Just over a year ago, Chase and Gopuff announced that they were partnering with each other, with Chase offering a $10 Gopuff credit each month on more than 30 of their credit cards, including cards that come with no annual fee like the Freedom Flex card.

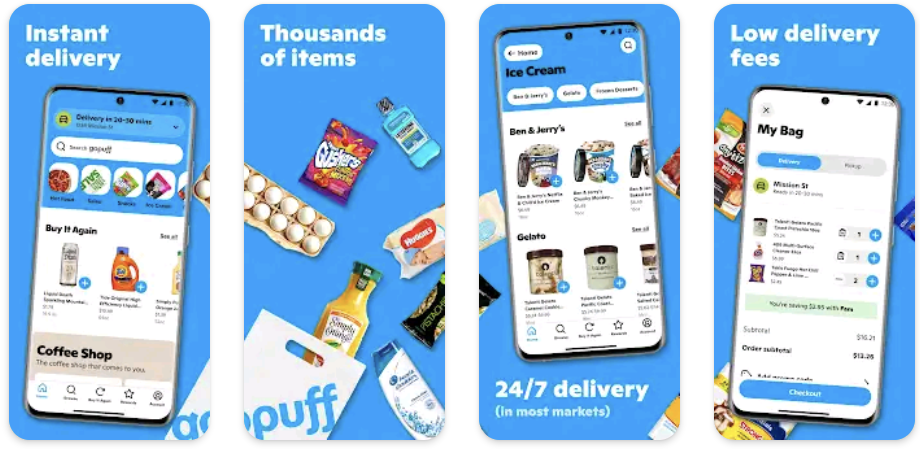

In case you’re not familiar with Gopuff, it’s a service that offers fast delivery (within 20-40 minutes) on a range of items, from groceries to toiletries to booze and more. There’s a minimum delivery fee of $3.95 and a minimum order amount of ~$10.05 (this can differ by location), so the $10 Chase credits mean you can regard it as getting $10 of items free or that the credits will cover the cost of delivery, tip and possibly more depending on how generous you’re feeling.

I used Gopuff for the first time last year while in Denver as they had a partnership with select Hyatt properties – you can read about my experience here.

The $10 monthly credits aren’t the only way to save on Gopuff orders though. There are several other potentially stackable elements that can make for a fipple stack with the right combination. If you’re not familiar with fipple as a concept, it’s a term Greg coined on a podcast earlier this year as an alternative to quintuple (i.e. 5x) and I much prefer it as a word, so fipple stack it is. Here are the different layers of the stack.

1) Chase / Gopuff $10 Monthly Credit

The first layer is the one that I’ve already mentioned – the $10 monthly credit. There are a couple of key things to be aware of with this credit. First, it’s valid for 12 consecutive months, so up to $120 in credits. Second, it’s valid through December 31, 2023, so you’ll want to start using the benefit soon if you want to be able to get all 12 credits of $10 before the benefit ends.

Note that the limit of 12 monthly credits means that if you’ve already been using this benefit, it won’t last through December 2023 – it’ll be for 12 months from whenever you first started using the benefit. Update: It looks like I misinterpreted Chase’s announcement from last year. That states “Starting today, Gopuff customers who add an eligible Chase credit card as the default payment on their Gopuff account will automatically receive up to a $10 statement credit each month they make a Gopuff purchase–a potential value of up to $120 over 12 months.” I took that to mean that the benefit was only valid for 12 months, but that’s not actually what it says; instead, it’s just saying that the benefit can earn you up to $120 over the course of 12 months.

