A reader shared an interesting anecdotal report with us this week about approaching credit card reconsideration via secure message. Much to their surprise, it worked. If you’ve been denied for a new card and you are hesitant to get on the phone to discuss it, you may want to try sending a secure message.

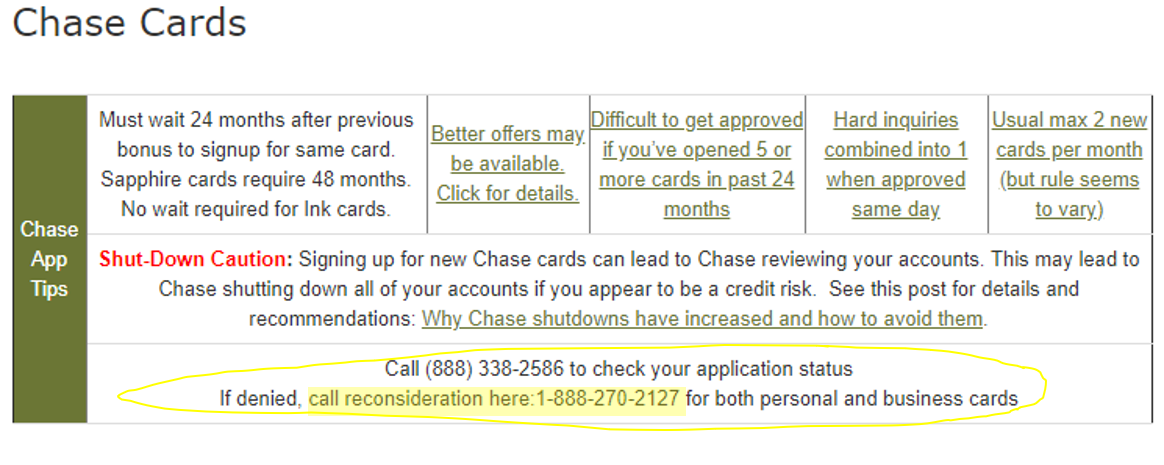

If you are denied for a few credit card, it can certainly be worth calling the bank’s reconsideration phone number to talk with a representative and plead your case as to why you would like the card and to ask them to manually approve your application. Sometimes a recon phone call can be really easy — it might be so simple as the fact that the bank doesn’t want to extend more credit to you, but you may be able to shift credit limit from your other existing cards in order to open the new card you want for its benefits. We keep the phone numbers for reconsideration with each bank on our Best Offers page.

Interestingly, we recently received a success report from a reader in a reconsideration attempt that didn’t even require a phone call:

My wife recently applied for a chase southwest business card and got a denied for having too much available credit. She has both an ink cash and unlimited with ok credit lines. She would have eventually called recon but it is something she really dislikes. So she sent a secure message referencing that denial and asked if she could open the new card by moving some of her ink credit line to open the new account. She got a response that they sent her request to the correct department and she would hear in 5-7 business days and on she got approved with out having to talk on the phone!

That was a very interesting data point, particularly for those in a household with a reluctant Player 2 who prefers not to make phone calls. The fact that it may be possible to get an application reconsidered without a phone call makes the process much simpler.

Of course I would not expect that this will always be an option. I am sure that there are instances where the bank would would to speak with the applicant, particularly if they have other reasons to be uncomfortable with the application or they have other questions about your business. I wouldn’t send a secure message expecting a successful reconsideration attempt, but rather I might approach it with a hopeful attitude and ask politely if your application can be reconsidered. It certainly wouldn’t hurt to offer a solution like moving available credit from another card(s), though keep in mind that rules vary from one bank to another. For instance, most banks will not allow you to move credit limit from a consumer card go a business card or vice vera, but other banks may allow that.

Overall, this seemed like a great little tip. It’s not something to count on, but it’s a great tool for your belt.

so i just did this on my CIP application and received a phone call after a few days from recon dept that then approved me after a few follow up questions. so while it wasnt auto-approved, it did save me from “making” a phone call.

This is not about using Secure Messaging, but a way that I handled a reconsideration call for P2 who didn’t want to deal with it.

This call with Chase was for a denial of P2’s application – with both of us (myself and P2) on the line. The Chase agent asked P2 if it was OK for me to handle things, which P2 approved and then I proceeded to answer questions and provide info. P2 stayed on the line just in case but didn’t have to participate much.