NOTICE: This post references card features that have changed, expired, or are not currently available

In the post “Pondering Prestige. When 30K beats 60K,” I described a short term opportunity to double up on card benefits by applying now for the Citi Prestige card. The card’s benefits change significantly on October 19th, some for the better and some for the worse. By getting the card now, it might be possible to get the best of both. Here are the details:

- Many card benefits are changing on October 19th:

- Benefits going away October 19th: Flight points, Airport Angel lounge access, annual $200 airline fee credit, annual companion ticket, and some parts of the Relationship Bonus.

- New benefits as of October 19th: 3X points on air and hotel; 2X points on dining and entertainment; $250 air travel credit; Priority Pass Select lounge access; and Complimentary 4th night hotel stays

- By signing up before October 19th, it may be possible to take advantage of both the card’s current benefits and future benefits with one annual fee:

- Before October 19th, use tricks of the trade to get $200 in airline fee credits.

- After October 19th, but before the end of the year, it might be possible to get $250 in air travel credit. Starting January 1 it will be possible to get another $250 in air travel credit since that is a calendar year benefit. Note: it is as yet unknown whether Citi will reimburse more than a total of $250 this calendar year.

- Use the worldwide companion pass within a year of applying (details here). Travel must be completed by October 18th 2015.

I decided to go for it. My intention was to increase rewards and reduce the Prestige annual fee by first signing up for a Citi Gold checking account and qualifying for a $400 bonus. With a Citi Gold checking account, the Prestige card would cost $100 less. Unfortunately, Citi denied my checking account application (I still don’t know why).

Undaunted, I went ahead and applied for the Prestige card despite the $450 annual fee. As a reminder, Rapid Travel Chai found that it is possible to sign up for the card with a $350 annual fee if you sign up in-branch. With no Citi branches near me, I resigned myself to the larger fee in exchange for the ease of signing up from home. If I wasn’t a blogger who writes about credit card deals, I doubt I would have signed up. But I am and so I did. After applying online, I called Citi for an instant decision, and I was approved. Lucky for me, their credit card approvals are easier than their bank account approvals.

Doubling up points earned

One of the benefits that Prestige cardholders will soon lose is the “Flight Points” feature. Flight Points are earned by buying airfare with the Prestige card. One flight point is earned for each mile flown. Flight Points become Thank You points when they are matched with equivalent spend. For example, if a cardholder earns 10,000 flight points and spends $10K on their card, all 10,000 flight points become ThankYou points. In other words, flight points are/were a way to double the base point earnings of the card. Since Prestige cardholders can redeem ThankYou points for 1.33 cents towards airfare or 1.6 cents towards AA / US Airways airfare, that means that the Prestige card can return the equivalent of 2.66 to 3.2 cents per point value. And, that’s why many cardholders are upset that the feature is going away.

My card arrived in an impressive box (with a slide-out drawer!) along with documentation about the card’s benefits and a flyer detailing the upcoming changes to the card. With respect to Flight Points, it said that “points will be earned on airline tickets purchased with your card through October 18, 2014.” And “Any Flight Points earned through October 18, 2014, will remain eligible for transfer to your ThankYou Member account once the matching ThankYou Points are earned from Purchases.”

Short of actually buying airfare and flying around the world to earn Flight Points, I’ve been told that one way to game the system is to buy award tickets costing $50 or more in fees. Those award tickets earn Flight Points based on the distance of the award flights. So, the trick is to book long distance award flights with fees of $50 or more. That’s something I can do. As a Delta Platinum Elite member, I can make free changes and cancellations to award flights. So, I should be able to book award flights to get Flight Points, and cancel them later.

One potential “gotcha” is that Flight Points aren’t earned until the date of departure. By then, it will be too late to cancel my award (Delta requires changes to be made 72 hours in advance). If I simply cancel right after booking, I run the risk that the fees returned to my credit card will negate the flight points. To try to avoid that, I’ll change my award flights before cancelling them. The hope is that the cancellation will be tied to the changed award rather than the original one. We’ll see. I’m not really worried about whether or not this will work. We’re not talking about a huge number of points here. It’s really just an experiment to see what will happen.