If you’re wondering which Chase cards have this $10 monthly credit, here’s a full list:

- Chase Freedom card

- Chase Freedom Unlimited card

- Chase Freedom Student card

- Chase Freedom Flex card

- Chase Sapphire Preferred card

- Chase Sapphire Reserve card

- J.P. Morgan Reserve Card

- Aer Lingus Visa Signature Card

- British Airways Visa Card

- British Airways Visa Signature Card

- Disney Premier Visa Card

- Disney Visa Card

- World of Hyatt Credit Card

- Iberia Visa Signature Card

- IHG Rewards Club Premier Credit Card

- IHG Rewards Club Select Credit Card

- IHG Rewards Club Traveler Credit Card

- IHG Rewards Club Classic Credit Card

- Marriott Bonvoy Credit Card

- Marriott Bonvoy Premier Credit Card

- Marriott Bonvoy Boundless Credit Card

- Marriott Bonvoy Bold Credit Card

- The Ritz-Carlton Credit Card

- Southwest Rapid Rewards Credit Card

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Employee Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

- Southwest Rapid Rewards Performance Business Credit Card

- Starbucks Rewards Visa Card

- United Club Card

- United Presidential Plus Card

- United MileagePlus Select Card

- United MileagePlus Awards Card

- United MileagePlus Card

- United Explorer Card.

2) SimplyMiles

At the time of writing this post, SimplyMiles has an offer for Gopuff giving 9 American Airlines AAdvantage miles per $1 spent. There’s a limit of 465 bonus miles, so you’ll max this out when spending $51.67.

In addition to the AAdvantage miles you’ll earn, you’ll also get a corresponding number of Loyalty Points towards earning American Airlines status.

SimplyMiles is a card-linked program, so you’ll need to enroll your eligible card(s) with SimplyMiles and activate the Gopuff offer. SimplyMiles offers are only linkable with Mastercards, so there are only a few of the Chase cards listed above that will be eligible, such as the Freedom Flex and various flavors of IHG cards.

Nick C has pointed out in the comments that the SimplyMiles offer states that it’s only valid for new customers.

3) Shopping Portals

Something that isn’t dependent on having eligible Mastercards is the ability to earn cashback or other rewards through a shopping portal – you can find the current rates for Gopuff here.

The best shopping portal will depend on a number of factors, such as the size of your order, whether it’s your first order, how you value miles if using an airline shopping portal, if you’re working your way towards American Airlines status, etc.

One good option could be the American Airlines shopping portal. At the time of writing this you can earn 8x miles per dollar spent with Gopuff which means you’d also earn 8x Loyalty Points towards status. This is separate to – but stackable with – the SimplyMiles offer.

Another option is RetailMeNot as they’re currently offering 20% cashback on up $250 of spend with Gopuff. A potentially better option – depending on how much you’ll be spending – is TopCashback which is giving $21 cashback for new customers or $8.40 for existing members. If you’re a new Gopuff user, you’d need to spend $105 or more to make it worth choosing RetailMeNot over TopCashback.

4) Drop

Drop is an app that works as both a shopping portal and a card-linked offer program. At the time of writing this, they’re offering new customers 12,000 points (worth $12 towards gift cards) when spending $20 or more with Gopuff and paying with a linked card.

As far as I’m aware, Drop doesn’t use RCLON (Rakuten Card-Linked Offer Network) which is what’s used by SimplyMiles, so these two card-linked programs should stack without any issues.

If you’re new to Drop, here are our referral links. You’ll earn 5,000 points (worth $5) when signing up and using any Shop offer (it seems like the card-linked Gopuff offer is eligible, but I’m not 100% certain), while we’ll receive 10,000 points (worth $10) at the time of publishing this.

- Stephen’s wife’s referral link (invite code: o9m64)

- Greg’s referral link (invite code: aj0l8)

- Nick’s referral link (invite code: vxjnp)

5) Fetch Rewards

Fetch Rewards is a receipt-scanning app that’s somewhat similar to Ibotta, but doesn’t tend to have anywhere near as many offers as Ibotta does.

When it comes to Gopuff though, Ibotta doesn’t seem to accept receipts from there whereas Fetch Rewards does. Fetch offers points (redeemable for gift cards) when buying a large number of eligible brands, plus they often have offers giving x number of bonus points when scanning any receipt.

If you’re new to Fetch, here’s my referral link – my referral code is D2CA8 if needed. At the time of publishing this, you’ll earn 2,000 bonus points (worth $2) the first time you scan a receipt, while I’ll earn 4,000 bonus points ($4).

