NOTICE: This post references card features that have changed, expired, or are not currently available

Acorns is out with a new referral promotion: this time both the new customer signing up and the person referring them will get $5. If you pick up 4 referrals, you’ll get $250. While we’ve covered a number of their monthly promotions in quick deal posts, I last wrote at length about Acorns a little over a year ago and figured it was time to update with my results and impressions given that we often report their promotions. In a nutshell, Acorns is worthwhile for those who can trigger these referral bonuses and is better than not investing for those who wouldn’t do it otherwise. It can also be worth it for the occasional good deal on the Found Money side of things. This isn’t a platform I’d join if the goal is to learn about investing and unfortunately the funds have under-performed in my layman’s opinion, so I recommend this deal more from a quick hit perspective than a long-term plan perspective. That said, if you’re playing this game in team mode and keeping your eyes open for opportunities, Acorns could be a quick and easy win with little downside. I recently wrote about low-hanging fruit from bank account bonuses and why you should pick it and I view Acorns through the same lens.

What is Acorns?

If you’re totally unfamiliar with Acorns, the basic rundown is that it’s a brokerage account that you can either fund on-demand or you can enable round-ups from your linked debit or credit card (rounding up the change and investing it in your portfolio). I disabled round-ups and have only invested money I deposited, money earned from referrals, and “Found Money” (which is essentially cash back from card-linked purchases). Since it’s a brokerage account, they collect your SSN when signing up and you link a bank account login to fund it much like you’ll find with a number of other investment / card-linked platforms these days. Those parts make some folks uncomfortable and I get that — Acorns isn’t for everyone on that front alone, never mind my lack of enthusiasm otherwise. On the other hand, I’ve been using it for a couple of years now without any problem from a privacy standpoint. Read more about how Acorns works in this older post I wrote — note that post is about a long-expired referral promotion from January 2018, but it explains how it works, the fees, etc. It’s worth reading that for more context, but the rest of this section borrows from that post to give the key details.

Acorns is a robo-investing platform that allows you to invest in ETFs in four ways:

- Making a one-time deposit into your Acorns account

- Automating weekly/monthly set-amount deposits

- Rounding up the change from your purchases via linked credit/debit cards (e.g. You spend $10.58 and Acorns automatically withdraws $0.42 from your linked checking account to invest)

- “Found money”, which has two methods — most partners work like a traditional shopping portal where you click through the Acorns link to earn cashback that is invested, but some partners work similarly to other credit card-linked programs (like in-store cash back, Shell Fuel Rewards, etc) and award cash back when you use your linked card at those retailers

During the signup process, you’ll have the ability to fill out some profile information and determine what kind of investment portfolio you would like.

You will also need to link a bank account if you plan to auto-invest, either via rounding up or recurring investments. One thing that surprised me here: I had not linked any credit cards for round-up when I created my account. However, I linked a bank account to transfer funds for a one-time investment. I later realized that I had a few cards linked for round-ups. The bank account I linked to transfer funds was a Capital One bank account, and to link it I had to log into my Capital One account via the Acorns system. Acorns automatically enrolled all of my Capital One debit and credit cards for round-ups. I was able to un-link those cards once I realized what happened — but I didn’t like the fact that they were instantly added. If you link a bank account login that also has credit cards linked to it, be aware that this may happen, though it’s simple enough to un-link them.

The kicker that makes this platform unattractive compared to stuff like Robinhood or SoFi is the fees. You’ll pay:

- $1 per month if you have under $5,000 invested

- 0.25% if you have over $5,000 invested

That’s expensive compared to the lack of fees for using Robinhood or SoFi to invest. On the other hand, I looked at the new account bonus as a way to cover the fee for the first few months and I’ve kept the account since I’ve gotten enough referrals that the $1 per month fee isn’t really a loss for me. If not for the big up-front referral bonuses that I earned, I probably would have closed my Acorns account long ago. As it has turned out, that would have been a mistake for me for reasons I’ll get to below, but know that this fee schedule does Acorns no favors in terms of its position as compared to other investing platforms where you could invest small amounts like SoFi or Robinhood.

