On last week’s Frequent Miler on the Air, Greg and Nick announced their picks for the 2025 Frequent Miler Deal of the Year. The fellas parsed through many terrific opportunities in points, miles, and travel from the past year and whittled them down to an excellent choice for the absolute bestest one (which I disagree with, but more on that later).

Now it’s your turn. Read through the nominees and decide which you think was the most delectable of 2025. Then, in the poll below, you can give your take on which one was king of the hill. We’ll publish the results later this week and send a fictional crown to the winner.

Did we forget one that should have made the top ten? Let us know in the comments and make your case!

2025 Deal of the Year Nominees…

Capital One and Bilt add Japan Airlines as a partner

Until this year, Japan Airlines (JAL) Mileage Bank wasn’t a partner of any transferable currency. You could convert Marriott Bonvoy points to JAL on a 3:1 basis, but those who hold bank points like Chase Ultimate Rewards, Amex Membership Rewards, and Citi ThankYou Points could do nothing but stare wistfully at JAL’s increased award availability for Mileage Bank members and tasty partner award opportunities. 2025 brought a sea change to that status quo, as Bilt and Capital One both added JAL as a partner (though Capital One transfers at a less-than-1:1 ratio). Nick immediately took to the keyboards to plumb the hidden depths of Mileage Bank, in the process finding several terrific values that, for the first time, are now within the grasp of most US-based points hounds.

JetBlue’s blingy 25 for 25 promotion

There are many different reasons people choose to have kids. For some, it’s a selfless act of hope and love; for others, it’s an opportunity to pass on what they’ve been given to the next generation. Some folks just love babies. However, for people who eat and breathe points and miles (like our own Mr Fedora, Nick Reyes), kids also come with a compelling fringe benefit: the opportunity to earn even more points and miles.

Earlier this year, JetBlue announced its 25-for-25 promotion, and it quickly became the talk of the blogosphere. In honor of the airline’s 25th year in business, JetBlue would give 350,000 True Blue Points and 25 years of elite status to any customer who flew the airline to 25 unique destinations by the end of 2025. Many folks saw that and started parsing through route maps, trying to find the cheapest way to trigger the promo while spending as little time away from their families as possible. Not Nick. His first thought was, “I have four people in my family. 4 people x 350,000 points each = 1.4 million points…and elite status for everyone until my kids are well into their 30s. Game on.” Thus, Nick’s family spent the next few months traipsing around the East Coast and the Caribbean, and will now ring in the new year 1.4 million TrueBlue Points richer.

Nick wasn’t the only person to take advantage of this fabulous opportunity, and being able to get 350,000 points and 25 years of elite status without leaving North America will make this many people’s choice for 2025’s deal of the year.

Wyndham Rewards celebrates with status upgrades and 50x earning

Wyndham Rewards doesn’t tend to hang out on the Deal of the Year lists, especially since it axed what was arguably the best part of its program: the ability to use Wyndham Points to book Vacasa Vacation Rentals. Wyndham wasn’t oblivious to the unpopularity of that move among its members, however, and launched a sneaky good promo over the holidays. All members could increase their Wyndham Rewards status level by one tier, and Diamond members could earn an extra 5x on paid stays. While that may not sound exceptional, the way that Wyndham did the math was.

Wyndham typically awards 10x points per dollar on paid stays, so you might assume that the 5x promo would ratchet that up to 15x. However, Wyndham actually quintupled the 10x, so Diamond members would earn 50x on paid stays. Suppose you booked a stay costing $200 per night. You’d earn 2,000 base points and an additional 8,000 bonus points for a total of 10,000 points. In addition to that, you’d earn a 20% bonus on the base points courtesy of having Diamond status, for a total of 10,400 points. That’s some chedda.

Amex levels up with Platinum card refresh

American Express wasn’t the only issuer to “refresh” its ultra-premium credit card by adding more coupons and raising the annual fee. In fact, it seemed like the Platinum and Business Platinum card reboots were more or less a response to Chase’s very noisy advertising for the new Sapphire Reserve® and Sapphire Reserve for Business®. However, unlike Chase, which took an excellent product and arguably nerfed it, Amex raised the Platinum card’s annual fee by $200 and somehow made it more desirable.