Question

Those are the fipple stackable elements that can make for a nicely rewarding Gopuff purchase, but are there any other ways to stack purchases from Gopuff that you’re aware of? Let us know in the comments below.

I’d just also suggest to sign up for fam in the middle of the month, and that way you can place all your orders during one half of the month, and then again the next month (during the first half of the second month). That way paying for one month of fam membership gives you “two months” of free delivery for to use up your chase credits. They also have rewards points (puff points) that can be used for 10% off 3 orders (this is a fam exclusive reward) for 5500 points. Since I’m placing multiple ~$15 orders to take advantage of multiple chase credits, this is about $4.50 worth of discount for 5500 points (seems to be one of the better redemptions, compared to say, 12000 points for $5 off a single order). You can spin their wheel daily for more puff points and complete certain missions as well.

$10 will get you some bananas and a yogurt in NY

Yes, but you can also do pickup in NY, and they have removed the minimum. So spend $10 and get $10 credit.

AA portal is a lifetime 1x per account FYI, once you use it once it wont track again.

Note that if you buy anything alcoholic there’s a $2.95 “regulated products fee” unless you get the $7 monthly Go Puff Family Fee. And when you pick up your alcoholic items your ID will be scanned or photographed for the records, so be aware so that you can cover up the ID number.

Also thats interesting that the World of Hyatt Business card triggers the credit too. Ive seen some people posting that their Chase Ink cards also trigger the credits. I haven’t been brave enough to try them. Any data points out there?

On the GoPuff website, in the payment page, if you click the terms and conditions link, it does show the Ink cards and, i think, many other cards.

Are you sure the GoPuff credits are only for 12 consecutive months? I was just checking my statements and looks like I have gotten 14 consecutive credits since November 2021. Is this a mistake? Anyone else?

Can you please point out where in the terms and conditions it talks about only limited to 12 months? The Gopuff site says nothing about that (scroll to the bottom):

https://www.gopuff.com/go/chase

Ah, looks like you might be right. I’d been going by the announcement on Chase’s website which said “Starting today, Gopuff customers who add an eligible Chase credit card as the default payment on their Gopuff account will automatically receive up to a $10 statement credit each month they make a Gopuff purchase–a potential value of up to $120 over 12 months.”

I’d taken that to mean that the benefit was only valid for 12 months, but rereading it that’s not what it specifically says – just that over a 12 month period you could get up to $120 back. I’ll fix the post – thanks for highlighting that.

Is there a way to consolidate thr $10 go puff credits across multiple chase cards? Either via gift card or some reload process?

Hyatt Business card credits for me

Bev Mo locations allow free pickup. Orders start failing after 2-3 concurrent orders and are allowed again after some cool off period.

FAM(free delivery for a month) is by calendar date activated or renewed every 30 days, not sure which. So, if you buy FAM on the 15th you can use 2x credits per card (Chase benefit resets on the 1st) before you have to renew.

That said, unless you’re buying clearance items, their prices are usually +%100 compared to the grocery store. If you aren’t a complete degenerate you tip $10+/order, so you end up paying 2x the price of the grocery store to buy mostly junk food. May be worth it if you’re at a hotel without a car or unfit to drive.

One thing to note is that the SimplyMiles terms and conditions state that their offer is for new GoPuff customers only. Not sure if that was covered above.

I’d missed that specification – thanks. I’ll add that to the post.

I know it’s irrelevant. But I am hoping someone can answer my question.

If I sign up for the AA instant status upgrade, do I lose my eligibility in the AA loyalty games? Or do my earning qualify for both challenges?

In other words, I am currently an Explorist with Hyatt and I can qualify to become Platinum with the upgrade promo.

However, I currently hold Gold status with AA and need another 22000 LPs to hit platinum.

If request an instant status upgrade and receive Platinum status, does this negate all my efforts and require me now to maintain my Platinum status only? Please let me know.

Thanks