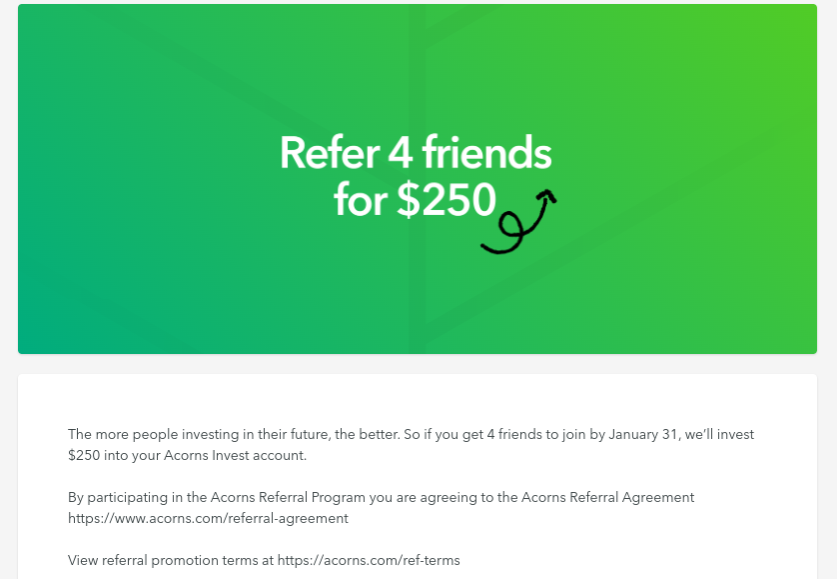

Current Referral bonus

If you’re new to Acorns, feel free to use one of our referral codes with our thanks – you’ll get $5 as will we when you invest at least $5. As noted at the top, the current promotion offers a bonus of $250 if you get 4 friends to join and invest $5 by January 31st. Here is a link to the full terms. The short story is that each referral must be new to Acorns and must invest $5 by 1/31. Bonuses are paid out on 2/15 and if the person you refer closes their Acorns account before that, you won’t get the bonus. Their referral system is pretty simple.

Here are our links:

If you have a referral link to share, visit our Frequent Miler Insiders Facebook group and find where I’ve shared this post. Share your referral link as a REPLY to my first comment on that post in the Facebook group. Links shared in the comments on our website will get caught in our spam filter and will not post, so please head to Frequent Miler Insiders to share your links. Thanks!

My impressions based on 2019 results

I originally went to write this post as a quick deal just outlining the latest referral promotion, but the new promo encouraged me to look back through my own results. As I said at the top, I figured it was worth re-visiting Acorns since the last time I said much about them at length was about 14 months ago in November 2018. If you’re not interested in digesting that whole post, here is the paragraph that summed it up in hindsight:

And really, that’s the lens through which I view Acorns: it’s a great platform for earning outsized value from referrals moreso than from investments. It can also be a good platform for earning “Found Money”, whether through card-linked offers or their shopping portal-like offers – Stephen has written about the many instances where Acorns Found Money can present better value than other shopping portal options (see the posts under “Acorns background” above). And if you’re the type who wouldn’t save without round-ups, it can be good for encouraging you to save (I opted out of round-ups). But if your only goal in singing up is to invest regularly and earn money doing it, this app probably isn’t the best for that based on my personal experience and opinion. You can only pick things like an “aggressive” portfolio or a “conservative” portfolio — you don’t have much control or visibility into what you’re doing, so there is no ability to fine tune or adjust really.

I was curious how things have gone since and I thought that readers might wonder how I feel about Acorns today after having used it for a more extended period.

