At the beginning of the year, Greg announced an awesome offer: he would “gift” me his Delta Global Upgrade certificates, which enable the upgrade of even cheap economy class flights to business class on Delta and partners like Air France, Virgin Atlantic, KLM, and Aeromexico. The catch is that I’d have to bring him with me since (unbeknownst to me at the time that I suggested he give his certificates to me) one of the rules of those Global Upgrade Certificate is that the certificate holder has to be traveling with the companion. Greg therefore tasked me planning the entire trip while scoring as many points as possible by completing a bunch of challenges. See: Passing the GUC: Greg gives Global Upgrades to Nick…with a catch for more detail.

I’ve thus recently been looking at trying to get good value for points in booking activities. We’re not yet ready to reveal details of the trip — and more importantly, I intend to surprise Greg a few times along the way — so I’m not going to share specific details of an activity I’m planning in this post but rather I’ll look more generally at a dilemma I’ve faced in the planning process: the crossroads between using points to get good value, maintaining key travel protections, and getting a good deal.

Booking directly with points: Easy process, good travel protections, but not always a great deal

When it comes to booking activities with points, the best value one can generally expect (at least on the surface) is using Chase Ultimate Rewards points to book activities through Chase Travel℠. That’s because if you have the Chase Sapphire Reserve card, you can use points at a value of 1.5c per point toward activities. Comparatively, Amex doesn’t offer activities through Amex Travel (at least online) and Citi only offers the same 1c per point that you could get with Capital One “miles” to erase a purchase. Chase looks to be the best game in town.

Unfortunately, it isn’t quite as simple as it looks on the surface.

In my case, I am looking at an activity that is available through Chase Travel. Let’s make up a price and say that Chase is offering the activity for $300 or 20,000 Ultimate Rewards points (note that this is just a made-up example to keep the math simple). Booking through Chase Travel has several key advantages:

- Use points directly for the Joy of Free: I could easily use points right off the bat, paying nothing out of pocket and having my activity booked

- Free cancellation: Chase offers free cancellation up to 24hrs in advance on the activity I have in mind (and many others). I expect cancelling would be relatively hassle-free and I’d get the points back.

- Trip protections: Using rewards to pay through Chase Travel should cover me for trip delay / cancellation insurance and also various trip insurances like accidental death / dismemberment / emergency medical / etc. (Scared, Greg?)

Those are some key “pluses”. If Chase also had the best price for the activity I want to book, the story would end there. But they don’t. Chase (and other online travel portals) uses the “full retail price” of activities, which isn’t always the best deal — or at least that the deal could be improved upon as you’ll see in the next section. That also means that using points through Chase Travel won’t necessarily yield the best possible deal.

Booking through Viator and “paying myself back”: Potentially a better (but not necessarily “best”) deal

Viator is a tours & activities website owned by TripAdvisor. It’s worth nothing that there are really only a few players in the online travel agency space: Expedia owns Expedia.com, Vrbo, Hotels.com, Hotwire.com, Orbitz, Travelocity, trivago and CarRentals.com. Booking Holdings owns Booking.com, Priceline.com, Agoda.com, Kayak.com, Cheapflights, Rentalcars.com, momondo, Open Table, and more. TripAdvisor owns Viator.

Based on my experiences looking at a lot of travel-booking sites (and airline and credit card activity portals), it looks like most activity-booking sites work with Expedia, Viator, or PlacePass.com running the booking engine. In the vast majority of my searches, cash prices between those engines seem identical. That is to say that whether booking through Chase Travel, Viator, Expedia, Marriott Tours & Activities, PlacePass, etc, prices are identical through each of the major activity bookers in most cases.

That means that there is a bit of an advantage to booking through Viator over options like Chase or Expedia: Unlike most other online travel agencies, there are consistently decent shopping portal payouts available for Viator. In the case of my example, let’s assume that the full activity cash price is the same whether booked through Chase or Viator (which is true).

