NOTICE: This post references card features that have changed, expired, or are not currently available

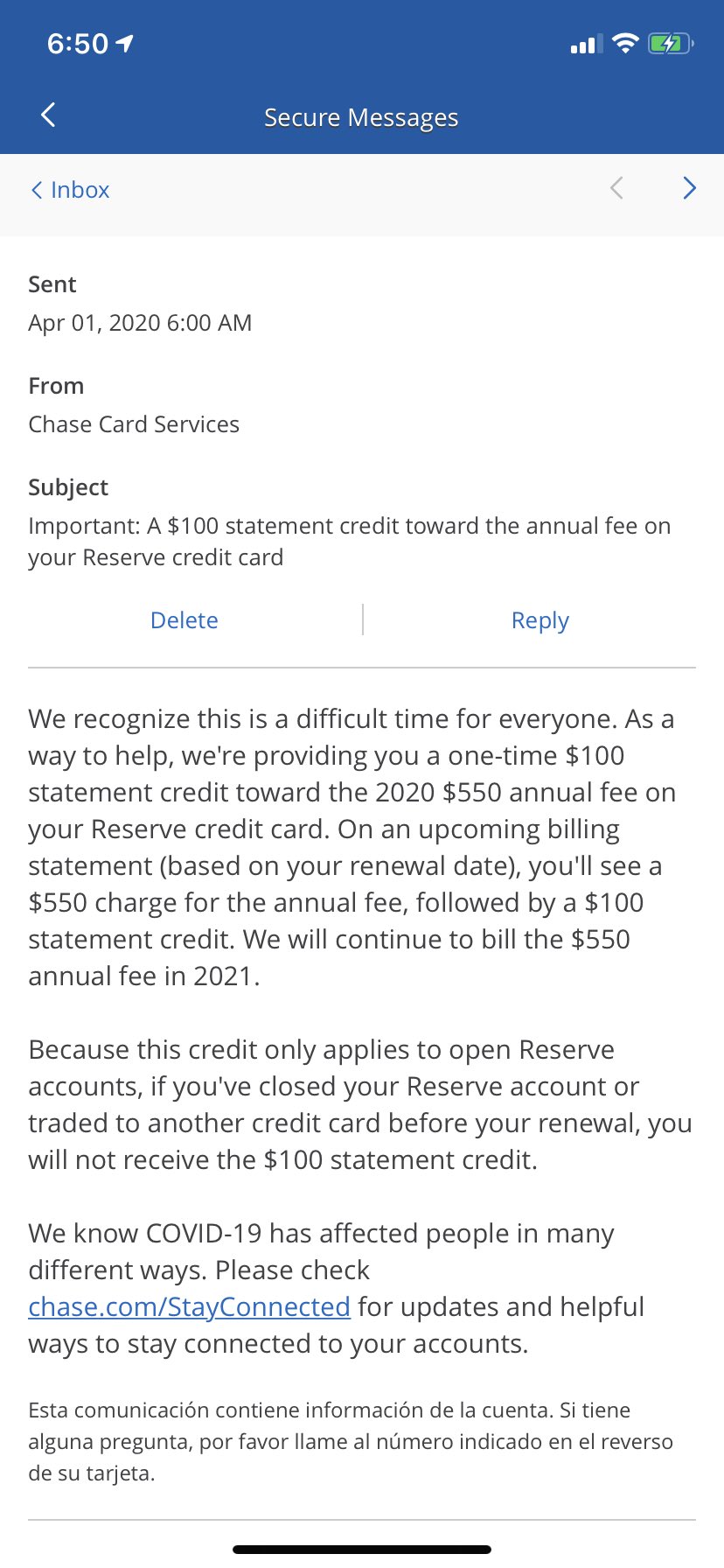

Chase is offering a $100 statement credit to some Sapphire Reserve cardholders whose annual fees have recently posted. That’s awesome. They are doing this by sending a secure message with the subject, ““Important: A $100 statement credit toward the annual fee on your Reserve credit card”.

