NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 10/18/20: This offer died yesterday shortly after Nick published it. Doctor of Credit has noted that it’s back, so if you missed out yesterday (like I did), now might be the time to get on it.

~

Somehow, I missed the Doctor of Credit post a few days ago about the increased bonus on Swagbucks for opening a NorthOne account (essentially a business checking-like account). Thankfully, I caught this post from Danny the Deal Guru at Miles to Memories last night. It literally took less than twenty minutes (taking my time and going slow) for my wife and I to open our accounts — and $300 each was immediately pending in Swagbucks after account opening. All things considered, this should be at least a $560 win for us that took less time than it took me to drink my morning coffee.

The Deal

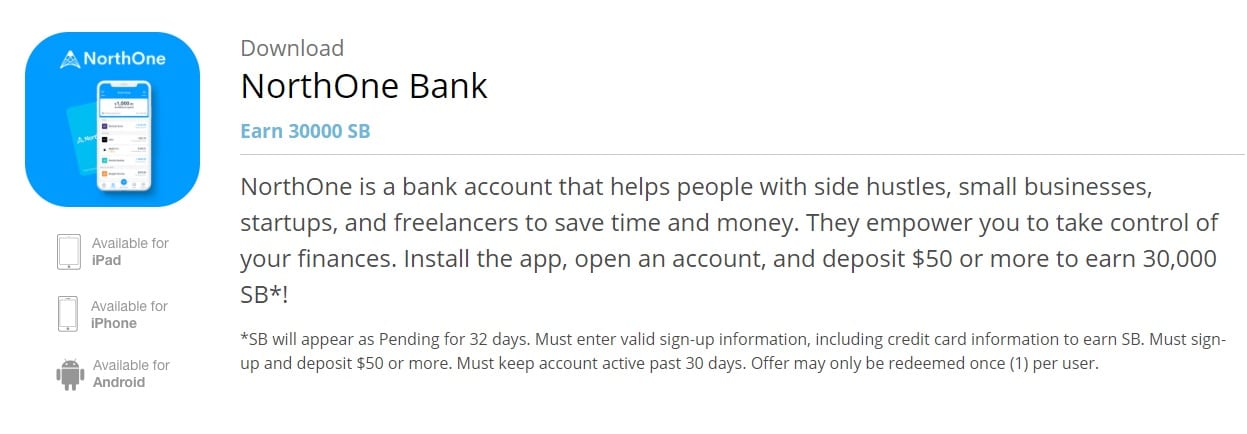

- Swagbucks is offering 30,000 Swagbucks (worth $300) when you download the NorthOne Bank app and open an account and deposit $50 or more

- Direct link to this deal

Key Terms

- Bonus Swagbucks will appear as pending for 32 days

- Must enter valid sign-up information to earn Swagbucks (the terms state that this includes credit card information, but NorthOne does not ask for credit card information, so I assume you just need to provide a debit card)

- Must deposit $50 or more and keep the account active past 30 days

- Offer may only be redeemed once per user

Quick Thoughts

The basic deal here is that the shopping portal-like website Swagbucks is offering 30,000 Swagbucks (which can be redeemed for a PayPal payment of $300 or for various gift cards) when you sign up for a NorthOne account through the Swagbucks site (if you visit Swagbucks on desktop, you enter your email address and then click the link in the email on your phone to download the NorthOne app from the Google Play store or Apple App store. The entire process of opening this account happens in the phone app). The only two requirements are that you must open the account with NorthOne and deposit at least $50 (which can be done via debit card during the account opening process) and to keep the account open at least 32 days (since the Swagbucks will be pending for 32 days). The other key to note up front is that the account has a $10 monthly fee that is not waivable – so you’re going to be on the hook to pay one or two $10 fees — that’ll eat into your profit and is why I said this will be a $560 money-maker for a couple in 2-player mode ($280 per person).

However, I won’t get too hung up on the fee since it is such an easy money-maker. I set a reminder on my phone to cancel the account unless I find some unforeseeable reason to keep it between now and when 32 days are up. Additionally, my wife didn’t have a Swagbucks account, so I was able to refer her and we each got an extra $3 in Swagbucks, making it a $566 money-maker for us when all is said and done. If you’re new to Swagbucks, feel free to sign up with the Frequent Miler link with our thanks.

If you read through the disclosures, NorthOne makes it pretty clear that they themselves aren’t a bank but rather an interface that gives you access to an account — the bank backing this is called Radius Bank.

