World of Hyatt Globalist status is widely thought to be the best hotel elite status in the business. I was lucky enough to be able to complete a Bilt status challenge earlier this year (long ago expired) to get Globalist status through February 2025. I ended up with more Hyatt nights than expected over the course of this year and I reached the end of my planned stays for 2023 at 57 elite nights. While I already have Globalist status wrapped up, that left me 3 nights shy earning highly valuable 60-night milestone benefits and as such I recently debated my options for getting to 60 nights.

World of Hyatt 60-night Milestone Benefits (2023)

World of Hyatt awards milestone benefits at every 10-night threshold beginning with 20 nights stayed. Some of those milestone rewards are changing in 2024, but that’s a consideration for another day. Hyatt’s best current selection of Milestone Rewards comes at 60 nights, when you receive:

- World of Hyatt Globalist status

- A category 1-7 Free Night Certificate

- 2 suite upgrade awards (which can each be used to upgrade a stay of up to 7 nights at the time of booking)

- Access to a My Hyatt Concierge

I already have Globalist status thanks to my fast track and I don’t really value access to a My Hyatt Concierge as I haven’t found that benefit to be wildly useful in the past.

However, a Category 1-7 free night certificate could be highly useful and valuable. As a parent who travels with young kids, I very much value the suite upgrade awards.

I therefore very much wanted to earn an additional three elite nights in 2023. The key question for me was in how to earn those last 3 elite nights.

Option 1: Mattress run at an airport Hyatt Place

In case I ended up a little short of a key milestone reward, I had long ago made a reservation for a mattress run at a Category 1 airport Hyatt Place. I have a 4-hour layover en route to visit family where I could easily leave the airport secure area to go check in and get back to the airport. This runs the risk of being checked out early, though with a stay of only 3 nights and the delight most properties seem to take in offering sporadic housekeeping, this seemed like a low-risk proposition to me.

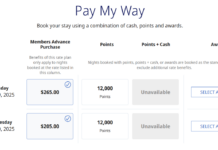

Since the property is Category 1 and the dates are off-peak, this solution would cost me 10,500 points, which seemed like a great trade for a Category 1-7 free night certificate and 2 suite upgrades.

Option 2: Buy $900 in Mr. & Mrs. Smith gift cards

World of Hyatt is currently offering a promotion whereby you can earn 1 elite night credit for every $300 in Mr. & Mrs. Smith gift cards purchased through March 31, 2024.

At present, Mr. and Mrs. Smith gift cards can only be used to book Mr. & Mrs. Smith properties. While the promotion explains that they can only be used through the Mr. & Mrs. Smith website to prepay for your stay, some readers have reported that it is possible to alternatively call a Mr. & Mrs. Smith hotel and book over the phone. Regardless, I believe that the gift cards can only be used toward the room rate & associated taxes, not incidentals. According to the terms, you will earn points and elite night credit when buying the gift cards, but not when using them.

I’ve never stayed at a Mr. & Mrs. Smith property and do not currently have any plans to do so. That said, I do have a couple of trips planned next year to places where there is a Mr. & Mrs. Smith property or two. On the one hand, I’m far from certain that I could use the gift cards in a timely manner. On the other hand, I imagine that chances are decent that I’d eventually stay at a Mr. & Mrs. Smith property. The Mr. & Mrs. Smith gift cards currently only work at Mr. & Mrs. Smith properties and Hyatt has given us no indication of that ever changing, but the optimist in me imagines that maybe someday they’ll get converted into regular Hyatt gift cards. Still, am I willing to gamble $900 on what amounts to a pipe dream at this point?

Realistically, I could only count on being able to use the gift cards at Mr. & Mrs. Smith properties, so I’d probably end up having to plan a trip around a chance to use the gift cards (and despite other options that cost less and/or are located where I want to be, etc). But, unlike Option #1’s three-night mattress run where I would essentially waste the points for 3 nights and get a stay that I couldn’t use, the Mr. & Mrs. Smith gift cards would mean that I would very likely get at least 2 nights in a hotel that I could actually use and where the stay itself could happen years from now, basically getting myself advance credit for a stay I will someday need rather than throwing away points that only get me the milestone rewards.

