NOTICE: This post references card features that have changed, expired, or are not currently available

Air Canada’s new U.S. based credit card seems to be custom designed for The Games we Play. It offers high rewards for spend at restaurants and grocery stores; it has unique features like Pay Yourself Back & discounted award pricing; and it offers interesting perks for big spenders, including the best companion-pass type of thing ever (but the latter requires one million dollars in spend!). If living that large has you feeling guilty, the Aeroplan Card has your back there too with automatic carbon offsets for certain types of awards.

Overview

On its surface, the new Air Canada Aeroplan Card appears similar to other airline cards on the market. For $95 per year, you get a free checked bag for up to 9 passengers; automatic travel protections; $120 credit toward NEXUS, Global Entry or TSA PreCheck every 4 years; and no foreign transaction fees.

Like a number of other airline cards, Aeroplan offered a welcome bonus worth up to 100,000 points after $4K spend in 3 months when it launched. In that case, though, you didn’t really get points. Instead, you got two vouchers which were each worth 50,000 points towards award redemptions. While I’d much prefer points over vouchers, the good news is that those had no expiration date: they were valid as long as you had the credit card. The welcome offer has since changed:

| Card Offer and Details |

|---|

ⓘ $694 1st Yr Value EstimateClick to learn about first year value estimates 60K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 60K bonus points after you spend $3K on purchases in the first 3 months that the account is open.$95 Annual Fee This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $4K spend in the first 3 months (Expired 11/13/25) FM Mini Review: Great card for regular or frequent Air Canada flyers Earning rate: 3X Air Canada ✦ 3X grocery stores ✦ 3X dining ✦ 500 bonus points with each $2K calendar month spend, up to $6K spend per month (1,500 points max) ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Renew 25K status w/ $15K spend ✦ Priority Reward w/ $100K, $250K, $500K, or $750K spend ✦ Free award companion for rest of calendar year and all of next with $1 million spend Noteworthy perks: Discounted award pricing ✦ Free checked bag ✦ $120 credit for NEXUS, Global Entry or TSA PreCheck every 4 years ✦ Carbon offsets on Air Canada awards ✦ Pay Yourself Back for travel at 1.25 cents per point, up to 200K points per year ✦ 10% bonus when transferring Ultimate Rewards to Aeroplan (25K max bonus/year) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

Also, don’t forget that if you joined the waitlist for the card by November 8th, then when you sign up for this card you’ll qualify for the waitlist Bonus: 10K points + 10 eUpgrade certs.

With that standard stuff out of the way, let’s get into the fun stuff…

Point Earnings

The Aeroplan Card’s point earnings are similar to other airline cards too, but with one exception… With this card you get 3x rewards for spend on Air Canada, and at restaurants and grocery stores. Unfortunately, you only get 1x everywhere else.

The Aeroplan Card also offers 500 bonus points for every $2K spend in a calendar month, up to 1,500 points per month. If you spend exactly $2K, $4K, or $6K per month, this feature adds an additional 0.25x to your point earnings. In other words, with this level of spend, you will earn the equivalent of 3.25x in bonus categories and 1.25x everywhere else. While this is a nice feature, I don’t find it too exciting.

I find the 3x grocery store bonus interesting because many of us spend a lot at grocery stores. The only other commonly available uncapped 3x grocery cards are the Citi Premier Card and Capital One’s Savor and SavorOne cards. The Citi Premier card has the huge advantage of offering transferable points, but if you’re interested in the Aeroplan Card’s perks for big spend, this could be a better choice. I also find this interesting because Chase hasn’t previously offered uncapped grocery bonuses. Hopefully this is an indication of more to come! I’d love to see a card that earns Ultimate Rewards points with uncapped 3x grocery earnings.

