Citi is currently running increased in-branch offers for the Citi Premier card. While the current online offer is for 60K ThankYou points after spending $4K in the first 3 months, the standard offer available in-branch is good for 65K points with the same spending requirement. Doctor of Credit also reports that there is now a 70K offer for Citigold customers.

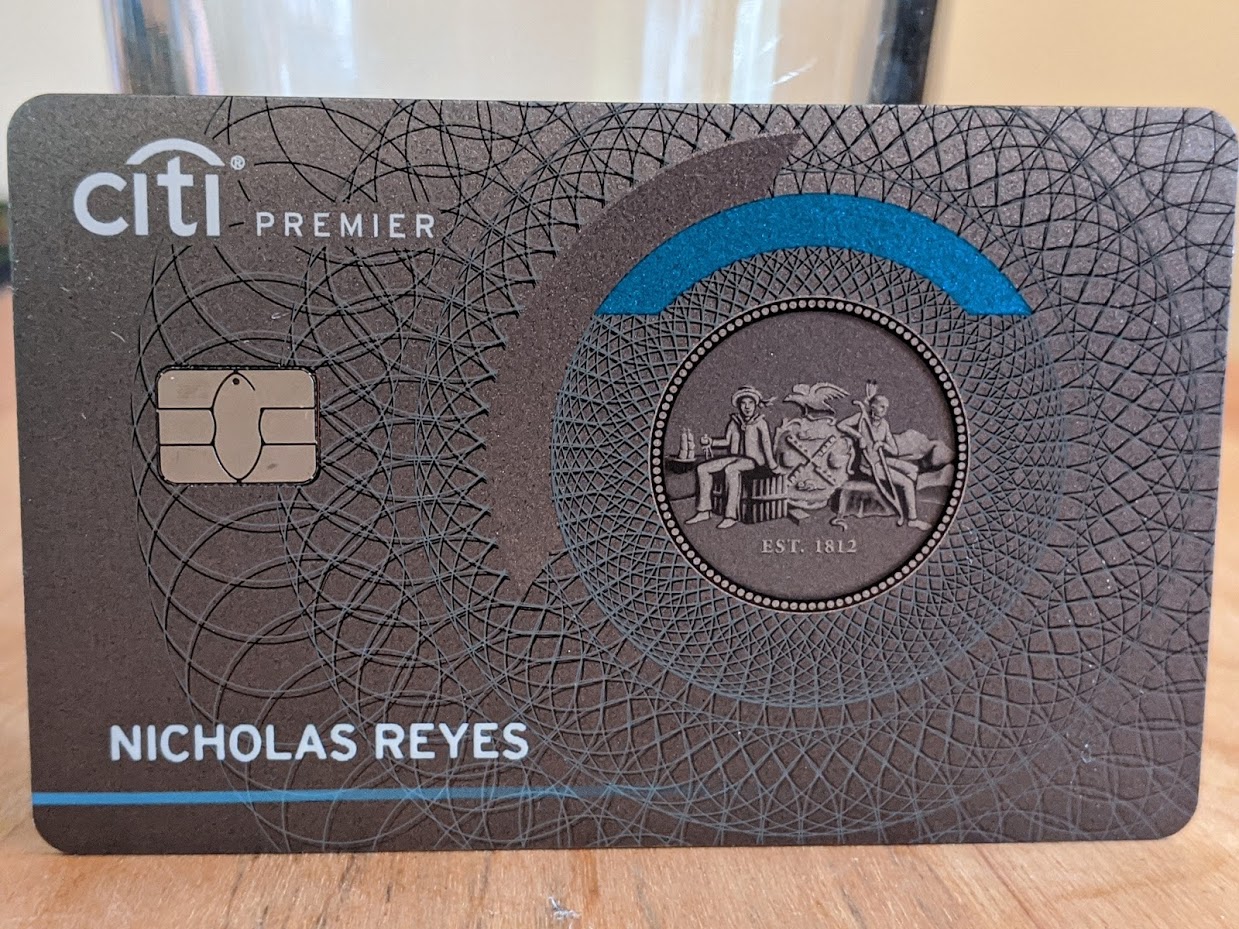

Standard online offer & key card details

| Card Offer and Details |

|---|

60K Points ⓘ Affiliate Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.$95 Annual Fee FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash and Citi Rewards+. Sadly, this travel card doesn't provide any travel protections. Click here for our complete card review Earning rate: 3X grocery ✦ 3X dining ✦ 3X gas stations ✦ 3X flights, hotels, travel agencies Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline partners ✦ $100 Annual Hotel Savings Benefit See also: Citi ThankYou Rewards Complete Guide |

Possible match

Citi is generally good about matching if you see a higher offer after applying. If you have applied online recently, it’s definitely worth reaching out to Citi via message to ask if they can match you to the higher in-branch offer (likely the 65K offer for most readers, but if you have Citigold status, it is obviously worth asking to be matched to the 70K offer). If you have a branch nearby, you could alternatively go to apply in-person if banks are open in your area.

Remember that to get the bonus on any ThankYou card, you must wait 24 months after receiving a new cardmember bonus or closing any ThankYou card account. This applies to the Citi Preferred, Premier, Prestige, and Rewards+ cards.

H/T: Doctor of Credit

Just got card with 60k, called to get match to 65k, wouldn’t do it.

Can anyone please provide a picture of the 65k offer? I’d love to get them to match it but they require proof and I do not have a branch in my state. TIA

What happens on a Citi card if when u cancel the card it has -1k points from rebated Travel ??

How can I request a match? Citi doesn’t have secure mesg anymore..

Have done it via chat before, however might take more than one try, some reps are less knowledgeable than others.

