Update: This post references offers that have since expired. See current offer information here.

“Easy” and “Frequent Miler” don’t tend to go together in the same sentence. I tend to gravitate to the complicated stuff. After all, why write about a simple deal that takes two sentences to explain when I can, instead, write about a complex 8 part scheme that requires a lot of risk and effort for moderate rewards and will most likely no longer work a week later (like this one)?

Pictured above is the view from our room in Mürren, Switzerland. Staying here at the Hotel Bellevue, for free, was one of many easy wins that my family has taken advantage of. In this case we used Barclaycard Arrival Plus points to pay for our stay.

For those who like my Rube Goldberg approach to earning points & miles, don’t worry, I don’t plan to abandon those noble pursuits. Today, though, I decided to list a few easy opportunities for big rewards. These are the deals that even my mom can take advantage of. Soon, maybe tomorrow, I’ll do a similar roundup of “big wins,” that are a bit more complicated.

A word of caution: Most of the easy wins described below require signing up for a credit card or two. There’s a reason that credit card companies offer huge signup bonuses: many customers use their cards unwisely and end up paying huge interest rates and fees. The bank’s income from those customers is more than enough to justify the expense of paying people to sign up for their cards. Don’t be one of those people! Only sign up for cards if you absolutely know that you have the ability and discipline to pay the balance in full every month. And, never take cash advances (i.e. don’t withdraw cash from an ATM using your credit card and never use those checks they send out!). One more thing: When playing the credit card game its easy to get swept up in a cycle of buying more than you would otherwise. It’s not easy, but unless you’re rich, its wise to keep spend amounts down despite the promise of great rewards from your credit card. See this post for more.

So, without further ado, my favorite easy wins:

Free Hotel Stays

There are a number of hotel branded credit cards that offer two free nights when you signup for the card and meet the minimum spend requirements. These can be used for a weekend getaway, or a couple can each sign up for the same card and book back to back two night stays for a combined four night vacation.

The best of these “two free night” offers, in my opinion, is the Chase Fairmont Visa Signature card. It offers not just two free nights, but free breakfast (for two) as well. And, Fairmont hotels tend to be really nice. The main downside is that they don’t have many properties compared to most other chains. Other good options include the Chase Hyatt Visa Signature card, and the Citi Hilton HHonors Reserve Card (but this Hilton card restricts the free nights to weekend nights and excludes a few properties).

Another path to free hotel nights is to sign up for cards that offer hotel points which can then be used to book free nights. One advantage of this approach is that while free nights generally have to be used within a year (or sooner), points can be kept for long term use. Also, if you tend to stay at less expensive properties, you may be able to stretch each signup bonus far past two nights.

To find the credit cards that offer the best first year value for hotel stays, please see: Top 10+ Hotel Credit Card Offers.

Use the free tool AwardMapper to find hotels, by chain, in the places you want to travel. The tool will even show you how many points are required at each hotel for a free night. Another very useful tool is Hotel Hustle. This hotel search tool will show you hotels available when and where you need them, along with how many points are required for your stay.

Free (and easy) flights

Airline miles can be a great way to save money on flights (especially international business or first class flights), but finding award availability and booking awards (especially with partner airlines) can be anything but easy. There are at least two good alternatives to typical airline miles: Southwest Airlines Rapid Rewards points, and bank points for booking flights.

Southwest Airlines

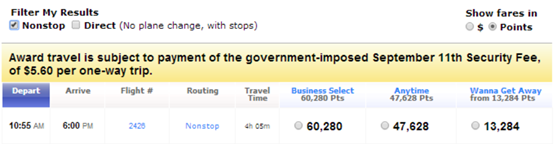

If you have Southwest Airlines points, booking a flight with points is incredibly easy. Simply browse to Southwest.com, search for a flight, and select “show fares in points”. To get the best deal, try to pick a flight that has availability in the rightmost column labeled “Wanna Get Away”.

If you don’t have Southwest points, look for Chase to offer 50,000 point signup bonuses on their Southwest cards (they tend to alternate between 25,000 and 50,000 point offers every few months). Alternatively, look for the best Chase Ultimate Rewards offers such as the Sapphire Preferred card, Ink Bold, or Ink Plus which each offer bonuses of 40,000 points or more. Once you receive the Chase Ultimate Rewards points, you can sign into your account (or call Chase) and transfer points to Southwest Airlines, as needed.

Bank points

Another solution for free and easy flights is to collect bank points which allow you to pay with points for airfare. One example is to sign up for the Citi ThankYou Premier card which (at the time of this writing) offers up to 50,000 bonus ThankYou points. With the Premier card, ThankYou points are worth 1.25 cents per point towards airfare. For example, a flight that costs $400 would require 32000 points. All it takes to book a flight is to log into thankyou.com, search for flights and book with points right from their web site. The ThankYou Premier card is just one example, though. Almost all bank point programs offer some way to buy airfare with points. The advantage to booking airfare this way is that there are usually no restrictions on what flight you take or which airline you fly on. And, when you book airfare this way, you typically earn miles for the flight if you are signed up with the airline’s frequent flyer program.