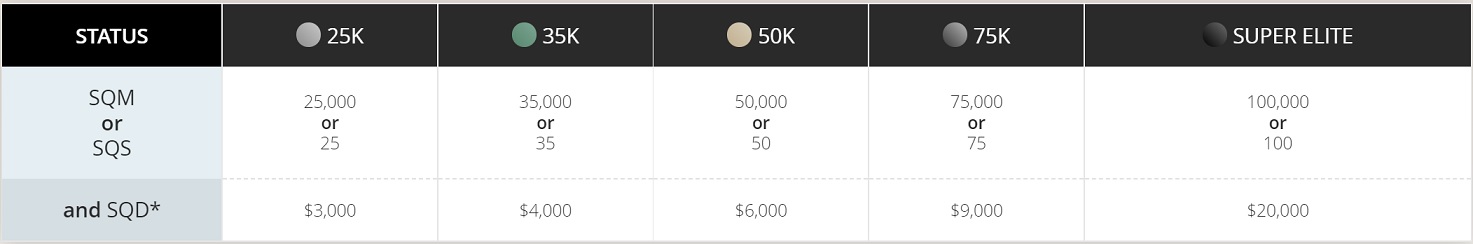

Elite Status

Aeroplan lists elite benefits for each tier here. Some notable perks are as follows:

- 25K: eUpgrade credits, Priority seat selection, 2 free checked bags, priority boarding, 2 Maple Leaf Lounge passes can be chosen as a Select Benefit

- 35K: All of the above plus more eUpgrade credits, 2 Maple Leafe Lounge passes

- 50K: All of the above plus Star Alliance Gold status (this gives you access to Star Alliance lounges, including United lounges, when flying a Star Alliance carrier), more eUpgrade credits, status passes (gift someone your level of status for a specific trip)

- 75K: All of the above plus ability to gift 35K status to a friend, more eUpgrade credits

- Super Elite: All of the above plus free award changes and cancellations, Air Canada Concierge Service, access to London Heathrow Arrival Lounge, more eUpgrade credits, 1 eUpgrade nominee (i.e. apply eUpgrades to friend’s trip even if you’re not flying with them), gift 50K status to a friend, complementary in-flight refreshment.

25K Status Upon Signing Up

Upon signing up for the Aeroplan Card, you’ll automatically receive Aeroplan’s lowest tier 25K Status for the rest of the current calendar year and all of the next calendar year. We’ve been told that those who sign up before the end of 2021, though, will keep status through the end of 2023.

Renew Status w/ $15K Spend

Each calendar year after the first, you can earn or renew 25K status with $15K calendar year spend on your card.

Status Boost w/ $50K Spend

Earn a one-level status boost after spending $50,000 in a calendar year. Here’s how it works: At the end of the calendar year in which you spend $50K or more, Aeroplan will look at the level of status you’ve achieved for the next year and will bump you up one level.

At a minimum, $50K spend will get you to 35K status (since the first $15K spend got you to 25K Status). However, if you achieved a higher level of status that is valid for the next year, you’ll get bumped up one level to 50K, 75K, or even to Super Elite status.

In some circumstances it should be possible to boost a status match. For example, if you are granted a status match to 50K status and you meet the challenge requirements so as to extend the status for the rest of the following year, then spending $50K in the current year should boost you to 75K status. Unfortunately, the timing of the recent status matches would make doing this very difficult as you would have to not only complete the match requirements (fly a round-trip Air Canada flight) but also spend $50K on the Air Canada card this year (2021).

When your status is boosted, you’ll earn all of the same elite perks and Select Benefits of your boosted status as if you had earned that status through flying.

You cannot stack boosts. For example, if you spend $50K in year 1 to get to 35K status, then spending $50K in year 2 won’t get you to 50K status. It will merely keep you at 35K status for another year.

Big Spend Perks

In addition to earning elite status through spend, as described above, the Aeroplan Card offers additional perks for really big spend…

Priority Reward w/ $100K, $250K, $500K, $750K Spend

Priority Rewards are vouchers for 50% off flight awards (including partner awards). Vouchers are normally earned each time you reach a SQD (Status Qualifying Dollars) threshold, and the type of the voucher you get depends on the status you hold at that time.

As confirmed with Aeroplan, the type of voucher you get with big (very big!) spend, depends on the status level you hold at the time that you surpass a spend threshold ($100K, $250K, $500K, or $750K):

- 25K or 35K) Canada / US – Economy vouchers: Use for travel wholly within Canada and the United States (including Hawaii) in Economy Class.

- 50K) North America – Premium Economy vouchers: Use for travel wholly within North America (including Mexico, the Caribbean, Central America and Hawaii) in Economy or Premium Economy classes.

- 75K) Worldwide – Premium Economy vouchers: Use for travel worldwide, in Economy or Premium Economy classes.

