| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

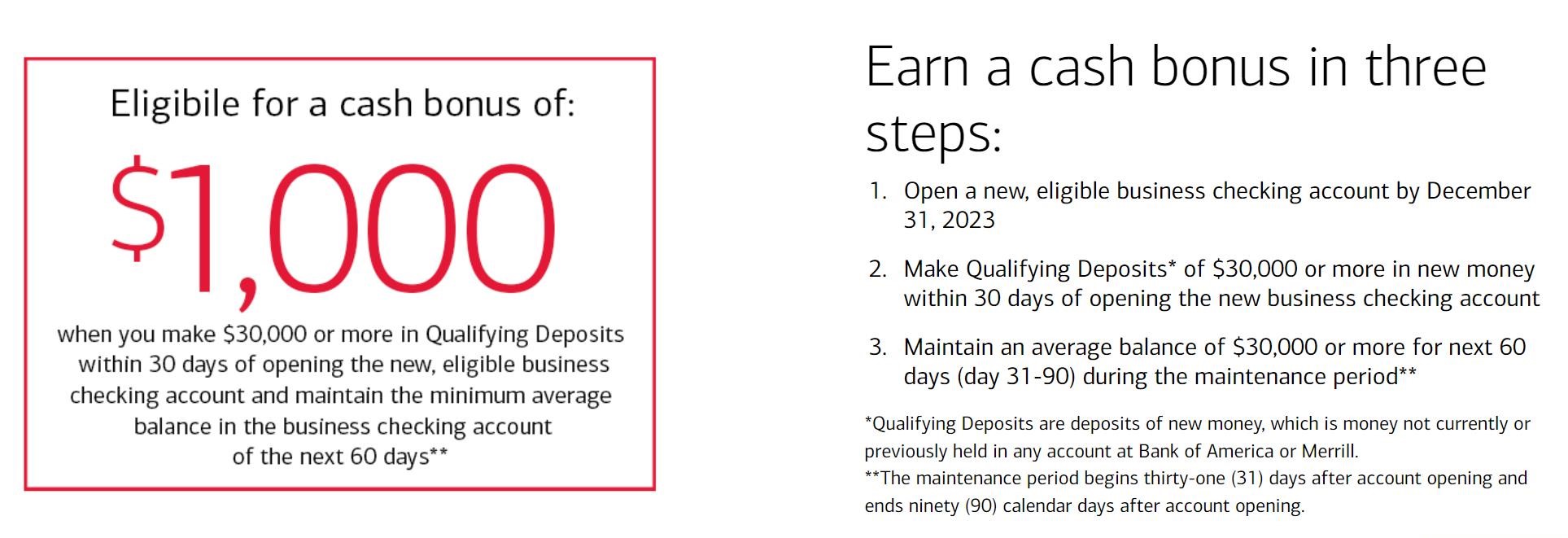

Bank of America is running a promotion for new business checking accounts that offers a $1000 bonus with fairly simple requirements. Deposit $30,000, keep it there for a minimum of 61 days, and you get $1000. Depending on how long you deposit the money, this effectively works out to an interest rate of ~13-20% on the money while it’s there.

Note that this offer is officially targeted per the terms. That said, whenever there’s been a public landing page for these bonuses in the past and you sign up through that link, it works. Take screenshots of the landing page to be sure.

The Deal

- Bank of America is offering a bonus of $1000 with a new business checking account.

- Requirements to Receive a $1,000 cash bonus:

