NOTICE: This post references card features that have changed, expired, or are not currently available

Oooops….I did it again.

I’ve recently been doing my part to test out consumer protections for your benefit (so it seems). In other words, I’ve managed to smash my second phone in about two months. After writing about my successful cell phone insurance claim for my broken Pixel 3a last month, I got the phone repaired and decided to trade it in for a brand new Pixel 4a 5G. I hadn’t even had that new phone in my possession for a week when I managed to drop it face down on the pavement as evidenced above. In the end, Amex purchase protection paid me back the full cost of the phone with no deductible. This was a significantly better deal than my previous experience with Chase’s cell phone insurance and as such all of my future phone purchases will likely go on an Amex. In fact, as a parent of two young boys, Amex purchase protection just became my new favorite credit card benefit.

The gist of Amex purchase protection

Here is how Amex bills the purchase protection benefit:

Sometimes your favorite new purchase gets stolen, accidentally damaged, or lost. But when you use your Eligible Card for Covered Purchases, your Membership can help protect them for up to 90 days from the Covered Purchase date.

The basic gist of the benefit is that when you pay for an eligible item with your Amex card and that item is lost, stolen, or damaged within 90 days, Amex may pay you back. There are some limitations both as noted and in addition to those seen below. For example, they won’t cover you to a loss due to an act of war; the coverage is secondary, so they may expect your homeowner or renter’s insurance to pay up first in applicable situations. Motorized vehicles and their parts (and even stuff like a trailer that can be towed by a motorized vehicle) are not covered. You have to check the fine print.

However, many ordinary purchases would be covered — and whereas cell phone insurance has a deductible, there is no deductible for Amex purchase protection. You may remember that in my post about my credit card cell phone insurance claim, I had concluded that the $100 deductible on my Chase Ink Business Preferred cell phone insurance made the benefit of very limited value to me since many Android phones can be fixed for $150-$200. The absence of any deductible on Amex purchase protection is a welcome difference (though of course note that purchase protection is only available for 90 days from date of purchase whereas cell phone insurance is entirely different).

Apart from phones, as the parent of two young and very energetic boys, I think that all toy purchases in my household will likely be put on an Amex for the foreseeable future thanks to the purchase protection benefit.

How to file an Amex purchase protection claim

Assuming you have an event that should be covered, you can file a claim at americanexpress.com/onlineclaim or call 1800-228-6855.

As shown below, you’ll need information like your original purchase date and price and you should take a picture of the damage if applicable (or have a copy of the police report). You may also be asked for information like your original receipt.

I’ll mention this again below, but keep screenshots of things you pay for online. It only takes a moment to take a screen shot and it can come back to save you in a purchase protection situation.

Purchase protection limits

Almost all American Express cards come with purchase protection. You can find a full list of cards and links to information about their purchase protection benefits here. I was surprised to see that even many Amex cards that are no longer available to new applicants carry this benefit (does anyone remember the Blue Sky card?). Even prepaid Bluebird and Serve cards have purchase protection!

Most Amex cards that offer purchase protection include the following limitations:

- Purchases are covered up to 90 days from date of purchase

- Max claim of $1,000 per covered purchase

- Max of $50,000 in claims per calendar year

- Max of $500 per natural disaster-related purchase protection event

I take that last line to mean that if your home is destroyed in a natural disaster like an earthquake or tornado, Amex isn’t going to cover every purchase you made over the past 90 days but rather a max of $500 total, whereas if you are instead just clumsy, they will (at least theoretically) cover you for 50 iPhone drops per calendar year (provided they happen within 90 days of purchase each time). Interesting side note: Bluebird and Serve cover purchases for up to 120 days in all states but New York (which is limited to 90 days).

Purchase protection limits are higher on the ultra-premium cards (i.e. those with annual fees of ~$450+) and the Amex Gold card. On those cards, an individual purchase is covered up to $10K:

- Purchases are covered up to 90 days from date of purchase

- Max claim of $10,000 per covered purchase

- Max of $50,000 in claims per calendar year

- Max of $500 per natural disaster-related purchase protection event

Additionally, certain types of purchases are excluded. Amex purchase protection provides no coverage for a number of excluded purchase types.

