NOTICE: This post references card features that have changed, expired, or are not currently available

Four days ago, I emailed Nick to ask him about a comment he had made in one of our Frequent Miler Live discussions. He had said that Citi shows points earned with each transaction. That would be great, but I wasn’t able see that on any of my cards. He replied that it worked on his Premier card, but not his AT&T Access More card.

Later that same day, Miles to Memories reported that Citi has fixed common login issues. That was good news! Even better, the next day, Doctor of Credit reported that due to the website refresh Citi was now showing points earned with each transaction! It looks like I had logged on to my account hours too soon. When I log in now, I can see points earned on all of my ThankYou cards except for my AT&T Access More card.

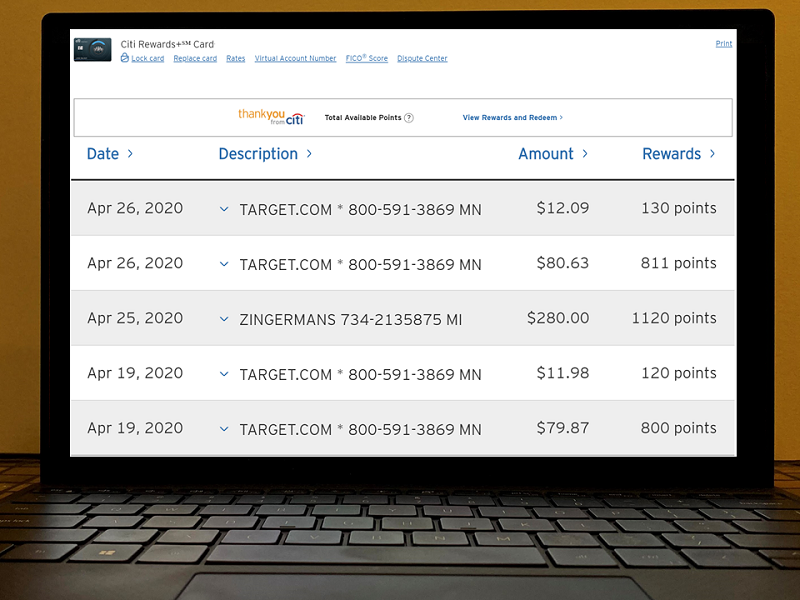

The ability to see points earned is an awesome enhancement. Now, for example, we can see at a glance whether a charge that we thought was a restaurant charge really coded as such. And when there’s a bonus promotion on your account for certain types of spend, it is easy to see whether that spend has qualified. For example, in April my Rewards+ card was targeted for a 10X promotion. I would earn 10X for all online purchases. So would orders made through the Target phone app count? In the image at the top of this post, you can see that those purchases did count because each one earned 10 times as many points as dollars spent.

Citi shows points earned on the following ThankYou cards (please let us know if you see the feature on other cards):

Citi does not show points earned on the following ThankYou cards:

- AT&T Access

- AT&T Access More

- Sears Card (the version that earns ThankYou points)

It’s awesome to see Citi improve their website in such a useful way! With this enhancement, Citi went from being the worst at showing bonus points earned to the best in my opinion. Good job Citi!

Next, Citi, please extend the functionality to the AT&T Access More card!

Someone give me reasons to keep the ATT More card

Cannot give you one- I’ve put several big online retail purchases on this card (some my fault- did not check the list to see that Adorama doesn’t get 3x) but did not get 3x. Converting to DoubleCash would net me almost as many points with no fee. I’ll be converting when the AF comes up.

I see this on the Preferred card as well.

Also, are you trolling us or testing in your screen shot with the Target transactions earning 10x?

Thanks re: Preferred. I mentioned the 10X in the post: it was from a promo in April on my Rewards+ card.

Citi was the worst and remains the worst.

Citi was the worst because point earning on SOME of their cards are impossible to make sense of. The most notorious of them are Access More and ThankYou Business. Rewards+, Premier, and Prestige never had major points calculation issues. Indeed Citi has fixed something that was not broken, and ignored fixing something that is broken….

I am seeing this on Premier, but I’m NOT seeing it on DoubleCash or on the Dividend World Mastercard.

Yep, it’s only on their ThankYou cards. Even though DoubleCash rewards can be converted to ThankYou points, it’s not a ThankYou card. Also, of course, it earns at the same rate for all spend so it’s not needed. It would be nice on the Dividend, but unlikely that they’ll invest anything in that old card.