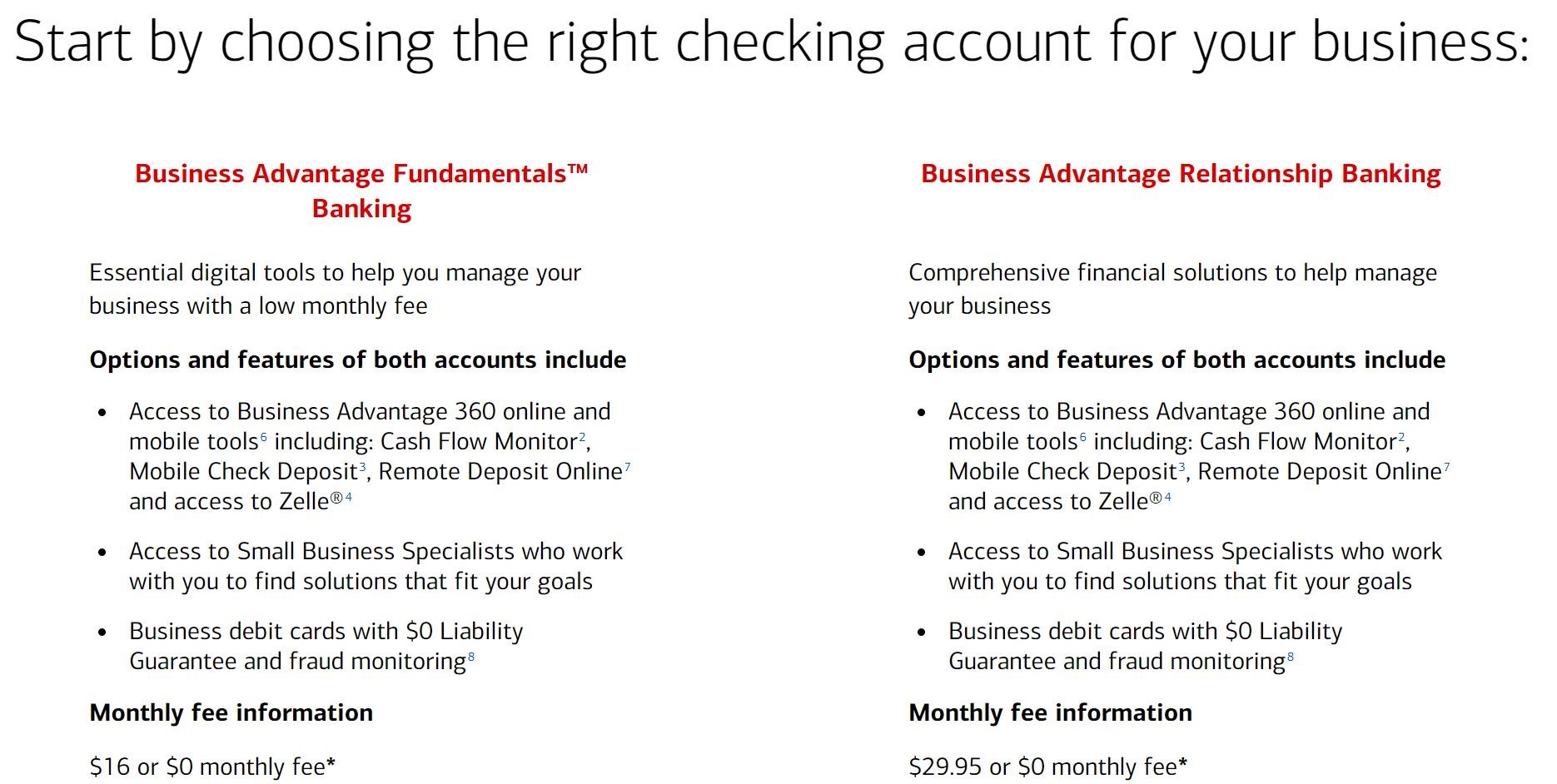

- Open a new Business Advantage Relationship Banking or Business Advantage Fundamentals™ Banking account by December 31, 2023.

- Make Qualifying Deposits of $30,000 or more in new money* into your new Business Advantage Banking account within thirty (30) days of account opening; AND

- Maintain an average balance of $30,000 or more during the Maintenance Period** into the new Business Advantage Banking account (days 31-90 from account opening).

- Promo code=SSPCIS

Key Terms

- This offer is only available to business owners who receive this offer via a direct communication from a Bank of America Specialist or from a Bank of America communication.

- This offer is intended for new customers only; you are not eligible for this offer if you were an owner or signer on a Bank of America Business Advantage Banking account within the last twelve (12) months. Only one bonus ($1,000) per business customer, regardless of the number of businesses owned or operated by the customer.

- Offer expires on December 31, 2023, and all qualifying activities must be completed within the stated time frames in order to be eligible for this offer.

- *New money is new funds deposited into your Business Advantage Banking account that are not transfers from other Bank of America deposit accounts or Merrill investment accounts.

- **Maintenance Period begins thirty-one (31) calendar days after account opening and ends ninety (90) calendar days after account opening.

- The value of this bonus may constitute taxable income to you.