Fourteen months later, my opinion hasn’t changed for the better. Having now used the Robinhood app and SoFi Investing app for a few months, and comparing results from Acorns against against my IRA, I can’t sugarcoat it: the Acorns app stinks. There just isn’t enough information or control. Never mind that you can’t really tell what you’re investing in (you can only pick the general tone of your investments), it’s hard to get any clear view as to how your gains or losses are calculated.

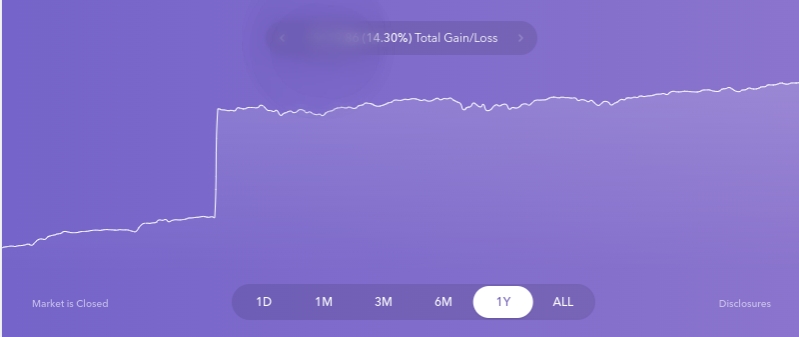

Between January and November 2018, I had lost some money invested through Acorns. It wasn’t a great time for the market, so I certainly wasn’t unique in having lost some money that year. However, when reviewing Acorns in November 2018, I wrote about how the Acorns app showed my losses as what felt like a misleadingly small percentage. I’ll drill back into that a bit below, but the short story was that the percentages shown for market gains / losses or total gains / losses felt a little misleading to me even if not totally inaccurate and had I just relied on the performance chart and gain/loss figures shown in the app, I wouldn’t have had a very clear view of the actual performance of my invested money. In January 2020, not much has changed. It still isn’t easy to tell what is included in the market gains/losses and total gains / losses shown by Acorns. The web interface does a better job showing detail than the app does, but the app sets the bar low in that regard. Check out my performance over the past year as shown in the more detailed web interface (note that I can’t seem to access this type of graphic or detail in the app, only in the web interface):

One of the problems with this graphic that should stand out immediately is the absence of numbers. Apart from the blurred dollar figure on my “total gains” percentage, there are no numbers, no hash marks, no measurements apart from a very general time period on the bottom axis. That makes it really hard to get any context as to what the gains or losses have been.

You’ll further see that it shows a total gain/loss of +14.30%. While the chart obviously moves upwards, I’m not positive what is included in the total gains. You can see where the chart jumps drastically upwards in approximately the first quarter. I’m reasonably sure that jump is from Acorns “found money” from a specific deal. Based on the amount it represents in dollars and cents, I can logically conclude that they aren’t including “found money” in my total gains. However, I’ve picked up a handful of $5 referrals throughout the year from posts with my referral link (no large bonuses — just $5 here and there). How are those counted?

When I wrote in November of 2018, I noted how the percentage loss/gain was skewed because they included a large referral bonus in my total investment numbers to determine the percentage of losses. There was some funny math at play. As a reminder, here were some concrete numbers from my 2018 investing experience:

- $200: Initial investment

- $220: earned from $5 referrals during 2018 (I left all of this money invested in Acorns)

- $5.00: earned when I opened my account and funded with at least $5

- $5.32: dividends earned

$430.32 “invested”

At the time (in Nov 2018), my portfolio was worth $403.74, for an actual loss of $26.58 (about $17 lost from the market and $9 from the monthly $1 subscription fee). Acorns was showing that as a loss of 1.84%. Twenty-six bucks is obviously more than 1.84% of my $430.32. The reason for the low percentage of loss shown was that at some point during the 2018 year I had triggered a referral bonus of $1,000 (in 2018, Acorns offered much bigger referral bonuses than they did in 2019). I had immediately withdrawn that thousand dollars, but Acorns was looking at my loss of $26.58 against a total investment of $1,430.32. From my perspective, that made my loss appear more mild than it was. Don’t get me wrong — thanks to that huge referral bonus, I was obviously way up overall. I wasn’t losing sleep over the twenty-six bucks lost in the market. And I get the perspective that the loss was relatively insignificant. But showing my investments as having only lost 1.84% wasn’t a great indicator of the actual performance of my portfolio since that thousand dollars was only in there for at most a day or two.

