NOTICE: This post references card features that have changed, expired, or are not currently available

This week on Frequent Miler on the Air, Greg almost convinced me that I need to go for Delta elite status. Thankfully, I came to my senses and realized that despite a ridiculously easy path to get to Delta Platinum status through early 2024, I just won’t get enough value out of it in my circumstances. However, if you can make good use of free upgrades on Delta, you’ll want to listen to this week’s show to hear how easy it is right now. We also talk about the Altitude Reserve card (momentarily :-), Delta lifetime Diamond, a great Fine Hotels & Resorts question and more.

Read on in this week in review for more on those topics and also how you can eke out thousands of free points and hundreds in free money by picking up the telephone, the best ways to book activities with your points (which may not be exactly how you think), and more — or watch or listen to the show below.

- 00:34 Giant Mailbag: Do you have any plans to to do a podcast about the US Bank Altitude Reserve card?

- 2:45 What crazy thing….did Alaska Airlines do this week?

- 10:37 Mileage Running the Numbers: Is it worth mileage running Delta Lifetime Diamond status?

- 19:26 Main Event: Delta elite status: easier than ever

- 51:24 Question of the Week: If you book a Fine Hotel & Resorts property and then downgrade your Platinum card, will you still get benefits?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

Easy path to Delta elite status through Jan 2024

Delta has made it easier than ever to enjoy elite status for all of 2023 because you can start earning now and add all of your activity through the end of next year to make it to 2023 elite status. The path is so easy that Greg almost talked me into going for it – until I came to my senses and realized that I am very unlikely to utilize the benefits of Delta elite status and subsequently talked some sense back into myself. Still, if you live in a Delta hub city and travel Delta enough to take advantage of the benefits, setting yourself on the path to status right now just makes sense. Picking up 20K MQMs from a credit card that roll over to next year is a great deal that significantly reduces the path.

Hyatt House Mt. Laurel: Bottom Line Review (2bdrm standard suite)

I stayed at a Hyatt House property this week where you can book a 2-bedroom suite for just 8K points per night. That sounds great on the surface and certainly can be if your primary concern is having plenty of space. Furniture within the room was also in excellent shape. On the other hand, the property is a bit worn down overall and our room condition wasn’t quite up to what I’d normally expect at a Hyatt. I’d try a different property in the area next time.

Manufacturing Lifetime Delta Diamond Status

When Greg started explaining this plan to me on Frequent Miler on the Air this week and he told me that he needed a friend to get a Delta Reserve card and for that friend to also allow Greg to spend $120K on that card, I thought “Greg’s good for it”. When Greg explained that he’d need 100 friends to accept that deal, I thought, “I don’t know if Greg’s good for $12 million“. This is a fun thought exercise, but the moral of the story is that Delta is getting the better end of this deal: by the time you get to Lifetime Diamond you may not have that much “lifetime” left.

Delta extends elite status, upgrade certificates, earnings on awards, and more!

While lifetime Delta Diamond status may be out of reach, keeping your current Delta elite status for another year is easy like the Staples button since Delta is extending whatever status you hold in 2021 through January 2023. Say it with me: That was easy! In other good news, upgrade certificates have been extended and award tickets will continue to earn both MQMs and MQDs through the end of next year – Delta is really going as customer-friendly as possible with all of these changes. Time for American and United to follow suit.

Tours & activities with points: which deal is “best”?

