NOTICE: This post references card features that have changed, expired, or are not currently available

Stephen alerted me this morning to the fact that there is an increased dummy booking offer on the Wyndham Earner credit card that adds a $50 statement credit after first purchase on top of the standard offer. While I’d personally prefer to have the Wyndham Earner Business card, this card can still be a useful option for the 10% discount on awards.

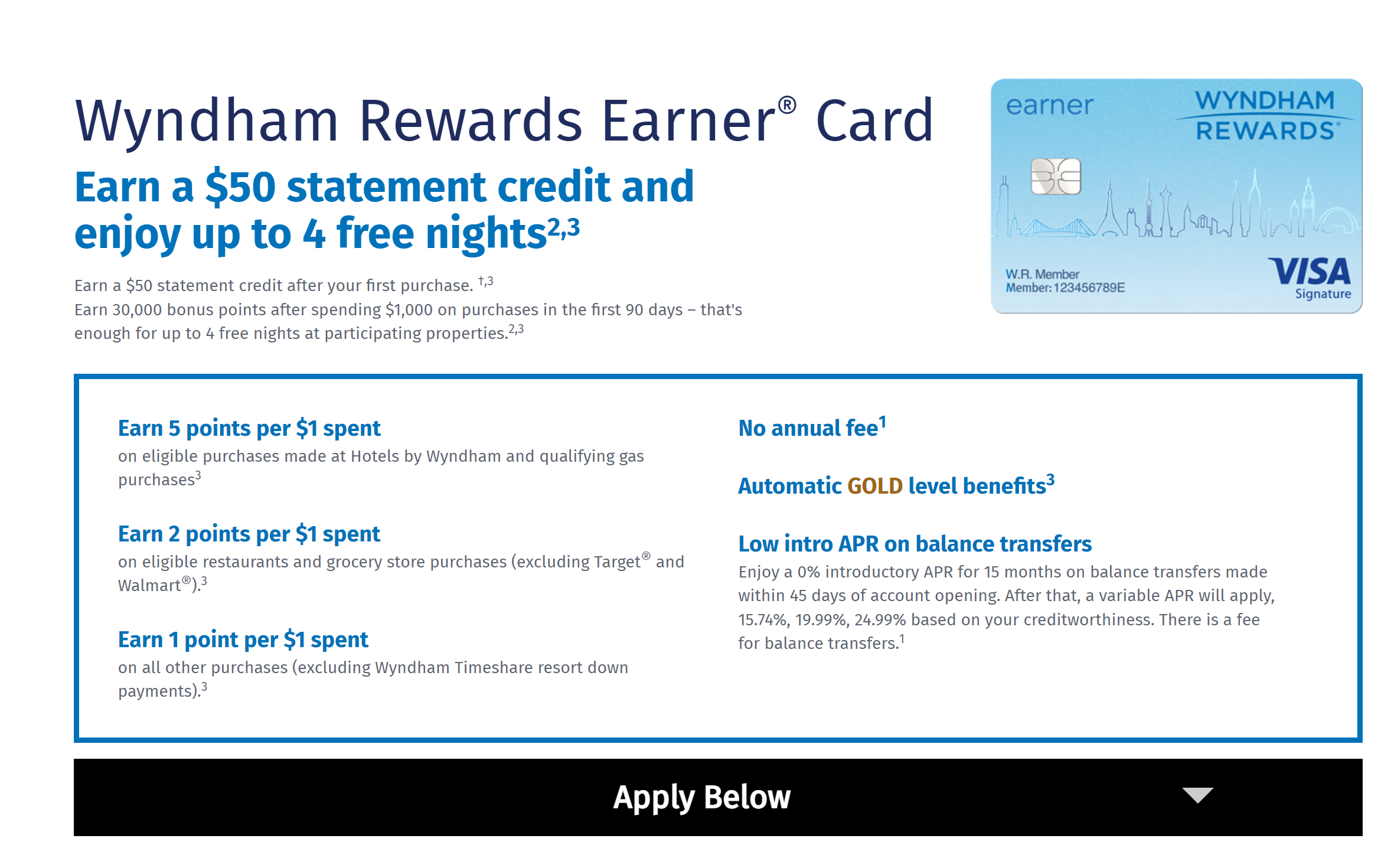

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $186 1st Yr Value EstimateClick to learn about first year value estimates 30K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 30K points after $1K spend in first 90 daysNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 75K after $2K in spend FM Mini Review: Sign up for the bonus. Keep for the 10% award discount. Earning rate: ✦ 5X Wyndham & gas ✦ 2X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 7,500 points each anniversary year after $15K spend Noteworthy perks: Priority Pass Select ✦ Global Entry Fee Credit ✦ 25% discount when buying miles |

Quick Thoughts

The no-annual-fee Wyndham Earner card occupies a really interesting place in this space. On the one hand, if you’re mostly after Wyndham points, grab a Capital One Venture or Venture X card for a bonus that’s much larger and points that transfer 1:1 to Wyndham.

If you send much money at gas stations or on utilities and you value Wyndham points, get the Wyndham Earner Business card. Yes, it has a $95 annual fee, but the card earns 8x at gas stations and 5x on utilities. It also provides 15K points at each anniversary — which, if you value Wyndham points beyond about six tenths of a cent, is worth more than the $95 annual fee.

On the other hand, if you already have transferable Capital One miles on hand and you are mostly after the 10% discount on award bookings, getting that benefit without an annual fee might make sense. Whereas the welcome bonus here seems incredibly low in the current environment of 100K offers, the ongoing value of 10% back on award bookings could really add up if you have a lot of points to transfer to Wyndham and make this card a better deal than it appears on the surface.

While an extra $50 may not make a huge difference for everyone, there’s no doubt that $50 back after a single purchase is pretty nice on a card with no annual fee that still comes with a welcome bonus that could get you two nights in a 1-bedroom Vacasa vacation rental.

While I don’t expect everyone to run out and go after this offer, it’s certainly more appealing than the offer without the $50 credit if you were considering this card.

Will Barclay let you downgrade Earner+ to this card, or can you not do that? If so this might be a useful card to me long-term.

Can you share points with P2?

Hi! I signed up for this card with a 60k pt offer. They awarded me 30K pts when I met the spend requirements. Despite 7 phone calls, a letter (including a copy of the 60K point offer they sent me on the same day I signed up for the card) and my most recent social media blast (out of sheer frustration.. it’s a principle argument at this point), they have only agreed to award me 45K points and open yet another case to look into the matter. This has been going on since Sept. Is this common with Barclays?? I’m blown away by their lack of customer service and shady business practices.

I’m personally still waiting on the extra 50k from JetBlue biz (50+50 offer) AND 45k from Wyndham biz (45 + 45 offer). LMK who to contact

I put on comment similar to the one above on a random Facebook post of Barclays. They asked me to reach out to them via messenger. I did and they opened another case. I have zero confidence they will resolve it, but figured it couldn’t hurt. It’s really surprising a major CC would act this way.