And that illustrates why the graphic above is so problematic: without more detail in a graphic like that, it’s really hard to know what +14.30% really means in terms of how my investments have done with Acorns. I think that Acorns is probably including the handful of $5 referrals I’ve received in 2019 in my total investment (which makes sense since I have left that money invested). Based on the fact that my portfolio showed a loss in 2018 despite the huge referral bonus I’d gotten, I assume that Acorns is not including the $5 referral bonuses in my total gains, but that Acorns is including any gains I’ve made on the investment of those bonuses (which absolutely makes sense to me). Thus, I think I’ve actually gained 14.30% after accounting for the $1 monthly subscription fee. But the fact that I have to use the word “think” and italics so much in this paragraph is why I’m not very impressed with Acorns. It isn’t very user-friendly or transparent.

By comparison, I’ve done some minimal investment through SoFi and the Vanguard ETF I purchased was up 5.8% from October 2019 to December 31, 2019. Of course, that’s one fund and only a two month sample size — but there is a lot more detail in the SoFi app and it would be easy for me to diversify my own investments through SoFi (especially given the ability to buy stock “bits”, meaning that I can micro-invest as I please while choosing exactly how to invest the money). Robinhood has also added the ability to buy pieces of stocks and I prefer that platform even more as noted below.

But from a performance standpoint, a more relevant comparison might be my IRA, which I have set to a relatively aggressive approach in mutual funds (which should match the style of my Acorns account since I also have that set to be aggressive). My IRA was up 26.74% in 2019. Much like SoFi, I have a lot more control there in terms of being able to hand-select how I want to invest, so it’s not a fair comparison to Acorns in one sense. On the other hand, it illustrates that Acorns probably isn’t the best you’ll do from an investment standpoint even if you’re looking to be relatively hands-off.

On the other hand, if you know you don’t have the discipline to make regular investment contributions and you’d just like to get started investing, I could see where Acorns would help. Truthfully, that’s the role Acorns had for me. While I’ve long had an IRA, I hadn’t been investing apart from that and wanted to be doing so. Acorns gave me an opportunity to put their money aside (since most of my account is from referrals and found money) and watch it grow. In turn, when SoFi came around, I was glad to use that for an easy opportunity and then leave some money invested. SoFi led me to finally open a Robinhood account and put money into investments there. I far prefer the Robinhood app for investing. The interface is slick, trades are quick and easy, and I have full control over my money. If I have any complaint about Robinhood, it’s that I have taken to opening the app multiple times throughout the day to see how things are going, which is unideal from a productivity standpoint. By comparison, I’ve only opened the Acorns app a few times this year.

However, the constant referral bonuses that Acorns offers makes it a platform worth considering for what they offer. Much like with SoFi, the institution is obviously looking to gain a customer base and they are offering good incentives toward that end. To me, it’s not much different than a credit card welcome bonus: if the bank thinks my business is worth 50,000 miles, who am I to say they’re wrong? And that’s why an Acorns promo like this just makes sense. They are essentially offering you their money to play with. They give you an easy double-up by giving you a $5 bonus when you invest $5. Then, if you can find four other people willing to double up five bucks, you end up with $250. At that point, you’re playing with the house’s money — whether you leave it in Acorns as I have (apart from that one large bonus) or you take it out and put it to work through other platforms instead, I think it is short-sighted to skip out on easy bonuses like this while simultaneously focusing on how to manufacture spend at a cost savings of a tenth of a cent per point.