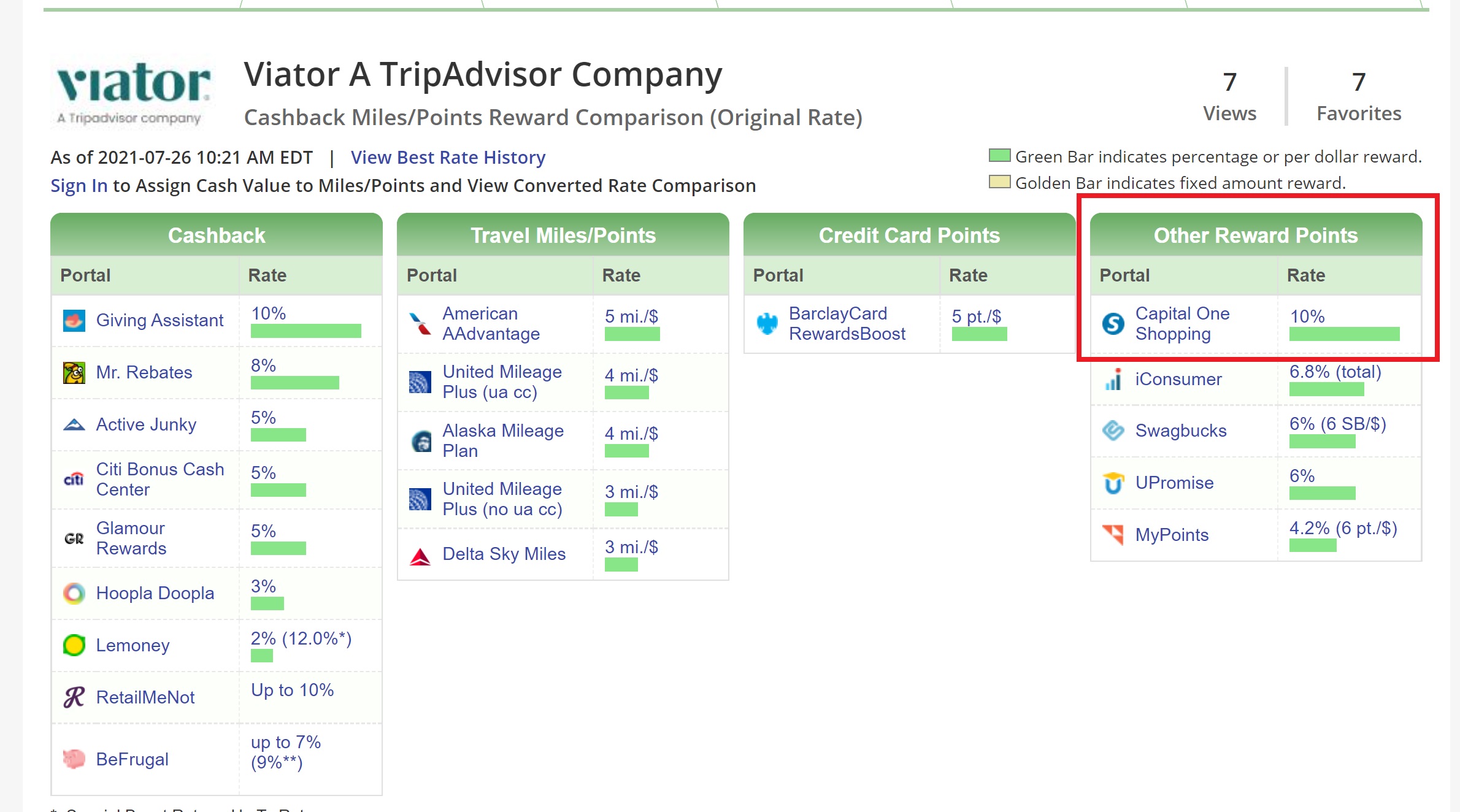

According to CashBackMonitor.com, the best rate currently available is 10% back via GivingAssistant.

I’ve done a lot of shopping through portals over the past decade or so and GivingAssistant is the one portal with which I’ve consistently had things fail to track properly. I just don’t use it anymore. The next best rate looked to be Mr. Rebates at 8% back (and I’ve used Mr. Rebates with success many times).