Amex added $400 in annual hotel credits, $400 in dining credits, $300 in lululemon credits, and free UberOne…and all of the old credit remains intact. Now, you can even use your $25/month in digital entertainment credits toward YouTube Premium and YouTube TV. In contrast to the serpentine method by which Chase rolled out its new benefits to existing cardholders, Amex gave its new perks to all Platinum cardholders immediately, AND allowed everyone with a 2025 renewal date to pay the old $695 annual fee. How…refreshing.

Alaska releases a compellingly different premium card

At the beginning of the year, Alaska announced it would become the latest airline to release a premium credit card as part of its ongoing merger with Hawaiian Airlines. Like most premium cards, we expected an annual fee of $500+ and enough marginal coupons credits to make our eyes water. However, once the card went live, we were pleasantly surprised. The new $395/year Atmos Rewards Summit card offers several innovative perks: 3x earning on foreign transactions, the ability to share points with up to 10 additional Atmos members, a partner award booking fee waiver, a 25,000-point annual companion coupon that includes partner awards, a yearly 10k status point boost, same-day change fee waivers, signature cocktails in their lounge, and more.

For those (like me) who fly Alaska a lot or who are spending towards elite status, this is a great card, and it surprisingly morphs into a 3x everywhere card for expats living outside the country. It was incredibly refreshing to see a new premium card that costs under $500, isn’t loaded with coupons we don’t want, and actually provides useful benefits to customers who fly the airline.

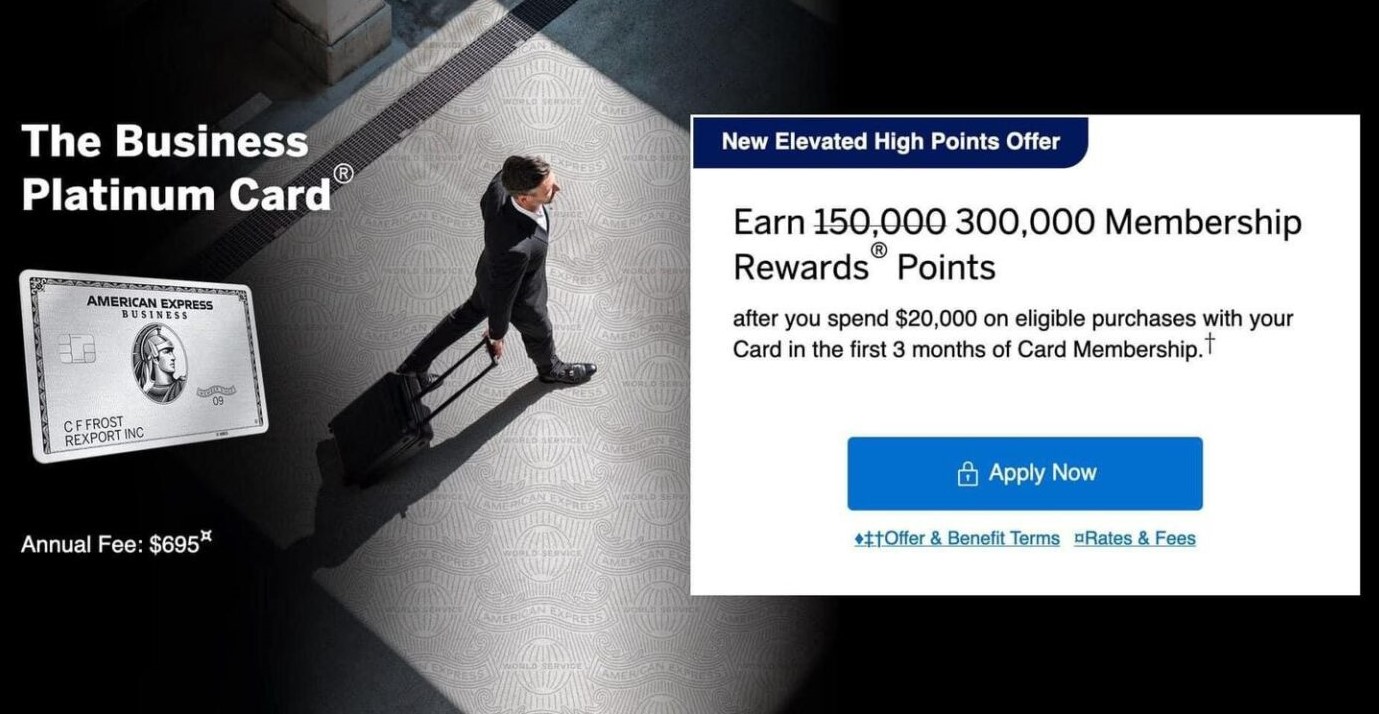

Amex goes bonkers with 300K Business Platinum offer

American Express has long been the grand marshal of the points parade. It was the first issuer to regularly break the (now quaint) 6-digit welcome offer, and it’s remained a mainstay at the forefront of our first-year values ever since. The first time we saw a 175K offer on the Business Platinum, we thought it couldn’t get better… until it did, with a (now common) 200k version.