No coverage is extended on a purchase which is:

- covered by an unconditional satisfaction guarantee

- damaged through alteration or modification of any kind

- animals or living plants

- one-of-a-kind items including antique, artwork, furts, or previously owned and used items (except when refurbished by the original manufacturer)

- purchases that are consumable or have a limited life span like food, perfume, light bulbs, batteries, etc

- credit cards, securities, documents and tickets, travelers checks and other negotiable instruments including gift certificates, gift cards, gift checks, food stamps, cash or its equivalent, notes, accounts, bills, currency, deeds, evidences of debt or intangible property, rare stamps or coins

- items that are rented, leased, or borrowed

- Motorized Devices or Motorized Device Parts, except for Motorized Devices and Motorized Device Parts that are permanent residential or business fixtures that can be removed without damaging the structure

- permanent residential or business fixtures, additions, or built-ins that can’t be removed without damaging the structure

- land or buildings

- more than one article ina pair or set. Coverage will be limited to no more than the value of any particular part or parts, unless the articles are unusable individually and cannot be replaced individually, regardless of any special value they may have had as part of a set or collection

- downloadable services, application programs, computer programs, operating software, firmware and other software of any kinds

- items voluntarily or involuntarily discarded

- indirect or direct damages to any other item or property resulting from a Covered Event

- items purchased for use as resale (i.e. goods purchased as inventory for sale)

- medical or dental devices or equipment

- items purchased for professional or commercial use including education, training or skills, to be used in professional competition

That still leaves a lot of room for covered items, but it is worth checking the fine print before you make your purchase to know that you’ll be covered.

My experience with Amex purchase protection

As you saw at the top, my phone screen was badly damaged in a fall to the ground. I blame this at least 60% on Amazon, which was supposed to have delivered the case I ordered the day before the damage took place. That small shipping delay (and my own clumsiness) cost me a screen.

Nonetheless, I was less upset than I’d have otherwise been given that this situation would give me the chance to at least test out Amex purchase protection. Once I found that there was no deductible on Amex purchase protection, I was hopeful that I might get back my entire purchase price (which is better than I’d have expected with cell phone insurance).