Earning the $200 airline fee credit

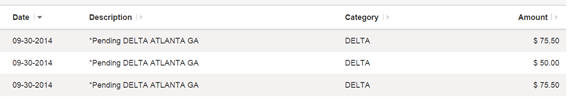

Until October 19th, the Prestige card reimburses airline fees up to $200 per year. According to the Prestige card’s documentation, fees are defined as airline charges of $100 or less. This one’s easy. I’ll use the same award bookings intended to earn flight points to earn these credits. In fact, yesterday, I went ahead and booked three flights: one to Seoul, Korea and two to Rome. $201 in charges now appear as pending in my Citi Prestige account:

Luckily for me, Rapid Travel Chai is a step ahead with his Prestige card. He found out that to get airline fee reimbursements, you have to enroll in that feature. When I called to activate my card, thanks to advice from my friend Rapid, I also signed up for fee reimbursements.

Next steps

I’m already close to meeting the minimum spend requirements for the 30,000 point signup bonus. I can now only wait and see if I earn Flight Points and airline fee credits from the awards I booked. Looking further out, beginning October 19th, I’ll repeat the process of booking awards in the hopes of securing $250 in credits. Then, I’ll do that again in early 2015. I’m also hoping to find good uses for the 4th night free hotel benefit, and the worldwide companion ticket benefit which I have a year from my application date to use.

So starting today I should be able to get $250 reimbursed if I purchase an airline ticket? I have already used my $200 for the year.

Well, most likely they’ll only reimburse $50, but yes this is the time to start experimenting to see if they’ll reimburse $250 more.

Have your $200 imbursement posted yet? I feel like if it posts after 10/18 it will be less likely that you will get another $250 vs $50, because the reimbursement is posting under the new conditions/system update reflecting the change.

Yep, the $200 just posted. Look for the full update tomorrow.

Just got the card and spoke with CSR and asked her about $200 credit and how this would work. She did some research and said that I could get $200 credit before the 19th and after will get $50 credit for the remainder of the year. Alternatively, get $250 credit after October 19th. Does this sound similar to what you have heard or do you still think we might be able to double dip this year?

Others have reported similar conversations. The real question is whether the people on the phone really know how the system is coded to work. I still think there is a small chance of double dipping this year, but I admit it is quite small.

Do I need to book the flight on Citi’s web? If I book the flight on AA’s web, using the prestige card. Can I still get the flight points? Thanks

You can book from anywhere as long as you pay with the Prestige card

Are airline gift cards considered reimbursable fees? Anyone know if that will work?

Yes, as long as it is charged by the airline it should work. It has to be $100 or less.

Thanks. Forgot to “enroll” before I charged two Southwest gcs for $100 each. They gave me the credits when I called in to complain about how confusing the T&Cs are (said they were baggage fees when they asked). CSR did say that you won’t need to enroll once the T&Cs change after the 18th.

No credit from the my comments in the last post? Bah.

You’ll want to book long flights with and change to shorter flights before canceling. Or make changes that have fee deltas over $50. 3 weeks to game it, have fun!

Oops, sorry about that, I forgot! For the record, yes, your comment was a big part of the reason I decided to try the flight points thing. So far I’ve changed the flights to later dates and in the process the fees changed a bit. I used a different credit card for those fees so I think I broke the connection between Citi and the changed flights. I understand I could keep adding more onto Citi for more flight points but I see this more as a fun experiment than a way to maximize points.

My wife and I received our cards yesterday. I signed up for the $200 in airline credits today. Do you happen to know how far after the annual fee hits can you cancel the card and get the fee back? Wonder if there might be another opportunity like the Executive card where you can receive the points and airline credit, and pay no fee.

That does seem possible,but I don’t know. I’m content with waiting and getting $250 next year.

Are you sure you want to go down that route accumulating flight points for cancelled flight bookings? Sounds ethically questionable, no?

Perhaps, somehow it doesn’t cross my line though. I think of this as an experiment more than an ongoing hack since it goes away Oct 19th anyway.

You only get flight points several weeks after you travel. If you cancel, you will just not get them at all. I think with your Delta status you can book a ticket that you will keep changing until you are ready to fly it and never cancel. The key is that fees stay on the same cc. If it does not post by itself (big chance) you need to sent them boarding passes. I also heard not $50 minimum, but $75. You can also buy a refundable ticket and change it to a different ticket in a future with no refund coming back to cc. After travel sent boarding passes. Refundable ticket ORD-STL is like $600 on ua. Use this credit for future $600 non refundable ticket.

The Flight Points scheme sounds really sketchy.