2025 kicked things into another gear, as Amex released a new offer for the Business Platinum card that gave an incredible 250,000 Membership Rewards after only $15K in spend. Then, only a couple of weeks later, we saw 300,000-point offers popping up…an offer that provided an insane first-year value of over $3,000. For a credit card. Our arms are filled with the beers we’re holding for Amex while it takes credit card offers into the stratosphere.

Rakuten offers Amex point bonuses for Chase cards?!?

In one of the more bizarre entries on this list, the shopping portal Rakuten offered an incredible deal in 2025, where you could earn either $300/30,000 Membership Rewards points when being approved for a Chase Sapphire Preferred® or Ink Business Unlimited credit card through their links. Our Reasonable Redemption Value for Amex Membership Rewards points is 1.5 cents per point, which made the Rakuten bonus worth around $450…and that’s on top of the Ultimate Rewards points that you’d earn from Chase.

Why would Chase pay Rakuten to give you Amex points for applying and being approved for a Chase product? We never got a good answer. But it sure was fun.

Citi waives Strata Elite annual fee and minimum spend requirements

Since the demise of the (greatly missed) Prestige card, Citibank has remained curiously absent from the bougie world of ultra-premium travel cards. Once it leaked that the bank had trademarked the name “Strata Elite,” years of false starts, rumors, and speculation followed, while points and miles collectors not-so-patiently waited for the moment that the new ThankYou Points superhero would finally be unmasked. This year, it finally happened.

Unfortunately, if there’s one truth in the world of points and miles, it’s that Citi’s gonna Citi.

The bank experienced a deluge of applications due to the card’s tremendous welcome offer and first-year value proposition. Evidently, it approved more applicants with bigger credit limits than it intended, and it then started locking the accounts of many cardholders, requiring them to mail in a 4506-C form (Request for Tax Transcript). But of course, Citi didn’t have enough man or bot power to process all of those forms, so requests waited…and waited…and waited. Meanwhile, the minimum spend period for some cardholders expired. It was a fiasco.

Public embarrassment ensued, including coverage from miles and points blogs and even the Wall Street Journal. Citi eventually responded with a surprisingly complete recovery: all affected cardholders would receive the 100,000 points from the welcome offer without needing to meet the required spend, and have the first year’s $595 annual fee refunded. What a ride.

Citi finally adds American Airlines as a transfer partner

Ever since I’ve been involved with the world of points and miles, there’s been one question burning at the center of conventions, meetups, and sordid online chat rooms: when will American Airlines become a Citi transfer partner? Among the major US airlines (United, Delta, AA, and Southwest), AA arguably has the most valuable currency, especially when it comes to partners, but earning miles wasn’t always easy. Outside of a brief frenzy when Citi transfers were possible, the only way to get them was through an American Airlines credit card (or by actually flying American…eww).

However, following the launch of the new Strata Elite card, Citi began allowing ThankYou Points transfers to American Airlines AAdvantage, to the delight of many. This is a huge development for the Citi ThankYou ecosystem. The ability to earn AAdvantage Miles through welcome offers and everyday spend on ThankYou-earning cards not only makes it easier to rack up a stash of AA miles, but it also makes Citi points more valuable in and of themselves. For the first time, ThankYou Points are now the equal of stalwarts like Chase and Amex. It went from being an afterthought when it came to domestic airline partners to arguably having the best one around.