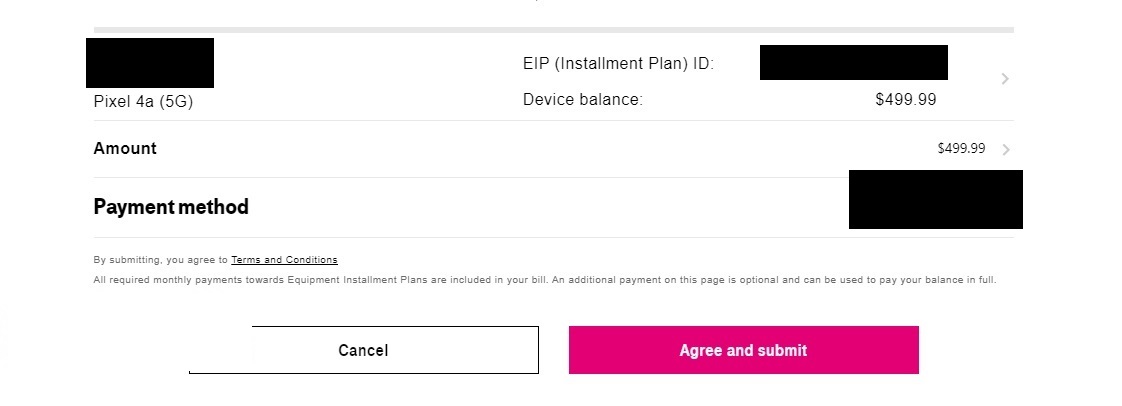

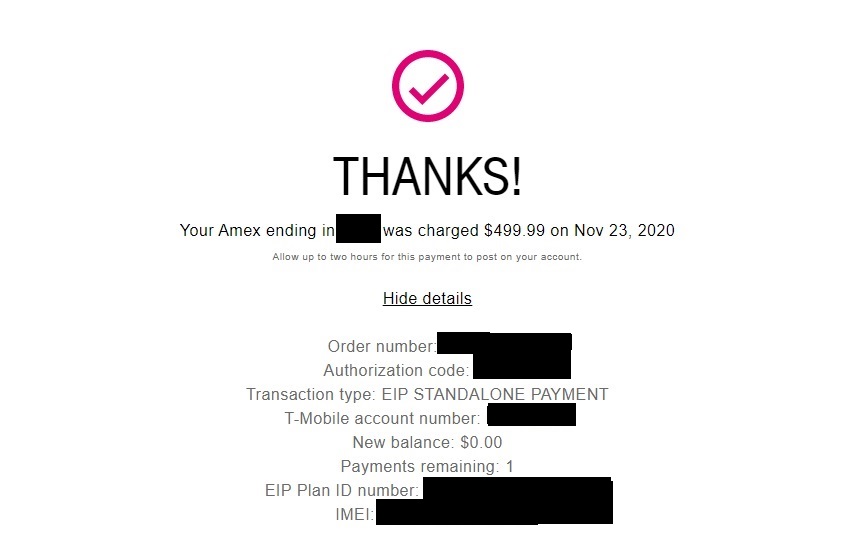

I had ordered my new Google Pixel 4a 5G phone through T-Mobile. I bought the device on an Equipment Installment Plan (i.e. I financed it) because that was necessary for the promo they were running, but a couple of days after receiving my new phone, I paid off the entire $499.99 balance on the T-Mobile website. I took screen shots of the entire process, which is something for which I would later be thankful. I can’t impress upon readers enough the value of taking screen shots. It’s so easy to do — if you’re on a PC just press the windows button and “prt sc” together — and it can save you when a problem strikes.

Some readers will surely find it odd to hear that I paid a ~$500 T-Mobile charge with an Amex Platinum card since wireless services are a 5x bonus category on the Chase Ink Cash (and my older Chase Ink Plus). In this case, I paid off the phone on our new Amex Platinum card despite its 1x return on the purchase for two reasons:

- I’m working on the spending requirement for the big new cardmember bonus and this would provide a decent chunk of spend

- We pay the cell phone bill on the Chase Ink Business Preferred (still), so I knew that paying for the purchase with an Amex would give me two layers of protection: If I had to make a claim, I’d start with Amex purchase protection for the purchase and if denied I could follow up with Chase cell phone insurance next.

To be clear, the Chase Ink Cash card also covers purchase protection, so I could have paid for the phone on that card and likely earned 5x and also had purchase protection. I was probably crazy, but I felt better about having coverage from two totally separate benefits providers here. Perhaps that was foolish and cost me an opportunity for 2500 points.

At any rate, I paid off the phone in full on the Amex Platinum card and about a week later I was making an Amex purchase protection claim.

I was marginally concerned as to how this situation would work with an item (my cell phone) on an installment payment plan (with T-Mobile) since the phone and not been purchased outright from the beginning. The exclusions above note that items which are leased or rented are not covered. A phone purchase fits neither definition in my opinion. However, there was also this section in the guide to benefits that initially gave me pause:

How are benefits paid on installment billing plans?

A Claim for benefits related to Covered Purchases under an installment plan will be paid up to the lesser of the Eligible Payment or per item maximum as described in the What is Covered? section for

- the total installment plan Eligible Payment as of the date of the Covered Event; or

- the last remaining installment plan balance if it has been dully paid with an Eligible Payment

Billing installments for the same Covered Purchase do not restart the Coverage Period for that Covered Purchase

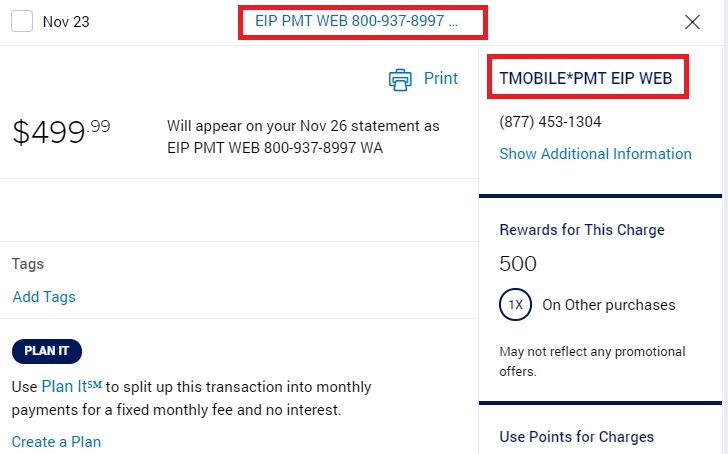

At first, I thought that the above somehow related to my cell phone purchase being on an installment plan with T-Mobile. I was further a little nervous about how the charge showed up on my statement; the line item on my statement / online activity said “EIP PMT WEB”. I had to click the transaction for further details to have any indication that the charge was from T-Mobile.

However, after further review, I think the installment information above applies to items you have on an installment payment plan with Amex. In other words, if you put an item on the “Plan It” installment payment plan that Amex offers, the above may apply (and I’m still not sure I quite understand the limitation). Regardless, I think that refers to items on Amex installment plans. While I didn’t love that “T-Mobile” didn’t show up in the top-line charge details, the fact that the further detail did indeed show it was a T-Mobile charge was good enough.

