NOTICE: This post references card features that have changed, expired, or are not currently available

Delta and Amex have announced huge changes to their credit card lineup. There are quite a few positive changes (including Centurion Club access for Reserve cardholders!), but annual fees are going up for new accounts and renewals beginning Jan 30 2020. Let’s look at each card to examine the changes:

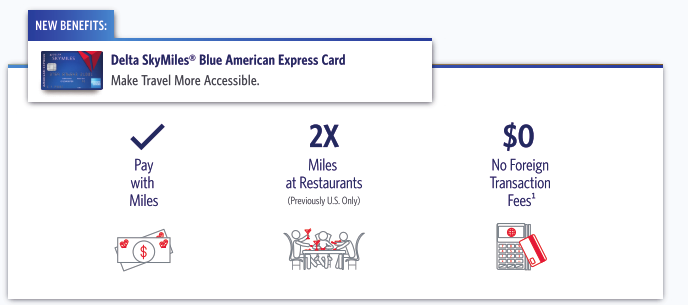

Delta Blue Amex

It’s all good news for the no-fee Delta SkyMiles Blue Amex. Beginning Jan 30th, the card will no longer incur foreign transaction fees and it will begin earning 2X at restaurants worldwide rather than only in the US.

Delta Gold Amex

The news is arguably mostly positive for the Delta SkyMiles Gold consumer Amex and the Gold Business Amex. Beginning Jan 30th,Gold cardholders will earn 2X miles at restaurants and 2X at US supermarkets (consumer version) or 2X for US shipping and advertising (business version). Both cards will earn a $100 Delta Flight Credit after $10K/year spend. This credit can be applied towards the cost of airfare, but the value expires after a year if not used. On the other hand, Delta Gold cardholders will pay an additional $4 per year, will no longer be eligible for reduced price admission to Delta Sky Club®, and will not earn a MQM (Medallion Qualification Waiver) with $25K spend.

Greg’s take on the Gold card changes: Overall, I like the changes to the Gold cards. Those who need the MQM waiver towards elite status will do better with the Platinum or Reserve card anyway. And now you’ll actually get something useful after $10K calendar year spend. I’m not too excited about the new bonus categories since many cards offer better rewards in those categories, but they’re better than nothing.

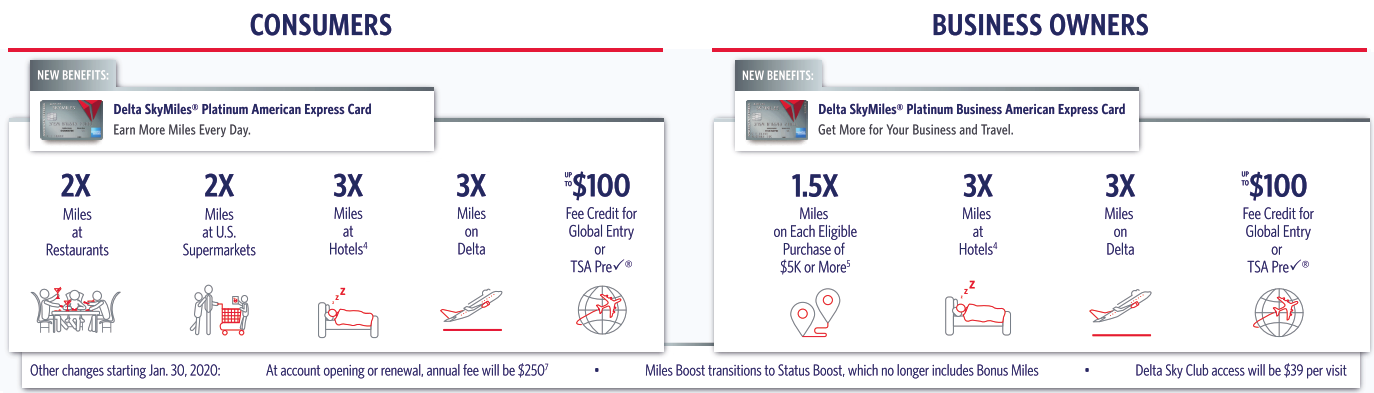

Delta Platinum Amex

The news is mixed for the Delta Platinum consumer Amex and the Delta Platinum Business Amex.

