NOTICE: This post references card features that have changed, expired, or are not currently available

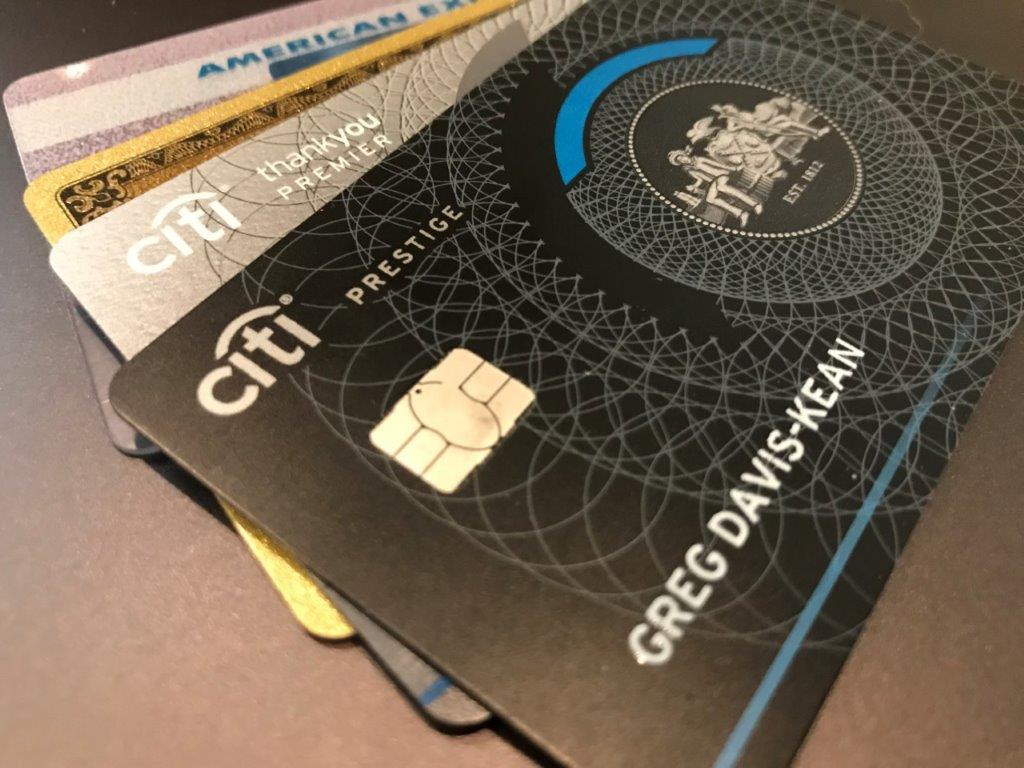

Citi’s high end travel card, Citi Prestige has been unavailable for new applicants for a number of months while Citi reworked the card’s benefits and upped its annual fee. Now, finally, the card is once again available for new applicants. Here are the details:

| Card Offer and Details |

|---|

ⓘ $-495 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$495 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

Please note these terms:

Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+SM, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi PremierSM or Citi Prestige®, or if you have closed any of these cards, in the past 24 months.

So… Make sure it’s been two years since you’ve received a signup bonus for one of the listed ThankYou cards before applying for this one. Also, if you have another ThankYou card, don’t cancel it until after you’ve successfully applied for a new one.

My Take

At $495 this card is expensive. Fortunately, it offers perks that many will find outweigh the annual fee. Here are just a few:

- $250 travel credit (get reimbursed up to $250 per year for any travel spend)

- 5X reward categories

- 4th Night Free hotel benefit. Starting in September this will be limited to 2 per year and bookable online only (so, no earning hotel points or elite credits).

If you don’t value the card’s perks and you’re interested only in the signup bonus, then I’d recommend the Citi Premier card instead since it has the same bonus, but with first year annual fee waived and only $95 per year after that:

| Card Offer and Details |

|---|

ⓘ $741 1st Yr Value EstimateClick to learn about first year value estimates 60K Points 60,000 points after $4,000 spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k after $6 spend in the first 3 months (ended 4/8/25) FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review Earning rate: 10X hotels, car rentals, and attractions booked through Citi Travel℠ ✦ 3X grocery ✦ 3X dining ✦ 3X gas stations & EV charging ✦ 3X flights, hotels, travel agencies Base: 1X (1.5%) Flights: 3X (4.5%) Hotels: 3X (4.5%) Portal Hotels: 10X (15%) Grocery: 3X (4.5%) Dine: 3X (4.5%) Gas: 3X (4.5%) Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $100 Annual Hotel Savings Benefit ($100 off a $500+ hotel stay, excluding taxes and fees, when booked through Citi Travel) ✦ Travel protections See also: Citi ThankYou Rewards Complete Guide |

Hat Tip: IAD Gr8 via Twitter

[…] Citi Prestige is Back. 50K offer is live. […]

this is what i was worried about – they are now including the Rewards+ as a disqualifying card from the bonus – and that is why i won’t downgrade any of my cards to the Rewards+ because they may consider that as ‘opening’ the Rewards+ – even though i strongly disagree that PCing a card is ‘opening or closing’.

[…] have been changing in the ultra-premium card space! The new Prestige card was just released with it’s new 5X categories and $495 annual fee. And Amex is expected to unveil more […]

Can you still get the older lower annual fee in branch with priority checking?

For my money $495 is too high for this and the sign up bonus isn’t at all tempting. I would use the 4th night free once a year tops though so for others it’s an easier choice.

I just don’t get the 50k bonus. Just seems too low for an annual fee this high and for a card they just made worse (unless you eat out every night) and want new folks to sign up for.

I don’t know. We were told that CitiGold offers the $350 fee, but I’m not sure about Citi Priority