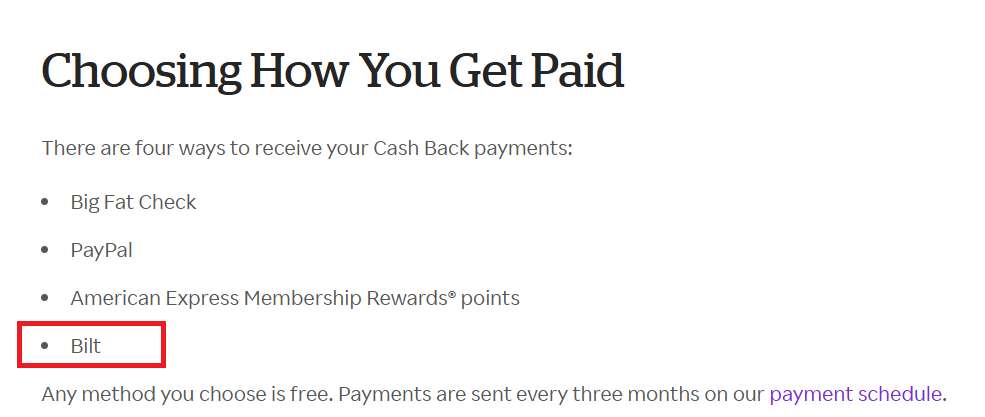

Rakuten adds the option to cash out in Bilt Points

Rakuten has long been a very popular shopping portal, thanks to a combination of competitive payouts, reliable tracking, and prompt customer service. But, perhaps the most significant part of Rakuten’s appeal has been the ability to link it to your American Express account to earn Membership Rewards points instead of cash at a rate of 1 cent per point.

This year, Bilt unexpectedly joined the party, and you can now choose to receive your Rakuten payout in Bilt points instead of cash back or Amex points. While Membership Rewards are great, it’s much harder to earn Bilt points, which are more desirable for many people because they transfer to partners like Hyatt and Alaska Airlines.

There’s one big catch, though. For the first six months of the partnership, Rakuten “cash” is converted to Bilt points at the same rate as Amex: $1 = 100 points. After that, Bilt Blue members will receive only 50 points per $1, while Silver/Gold/Platinum members will continue to receive 100 points per $1 (we think), making it a much less attractive long-term option for those without Bilt elite status.

The FM Team’s Picks

Greg’s pick: JetBlue’s 25 for 25

Whether you participated in this deal or not (I didn’t), you have to admit, it was fun, exciting, and offered a huuuuuuge payout. I mean, 350,000 points was great, but also offering twenty-five years of elite status was bonkers! I really wanted in on this deal, but I couldn’t quite shoehorn it into my schedule. I’m so glad that Nick and his family went for it! I’m curious if many Frequent Miler followers completed this challenge. I bet there were a lot!

Nick’s pick: JetBlue’s 25 for 25

As the only member of the Frequent Miler team who actually completed the JetBlue 25 for 25 promotion, it might seem like that was a shoo-in for my Deal of the Year pick. However, it wasn’t easy at all: The Amex Platinum refresh surprised everyone and turned out to be a particularly amazing deal for those who were able to renew at the old annual fee while enjoying the new benefits. And a great case can be made for the broad applicability of Citi transfers to American Airlines. In contrast, the JetBlue promotion was tough to complete for anyone who wasn’t based in either the Northeast or Florida and had sufficient flexibility. Still, it’s hard not to tip your cap to Jetblue for not just copying the SAS formula with a big points payout, but instead creating bonus levels that naturally made it compelling to reach for the next level all the way to the icing on top of the cake: airline status set to last for so long that it would be silly not to chase it if you were going to be anywhere near the goalpost. Kudos to the JetBlue team for a job well done in designing and implementing something creative and unique that both benefited JetBlue and provided a great deal for members.

Stephen’s pick: JetBlue’s 25 for 25

It wasn’t a promotion I was personally interested in because I’d have very little use for the JetBlue points and status. However, being able to earn up to 350,000 bonus TrueBlue points and get 25 years of elite status through the 25 for 25 promotion was an incredible opportunity for the right person (such as Nick and his family), and gave an excuse to have some fun travel experiences along the way.

An honorable mention goes to Amex for adding legit value to the Platinum Card® and Business American Express Platinum Card® despite the increased annual fees. I was apprehensive initially about what might come with a higher annual fee, but this was a rare example of a bank genuinely enhancing a couple of cards (for most people anyway.

An additional, almost honorable mention goes to the Rakuten/Bilt partnership, but as someone with no Bilt status, that’s less exciting, seeing as the earning rate will be halved in May.

