NOTICE: This post references card features that have changed, expired, or are not currently available

As expected, Amex publicly announced today that the Amex Gold Card now offers 4X points at restaurants worldwide rather than only in the US. They also threw in another enhancement… Remember that $120 per year dining credit where you earned up to $10 per month back for purchases at certain restaurants and food delivery services? Now they’ve added Boxed.com to the list of available merchants for this credit. This should make the dining credit much more accessible to many cardholders.

Summary of benefits

The $250 per year Amex Gold Card now offers the following benefits (the first two are newly enhanced):

- $10 per month dining credit: Enroll in this benefit and earn up to $10 back per month for purchases at Boxed.com (new), Shake Shack, Seamless/Grubhub, Cheesecake Factory and Ruth’s Chris Steakhouse.

- 4X at restaurants worldwide (previously US only)

- 4X at US supermarkets on the first $25K spend per year, then 1X

- 3X on flights booked directly with airlines or via amextravel.com

- $100 airline fee credit: up to $100 in statement credits per year for incidental expenses like baggage fees at one selected airline (see what works here).

- The Hotel Collection: Gold Card Members get a $100 hotel credit on qualifying charges, plus a room upgrade upon check-in, when available, when they book a stay of at least two consecutive nights at hotels in the collection

| Amex Membership Rewards points can be incredibly valuable if you know how to use them. In general, if you use Membership Rewards points to pay for merchandise or travel, you won't get good value from your points. One exception is with the Business Platinum card where you'll get a 35% point rebate when using points to book certain flights. This gives you approximately 1.5 cents per point value, which is pretty good. Another exception is with the Business Gold Card where you'll get a 25% point rebate when using points to book certain flights. This gives you approximately 1.33 cents per point value. If you don't have either card, then your best bet is to transfer points to airline miles in order to book high value awards. More details can be found here: Amex Membership Rewards Complete Guide. |

Rose Gold until 7/17/19

If you would prefer the Rose colored version of the Gold Card, you can get this version by applying by 7/17 or by calling to request a change to the Rose version if you already have the Gold card.

My Take

Despite my post yesterday (Amex Gold lost its shine – for me) I’m a fan of this card. Just because it isn’t right for me doesn’t mean it isn’t perfect for many others. I have a unique situation in which I have many cards that earn high multiples in many categories of spend and, as a result, I have trouble justifying the Gold card’s $250 annual fee.

For those who want to stick to a small number of cards, I think the Gold card should be a serious contender for a place in your wallet. The ability to earn 4X at restaurants and US supermarkets plus 3X for airfare is a potent combination. The ability now to earn 4X at restaurants worldwide is a big improvement, but keep in mind that many restaurants outside of the US don’t accept American Express.

The card’s $10 per month dining credit also goes a long way toward justifying the card’s significant annual fee. If you regularly dine at the included restaurants, or order delivery from Grubhub or Seamless, or shop online at Boxed.com, you can easily earn back $120 per year.