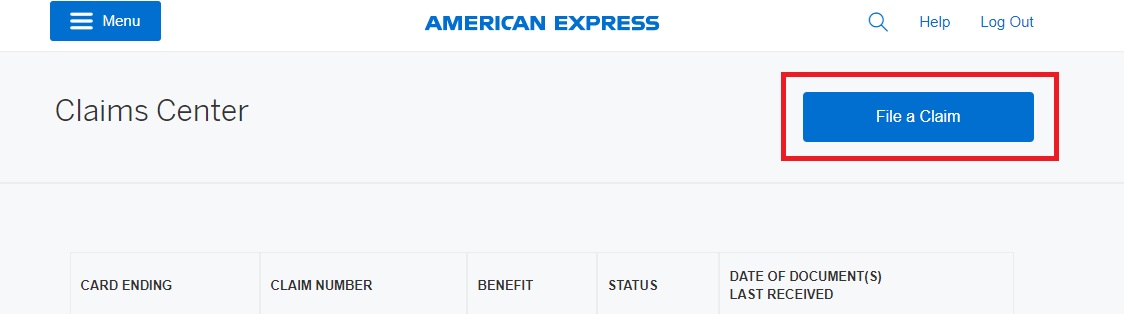

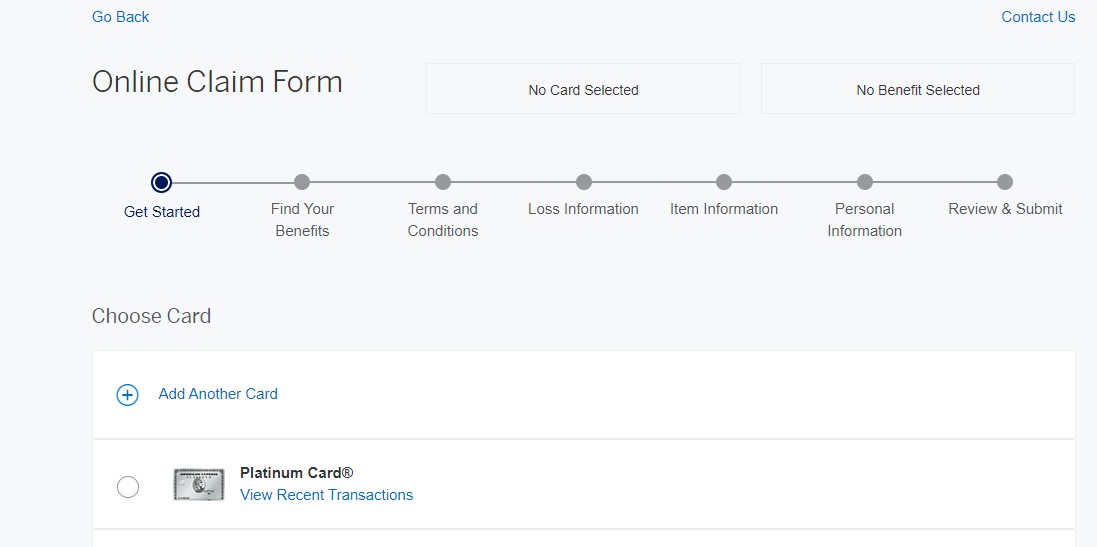

Thus I proceeded to americanexpress.com/onlineclaim and hit the blue button to “File a claim”.

After clicking to file a claim, you are prompted to select the card with which the purchase was made.

After clicking to file a claim, you are prompted to select the card with which the purchase was made.