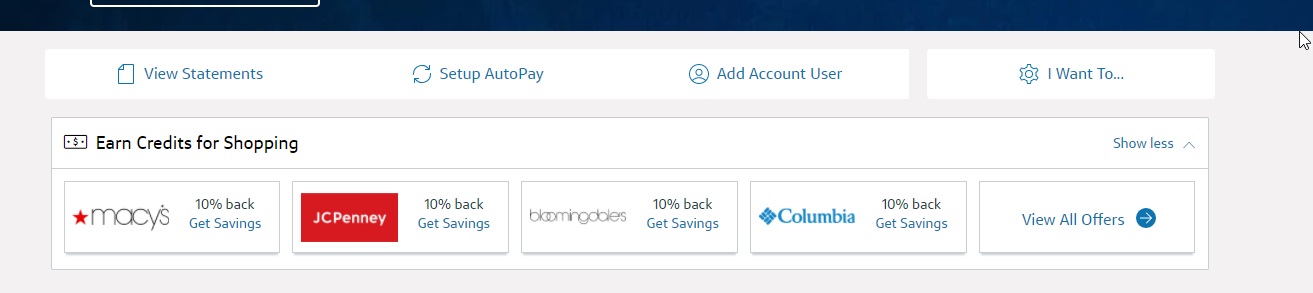

However, I remembered that I had seen Viator available as a cash back option when logged in to my Capital One account. I wrote about Capital One offers last fall. In short, some Capital One cardholders see offers when logged in to their account that kind of look like Amex Offers or Chase Offers but are actually meant to work like a shopping portal. I logged in to my Venture card account and found the “Earn Credits for Shopping” offers under my card info:

