NOTICE: This post references card features that have changed, expired, or are not currently available

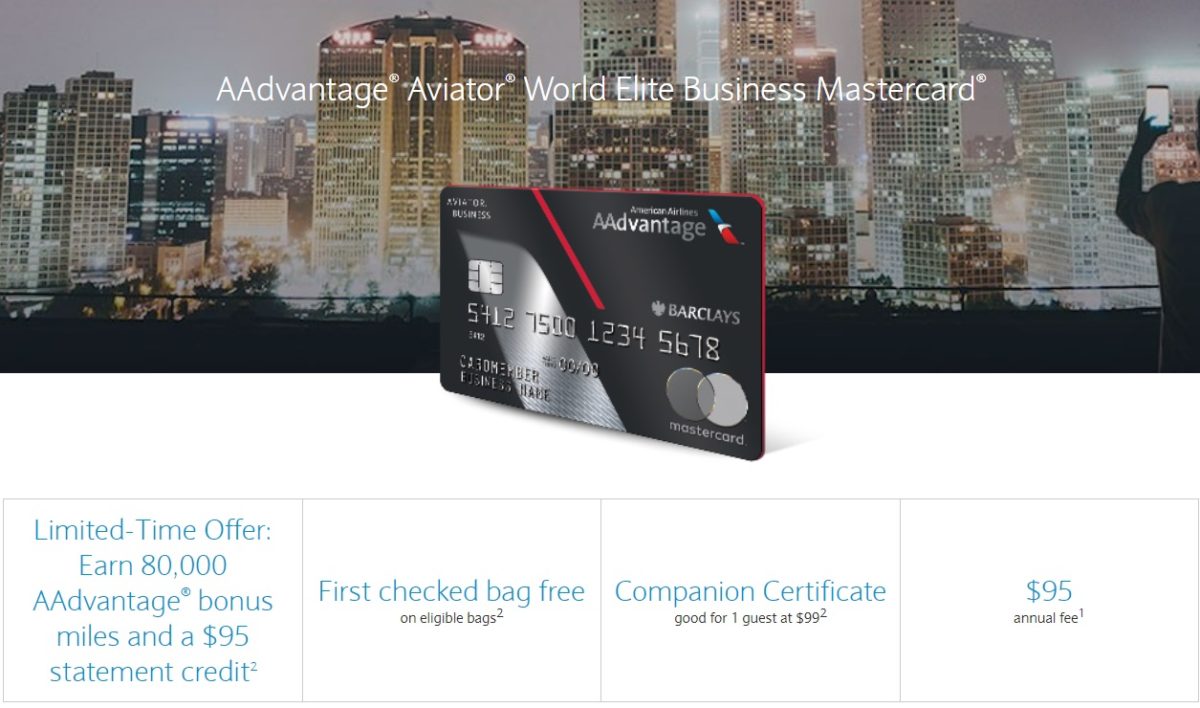

Throughout August and September, the AAdvantage Aviator Business MasterCard has had a solid welcome offer of 70,000 miles after $2,000 in spend. That offer has now been bumped up to 80,000 AAdvantage miles after the same $2K in spend and also throws in a $95 statement credit in the process.

This makes the Aviator Business card one of the top ten best business card offers on our Best Offers page.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-95 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

Quick Thoughts

This new offer matches the best that we’ve ever seen on the Aviator Business, most recently in July of this year. Not only does it award 10,000 more bonus miles than the previous offer, but it also comes with a $95 statement credit which effectively waives the annual fee for the first year.

$2,000 is a fairly low minimum spend requirement compared to other welcome offers of this caliber. Our current reasonable redemption values have AAdvantage Miles at 1.3cpp, giving this offer a total value of ~$1100…a great return on only $2K in spend with no 5/24 impact (since it’s a business card it won’t add to your 5/24 count with Chase).

My wife and I are both at 4/24, so it’s VERY tempting for each of us to pick up one of these to earn some easy AAdvantage miles while we’re waiting to apply for more Amex cards.

For those playing the AA Loyalty Games for elite status, it’s worth noting that the bonus miles you earn here will not earn a corresponding number of Loyalty Points. However, your base spend on the card does earn you 1 Loyalty Point per dollar and so cards like these can still help you towards AAdvantage status.

P2 is a 3% owner of my LLC. If I apply under my name, can P2 apply under his name (same LLC with same EIN) a week later? Not sure how this works…

If you get this card under LLC #1, can you also get this card under LLC #2, within a few months of each other? (Both LLCs have a unique EIN)

It’s your SSN that counts. I would think no as the 24 month rule after closing your old card, not when you took the first card out.

Is this able to be churned? If I open, then wait a year, close, do i need to wait 24 months to reopen and get another SUB?

Read the comments below

PSA: imo, dont bother applying if received a SUB from this card in past 24 months.

from t&c it states that “Existing accounts and previous cardmembers with accounts closed in the past 24 months may not be eligible for this offer.”

I can confirm that. Applied a week ago and was denied for precisely that reason (my previous card was closed just over a year ago.)

When was it opened? Isn’t it 24 months from receiving the bonus?

no, it’s 24 months from closing account.

afaik there is no way around this even with recon, but would love additional DP to the contrary.

PSA: you may have to manually call in to get the $95 SC. I still haven’t gotten mine from July

How far between applications with Barclay Business cards? I got this card in September of last year. 12 months okay?

No, you will be denied, even with recon. Must wait 24 months since *closing* (not opening).

Will Barclays let you have more than one of this card? Alternatively how soon after closing one can one apply for the same card?

Must wait 24 months since the card was closed (as per their recon rep).

Bc AA is not a transfer partner AND bc I had a small amount of AA award miles this summer that saved a summer holiday, I’m doing this for sure.

Kind of a old / new offer… I got approved for this same thing in June. Nice to see it back.

Terrific. I am signing up for this now!

Applied and, while under review, got notification right away from credit bureau (TU) about a credit inquiry. So the inquiry definitely goes on personal report, but not 100% sure if the same goes for “New card” on personal credit report. Will wait and see.

Yes, the inquiry will show up, but the card shouldn’t. There was a glitch earlier in the year where some Barclays Biz cards were showing up on credit reports, but that seemed to get fixed fairly quickly. I signed up for the Wyndham card a few months ago and it’s not on my report.

Is it confirmed that Barclays reports all biz cards to count towards 5/24?

From what I have read in various sources, most BIZ cards do not count towards 5/24. Even Barclay.

As a data point, my Wyndham business card doesn’t appear on my personal credit report. My best guess is that this card won’t count towards 5/24.

Can confirm Barclays business cards do not count for 5/24.

On the 2X categories, do you get 1 or two loyalty points? Tempting offer!

You earn double the AA miles, but it is still a single loyalty point