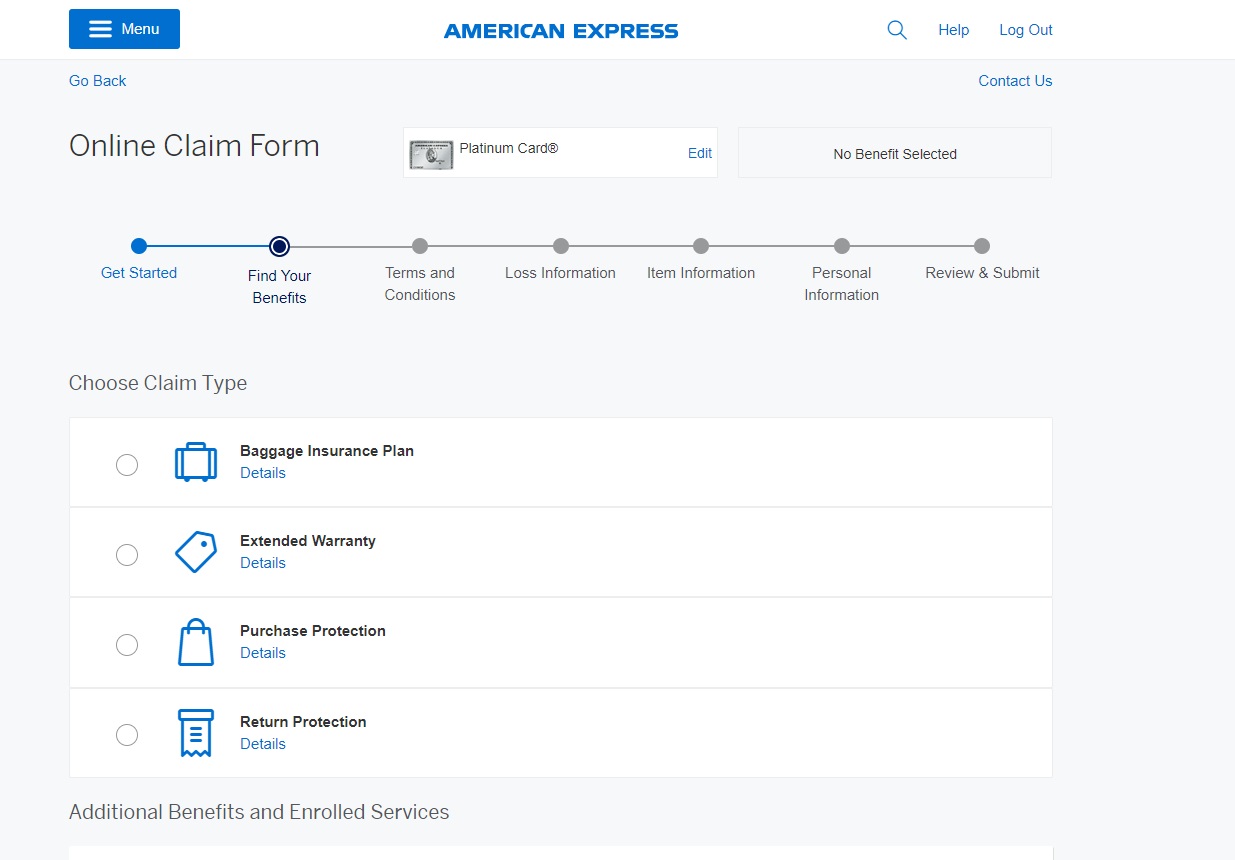

Since Amex provides a number of types of protection, you’ll next need to choose which type of protection you are claiming. I found it interesting to learn that an online claim could easily be filed for things like baggage insurance or return protection as well.