Tim’s pick: Citi adds American Airlines as a transfer partner

This is the first time that the three “seniorist” FM team members have picked the same answer for the Deal of the Year, a feat that JetBlue should be proud of. 25 for 25 was an exciting promotion and an excellent deal for folks who could take advantage of it. You may notice a strange thing, however: of the three guys who voted for it for Deal of the Year, only one actually did it: Nick. Not coincidentally, he’s the only one who lives full-time on the East Coast. For West Coast (or even Midwest) dwellers like me, one glance was all it took to convince me that the points and low-level elite status provided weren’t worth the time and effort of flying repeatedly to the East Coast and then taking a bunch of short flights before having to fly back to the West Coast. It’s a fun promotion, but it’s too niche for me to call it my Deal of the Year.

That’s why I’m going with Citi adding 1:1 transfers to American Airlines (a close second would be the Platinum refresh). 1:1 transfers to AA have been the white whale for points and miles collectors for years, and somehow, it’s almost flown under the radar this past year, now that it’s happened. AAdvantage Miles are arguably the most desirable domestic airline currency, and their inclusion in the ThankYou Points portfolio creates a seismic realignment of what was previously a fairly ossified hierarchy of transfer currencies. Last year, the idea that ThankYou Points would be more desirable than Amex Membership Rewards or Chase Ultimate Rewards would have been laughable. Now you can make a very good case for it. I think Citi’s 1:1 transfers to AA will have the broadest, longest-lasting positive effect for the most points-and-miles enthusiasts of anything on this year’s list, and it’s my choice for Deal of the Year.

Readers’ Choice for Deal of the Year

What do you think? Who should get the coveted Frequent Miler’s 2025 People’s Choice for Deal of the Year award? Let your voice be heard below.

2024 Winners

In case you’re wondering, here were the winners in 2024:

- Greg’s pick: SAS Eurobonus Millionaire Promo

- Nick’s pick: Hilton rolls out Small Luxury Hotels of the World

- Stephen’s pick: SAS Eurobonus Millionaire Promo

- Tim’s pick: Chase Ink Welcome and Referral Offers

- Reader’s Choice: Chase Ink Welcome and Referral Offers

Completed Jetblue 25 for 25 out of LAX. Daily reader here. Was fun and not too hard

There’s a big one missing – Amex transfers to Alaska (via Hawaiian). When I was thinking about this it occurred to me “what deal do I most regret missing out on” is another way to frame this. I did transfer some Amex points to HA, but I’ve got such good value that I’m starving for more now. If I only had a redo I would have cleaned up my Amex MR!

I would have voted for Citi transfers to AA, but I deducted quite a bit from that entry because of how difficult it is to use Citi cards with their absurd fraud protection system. I’ve probably charged at least $10,000 to my Venture X this year after I tried to use my Citi Double Cash and had it declined with no easy or fast way to approve the purchase. If Citi ever learns how to run a bank they could be a real force to deal with.

The scale of the Bonvoyed list compared to the “Deal of the Year” list is so lopsided toward the negative. The obvious prediction for 2026 is that AA will require a AA credit card to get the best redemptions using their miles which somewhat reduces the excitement about AA becoming a citi transfer partner. The platinum card refresh is hard to call a deal, I had the card and Amex refreshed it and I did not close the card – I guess that makes it a deal for somebody. Alaska and Jet Blue while interesting are so small. I did vote for the Summit card but it is hard to get overly excited about the 5th largest domestic airline as the deal of the year.

I feel many of these aren’t exactly “deals.” I am surprised the 100% accidental transfer bonus to Accor that was live for 2ish days wasn’t mentioned. Combined with their Black Friday sale, I was able to score some excellent value. That actually felt like a deal.

The deal of the year was so incredible that, checks notes, only one of the four FM voters actually took advantage of it? It a group of people who travel for a living and love travel challenges find the deal so uncompelling that they don’t bother to go after it, how can it be deal of the year?

You make a compelling case for Citi AA transfers.

Perhaps next year FM should consider separate award categories for personal favorite deal of the year and best overall deal that applies to the most people.

JetBlue 25 for 25 is too niche. Not many people have enough time to complete such a promotion. AMEX Platinum refresh and Citi AA transfer have the broadest appeal.

The Amex Platinum refresh takes the cake for me because it has materially boosted my quality of life. The $400 in Resy dining credits, split quarterly, mean that I basically get a free date night with my wife every 3 months, which is even better when I can combine the $100 credit on the gold card. We’ve been using the credit to try out, for free or nearly free, restaurants we probably never would have visited otherwise due to cost, and we’ve had a lovely time doing so.