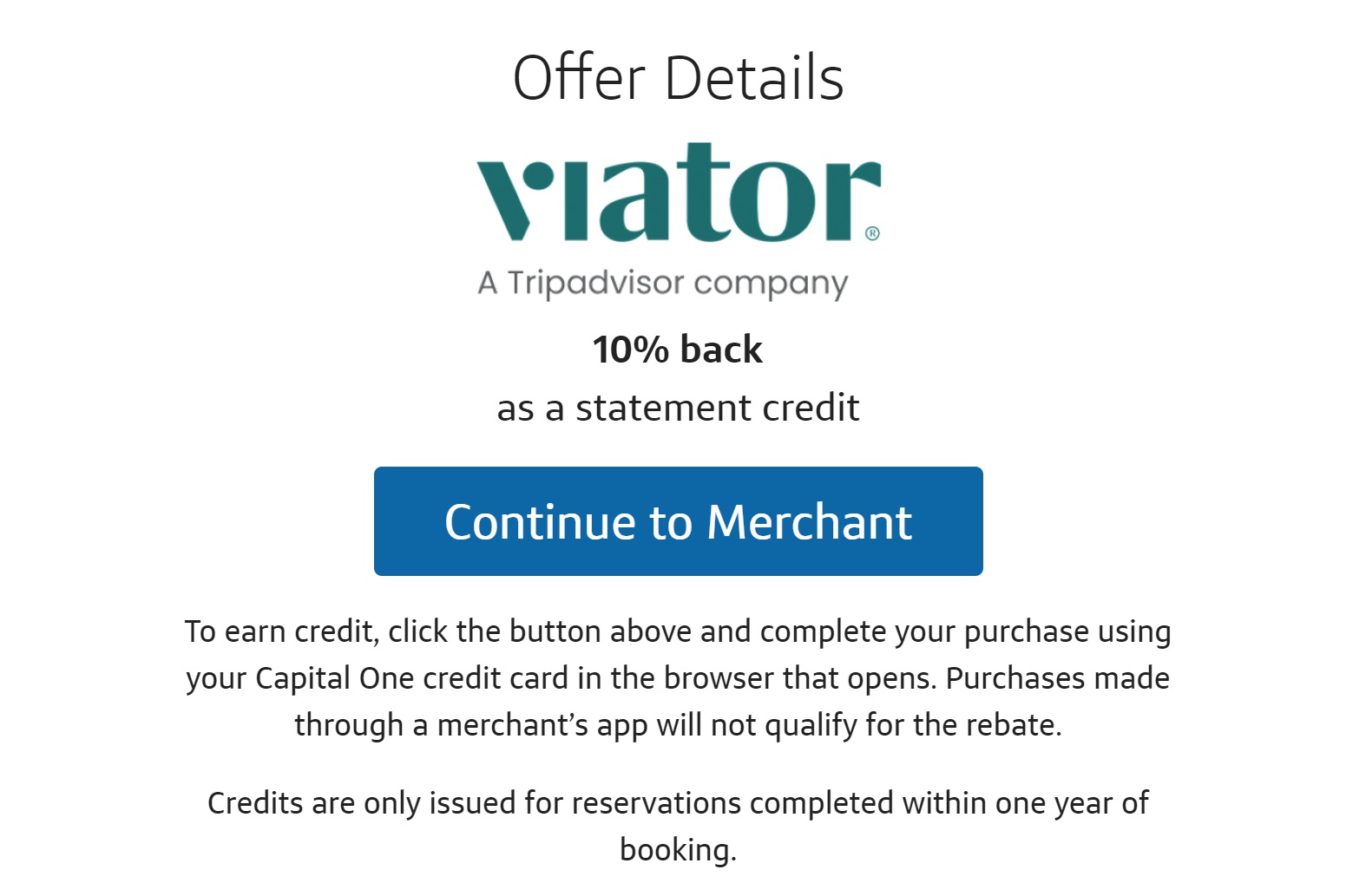

When I clicked to “View All Offers”, I found an offer for 10% back at Viator.

With my theoretical $300 activity, getting 10% back would drop my net cost to $270. There are a few advantages here:

- Save money: Booking with cash would save me thirty bucks

- Free cancellation: Viator also offers free cancellation up to 24hrs in advance

- Still get the Joy of Free: I would need to use my Capital One Venture card to pay, but if I really wanted to experience the “joy of free”, I could use Capital One “miles” to erase the charge and it would cost me 27,000 net points after cash back. Alternatively, I could still use my Chase Sapphire Reserve to Pay Myself Back for $270 worth of groceries and use that $270 to pay off my Capital One card. That would only cost me 18,000 points — saving me 2,000 Ultimate Rewards points over booking with Chase.

But there are also some downsides to this option:

- No trip protections: This activity might not qualify for any trip delay/cancellation protection since I didn’t use my Venture card to book the flights. With free cancellation up to 24hrs in advance, hopefully this won’t be an issue, but this is a downside nonetheless. I also assume I’d miss out on other credit card travel protections like insurances that may cover me if I get hurt

- Risk of not getting paid: What happens if Capital One inexplicably closes my account before the credit posts? While I think that’s a low risk, Greg’s experience indicates that it isn’t “no-risk”.

- Poor luck with these offers: I haven’t had good luck getting stuff to track through those Capital One offers in my Venture account.

That last bullet point is obviously an issue. The terms of the offers found in your Capital One account state that you must click through their link and use your eligible Capital One card to pay and then you’ll see a statement credit within 3 months. I have only made a couple of small purchases through these offers, but I haven’t yet seen one track. That’s a problem.