Opt 3: Apply for the World of Hyatt Credit Card

It may surprise you, but I have never had the World of Hyatt Credit Card before. Back when I started my rewards card journey, I didn’t realize how much I would later come to appreciate Hyatt. Then I was over 5/24 for a long time. And then even when I came under 5/24, I wasn’t sure I really needed to pay $95 a year for the annual Category 1-4 free night certificate rather than just making a trip or two to Staples during a fee-free gift card promotion to get plenty of points to cover a Category 4 hotel if I needed one (and unlike the certificate, points are more flexible!). For the record, my wife has had the World of Hyatt card for a couple of years and we have done the $15K calendar year spend for an extra Category 1-4 free night certificate (and we’ve used them to good value), but I’m less convinced that the card is a home run.

However, the World of Hyatt credit card comes with 5 elite night credits annually. Just getting the card would give me enough nights to put me over the top from 57 nights to 62 nights.

With a $95 annual fee, this option would “cost” me a bit less than the three-night mattress run since I value 10,500 World of Hyatt points at considerably more than $95. Even if we only value Hyatt points at 1.5c per point (which feels low as compared to my typical redemptions), the points are worth $157.50. In reality, the three nights worth of hotel I would trade them for would otherwise cost more. The fact is that the points could buy me more hotel stay than $95 could.

The side benefit of finally getting the credit card would be that I would have a way to manufacture elite night credits moving forward. With the loss of the MGM partnership, my path to renewing Globalist status next year looked unlikely as I just don’t have 55 nights planned with Hyatt. However, since the card earns 2 elite nights per $5K spent, it would give me a way to supplement my stays (albeit at a poor return on spend since the card earns 1x on most purchases).

Determining which is best

I was conflicted as to which path was the best one forward. While the credit card path was the “cheapest” and the path of least resistance, I was on the fence as to whether I felt like I needed it long term. Additionally, while it would “only” cost $95 now, I would be trading that away without the ability to recover it — whereas the Mr. & Mrs. Smith gift cards would essentially let me store value for later use.

And while the credit card would “cost” less, it would be cash going out of my pocket versus points that were mostly earned through pretty low-effort MS that would be spent on the mattress run. I realize that you could make the (entirely valid) argument that I could have (and still could) just cash out 9,500 Ultimate Rewards points for $95 if I wanted to “pay myself back” for the annual fee on the Hyatt card, which effectively costs me a thousand fewer points. That is entirely rational. Perhaps what is pushing against that rational solution is the amount of money my family spends in annual fees — we really ought to trim back on annual fees rather than add more, so I’ve tried to be a bit more selective as of late with regard to deciding what we really want/need in terms of annual fees (and I was looking at the Hyatt card as a likely long-term commitment rather than a one-time cost).

All that said, I threw the dilemma out to the rest of the Frequent Miler team to ask what they would do. As you might expect, they had little hesitation: they all said to get the World of Hyatt credit card. I was a little surprised that they all chose using the points on the mattress run as the backup if I didn’t get approved for the Hyatt card or the elite nights didn’t post quickly enough, but in reality I shouldn’t be: I shouldn’t value the Mr. & Mrs. Smith gift cards at full face value since I don’t have any current need for them and would likely have to stretch to find a scenario to use them.

The fact is that Mr. and Mrs. Smith hotels generally cost more than I would otherwise spend on a hotel night if I were paying a cash rate, so I can’t really value the gift cards at full face value. In other words, if I end up paying $450 for a night at a Mr. & Mrs. Smith property in a situation where I’d otherwise have spent $300 on a different hotel, I can’t really value the gift card at full face value since it didn’t really save me $450 over what I would have spent. I would essentially be pre-paying for $900 in “someday” stays at an unknown rate that is likely higher than I’d have otherwise considered. While it feels like storing value, I realized that the FM team was right — by some measure, that option was the most expensive one for me. Note of course that if Mr. & Mrs. Smith fits within your typical budget / plans, the math may be considerably different for you.