B&Bs, taxis, and more

Some points programs will let you pay for any travel with points. One of my favorite of these is the Barclaycard Arrival Plus card which offers a signup bonus of 40,000 points, earns 2 points per dollar on all spend, and has no foreign transaction fees. The 40,000 points earned from the signup bonus can be used to pay for up to $400 worth of travel related charges of $100 or more on your Arrival credit card. Even better, 5% of those points are immediately rebated to you so that you can redeem points for $20 more in travel. In a trip to Switzerland, I used my Arrival card to pay for train travel and two nights at a B&B in the Alps, then I used points when we got home to pay the statement charges.

Status challenges

If you have upcoming plans to fly more than usual or to stay in hotels quite a bit, you may be able to make your upcoming and future travel more comfortable and rewarding by enrolling in a status challenge. Many airline and hotel programs offer challenges that make it possible to get high level status quickly by meeting certain requirements. With high level airline status you’ll generally get free economy plus/comfort seating, the chance of a free upgrade to first class, reduced or eliminated fees, etc. With high level hotel status you may get free breakfast, room upgrades, welcome gifts, etc. If you have plans for a lot of upcoming travel, it is well worth it to call the airline or hotel chain in question to see if they’re willing to offer you a status challenge.

Can you tell me which credit bureau the three major credit card companies use (make hard pulls) when checking your credit rating during an application? I have a freeze on the three major credit bureaus and would have to lift the freeze in-order to get my application approved.

It depends upon where you live. You can search here to see what people have reported for your state: https://creditboards.com/forums/index.php?app=creditpulls

I want to learn how everyone but me can get free perks and I don’t know how to.

Please show me so I can be prepared when I am ready to Travel.

Our online tutorial is a great place to start: https://frequentmiler.com/2016/02/03/table-of-contents/

Is there something about the arrival card that is better than the venture card from cap one? Both have 2x points. Is the 5% worth the higher annual fee?

The Arrival card had two benefits over Cap1: 10% rebate on travel redemptions (now/soon 5%) and only 1 credit bureau is pulled when applying (Cap1 pulls all 3).

.

Now that the Arrival card has a $100 minimum on redemptions, though, I prefer Cap1

[…] In the points & miles world, Amtrak (yes, Amtrak) offers some of the best bang for your buck when it comes to redeeming points. Currently, points can be transferred from Chase Ultimate Rewards, SPG, or Diner’s Club to Amtrak, and from there you can book sleeper car trips for as little as 25,000 points for two people – all meals included. Another great option is to spend only 1,500 points for Amtrak’s special routes. Due to these terrific (and very easy to obtain) redemption options, Amtrak is one of a few great travel options highlighted in my post “Easy Wins”. […]

[…] my recent post, “Easy wins,” I showed, among other things, easy ways to get credit card signup bonuses for luxury hotel […]

[…] Amtrak points are extremely valuable for train travel. See more here: Easy wins. […]

[…] game we playThe tools we useEasy winsBig WinsDrawing the line Visit the Frequent Miler […]

Sorry so late to the party, Fairmont’s offer is currently the only offer that gives upgrades into a suite on the free nights as well (in most cases) using their mid-tier Premier status.

I didn’t realize they did that. That’s fantastic.

Love your blog, FrequentMiler. By your logic above for identifying the best hotel rewards cards, wouldn’t the Ritz-Carlton at 140K points be the best, by far? One could get nearly 19 nights at a Category 1 Marriott. Or nearly 6 nights at a Category 5.

That’s a very good offer, but it does require paying the $395 annual fee up front. Ultimately, I think the best approach for the “quick win” is to find where you want to go and stay and then see if any of these offers will do the trick for you.

And you hiked up the mountain with Heidi and at the top of the mountain you met Julie Andrews because of a Citi event promotion? We’re on to your game Frequent Miler!

Eagerly awaiting your trip report from Mürren.

My Arrival card says it has to be a minimum of a $25 charge to apply the travel credit.

Oops. Yes, $25 is correct. Fixed.

Oops. Yes, $25 is correct. Fixed.

Do you have a good working link for the 80K IHG CC?

Yes, the link on my Best Offers page works. It doesn’t show the 80K bonus, but readers have confirmed that it works. You can find it here: https://frequentmiler.com/best-credit-card-sign-up-offers/#ChaseHotels

thanks a lot.

Confirmed it works. I had to call the recons line and had some credit moved from my CSP. I asked to spell out the benefits and she said the magic word: 80K

Glad you’re emphasizing the Amtrak options — for using Chase UR points. Here on the east coast, the 4,000 point one-ways can be big $$ savers, esp. on short notice fares.

Yet about those long haul trains, like the Coastal STarlight, is it possible to break the long journey into segments, using points? (For example, one could stop at spots like Klamath Falls, Oregon where there’s an IHG point break hotel presently — if that was possible)

Or are you forced to have to buy separate segments? (if you want to get off the train)

Unfortunately, in most cases you do have to buy separate segments if you want a stopover during the trip. In some cases, where you have to change trains anyway, you are allowed a layover on one ticket of (I think) just under 24 hours.

Is the hotel bellevue part of a chain? Can you please elaborate how you were able to use points there? Did you use Arrival points?

No, it’s not part of a chain. I simply used my Arrival card to pay at checkout and then I later used Arrival points to pay the statement charge

What is the statement charge? I am NEW to this and I want to be able to travel without complications.