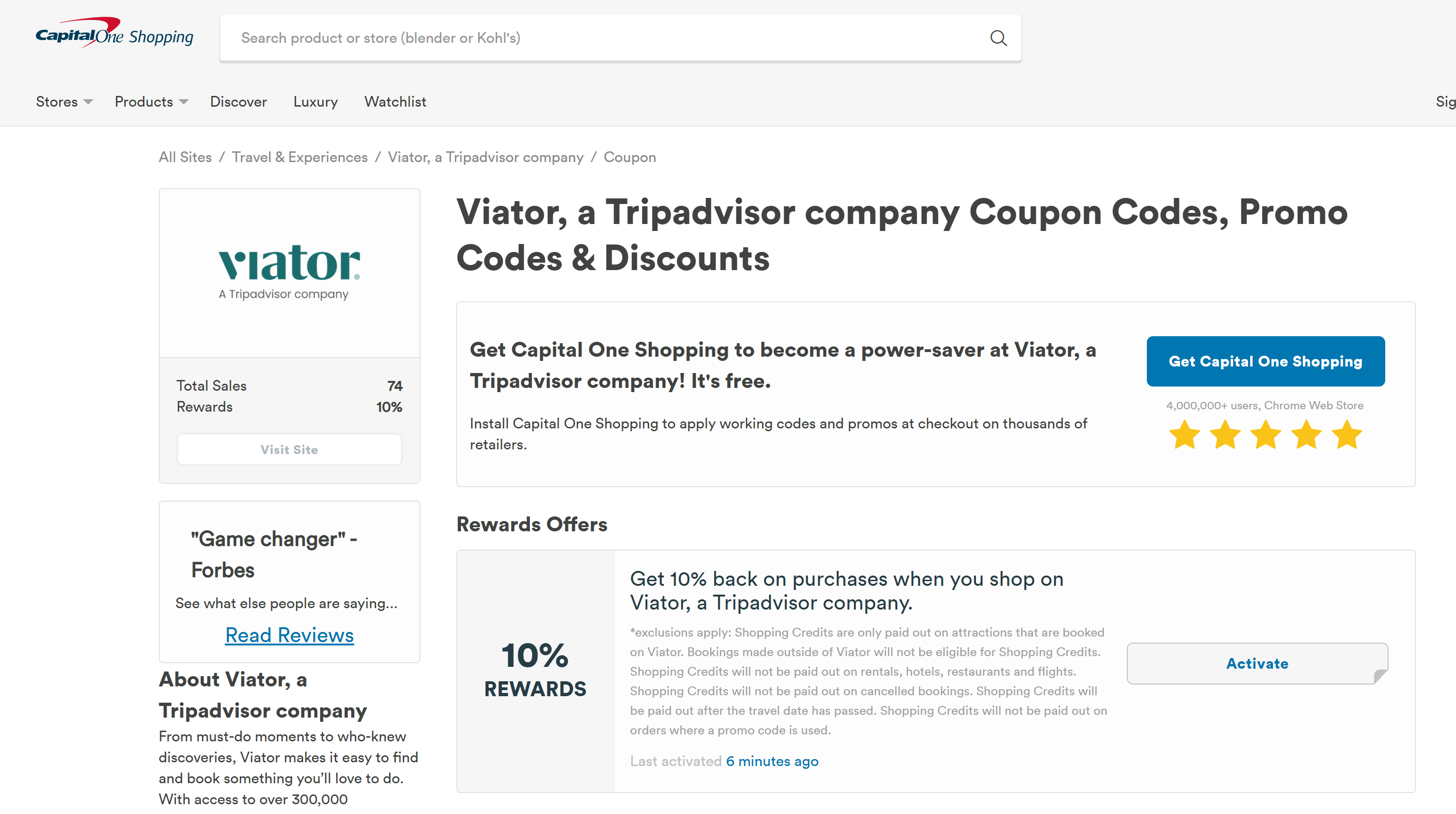

However, when thinking about whether or not it was worth risking another swing at a Capital One offer from within my Venture account, I looked back at CashBackMonitor and realized that my eyes are so used to only scanning the left side of the current rates that I’d missed something on the far right side: Capital One Shopping is also offering 10% back at Viator.

Now this is confusing: the Capital One offers I was talking about above show up within your Capital One account, but Capital One Shopping is a shopping portal that is open to anyone whether or not you are a Capital One customer (See: Capital One Shopping: A New – But Old – Shopping Portal). As such, you can click through the Capital One Shopping portal and use any card to pay, which is an advantage over the offer in my Venture account that requires using an eligible Capital One card for the same 10% payout.

That eliminates two of the negatives above: I should be able to book the activities using the same Chase card I used for flights, so all of the applicable trip insurances should still apply. And I still have to rely on Capital One Shopping tracking the purchase, though for some reason I find that more likely through the general shopping portal that doesn’t require using a specific credit card.

So, again, in my theoretical example, that means paying $270 or 18,000 points for the same thing that Chase is offering. This seems like a better option. It may even get a bit better: the Dosh App lists Viator at 5% back up to a maximum of $10 per day, so I may be able to link my payment card to Dosh and get another $10 back. Maybe.

Note that another option here that I’m not sure about is US Bank’s Real-Time Mobile Rewards. We maintain a list of what works to trigger real-time rewards, but I’m not sure whether Viator would work. If it would, that is potentially another way to get 1.5c per point. Note that US Bank’s official requirement is to use it for US-based travel providers, but since Viator is US-based I think it might work.

Booking direct: get the best price, but maybe not the best deal

It probably won’t come as a surprise to hear that I’ve found some activities that are even cheaper when booked directly through the activity provider itself. It makes sense that the activity provider can offer a discount when they aren’t paying a commission to Viator et al.

In my case, I’m looking at an activity provider that is offering a price that is 20% cheaper than the full Chase Travel price when booking directly with the provider. Key advantages to booking direct include:

- Save money: The same “$300” activity would cost $240.