And so I ultimately decided to apply for the World of Hyatt credit card and I was approved. The five elite nights posted four calendar days after approval, putting me at 62 nights for the year and awarding me the 60-night milestone benefits instantly.

I’m not enthused by the current welcome bonus that requires $15K in total purchases to award what is essentially 45K bonus points (plus the 15K points you earn from spend at 1x), but as it turns out I have the capacity to likely meet that spend this month. If I am able to meet that $15K spend this month, I would earn both the welcome bonus and a Category 1-4 free night certificate for this year (and then I would have the chance to earn another Category 1-4 free night certificate next year). I’d also earn 6 more elite night credits, which will put me at 68 nights.

As fate would have it, I’d end up two nights short of another two suite upgrades. Hmmmm…..

I’m kidding. I’ll quit while I’m ahead(ish).

[…] Hyatt’s Globalist status is highly sought after by frequent travelers. To achieve this status, individuals who plan on staying with Hyatt frequently in the upcoming year may benefit from paying for a few nights at a lower-priced Hyatt before the end of the year. This will result in attaining Globalist benefits on every stay in 2024. Also, Hyatt Globalist members do mattress runs to earn additional milestone awards, as shown in this example from Nick at Frequent Miler. […]

To me it’s simple, the card is the clear winner. So obviously there is the SUP, 30k + 30k for standard promotion. But let’s ignore that just for a year to year basis on the card. If you need mattress runs the card comes in cheaper than a mattress run. For all spend that is base spend with no additional categories the card, compared to CF at 1.5x, you’d get .0225 vs .015 per point but you’d also get 2 EQN per 5k. So for 5k on base spend you are at 112.50 vs 75, so a difference of 37.50. But you’d also get 2 EQN at the cost of 18.75 per EQN. There isn’t a mattress run out there that cheap. Now, add on top of it that you get a free night ea year and an additional at 15k, so if you spend just 15k, you will get 11 EQN and (2) 1-4 category nights for 211.50. On top of it you would get the 4% additional back on direct Hyatt spend or how you value them, $0.06 per $1 spent.

Hi Nick,

Did you meet the spend? I’ve been trying to decide if it is justifiable to do that or not (after getting to $3k). Don’t you have better ways to spend than getting 2x hyatt points on non-bonused spend plus a FNC (so we will generously call it 3x)?

What are the latest data points on the WOH biz cc…about to cross another $10k threshold…will going over that magic number give me 5 nights credit based on date of spend (and credit retroactively after Jan 1) or will it give me the nights when the statement closes in January for 2024?

If the latter, does anybody know if I can request a new statement closing date for the end of the month so they post in 2023?

Thanks, all.

[…] Hyatt’s Globalist status is highly sought after by frequent travelers. To achieve this status, individuals who plan on staying with Hyatt frequently in the upcoming year may benefit from paying for a few nights at a lower-priced Hyatt before the end of the year. This will result in attaining Globalist benefits on every stay in 2024. Additionally, Hyatt Globalist members also do mattress runs to earn additional milestone awards, as shown in this example by Nick from Frequent Miler. […]

Great write up Nick!

As long as your travel isn’t exclusively to NYC, London, etc., a category 1-4 FNC should be worth well more than $95. The SUB sucks but it’s a sock drawer card that I plan to keep for a long time.

I’m very conflicted on that. The FNC “can be redeemed for a night that would cost well more than $95” is not the same as the FNC “is worth well more than $95”.

Here’s what I mean: at peak price, a Category 4 night costs 18,000 points. My wife and I could walk into a Staples tomorrow and each buy $1,800 worth of Visa Gift Cards with no activation fee and could turn around and liquidate those in the same day for a net cost of no more than $9 plus the time it takes to make a couple of stops. Those 18,000 points don’t expire in a year, and if the Category 4 hotel where we use them actually costs 15K because it has standard pricing or 12K because it is off-peak, we’ll have points left over.