- Super Elite) Worldwide – Business vouchers: Use for travel worldwide, in Economy, Premium Economy or Business classes.

Personally, I can’t see spending that much for any but the Super Elite vouchers that work for worldwide travel in business class. Even at that level, you would have to use the vouchers for very, very expensive awards for it to make sense. I think they should make these vouchers work worldwide and in first class, regardless of the cardholder’s elite status at the time they hit each big spend threshold.

Ultimate Companion Pass w/ $1M Spend

When you hit one million dollars of spend within a calendar year (yes, you read that right), you unlock the ability to get 100% of points back on all redemptions in all cabins for a designated companion. You can think of it as getting a free companion for a year on all award flights, including partner flights (Etihad, Oman Air, Star Alliance Partners, etc.). You might argue that it’s not really a free companion because you have to have enough points to book them in the first place. That’s true, but after spending a million dollars on the card, I’m confident that you’ll have more points than you know what to do with.

I’ve confirmed with Aeroplan that this “companion pass” kicks in once you complete $1 million in spend in a calendar year and will last for the rest of that calendar year and all of the next year. Unfortunately, unlike Southwest’s Companion Pass, Aeroplan won’t let you change your designated companion.

Carbon Offsets

Aeroplan will purchase carbon offsets to reduce the impact of greenhouse gas emissions associated with cardmember travel when they fly Air Canada using an Aeroplan flight reward. Applies to Chase Aeroplan primary cardmembers and travel companions on the same reservation for flight segments with Air Canada, Air Canada Express and Air Canada Rouge.

Pay Yourself Back

Beginning early in 2022, Chase will add Pay Yourself Back benefits to the Aeroplan Card. Chase Aeroplan Cardmembers will be able to apply their Aeroplan points toward travel purchases on any airline, including hotel, car rental, and more at a rate of USD 1.25 cents per point up to 50,000 points per year (US$625 of value).

Discounted Award Pricing

When booking awards for flying Air Canada (not partner airlines), the primary cardholder will “often” see lower award prices than those without the card. Aeroplan refers to this as Preferred Pricing.

A while ago, Prince of Travel crunched a bunch of numbers to try to understand Aeroplan’s Preferred Pricing. He found that discounts seemed to be based on some combination of whether you are an Aeroplan cardholder and/or an elite member. That said, it seems that we can expect award rates to be discounted 8 to 15%, with some exceptions. See Prince of Travel’s full post, here: New Aeroplan: A Closer Look at Dynamic and Preferred Pricing.

My Take

I didn’t expect to have any interest in this card, but I was surprised — in a good way. I’m not saying that I necessarily want to get the card myself, but I am intrigued by the possibilities it offers. It seems to be custom designed with the points & miles enthusiast in mind. The card provides both elite status opportunities and award discount opportunities to those willing to spend a ton of money on the card. And, if you can spend a ton of money at grocery stores, all the better because you’ll earn 3x!

Is the card right for you? If you’re a regular Air Canada flier, then definitely. If you’re a huge spender and love getting award deals, then probably. For anyone else… I don’t know. I think you’d have to fly Air Canada enough to at least get some benefit from elite status for the card to make much sense past the first year.

[…] 50,000 miles each. And no, they can not be used together. You can learn more about this card here: A wild card enters the game: Chase’s Air Canada Aeroplan Card. I do NOT recommend this card! Hopefully it just fails and Chase learns that doing similar signing […]

Did this benefit ever make it to the Chase card? I can’t see any mention of it on the Chase website. However, I don’t have the card myself to confirm.

Yes this card is available I have it but you must search for it in chase it does not automatically populate in offers.

Any guess as to why Aeroplan’s partner award charts don’t offer any Premium Economy levels? Many airlines are installing PE seats and I personally like them. I can still sleep in those seats but save a bunch of money/points compared to Biz Class. If I’m sleeping all the way to Europe, the biz class amenities are a waste.

anyone having trouble adding this card to apple pay wallet? wont’ let me

One more question:

Is there any reason why getting the card in 2021 is better or worse than January 2022?

The only advantage that I can think of to getting the card in 2021 is if you plan to spend $50K before 12/31/21 in order to bump your status for 2022.

!! Not likely. Thanks.