Positive changes starting Jan 30 2020:

- Bonus categories: Earn 2X or 3X for various categories of spend.

- $100 Global Entry fee credit every 4 years (or 4.5 years for TSA Precheck)

- Business card earns 1.5X on eligible purchases of $5K or more (max 50K extra miles per calendar year)

Negative changes starting Jan 30 2020:

- Annual fee increases from $195 to $250

- Miles Boost is replaced with Status Boost. It’s basically the same thing (earn 10K MQMs with $25K spend, and again at $50K spend), but now you won’t earn bonus miles with the MQMs.

- Delta Sky Club access price increases from $29 to $39 per visit.

Greg’s take on the Platinum card changes: I don’t like it, but it could have been worse. The annual fee will increase by $55 and we’ll lose the ability to earn bonus miles with our MQMs when hitting spend thresholds. We can breathe a sigh of relief, though, that the MQM bonuses are still in place. Also still in place are the valuable companion certificates you get each year upon renewal. And I do like the 1.5X earnings for the business card for large purchases. I could see myself continuing to spend $50K per year on the business version of the card. If I do so only with large (over $5K) purchases, I’ll earn 75K miles in the process. That’s a bit more than I’ve been earning to-date on the same spend (currently, with $50K spend, I earn 50K miles plus 20K bonus miles thanks to Miles Boost).

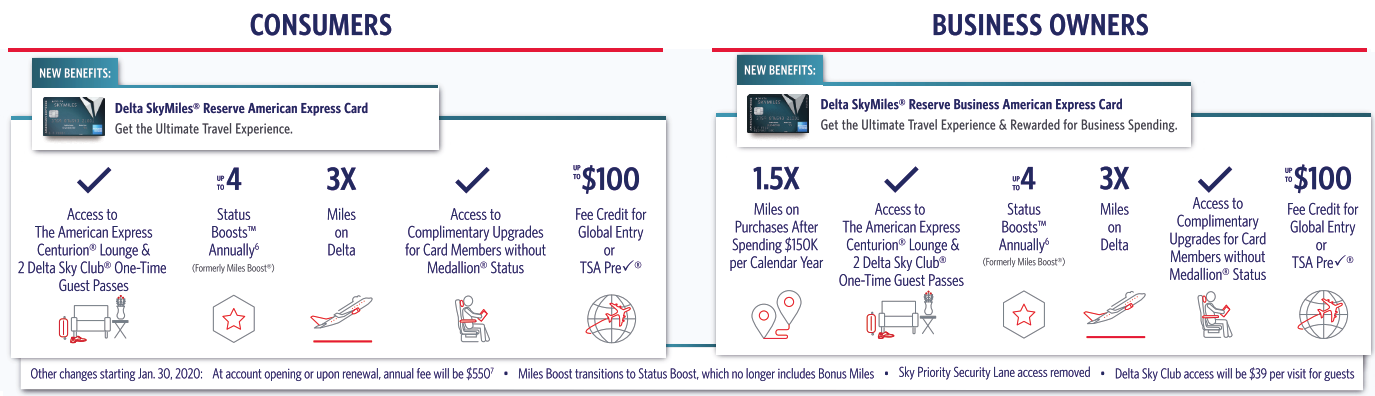

Delta Reserve Amex

The news is also mixed for the Delta Reserve consumer Amex and the Delta SkyMiles® Reserve Business American Express Card.

Positive changes starting Jan 30 2020:

- Centurion Lounge access when flying Delta

- 2 Delta Sky Club one-time guest passes (the card continues to offer Sky Club access for the primary cardholder when flying Delta)

- 4 Status Boosts Annually (Ability to earn up to 60,000 MQMs with $120K calendar year spend)

- Earn 3X miles on Delta

- Complimentary upgrades (non-elite cardholders get on the free upgrade list behind any elite members traveling on the same flights)

- $100 Global Entry fee credit every 4 years (or 4.5 years for TSA Precheck)

- Business Reserve card adds the ability to earn 1.5X on all eligible purchases per calendar year after spending $150K.