You could argue that the time it’ll take us to go to one Staples and maybe a couple of other stores to liquidate is worth more than $95. I don’t look at it the same way since we do it in “free” time when we wouldn’t otherwise be working (so I think it is a mistake to put a monetary value on that time), but I can concede that you may have that argument. Still, I don’t think a free night certificate that expires in a year for $95 is a slam dunk given the ease with which one can generate Hyatt points. I’m not saying that it’s a bad deal, just that it’s not as amazing as the difference between $95 and whatever your chosen Cat 4 would cost may suggest.

Not all of us have such cheap and easy liquidation available though. In addition to the time aspect you already mentioned.

But if you could redeem those Chase points at 1.5cpp–easy enough to do with PYB–then those same 18,000 points are worth $270 in untaxed cash. $270 > $95.

And keep in mind that holding the card comes with other benefits. Some “bonus journey” promos are better for cardholders, for instance. That’s before considering the 5 elite nights, option for EQNs, et cetera.

Where and how do you liquidate the VGCs on the same day?

I would love to know, too … or a link that explains would be super.

I’m not doing anything you can’t find in our Manufactured Spending Complete Guide. https://frequentmiler.com/manufactured-spending-complete-guide/

So why are these things mutually exclusive. You can get a the Hyatt card and still buy your gift cards with another credit card. Your logic seems to have a gap. The points you get from the credit card at the office supply store could be used for many different things. The nights and free night you get from the Hyatt card hit your globalist goal.

@Phred – my point was just regarding the annual Cat 1-4 free night certificate. Bottom line: if you offered me an unending supply of $95 Cat 1-4 free night certificates, I probably wouldn’t buy them because I can generate the points much more cheaply and the points have fewer restrictions.

The Hyatt card obviously made sense for me for the elite night credits — and maybe it will for the chance to generate more elite night credits in the future. But the Cat 1-4 free night cert does not justify the $95 AF for someone who has enough 5x office supply store capacity to exceed the annual need for Category 4 stays.

Again, I obviously get that the cert can be used for something worth more than $95 for many people (and that many people can’t or aren’t going to MS much). I definitely think it makes sense for a lot of people — I just don’t find that the certificate makes it a home run. The combination of benefits might yet make it a keeper for me though.

If you have not had the Hyatt credit card before, it seems a no brainer. The $95 fee is more than offset by the Cat 1-4 free night – which should be worth about $300.00, plus you get the bonus points. You get the five nights needed for this year (CAT 1-7) , plus five nights towards next year. In January, do the necessary spend, and then work your way towards the $15K for another Cat 1-4). I keep the card because the free night covers the cost of the card and the Cat 1-4 certificate at $15K makes the spend worthwhile, and it gets you another 6 elite night credits, so you can start with 11 nights next year before your first stay. On top of that, you get a bunch of Hyatt points just for taking out the card, even if you decide you want to cancel it next year.

Thanks for showing us your math.

Great but put the do not disturb sign on the door and they won’t come in until after you check out…

Very fun article. Thanks, Nick.

Don’t the night credits for spend hit based upon statement closing date? The extra 6 nights would post in January I think. I just did this on the WOH business card and they all posted when my statement closed mid month instead of as the spend was completed. You would be 8 nights short of the two suite upgrades.

For the Hyatt personal card, it is spend date, not statement date. See my below comment (just approved) quoting Chase T&Cs for this card, correlated with multiple data points. It might take until your statement cycles for the nights to be retroactively posted, however.

You can’t be blamed for wondering though! Weirdly, chase policies on this seem to vary per card. Southwest cards, for example, credit companion pass points based on statement close date, not spend date.

I love these articles the best

Why not just cancel the cards you don’t value after a year like we, and many others, do? There are only a few cards with fees worth keeping IMO. Even then I even wonder if Amex Bonvoy business is worth keeping at $125 per year.

Nick, I would not buy the Smith gift cards unless you have a specific stay in mind in the near future. I would choose option 3 only if you plan to spend $15,000 on that card next year to get 6 tier nights plus a Cat 1-4 award.

Simplest is the mattress run, though I tend to avoid those.