How to get Fees Waived

- The Monthly Fee for Business Advantage Fundamentals Banking will be waived when you meet one of the following requirements during each checking statement cycle:

- Maintain a $5,000 combined average monthly balance

- Use your Bank of America business debit card to make at least $250 in new net qualified purchases

- Become a Preferred Rewards for Business member

- The Monthly Fee for Business Advantage Relationship Banking will be waived when you meet one of the following requirements during each checking statement cycle:

- Maintain a $15,000 combined average monthly balance

- Become a Preferred Rewards for Business member (first 4 checking accounts, per enrolled business)

Quick Thoughts

The nice thing about this business checking account bonus is that it is very simple: deposit the money within 30 days of account opening, leave it there for 60 days, collect a nice bonus and also get Bank of America Preferred Rewards Gold status (which waives the monthly fee without needing to meet any requirements).

While the offer appears to be targeted based on the terms, I’ve seen multiple data points from people who have received the bonus despite not being targeted. YMMV — there is could obviously be a chance that it won’t be honored if you weren’t targeted. Take screenshots just in case.

Nick did a similar bonus in 2020, depositing $20K for 60 days, and he quickly received his $500 bonus (see his 2020 bank bonus tally post for more info about the all the bank bonuses he did).

Now, because of the $30,000 deposit requirement, BOA has added Preferred Rewards for Business Gold tier benefits right off the bat. This gets you a 25% bonus on eligible business credit card earnings and a 5% interest rate boost on a Business Advantage Savings account.

(h/t: Miles Earn and Burn)

Did this deal work out for anyone? I did this the day the story was published, and still no bonus. BOA was unable to find SSPCIS and SGDDIG they say has a totally different amount. 500 for 20k.

Been on hold for a couple hours.

Anyone NOT targeted? If so, you still got the $1000 bonus by using the promo code SSPCIS ? I went to branch today – the banker said the system didn’t let him go past the application page when entered SSPCIS and stated the system throwed a not valid code error (Not sure whether he’s telling the truth). He asked me to either open online Or call CS by giving me a toll free number. When I called the CS, the rep said the SSPCIS code is targeted and should’ve received from BOA either through login popup Or through a direct email from BOA. He said I won’t get the bonus even if I go ahead and use the code when opening the account, since they know who got targeted. Someone, Please shed some light here.

I was not targeted, just cleared the 90 day mark a week ago and haven’t gotten the bonus 🙁

I am also waiting. I cleared the 90.days inlate December.

Bonus ended up posting after all! Posted after I already transferred the $30k back out again.

Application approved, but then got an email saying it was under review right away. Site let me login, but i cant add a bank to transfer from until I get my debit card.

Does BoA care if you cancel the account after 90 days? I like their Rewards card and wouldn’t want them to cancel my credit cards because I opened/closed a biz checking account with them.

This is a soft pull, right?

I’m not driving two hours to bank,there are none in either state

Approved as sole prop “business” online. Long time existing BoA personal customer, not sure if the existing relation relationship helped.

Does this work if you go in person or is this only online?

Applied as sole prop, went pending, called, rep said should be no problem to be approved in couple of days

Anyone else get “Unfortunately, we’re unable to continue your online application at this time.”

Was not expecting that…

I got a sorry you are not approved. That never happened to me and I have done several bank bonuses with other banks…

They mad bc I just cancelled their AS Biz card

When clicking through to the link and starting an application, the promo code is pre-filled as SGDDIG. Do you know which one is correct (or if both work)?

Sharp eyes. If I replace the SSPCIS in the URL that’s linked above with SGDDIG, the same landing page comes up. They should both work (but take screenshots of the sign-up page, just in case).

SGDDIG is the code when you apply directly through your BofA account on the website

Awesome, thanks. I’ll add that into the post.

Looks like you have to keep it there until day ninety regardless as to when you put it in.

You need to maintain the $30,000 from day 31 to day 90. = 60 days

Yes, that’s correct.

You should probably update the post as it states that $30k should be kept for 60 days from the moment of funding, but it’s actually 60 days from the 31st day. If you don’t fund on the 31st day then the money should stay in the account for longer.

Well, I opened the account on Sep 9, funded same day, called to see where my bonus is and am now told that I have to wait another 60 days AFTER the 90 days !!!

Not impressed.