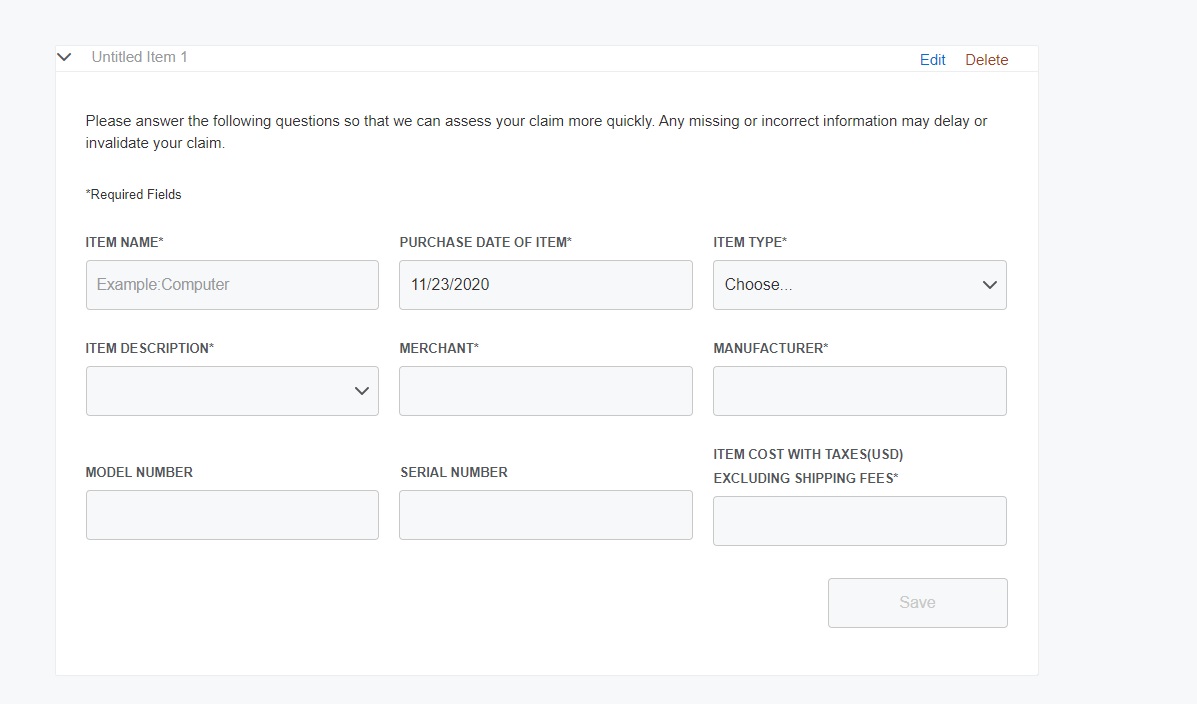

I then had to supply information about the item, purchase date, purchase price, etc. There was also a place to write a description of the claim (I kept it simple and wrote something like “I dropped my phone when exiting my car and the screen was smashed”).

I then had to supply information about the item, purchase date, purchase price, etc. There was also a place to write a description of the claim (I kept it simple and wrote something like “I dropped my phone when exiting my car and the screen was smashed”).

I included a picture of the broken phone as proof of damage. While it had been indicated that I’d need to have proof of purchase price like a receipt, the process didn’t actually ask for a receipt but rather just proof of loss, so I only attached the picture of the broken phone. Amex could obviously see the $499.99 charge from T-Mobile on my bill as shown above, so I figured maybe that was enough.

I included a picture of the broken phone as proof of damage. While it had been indicated that I’d need to have proof of purchase price like a receipt, the process didn’t actually ask for a receipt but rather just proof of loss, so I only attached the picture of the broken phone. Amex could obviously see the $499.99 charge from T-Mobile on my bill as shown above, so I figured maybe that was enough.

It wasn’t enough. A day later, an email from Amex came through asking me to upload an itemized store receipt. That seemed like a fair request, but T-Mobile didn’t provide a receipt. I thought that was odd: when I paid off the phone online, I didn’t even receive an email confirmation of the receipt of payment. The only proof of purchase that I had were the screen shots I had (thankfully!!) taken during the pay-off process and a line item in my online T-Mobile activity showing the payment without much detail (certainly not like an itemized receipt). I took screen shots both showing the card number (last few digits) being used and the EIP number just before hitting submit and then the “Thanks” message from T-Mobile after submitting the payment (which also showed the phone IMEI and the EIP number). I submitted both screen shots.

That didn’t feel exactly like an itemized receipt, but it was the closest thing I had. I’m glad I took those screen shots. I’d have ordinarily assumed that T-Mobile would have sent me an email confirmation / receipt, but they didn’t. I have the initial purchase agreement with T-Mobile from the day I ordered the phone, but that only shows the agreement to pay in installments rather than proof that I paid in full.

That didn’t feel exactly like an itemized receipt, but it was the closest thing I had. I’m glad I took those screen shots. I’d have ordinarily assumed that T-Mobile would have sent me an email confirmation / receipt, but they didn’t. I have the initial purchase agreement with T-Mobile from the day I ordered the phone, but that only shows the agreement to pay in installments rather than proof that I paid in full.

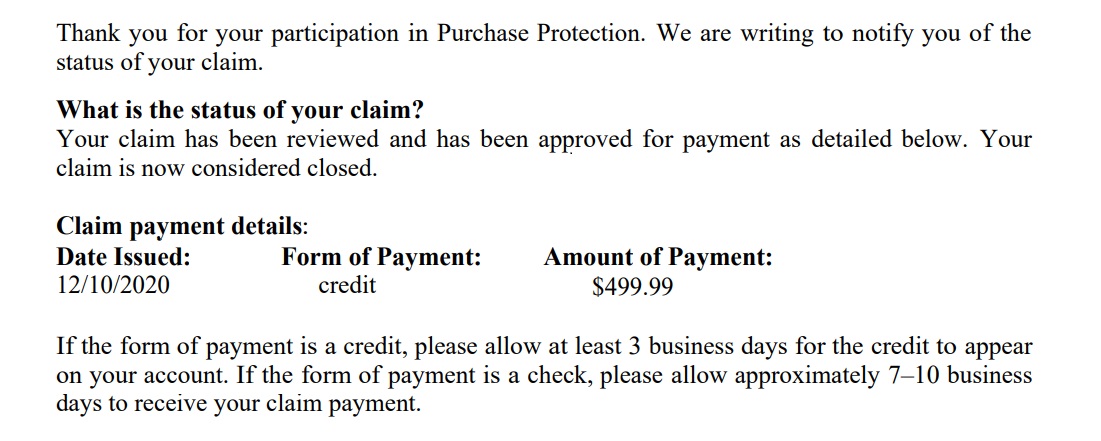

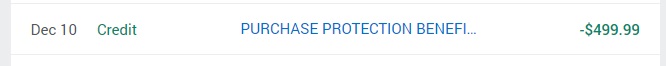

Still, that proved to be enough. I initially filed the claim on November 30th and Amex followed up asking for a copy of the receipt on December 1st. I uploaded the screen shots above that same day and the system indicated that I would receive a decision within 10 days. On December 10th, the email came through that the claim was approved and a credit of $499.99 had been issued.