Greg, thanks for the post. I am an omnivore with a BIG appetite so I will likely try for this card. Some questions:

1) Is this card more likely to be approved than other cards because it is new? I am at 3 or 4/24 depending on AU card.

2) How long do we have to get that 10,000 mile bonus we signed up for earlier in anticipation? By when do we need to get the card?

3) How good is the availability of Business US to Europe award space from the West Coast compared to United?

Thanks. I think I’ll apply for P2.

I could not find terms for high spenders above 50k on the website.

$1M on the Citi DC / Cap One VentureX gives 2M points – transfer to Aeroplan= 2M

$1M spend on this card = 1M Aeroplan points- with free companion

You lose 1M points for the privilege of the free companion.

I think the sweet spot is 50k spend, even for Aeroplan members.

Unless you are Lucky or Frequent Miler (and even then) this is going to be hard to get 1M points value from a companion free award – although this is a nice touch for high spenders loyalty.

i’d rather keep the transferable points for now –

On the other hand, if they came up with a premium card that gives 2 points and the 1M free companion award ….

Good analysis, unless you spend $1M at grocery stores at 3x

So I matched to 75k about a month ago, If I get this asap, will the $15,000 2021 spending keep me at 75k going forward (without completing the challeng)? If I spend 50k before the end of 2021, and complete the status match by jan 15th, would I then have super elite for all of 2022, and be able to spend 15k a year just to keep it?

No, spending $15K won’t help you. I believe you will have to complete the challenge w/ the round trip flight before the end of this year AND spend $50K this year to bump up to super elite for 2022. Spending $15K doesn’t help you keep status going forward except at the 25K level.

Just so I’m clear, if I sign up for the card next month I get 25k status immediately. Then, if I fly 35k miles during 2022, I get 35k status.

If I also spend $50k during 2022, I will get bumped to 50k status/*A Gold for 2023? Then, I can maintain that status by spending $15k thereafter?

Yes to the first part (although keep in mind that you have to qualify for 35K with qualifying dollars as well), but no spending $15K doesn’t maintain your status — it just keeps you at 25K status

Is the Cap1 Savor not commonly available? 3x on grocery uncapped

No, CO cards are extremely difficult to get approved for, and it’s even more difficult to get approved for additional CO cards like the Venture or Venture X which will allow you to take those cashback points and turn them into transferable miles, which is where the big value is at.

Venture X has been very to get approved for so far and Cap1 miles are transferable between members so a Savor coupled with any of ventures or a spark miles with two players is very feasible

As someone who has a decent credit score and income who has been rejected when applying for the X, I wouldn’t say that it’s easy to get accepted for. Maybe easier than CO’s other cards, but definitely not easy in general.

LOL, you got me Benn. I’ve updated the post. Thanks!

Seems like west elm/pottery barn card actually earns 4% back uncapped

If I get this card, I cannot burn any of my United miles.

If I spend $2 million on the card, can I bring along a second companion?

Sure, you can bring them. They won’t be free, but you can bring them because you’ll have plenty of points 🙂

Before anyone gets too excited, I believe the PYB is capped at 50k points per year. I can’t find it anywhere officially, but a lot of the blogs are referencing this limit.

That’s correct and that’s what is listed in this post.

You’re right, I missed it!

Does this mean you can transfer points from AMEX/other aeroplan transfer partners to your aeroplan account and use those points for the 1.25c pay yourself back on travel as well? Better than the 1.1c option with Schwab for AMEX cardholders.

Yes, up to 50K points per year.

Not bad, but still think *A flyers will be better served with Chase’s suite of United cards. Your research seemed to find generally better pricing with United, plus multiple cards to earn SUBs on.

I’m sitting on a pile of UA points from cancelled biz seat Award trips (transferred UR to UA) while I would have been cheaper if I had booked AC for Biz seats on pre-COVID booked trip to AU (Cap1 to AC transfer) . We have already used miles domestically.

But because of that pile of UA miles the only Airline card I/We have opened since before Jan 2020 was the 100K UA Quest card (for miles and expanded award availability).

But also since have almost $3K in UA Travel bank. We have banked Amex airline credits on Gold/Plats/Aspires cards in our UA Travel bank.

We also have only opened one Hotel card the Aspire for P2 so wenow have 2 Hilton FNA each year.