Negative changes starting Jan 30 2020:

- Annual fee increases from $450 to $550 (ouch!)

- Miles Boost is replaced with Status Boost. It’s similar to before (earn 15K MQMs with $30K spend…), but now you won’t earn bonus miles with the MQMs.

- Non-elite cardholders lose access to the Sky Priority Security Lane

- Delta Sky Club access price for guests increases from $29 to $39 per visit.

Greg’s take on the Reserve card changes: I’m impressed. The Reserve card goes a long way toward mimicking real high level elite status. When flying Delta, cardholders will have more lounge choices (with the addition of Centurion Lounges), they’ll be able to invite 2 guests into the Sky Club for free one time per year, and they’ll appear on the upgrade list for all flights that qualify for complimentary upgrades (mostly domestic flights and flights to nearby countries). For those who want to manufacture elite status with spend, I really like the ability to earn four status boosts annually (the current limit is two). This means that you can earn up to 60K MQMs with a single Delta Reserve card. Those with both the consumer and business version of the card could earn up to 120K MQMs. Of course I’m not happy about the increased annual fee or the loss of bonus miles with each spend threshold. Overall, though, I think that the changes are a net positive for most people.

Conclusion

I was really scared when I saw the announcement about big changes coming. I figured that they would gut some of my favorite card features. Specifically, I thought we’d lose the ability to spend our way to high level elite status. The truth is the opposite. With the Reserve card, it becomes easier to spend our way to high level status. Unfortunately, it also becomes harder to justify that spend since we no longer earn bonus miles along the way.

Overall, there are both good and bad changes to the cards. I think there are more good changes than bad changes, but if I were to look only at the Platinum cards, I would say the opposite. My bet is that Blue and Gold cardholders will be happy with the changes. Platinum cardholders will be annoyed, but not desperate to dump the cards. Reserve cardholders will be happy with the card’s new features but will be unhappy with the increased annual fee.

If you have a Delta card, what do you think about the upcoming changes? Please comment below and let us know which type of card you currently have.

[…] covered a number of the key changes along with some analysis of their relative value (See: Delta credit cards: huge changes coming.) While you could earn better category bonuses on cards that earn Amex Membership Rewards points and […]

[…] Miler already has a detailed analysis that I mostly concur. My first reaction was ‘not terrible.’ I am less positive after […]

[…] Credit Cards: This week, Delta and Amex announced some changes coming to their credit card lineup. This post from Greg at The Frequent Miler sums up the changes nicely. I’ve had the Delta cards in the past, but I haven’t held onto them […]

[…] Miler: Delta Credit Cards: Huge Changes Coming (September 30, […]

Does anybody know where the Reserve Card holders stand for the UPGR queue? Do they go before or after the medallions?

After

The new terms say Delta Reserve basic and additional card holders receive access to both centurion and Delta lounges. I believe that is a change too for the additional card holders. Can you confirm?

I think that additional cardholders previously got Delta club access as long as they had Reserve AU cards. I don’t remember how much they cost, but they are expensive. I’ve always added additional AUs to the Reserve card as Platinum AUs which have no benefits other than being free.

I just checked the current terms and compared to new terms… the AU access to clubs is definitely a new feature of the Reserve Card. Not sure its worth the $175 per Additional User though.

If the current t&c doesn’t list sky club access for Reserve AUs ($175 per person, I believe), then I believe that is an oversight.

What exactly is Pay with Miles (vs using regular miles)? And with the Pay with Miles, can you pair a companion cert with that?