Indeed, the credit showed up online right away.

Indeed, the credit showed up online right away.

That was awesome. As I had hoped, I received the entire $499.99 purchase price: no deductible, no fuss. Truthfully, I was somewhat surprised that Amex didn’t ask if the item could be repaired and then require a repair estimate but rather they just paid out the entire purchase price. They didn’t even ask me to return the phone. The process was as customer-friendly as one could imagine.

Bottom line

Amex purchase protection paid me back the entire $499.99 cost of my phone when I dropped it less than a week after paying it off in full. There was no deductible (as there would be with cell phone insurance) and no fuss: I simply had to provide the purchase details and proof of purchase. Other card issuers offer purchase protection (see this post: Best credit card purchase protections for more detail), but this was the type of terrific and simple customer service experience that makes me want to put future similar purchases on Amex cards (indeed, a turnaround time of 10 days on this claim is much better than the month or so it took me to get my claim approved to get my phone fixed via Chase’s benefits provider). As the parent of young kids, I could see this benefit being worth its weight in Gold (errr, Platinum) over the coming years. I’ll keep an eye on the exclusions, but given the ease of the claim process I know this would give me peace of mind (particularly with two young destructive spirited boys in my household….and one clumsy dad).

hi, i have a amax platinum and I perched new clothing and lost my shopping bag! I am so frustrated. will amax cover this how do I go about this,i would love advice

[…] purchase protection when I smashed my brand new Google Pixel 4a 5G within a week of having it (See: Amex purchase protection to the rescue). Once my claim was settled, I wanted to see whether it made more sense to repair or replace the […]

Good write up on this. Seems like time to go use that Chase Ink card at an office supply store for some Otterboxes for the family. They would be great stocking stuffers it seems 🙂

There is no other credit card like American Express ! It is, in my opinion, the BEST credit card company. Superior customer service, they stand with their customers. Have utilized the benefits on my cards many times. Like the commercials they used to have said …. ” Don’t Leave Home Without It. ” And I don’t.

I’m assuming you got either the free or 50% off deal for the Pixel 4a 5G. What is the benefit to paying it off? Do you still get the monthly bill credits?

Yes, I still got the monthly bill credits after paying it off. The advantage would be getting the phone unlocked. And the fact that it’s eligible for purchase protection like this.

Purchase protection is great, but I’ll note that its difficult to get reimbursed for a lost item. Both lost and stolen items require a police report. Most people don’t file a police report for a lost item. I’ve lost things at the gym, and while I’m saddened by it, I’m not going to file a police report for it. I guess it would change if the item was >$100 (or maybe >$50)

Thank you for the link at the end. I was wondering if you will purchase the phone with CIC if not working on the sign up bonus. Chase provides 120 days purchase protection instead of 90 days. However, amex claim process seems to be more customer friendly.

Btw, it is good to know you are getting a case for your phone, especially you damaged two phones in two months.

What happens after 90 days? AmEx does NOT have cell phone insurance included for pay monthly bills. Need another card for paying monthly bills for free cell phone insurance!

I paid zero cell phone service bills with the Amex card. I only paid for the equipment with an Amex card. I agree that I would not pay for the service bill with an Amex card.

Personally, I don’t think it’s worth using a card that has cell phone insurance over a card that earns optimal return. I linked to a post that I wrote about that. The short version is that I would have come out well ahead using a Chase Ink Cash for 5x over using a card with cell phone insurance because of the relatively low cost of many Android screen repairs and factoring in the deductible. I recognize there is a contradiction here because I note in the post that I’m still paying the monthly service bill with the Chase Ink Business Preferred. I meant to have switched that to the Chase Ink Cash after writing my post last month and just haven’t done it yet.

So essentially I agree with you that I wouldn’t (and didn’t) pay the cell phone service bill with an Amex card, but I disagree that you need to pay that bill with a card for cell phone insurance. I’d advocate for a Chase Ink Cash for 5x on the ongoing bill. Again, I recognize that some folks will rather have insurance. That’s fine. But finding the sweet spot in terms of the amount of coverage that fits your needs, a deductible that doesn’t represent the majority of the repair cost, and a reasonable category bonus is hard to find.