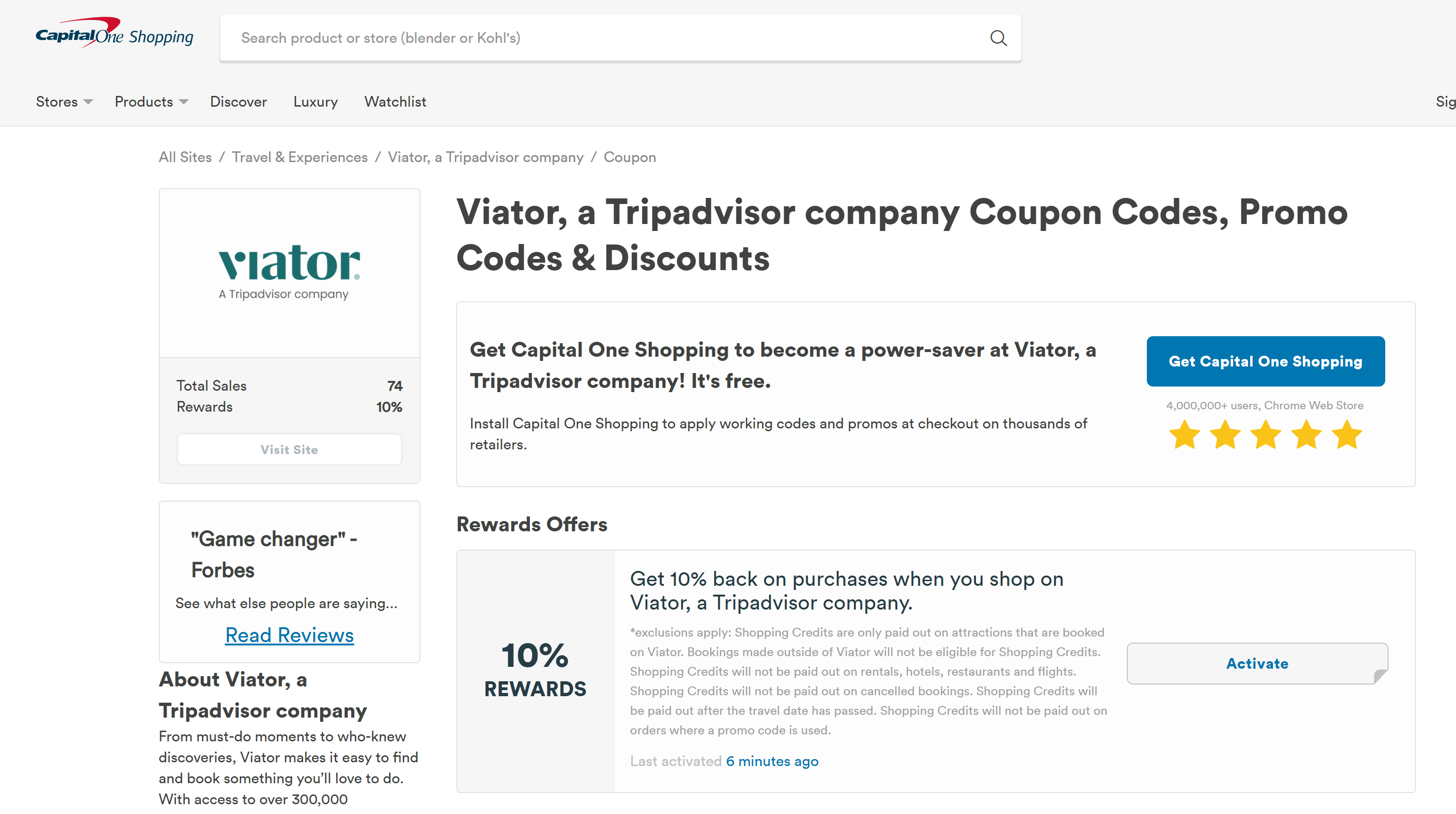

In planning activities for our GUC trip, I came to find that the best deal for using points is cashing them out via Pay Yourself Back and booking with bucks. Even that wasn’t as simple as it sounds since the prices shown by booking sites like Chase and Viator were higher than the cost of booking direct (but booking direct came a the cost of having no cancellations). In the end, I added a step left out of the post: I went through a shopping portal and booked via Viator (hoping for 10% back) but then I noticed that Viator has a low price guarantee. I filed a successful low price guarantee claim with Viator to get 20% of my purchase price back. If I also get the 10% cash back from the shopping portal (questionable since Viator gave me a partial refund), we’ll end up saving thousands of points over booking directly through Chase.