“Free date night” is a bit relative in a $895/year card, don’t ya think?

People seem to ignore the fact they have prepaid for many of these credits.

If you tend to eat out frequently and one of your restaurants is in resy then it is good. But if you are going out to a $100 tab because of the credit and normally would only do $60 you aren’t getting $40 free because you spent that money on the AF.

We were lucky because 2 of our restaurants were in Resy but one just has left Resy. You need to constantly check because things change easily.

Obviously I was already getting outsized value out of the card before since I had it before the change and was making good use of the card. I still would have kept the card even without this change, but it just makes it that much better.

You people think way too hard about all of this. You should be asking yourself if you are enjoying the product you are getting rather than fretting over ridiculous hypothetical opportunity costs. I enjoy the extra experiences that I’ve gotten from this change while not going bankrupt and that’s what matters.

Amex plat refresh was DOA. Closing card Jan 2026. I do like business plat refresh tho. But then again, I’m a traveler and not an extreme couponer.

Alaska Summit CC for me. Living abroad I was able to get Alaska Titanium status simply based on spend and a few long-haul award flights.

I was surprised you 3 chose the Jet blue 25 for 25 as it has limited appeal to average people – those who don’t live on the East coast and practically fly for a living. For those of us who are looking to maximize the return on their spending with valuable credit cards, Amex and Atmos are infinitely more appicable to real life points and miles enthusiasts as reflected by the “popular” vote.

To be clear, one reason it’s tough to pick is because there weren’t many amazing deals this year.

And I think the positive Platinum refresh vibes result from low expectations. We knew the AF was going up sky-high, we just assumed that we’d get $1 daily Dunkin credits or some BS as a result. Instead, we got better FHR credits and usable Resy credits. But it’s hard to call that the Deal of the Year – anyone who is happy is just glad it’s not an even worse value proposition, and you can maybe come out ahead slightly. But it’s still a $900 AF. Turn the clock back 3-4 years, describe this version of the Platinum card to any cardholder and ask them if this should be a strong candidate for Deal of the Year.

For Citi transfers to AA, Greg and Nick mentioned the outsizes value AA miles can deliver for international partner redemptions. But I know finding award space can be difficult. Even so, I find AA miles are the most regularly useful and easiest to redeem for good value (1.5-2 cents) almost all the time. Far better than Delta or UA, and have the benefit of free cancellations that foreign carriers don’t.

Absent partner awards, I think most would say that AA points are worth about 1.3cpp +/-. Which is what one might expect at Delta with the cardholder discount.

FWIW they’ve actually been worth more than that for this AA-hub based flyer. Not uncommon to see 13k domestic AA flights for $300 or more cash fare, helped by the fact that all AA points book to main vs basic economy.

Certainly, it’s a win for *some*. But, I think the FM team would agree with *most* would put the RRV around 1.3-1.4 cpp. Happy travels.

I guess the votes might be fairly personal this year. I’ve read comments that the JetBlue deal applies to so very few people, even if it’s amazing. The most appeal is probably Summit and Amex Platinum deals. I’d even say the Citi->AA transfer is a huge negative for some. If you have no AA miles, it’s great. If you have tons, you see a tidal wave devaluation rolling in.

I am surprised that transferring Amex points to Atmos Rewards (via Hawaiian airlines) was a huge opportunity this year and it didn’t even make the list of best deals of the year? To me, this was a game-changer, I have so many Alaska miles that are much more valuable to me than Amex points. The frequent miler team talked about how they transferred over a ton of points, I think you would regret it if you didn’t take advantage of this deal that ended June 30, 2025.

Honestly, I totally forgot about this, but I definitely agree. Shows how much has happened since then!

Yeah, that was a big one and should have been on the list. The same loophole also gave a backdoor for combining Alaska points between accounts.

I agree, Amex transfers to Alaska via Hawaiian was the winner to me! Perhaps that started in late 2024 though? I can’t exactly recall but thought it was last year Greg transferred the 1M MRs over. In lieu of that option I went with Citi adds transfers to AA. Being in an AA hub these two deals combined (Amex Alaska loophole and Citi AA transfers) have been game changing for me.

as we are already seeing by the voting, theres a big difference between “bloggers top deal of the year” and “average people deal of the year” lol. was fun following nicks 25 for 25 journey, but not applicable to most people with day jobs