For more on my experience with cell phone insurance and why I found it to be a bad deal for me, see:

https://frequentmiler.com/cell-phone-insurance-success-lessons-learned/

For a comparison among various cards that offer cell phone insurance, see:

https://frequentmiler.com/credit-card-cell-phone-insurance-compared/

What is your address? Let me send you a phone case 🙂

Pretty awesome coverage though – thanks for sharing.

LOL. But if you send me a case, I’ll miss out on my chance to compare my experience getting the phone fixed directly by the Google Store versus what it’s like taking it to authorized service center uBreakiFix when I break my next phone. 😀

The sacrifices we make for the job 🙂

Clearly unbelievable

Yes, they are entirely different; I don’t understand why you are making this comparison. Chase also has purchase protection (and it lasts 120 days vs. the 90 days on Amex, although I believe the Amex coverage levels are higher). Does Chase’s purchase protection have a deductible? I didn’t think so. The Amex Platinum doesn’t have cell phone insurance at all.

I’m just making the point that purchase protection was a smoother / better experience. In other words, I’d prioritize buying the phone itself on a card with purchase protection and paying for the service on a card that offers 5x and no cell phone insurance at all in most cases.

Correct that Chase has purchase protection. I noted that in the post (and also linked to another post will full purchase protection details). I may have come out just as well on that. One thing worth noting is that it looks like it is the same claims administrator for Chase purchase protection as it was for cell phone insurance. Obviously YMMV, but my cell phone insurance claim took almost a month and required me to get an estimate. That was an entire month that I went without the phone as I didn’t get it fixed until they paid the claim. By comparison, this experience was much better as it was resolved quickly and didn’t require me to go out for an estimate.

I definitely wouldn’t pay the monthly bill with an Amex Platinum though. They neither have cell phone insurance nor a good return on that type of spend. I meant to switch my phone bill to the Ink Cash for 5x and forgo cell phone insurance altogether and just hadn’t gotten around to doing it yet.

Short story: I’m happy with purchase protection for the first few months and think it would pair best with 5x earnings. Cell phone insurance just isn’t worth it to me (obviously your situation may be different).

Please note that “lost” is not covered by all Amex cards it’s mostly only the premium cards. The other will only cover stolen or damaged.

I had a great experience this weekend as well. I had a pair of ear buds that have magnets for charging. One got stuck to a pan and headed into the oven. Needless to say it did not come out alive. I filed a claim the next day and was credited in the account the day after filing the claim. Easy and quick.

Interesting! One reason that going forward I planned to put T-mobile cellphone purchases on my Amex rather than Chase biz cash is that I did not receive 5x for the initial taxes for the EIP purchase of a phone in November. Thanks to this post I will definitely be paying off the pixel 4a 5G (and taking screenshots) using AMEX. This allows you to request the unlock of the phone from T-mobile after 40 days of service. If the phone is still on EIP, it is not eligible for unlock.

I originally had a paragraph in the post about this – I bought another 4a 5G from T-Mobile and like you I only earned 1x on the taxes – but as that was a totally separate purchase I didn’t want to confuse things. I’m not positive whether or not the EIP payoff on the Ink Cash would earn 5x (I think it has for me in the past, but I need to double check).

Separately, I also bought a 4a 5G from the Google store and that coded 5x on the Ink Cash FYI.

Off topic, but did you see the issues people are having with the T-mobile port promo when adding the free line at Costco? I posted my question (in a convoluted way) on your post with a link to the relevant slickdeals thread on your post titled something like “T-mobile subscribers don’t miss this deal.” I haven’t filed for either rebate, but am trying to figure out the best COA.

I did see your comment last night (I was off yesterday) but haven’t had a chance to look into it. The short answer is that no, I haven’t seen the issues. I didn’t port a line – I didn’t have the info with me to port at Costco and I was happy enough with the $200 rebate from Costco and then happier yet if it would stack with the free Pixel 4a 5G deal. Thus far, it looks like my $200 Costco rebate is processing successfully (status on it changed a couple of times to something like “will be paid within 14 weeks”. If people are reporting trouble stacking them, I guess you’re better off sticking with the $200 rebate.

I did not port a number while at Costco and only did so recently. So I was researching to confirm that I would put my newly ported number on the Costco rebate instead of the original number. Oh well, porting a number only cost me some time, not any cash. So I will try both and hope for the best. Cheers!

Weird they didn’t ask you for the repair quote. Maybe because you are on platinum? In my experience, I always had to include a repair quote.

I did with Chase cell phone insurance, but not with this. YMMV I guess.