Found Money gems

One aspect that makes Acorns very different from SoFi or Robinhood is Found Money through card-linked offers. Every now and then, Acrons has some gems in its Found Money offers. Stephen Pepper has often written about these. He has covered some Found Money that didn’t require spending any money at all and times when Acorns Found Money has had better payout rates than any of the major shopping portals. He has noted how even though most shopping portals offer poor rewards for Hilton Gold and Diamond members (or no rewards at all for Hilton elites in some cases), Acorns has in the past offered flat rewards for all Hilton bookings (not recently). Around Christmas 2017, Geg uncovered a mighty stack at 1800Flowers/Harry & David where you could stack Dosh, a shopping portal, an Amex or Chase offer, and a flat rate of cash back per order via a card-linked Acorns Found Money offer. This was the found money that led to the jump in my 2019 chart above — all of my family members had stocking stuffers from Harry & David that year and in return my Acorns account got stuffed a few months later.

I admittedly ignore Acorns Found Money more often than I should because it requires logging in to see the offers. I also think that the offers have likely tamed some and are mostly shopping portal-esque rather than card-linked these days, reducing opportunities for stacking. Still, I recently wrote a post about miles and money you may be missing if you don’t look beyond the major shopping portals and Acorns Found Money can be one of those things. Are there enough opportunities to justify paying $12 per year for the platform? I don’t think so. Would I be willing to throw $12 at it if I picked up $250 from a referral promo? Sure. Like I said above, the referral bonuses they offer make it possible to kind of play with the house’s money for a while if you want to play. Just like Stephen did with his casino free play, you might choose to cash out while you’re ahead and that’s obviously a good strategy. I’m the type of gambler that will probably continue to play with the house’s money for a bit longer, but I’m not going to try to justify how it’s logical. It’s a gamble — a cheap one for me, so one that I’m willing to accept for now.

Bottom line

After a couple of years of using Acorns and a couple of months with some other popular investing platforms, I’m just not much of a fan of Acorns from an investment standpoint. Similarly, I wasn’t a huge fan of Capital One’s rewards program for years, but I was happy to take a welcome bonus when it made sense and I turned out to be glad that I held on to their cards because they eventually turned in to a big win for me. Acorns is kind of the same beast for me: I see the bonuses being worthwhile for those who can go after them and a $250 win once or twice is more than enough to justify the low required effort as compared to MSing a welcome bonus on a credit card. I’ve then been willing to donate back a piece of those bonuses for the opportunity to take advantage of something like the 1800Flowers stack noted above. Unfortunately, I went through all of 2019 without taking advantage of another similar offer (while the found money from that deal posted in 2019, the deal was from 2018), so it’s not like opportunities abound. Still, there have been enough (that just didn’t apply for me last year) that I’ll keep Acorns around for a while. At the end of the day, my portfolio did make money last year and the reality is that I probably wouldn’t have invested that money in something better. In 2020, I am more likely to invest that money more wisely, so I’ll probably shift more resources out of Acorns and just keep the account around for another 6 or 12 months to see if Found Money produces any more gems. If it does, maybe I’ll keep Acorns around for a while longer for its occasional bonuses, but it definitely will not become my primary investment platform and I wouldn’t recommend it that way.

Of Course I go to Travel cc blog ($$) to learn something about money .

CHEERs

I just don’t see the point. Right now there are many brokerages out there that don’t charge you anything to trade stocks or ETFs. For example, Fidelity has some stock funds that have zero expense ratio on the fund, they don’t charge you to open or keep an account (no minimums), they have free bill paying and will also reimburse you on ATM charges, etc. Even their money market account is paying 1% or so interest which is better than many banks.

Why pay $12 or more to keep an account open when there are so many other options that don’t charge anything?

Seems more like a pyramid scheme more than anything else.

You can sign up for the Losing Trader program where I “round up” your charges and debits and transfer the excess to my personal account if you’re just looking to help the needy.

501(c)(3), 401(k), are just a bunch of numbers and symbols you don’t need to worry your pretty little head about. I promise to use the money wisely.