That said, the process is essentially one of setting up a business checking account. The application process asks basic questions about your business (What’s your title? How many employees do you have? When did you start the business? What’s your business address? etc). My wife and I had no trouble at all opening accounts as sole proprietors and including links to our eBay / Amazon accounts for website addresses. Maybe we spent 8 minutes on the questions and that was probably too much. At the end of the application process, it runs a 2-minute countdown timer where they say they are working on “reviewing your application” but it’s really just a chance to take advantage of having you captive so they can run some animations on the screen to explain account benefits. When that timer is up, we got an email asking us to verify our email address. After clicking to verify, we immediately each got an email saying that our accounts were approved and that email was immediately followed by an email from Swagbucks (literally the timestamp was the same minute) confirming the 30,000 Swagbucks were pending. It was easy peasy.

As noted above, the account can be funded with a debit card during the application process (and I believe in fact needs to be funded this way). I do not know whether a gift card would work. Personally, I didn’t want to chance that it didn’t work and I’d somehow miss the chance to pick up the easy bonus, so I wanted to use a real debit card. It didn’t hurt that my HSBC account was targeted with another easy money offer that requires 10 debit card transactions per month, so this was an easy debit card transaction where I didn’t miss out on any rewards.

Note that immediately upon approval last night, my account showed a balance of $0 and $0 pending despite the fact that it had authorized my debit card for my opening deposit. My available balance updated this morning to include the debit card funding.

In terms of the app interface itself, it looks pretty easy. You can deposit checks or make an ATM or ACH deposit if you want to use the account more traditionally. I doubt that will be worth $10 per month, but it will certainly be worth getting some easy Swagbucks and we can go from there.

Note that Swagbucks previously offered $25 worth of Swagbucks, then $30, then $50, then $75, then $100, then $150. This new $300 offer is therefore a huge increase. I saw the deal late last night and rushed to get it done before midnight just in case it was going to get pulled. I have no idea how long this will last, but I don’t recommend dragging your feet if you are interested. The bar here is really low.

As a general tip, if you have any of your credit reports frozen, you’ll want to thaw them (lift the freeze) before applying for a bank account as most banks will perform a soft pull to verify identity and they won’t be able to do so if you have a freeze on. In many states, you can temporarily lift a freeze. I note this here because I saw data points about it in the comments at Doctor of Credit and know it’s always best practice to thaw first so they can verify your identity.

Note that after opening your account, you will notice that you can generate a referral link to refer others. However, it’s not a good deal: it only offers $75 for you and $75 for the person you refer. The Swagbucks offer is much better.

If you’re looking for more on the account opening process, it’s worth checking out the Doctor of Credit and Miles to Memories posts linked in the first paragraph at the top of this post as well.

[…] very briefly offered a 30,000 Swagbucks bonus (worth $300 in PayPal cash or gift cards) for signing up for a NorthOne business checking account. […]

What happens if you don’t put in $50 but you still open the account, will they take back the Swagbucks after 30 days?

No idea. I wanted the money, so I put the fifty bucks in lol.

[…] you recently opened a NorthOne account (we wrote about a $300 bonus offer here that has since expired), be sure to activate your debit card and have it on hand for Small Business […]

SwagBucks also has an offer of 10k SBs for signing up for a Chime bank account.

About Offer

When you open a bank account online with Chime, you get a Chime Visa® Debit Card, a Spending Account, and an optional Savings Account. Get started today!

1) Enroll with Chime between 10/5/20 and 10/31/20.

2) Download the Chime App.

3) Access your account number and routing number from the app.

4) Add your account number and routing number to your payroll contact or service.

5) Receive your first direct deposit by 11/30/20 to earn 10,000 SB!

Missed out on this because they wouldn’t approve me thanks to a damn Equifax extended fraud alert that I’ve been trying to remove for months.

Pro tip: Never, ever place an extended fraud alert on your credit report if you like to chase bank bonuses, even if you were really a victim of identity theft (like I was). Nearly all banks will refuse to open an account for you unless you go in person; which kills most deals or makes them too much effort to be worth it. Thankfully, TransUnion and Experian make it relatively easy to remove an alert but Equifax’s customer service is utter garbage.

Thanks for the HU! Got in this time!

“Offer Unavailable”

I tried different browsers and incognito window. Seems to be dead again.

seems to be dead again 10/18 less than an hour after repost :/

I have been getting the not available expired message for about the past 30 minutes. Tried a few crepes red – same message.

Dead??

Just did it. Swagbucks pending instantly as noted. How can money be so easy? Thanks!

Ugh, missed it again!

Success. Thanks!

Okay so this is kind of BS. I signed up, 30000 Swagbucks appeared immediately. Go through exact same thing with my wife’s account, nothing pending after an hour. Not sure how to proceed.

I had similar thing happen. Tried to contact swag bucks support but they wouldn’t let me contact them about the clickthrough to Northpoint until a few days go by. I’m assuming it’s a list cause.

Thanks! Worked like a charm this evening. 🙂

Still worked for me as of 13:20 CST. It asked me to enter my email address to send a download link. The email contained instructions for completing the offer and a link to the app.