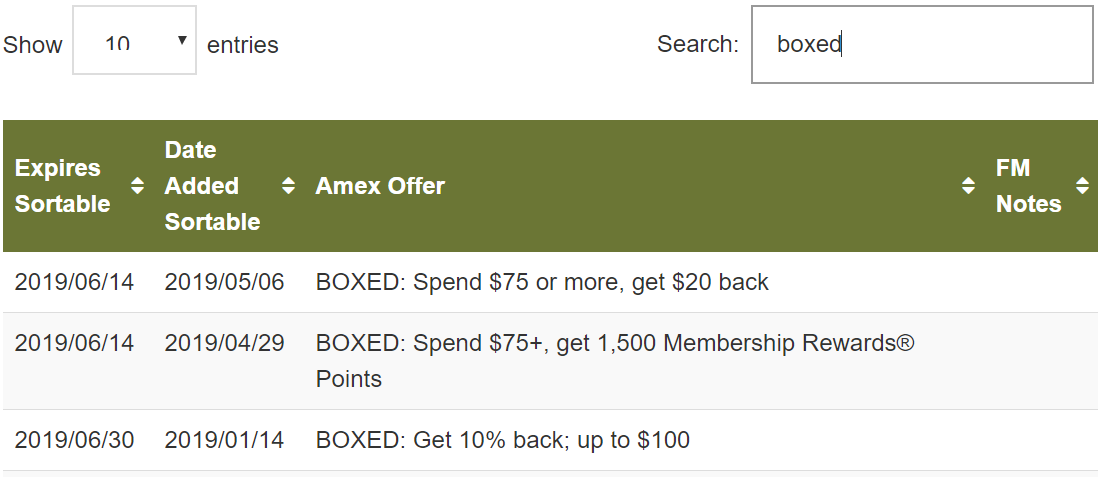

The addition of Boxed.com to the $10 credit lineup is even more interesting considering that Amex often has Amex Offers for Boxed.com. For example, via our Current Amex Offers page, I see that there are at least three current offers that you might find available through your Gold card:

Current Offer

As always, we publish the best public offers even if it means that we won’t earn a commission. In this case (at least at the time of this writing), the refer-a-friend offer is better than the affiliate offer, so we published the refer-a-friend offer. Note that you can refer yourself from a different Amex card so that you’ll earn credit for referring someone, and you’ll get the welcome bonus (if eligible).

| Card Offer and Details |

|---|

ⓘ $1307 1st Yr Value Estimate$120 Dining credit ($10 per month) valued at $30, $100 Resy credit ($50 per six months) valued at $85, $120 Uber credit ($10 per month) valued at $60 Click to learn about first year value estimates As high as 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As high as 100K points after $6K spend in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Terms apply. Rates & Fees$325 Annual Fee Recent better offer: 100K after $6K in the first 6 months + 20% back at restaurants for the first 12 months up to $250 back [Expired 11/10/24 - referrals only] FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide (up to $50k in purchases, then 1x) ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, The Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month - must select Amex card as payment method to redeem) ✦ Up to $7 monthly Dunkin' credit - enrollment required ✦ Up to $50 twice-annual Resy credit ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

[…] If you have the Boxed Amex Offer loaded to an Amex Gold card, it can be stacked with that card’s $10 dining credit now that Boxed has been added to the participating “restaurants”. […]

@FM Just got an upgrade offer on my green card to increase up to a gold card. They are offering me a bonus of 25K points after $1k spend. I have already received the bonus for a new application of the gold card in the past, but they assure me that I am still qualified for this upgrade offer. My AF for the green card hits this month, so I’ll end up paying the whole $250 AF for the gold card. Should I go for this?

I certainly think the Gold card is much better than the Green, so I’d be inclined to go for it. On the other hand, there have been reports that the Green card is going to be refreshed soon with new benefits and possibly a higher annual fee. Keeping it may be the only way to keep the lower annual fee for another year. That’s just guessing though

Boxed.com used to have gift cards, but can’t find where they sell them? I was going to see if that triggered the $10; I’d love to save them up to make a larger purchase after a few months.

I had tried that with cheesecake factory and buying the gift card from their site did not trigger the $10. I had to actually eat in the restaurant and use in order to get the $.

The gift cards were killed last year when people realized they could buy gift cards there. It no longer offers gift cards on its site. They now just sell the huge size goods often from Costco leftovers. Unless you use huge volumes on day to day stuff, Boxed.com is a worthless option.

I bought GC at Cheesecake factory one month then the following month order a take out lunch of 2, paid with the GC from prev month and the Gold card. It worked but it is a CHORE, plus Cheesecake factory is several miles drive, and it is more expensive than Carrabba’s, Bonefish and Outback which we prefer more.

My Gold card will go once the $195 AF is billed (grandfather from a targeted offer of 1st year free PRG last year.) Can’t justify the $195 let alone $250.

As a data point, my Amex offer was “Spend $75+, get 2,000 Membership Reward points”. Thanks, as always, for the nice summary.

I just closed my Amex Gold card a couple of months ago when the AF posted because I am an AU on my husband’s account. I looked in “Check for Pre-qualified Offers” in my Amex account for the Hilton upgrade this morning, but instead found a Gold card offer with 35,000 MR after $2K spend. So, it looks like Amex is really pushing the Gold card.