My $895 plus 75,000 points retention call

Greg continues to hit it out of the park on retention phone calls. The $595 offer on his Business Platinum card would be good enough for many people, and the 15K points on the Everyday Preferred has been the standard retention bonus offered via online chat for quite a while now, but the 60K points on the Schwab card for $4K spend in 3 months is basically the old welcome offer on that card! Getting that offer in the middle of the year months before renewal definitely surprised me. This post is a good reminder that if you also like pleasant surprises, it is worth calling now and then to see how much the bank values your business.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

On the FHR thing … I don’t have the answer, but yesterday I think I learned something interesting that might be relevant. Or not. It does go to Greg’s speculation about what the hotel might be seeing.

Amex FHR gives the hotel a virtual card number that the hotel is supposed to bill for the FHR pre-paid charge. That is, the hotel is not supposed to bill the Amex card you provide at check-in for the contracted FHR rate.

Let me break this down:

How and why did I discover this fun fact? Because I am currently in a hallucinogenic inquiry with Amex. Booked a pre-paid FHR. Paid the charge. Got the new $200 credit. Stayed at the hotel. Showed them the Amex Platinum card. Used that card to pay incidentals at check-out. But then: A couple of days later, The hotel charged me for the night I had stayed via the pre-paid Amex FHR booking. And on my first go-round with Amex’s contest-the-charge system, they ruled in the hotel’s favor! So I called in yesterday to talk to a human, pointing out among other things that Amex is on all sides of this — i.e., they are not just the credit card company to which I am appealing an incorrect merchant charge, they are the travel booking company that charged me for the night as well and was supposed to be responsible for reimbursing the merchant! When I finally got to someone who seemed to understand the problem — the hotel has not given in yet! — he explained that the likely source was the hotel belatedly billing the Amex FHR card that I presented at check-in, and not the virtual Amex account number from FHR that the hotel either was or was supposed to have been provided.

Fascinating! Thanks for sharing this.

By the way, I got independent confirmation when I called back again to Amex Travel — the fellow who had given me this info had not been able to reach the accounting department at the hotel on the weekend, so I had to call again earlier last week. The new person I talked to, after talking to the hotel, gave me (unbidden) the same explanation: That the hotel had failed to charge the Amex Travel virtual card/account.

Would be nice to know ideal pathways for people who already have some degree of status. For example I am gold but have only qualified for silver equivalent this year based on MQM and spend, I am still going to be gold next year anyway but what is the best course thereafter? Should I be taking a flurry of trips (which does sound fun) now given the status accelerator? Should I wait until 2022. Should I get a Delta card now or in 2022?

It doesn’t matter when you get a Delta card except that the 20K MQMs being offered by the Delta Reserve right now are not the usual offer on that card. I don’t know whether or when we’ll see that offer again, so I don’t know whether you’ll be able to get that many MQMs from the card next year — but I do know that if you get the card now, the MQMs roll over to next year. That makes it a more desirable “get” right now (though obviously YMMV — for all I know they’ll start offering 25K MQMs on it. That seems doubtful to me, but I can’t predict the future). If you already have 25K MQMs right now, a Reserve card puts you at 45K. $30K spend on the Reserve this year gives you a total of 53,750 MQMs — and you’ve got through the end of next year to pick up 21,250 more MQMs for Platinum status (and you’ll need $25K spend next year for the MQD waiver, so you may as well go to $30K next year which puts you at 68,750 MQMs before anything earned from flying). So you really don’t need a flurry of trips right now necessarily unless you don’t want to do the $30K spend this year for the 18,750 MQMs but would rather take a flurry of trips (since you have presumably already earned an MQD waiver?).

I earned 25k in 2019 and 2020 and 2021 . So I guess in January 2022 I will be a rollover plat

Thanks, super helpful!