It’s always been very easy to get Citi cards for me, 6+ or so last year alone, but I’ve applied twice now for the Premier and been instantly denied. High income, high credit score, recently downgraded existing Premier card. I’ve never had a problem getting a Citi card before, maybe they are restricting after the grAAvy train fiasco?

Hey guys are you 100% confident that a Rewards+ bonus in past 24 months prevents you from earning a Premier sign up bonus? I’m currently debating how to handle my Prestige which has AF due in a couple weeks. If I’m ineligible for a Premier bonus due to Rewards+ from last year I may just accept a downgrade from Prestige to Premier and forego the SUB.

This is a direct copy and paste from the landing page for the Premier:

Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+℠, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier℠ or Citi Prestige®, or if you have closed any of these accounts, in the past 24 months.

Haha ok, guess that settles it pretty definitively.

Does a product change count as a closure? I.E. If I downgrade my Prestige to a TYP Preferred does that reset my 24 month clock?

if the pc has the same acct #, likely won’t reset

is there any way to know in advance if the PC will retain the original account number?

There isn’t. It *usually* doesn’t change when you stay within a card family like that, but you never know when Citi will issue a new acct #. I recently downgraded Prestige to Premier and got a new account number unfortunately.

a hard one for me to figure out, I had a prestige & premier.

I downgraded prestige to double cash ( got a new acct #), then upgrade premier to prestige w/o no change on acct #.

coming up on 36 months from original prestige SUB, 24 months on premier SUB. will I be eligible for any SUB at all?

Not true, at least in my case. I downgraded from premier to rewards+ last May, card number stayed the same, when I tried to apply for another premier (24 months after first one), it was an instant denial, and citi said it was because “too many cards” within 24 months.

which part is not true? the reason for a denial not b/c a previous bonus for the premier was given within 24 mo; rather, sounded that to citi u have had many CCs or hard pulls within 24 mo

wow, 24 mo from either the acct bonus was earned (not when was open) or acct was closed; my last bonus for premier was earned in 9/2018 & opened in late 7/2018; will see that the offer will still be around