- Save points: Using Chase “Pay Yourself Back” the same way noted above, I could effectively pay just 16,000 points (by “paying myself back” for $240 groceries and using the cash saved on groceries to pay for this activity). This saves 4,000 points over booking directly through Chase — nearly enough for a Category 1 Hyatt free night.

- Use my card of choice: I should be able to qualify for various credit card travel insurances since I’d use the same card used to book my flights.

However, there is a key downside:

- No refunds: The activity provider offers no refunds when booking directly – you can only get a voucher valid for 12 months

That’s a big time bummer. Pre-pandemic, I might have been more willing to take a swing at something with a cancellation policy like that figuring that I’d surely make things work some time within 12 months. In 2021, I know that I don’t know if that will be possible. The potential savings are attractive, but the inability to cancel for a full refund is concerning. If I were booking an activity happening within the next couple of days, I’d certainly be happy to pay a little bit less. Farther in advance of a trip, with the fluid travel situation, I have a hard time boxing myself in. While my credit card would cover me for trip cancellation if a doctor determines that it is inadvisable for me to travel or the airlines cancel my flights, it may not cover me if I just change my mind about the trip and cancel of my own volition.

I imagine that there are many situations like this where you can save a substantial amount when booking directly through the travel provider, so I would definitely keep this option in mind for domestic trips, but I’d probably stick with booking through Chase or Viator et al in situations where a refund would be important in the event of cancellation. I recognize that when the pandemic hit, even those major outfits were initially major headaches from a refund standpoint, but I have more faith in my ability to chase the refund down from them than a small travel provider in a foreign country.

The deal hunter in me wants to pay the least and pay myself back with the fewest points, but wasting a bunch of points if the trip gets cancelled would be the antithesis of a deal.

Bottom line

Apart from options in this post, I have taken a good long look at the ability to use points through airlines, hotel programs, and more. In most cases, prices for activities are nearly identical across booking sites at least in part because there aren’t very many different activity-booking engines powering the various airline/credit card tools. This means that the best balance between getting a deal on activities while keeping travel protections may be using Viator and a shopping portal and “paying yourself back” in a roundabout way — essentially meaning that 1.5c per point is the best deal as long as you’re willing to go about that in a roundabout way since booking directly at 1.5c per point via Chase isn’t the best deal. Viator and paying myself back is what I’m likely to do in order to get the best bang for my buck points when booking activities — but I’m still on the hunt for ways to make it even better.

Hi! I have a trip coming up and booked a few activities with Viator through the Rakuten shopping portal for one of them and through the AmericanAirlines shopping portal for the other two. I haven’t seen any evidence of tracking with either of those portals (no emails or check mark), but my activities aren’t due to take place until next week. Wondering if you had any data points on if the portal payouts for Viator do track and when they pay out? Maybe I won’t get the payouts until after the activity? My American Airlines status match is dependent on these particular points tracking by a certain date. Thanks in advance!

I booked several things in Iceland and found every time that direct was more expensive. Really weird! SkyScanner found the best rental car price and Viator had the best deal on activities, especially if you can get a 10% coupon to work too. Giving Assistant has been fine for me. Although I just noticed that when I used a 10% referral coupon, it did update to subtract out the cashback.

Nick,

US Bank Rewards also allows booking at 1.5 cpp value if you have altitude reserve AND they are powered by Viator. You should take a look. I often find a little better pricing than Chase, but I’ve never put the elbow grease into this that you are.

Hey Nick, another option once you identify the activity you want to book is to search for that activity and provider on Groupon. You might get lucky and find the activity discounted 20-30%, plus the ability to go through a shopping portal and buy discounted Groupon gift cards.

I did try that. Not available on Groupon right now.

But good thought!

I wonder if any sites like Viator sell gift cards at supermarkets? If so, how about this:

I did indeed think of that. I also thought that I could probably book via the Chase portal and pay cash with a Freedom or Freedom Unlimited for 5x points and then still run the round-about-pay-myself-back and get close to the same net result. With regard to supermarkets, I would sooner use my Chase Freedom that was opened with the 5x first year grocery. Since grocery is also a 5x category this quarter, I would get 9x on gift cards and I could still run the pay-yourself-back round-about way. But in any of those cases, I lose travel protections and if I cancel I’m stuck with a Viator gift card. Not sure I like the trade-offs there.