I am not chasing Delta status and have the Platinum card, mainly for the companion certificate, priority boarding, free bags and $29 per person lounge access. I also have the Ritz Carlton card, so the value of the companion certificate was there but a bit marginal (Ritz will give me $100 off two tickets domestically for an unlimited number of times, and Delta Platinum will give me a domestic second ticket free minus taxes as long as my primary ticket is in certain fare classes). Increasing the price of the Delta Platinum card by $50 makes the value of the companion certificate even more marginal compared with the Delta Gold card. Adding $10 per person onto lounge access tips me more toward just using free Priority Pass lounges. So, for me, downgrading to Gold is a no brainer, since the $100 off can be used internationally and I can stack two $100 off coupons by putting my last dollar towards the $10,000 requirement late in one year and early in the following year (Terms and Conditions appear to allow international flights and will let you use up to three $100 off coupons). The rest of the changes are worthless to me since I have AMEX Gold which will earn me double for restaurants and US supermarkets and Sapphire Reserve for hotels (plus I use co-branded cards for Marriott, Hilton and Hyatt anyway). So, downgrading to Gold will save me $150 per year.

Am I missing anything in this analysis?

I hold the Reserve Card…not sure how the Centurion Lounge access is helping me? There aren’t that many of them and there are Sky Clubs in all the airports that have a Cent Lounge. If it gave me access when not flying Delta that would be a perk. Also, I do not have TSA Pre-Check and was happy with the Sky Priority Access lane which has saved me big minutes on very busy travel days. $100 more/year and they take that away? Seems petty…

So with two current Reserve Cards to chase 60k mqms, I will drop to one card saving $350 in annual fees. But I’ll lose 60,000 bonus miles with a assured value of at least $600. And I’ll lose a companion ticket, which as a single guy I often wind up giving away, but which is worth at least $200. Net loss, but my big fear would have been some material erosion in the MQM boost feature. And that didn’t happen. Also positive is not having to figure which of two cards I need to be using and not needing to shuffle all the automatic payments from one card to another.

Does anyone here know if gift cards purchased at a supermarket might be ok for earning Amex points vs the Simon cards which we know do not work.

It has thus far on other Amex cards been ok to do this.

I have re-read this term multiple times in the the notice I received on my personal Delta Platinum Card.

“Card Members are only eligible to receive one annual bonus per threshold per calendar year for each type of eligible Delta SkyMiles Card (e.g., Platinum or Reserve) that is linked to the same SkyMiles account. ”

I also have a Delta Reserve Business Card. Does that mean I will or will not be able to get the full MQM bonuses on both cards? I have read it both ways. (I primarily chase status for myself and use miles for others)

The complimentary Centurion lounge benefit requires Delta ticket purchase on a Reserve card. I wonder how the Centurion counter agent will be able to tell how you purchased your ticket and if you can split the cost of the ticket to maintain the trip delay benefits of purchasing a portion on Chase Sapphire Reserve?

The simplest way to do it would be for the computer to trigger when you meet the requirement with your reserve card. Then on your boarding pass a statement to the effect of “this traveler gets access to the centurion lounge” would be printed.

Based on my understanding of this, one should still be able to earn the 15k bonus miles if $30k spend is met before the end of January. However, I wonder if it might need to be completed before the January statement close so that it posts correctly?

I will be operating under the belief that 1/1-29 will earn as current.

Currently, the Blue card doesn’t qualify on its’ own for the MQD Waiver, but the spend does count towards the total spend of the cardholder’s other Delta AMEX cards. I’m assuming, based on no mention of that being changed for the Blue card, that the Gold card will now work the same way: no standalone MQD waiver, but spend accumulated with Platinum/Reserve spend towards the total. Can you confirm this?

Found the answer –> According to the FAQ’s, If you have an eligible Delta SkyMiles Card (Delta SkyMiles® Platinum, Delta SkyMiles® Reserve, Delta SkyMiles® Platinum Business, or Delta SkyMiles® Reserve Business) with the MQD waiver benefit in addition to an ineligible Delta SkyMiles Card (Delta SkyMiles® Blue, Delta SkyMiles® Gold, Delta SkyMiles Gold Business, Delta SkyMiles Business Credit Card from American Express), purchases made on each of your Delta SkyMiles Cards will continue to count towards the MQD waiver.