We received that above screen shot / report from reader AG on Twitter:

We received that above screen shot / report from reader AG on Twitter:

@FrequentMiler chase sent me a message for a $100 annual fee statement credit! pic.twitter.com/gnASwgzLJM

— AG (@YankeesJetsSoup) April 1, 2020

Note that not everyone is receiving this secure message. The annual fee on the CSR in my household won’t post until September, so we didn’t receive this offer. One Mile at a Time reports that this message has or will go out to those whose with CSR renewal dates between April 1 and July 1, 2020. If your renewal date is within that window and you haven’t yet received the message, I recommend being patient as I imagine messages will go out in waves.

Overall, this is a nice gesture. Is it enough to encourage people to keep an ultra-premium card with a high annual fee? Given the fact that Chase recently increased the annual fee from $450 to $550, I’m not sure that a $100 credit will be enough to get people to keep it. As Greg and I recently discussed in a Frequent Miler on the Air episode, we expect that issuers will likely need to offer good retention offers to keep customers holding expensive travel cards in a time when they can’t travel. Chase hasn’t previously offered generous retention bonuses on this card, so on the one hand $100 is more than most have ever gotten. On the other hand, I wonder if this wasn’t a move to try to placate some folks with the knowledge that there will be others who will call for something better.

At this point, I wouldn’t expect that Chase has yet begun to make retention offers, but I expect this is a first step in that direction. Obviously if you get the offer, that’s nice. At the same time, you need to crunch the numbers. I imagine that within the next year travel will likely resume and most of us will be booking future travel and thus able to use some of the card’s benefits ($300 travel credit, redeeming points at 1.5c each, 3x dining if you’re ordering takeout, etc), but totally unable to use other benefits for at least a few months and maybe more (like Priority Pass). I suspect there are many who will determine that even $450 is too much given the current environment. On the other hand, if you value the $300 travel credit near face value (again, you could use this year’s credit to book prepaid things like flights or hotels for next year or pay to load an EZ Pass, etc) and you value this year’s $60 DoorDash credit near face value (note there will be another $60 credit next year also), the net cost may still be worth it to some for ancillary benefits and 3x dining for some.

However, if you decide that you no longer want the CSR, I do not recommend cancelling but rather calling to downgrade to a card with no annual fee (the Chase Freedom or Chase Freedom Unlimited). Keep in mind that even if you already have a Chase Freedom card, you can downgrade your CSR and have another Freedom card. It makes more sense to keep the slot there to be able to upgrade again in the future or to use the benefits of the no-fee card.

[…] right now. For Sapphire Reserve cardholders balking at the prospect of renewing with a $550 fee (or even a decreased $450 fee) but still wanting to retain travel and dining spend as 3x categories, the Citi Premier card could […]

I have not yet used my $300 airline credit. Card expires in September. Will they extend this benefit? otherwise the card had little value to me this year.

I meant it renews in September … but at this rate it may just expire too. Think they’ll make some adjustment for non-use of features? Perhaps it depends on how long the stay-at-home order is in place.

My annual fee is due this month and I received the offer. I may cancel anyway. I don’t see using the card much in the next 3 months or possibly longer. Because of that it is hard to justify $450.

I don’t see any secure messages in my Chase account and my CSR renewal is in October.

Now just waiting on Amex to do something. Not sure if I will be able to use all 200$ airline credit this year….

My wife and I have been 5/24 bound for quite some and don’t see us getting below it anytime soon.Our UR points are just about gone. So, I don’t see any need for us to ever collect UR points again (we don’t MS). Consequently, we will be cancelling our CSR, Freedom Unlimited and United cards. We will keep our IHG and Hyatt cards (free nights) and our Southwest card (6,000 pt). Basically, we are done with Chase.

My CSR renewal is in September. I had planned to cancel and switch to CSP due to the increased fee. I would however keep the card for another year if they extended this offer beyond July.