention specialist wouldn’t take you seriously if your account had a balance, but that wasn’t the case. We had made some purchases during my wife’s current billing cycle which won’t be due until sometime in January and that didn’t make any difference. Again, that bit of knowledge is probably second nature to some readers, but at some point in the past I would have assumed that I needed to pay and wait for the payment to clear before I could discuss canceling so I note this for those who would have made the same incorrect assumption.

A lucky stack with the old +4 referral bonus

Juicing things a bit farther, my wife had referred someone from this Platinum card with the referral offer that was around until 12/1/21 (since expired). That means she is currently earning an additional 4 points per dollar on all spend on up to $25K in purchases over the next couple of months.

The fact that she has that extra 4 points per dollar offer surely makes it sound crazy to consider cancelling, but because I am very fortunate to be a blogger we were able to get referrals and trigger the +4x offer on several cards. The truth is that we are unlikely to meet the full capacity that we have on the +4 offer as-is (and as I’ve previously written, stacking the +4x with additional cardholder bonuses on some of the business cards adds a lot of capacity to spend beyond 5x).

However, taken together with the retention offer, the +4 from the referral bonus will be great. Thanks to stacking these bonuses, the $4K in purchases required to meet this offer (if completed before her time runs out on the referral offer) should yield:

- 4K points at 1x (base earnings on spend)

- 55K points from the retention offer

- 16K points from the referral offer (+4)

- Total = 75K points

That’s awesome.

Bottom line

Getting 75K total points after $4K spend without opening a new account is terrific. In the end, that’s an average of 18.75 points per dollar spent assuming we complete the spend while her +4 bonus is active. The nice thing is that this 18.75x is on all purchases. Looks like we won’t miss the 19x that I’ve been earning at small businesses and restaurants on my Platinum card too badly.

I know that many readers must be in a similar boat with a Platinum card opened about a year ago thanks to the increased offer of that time and a chance to triple dip annual credits by applying in December. If you were considering canceling after using some 2022 credits in early January, it might be worth chatting with a representative and giving Amex an opportunity to change your mind. They might just invite you to march back into the points parade.

[…] “amex no retention offer” is an offer from American Express that allows users to get up to $695 (69.5K Points) in […]

45,000 MRP for $4K spend today via chat. Yesterday via phone wasn’t offered anything.

Are there any good, solid data points on how many times a person can request a retention offer, especially for the personal Platinum card? Is this something a person could do annually or just once?

Thank you!! We were just able to get a retention offer on my husband’s Amex Platinum (on day 30 after the annual fee posted). First I tried on the chat; no offer, but they gave the phone number to try speaking with a retention specialist (1-855-857-7657). I called and explained how living in a rural area we can’t take advantage of a lot of the benefits, and travel is still looking sketchy, etc. I’m not sure that was even necessary, and she quickly offered 40K pts or a $400 statement credit after $3K spend on the next 3 months. I happily took it and we kept the card, especially since the annual fee was still $550. The increased $695 fee won’t kick in until December (2022).

So, thank you again… If I hadn’t read this article and the comments, I likely would have forgotten to even try for a retention offer. And I almost definitely would have given up after the chat, and missed out on a free $400!

Perfect timing for this post. My annual fee hit a couple of weeks ago. I did the chat thing as described by Nick and got $400 credit for spending $3K. No other offers were available so I accepted. Thanks!

Strangely, when I chatted online they suggested I downgrade to the Green ($150 AF, I think), then when I asked directly, told me there were “no retention offers via chat.” But directed me to Membership Consulting Services Team at 1-855-857-7657. Got 40,000 MR after $3K in 3 months. Never had it happen that way before…

Your comment gave me the extra encouragement to call the number after being denied in the chat, and sure enough, I got the same offer–thanks!!

Thanks, Nick! The reminder was well worth it! Almost overlookwd that AF had posted almost a month ago. Contacted Amex chat today and got the 40k MR points after 3K spend offer. Considering that I did not plan to close or downgrade the card, that’s free money!

Great job, guys! All the best for you and FMs in 2022! Keep it up!

Boom, got 55k MR for $4k spend in 3 months. Holla!

Wish I had seen this before I re-upped about a week ago. I’m a newbie at asking for retention offers but after a number of offers she gave me 400 dollars off the 550 renewal fee this coming year so not really all that bad. Required 3k spend which I paid an insurance premium to cover. I am not a big AMEX user to begin with but do use the Uber, streaming and airline credit easily. Also like the late checkouts hotel credits etc etc.

southwest codes the upgrade benefit to be covered and this way I get 5 exit rows per card covered per year. Well worth the cost of the card after this 400 rebate. Guess I could have ground on her harder, but that’s just not me!

Thank you. My AF posted last week and will hit the January 2022 statement. Was offered the 40K miles for $3K spend even with a balance of $5K showing. Accepted.

Nicely put –

Hey Nick Thanks For The Great Blog Post. I Know I’m In The Super Wrong Section LOL. But..I’m 27 And My Credit Is Around 680, Pretty Shitty Huh.. Anyway I Have A Small Business, A Handyman Company, I Was Seriously Affected By Covid And Lost Over $12,000 In Money spent for my overall company. I have bank records of monthly 3k-5k deposits from customers and so on. I’m In Dire Need Of A Business Credit Card & Bank Account. Could anyone help me with the basics of starting off with setting up a business bank account and business credit line. My father started helping me but then suddenly passed away a few months so I’ve had shit of luck with helpm plus I’m caring for my mother who has been struck with stage 3 brain cancer and stage 4 lung cancer and our previous nurse stolen over 6k from us… Taking advantage of my mother… I’m sorry for ranting but I’m 27 and I’m basically stuck in a 40 years Old (+) body and mind to run a household just fine… Please Any Advice I’ll Take Openly. If you would be a blessing and reach out via Instagram (@Bigdawgaustindareseller) I’ll be patiently waiting .

Thank you and God bless, and again Merry Christmas & A Happy Holidays.

Would Amex chat agents look at previous conversations? Wondering if it’s a bad look to chat in about a retention offer on a card when the previous history for (a different card’s) retention chat is still around

Called Wednesday on my platinum card and got bupkiss. Messaged Thursday on the same card and got an offer.

Thanks for the very unexpected Christmas gift, Nick! For grins I just chat with AMEX. I first of all forgot I was given a points retention offer last year on my Green card, so at that point thought it was all over based on the AMEX rules you posted. I subsequently earned 40k more this yr to upgrade to Gold then 100k (& $150 credit) to upgrade to Plat 2 months ltr.

Lol the agent said in light of the change in acct terms she’d give me a $150 statement credit to keep the acct open another year. It has been exactly 30 days since my $695 AF posted.

Thanks again!

(& I’d already paid the AF)

Ho, ho, ho! Merry Christmas 🙂

First retention chat to AMEX – 40K points for 3K spend; with the AU bonus of 20K on 2K spend, that will be 63K points for the 3K spend (making sure we use the right cards along the way) – if my math is right, that’s 21x!

Nice!