NOTICE: This post references card features that have changed, expired, or are not currently available

There was a time when I was excited about the idea of booking hotels through the Citi ThankYou portal. That was when I realized that it was possible to stack Premier & Prestige benefits. If you book hotels with points through the ThankYou portal and you have the Citi Premier card pooled with your Prestige card, then the Premier card’s 20% point discount on travel stacks with the Prestige card’s 4th night free. These combine to give you up to 1.67 cents per point value, or a 40% point discount if you prefer to think of it that way.

After signing up for the Premier card and combining ThankYou accounts (see: Should you combine ThankYou accounts?), my enthusiasm diminished quickly. When I searched for a four night stay through the ThankYou portal, I did find that the two benefits stacked together. And, compared to the full hotel price as listed on the portal, I could indeed get nearly 1.67 cents per point value. The problem was that I found that the same exact hotel was available for fewer points through Chase Travel℠. With Chase and the Sapphire Reserve card, you get 1.5 cents per point value. So, the point price through Chase should have been a bit higher than the point price through Citi, but it was actually cheaper. The reason was that Chase offered a better cash rate for the hotel.

Since then, I’ve repeatedly seen higher than expected hotel prices through the Citi ThankYou portal. I decided to test this out. Was it just bad luck that I found bad prices now and then? Or, is this a systematic problem with Citi?

The Experiment

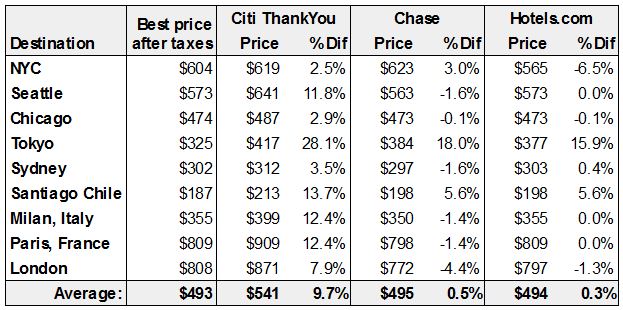

I picked 9 cities around the world and a random weekend (July 19-21) with which to search for hotel prices. I used Kayak as the “source of truth” as to the best hotel prices. For each city search, I simply picked the hotel that showed up at the top of the Kayak results. If Citi’s search engine couldn’t find the same hotel, then I moved down the list until I could find the same one in both search engines. I then clicked through from Kayak to one of the sites that Kayak believed had the best price. I did this in order to get to the final screen showing the total price for the weekend, after taxes and fees. I recorded this information into a spreadsheet. I then did the same with the Citi ThankYou portal. Then, I did the same with Chase Travel. Finally, I did the same with Hotels.com.

There was one type of Kayak result that I ignored. In some cases, the best listed price was through something called snaptravel. In those cases, you need to book through Facebook Messenger or SMS. When I came across those deals, I skipped to the next best price since I couldn’t see online the total price after taxes with snaptravel.

The Results

Citi charges almost 10% too much. Here’s the spreadsheet:

As you can see above, the average weekend price found through Kayak, including taxes & fees, was $493. Chase and Hotels.com offered nearly identical averages: $495 and $494, respectively. Citi’s average, meanwhile, came to $541. That’s 9.7% higher!

There was one outlier in the data. In Tokyo, Kayak found that Agoda had a far better price than any of the other online travel agencies (OTAs). Even though Citi’s website indicated that this hotel was available through a special offer, Citi still wanted 28% more for this hotel than Agoda.

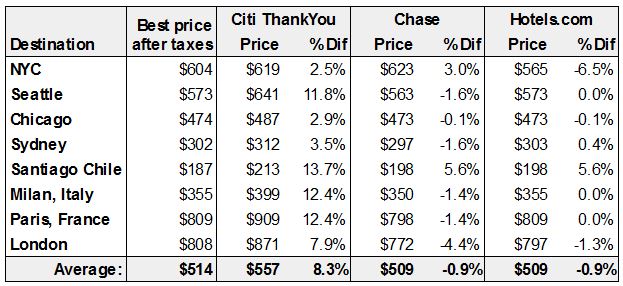

If we remove that one data point, Citi’s badness creeps down a little bit to 8.3%. Meanwhile, the prices found with Chase and Hotels.com were often a tiny bit better than those found through Kayak. Each offered, on average, about 1% better pricing:

What this means for Citi Prestige 4th Night Free

Until September 1st 2019, it’s still possible to book hotels through the Citi Concierge. This way, you can ensure that you get the best available price, including any discount rates you can find. Then the 4th Night Free benefit gives you an additional discount in the form of a 25% rebate (before taxes & fees) on a four night stay. See our Complete Guide to Citi Prestige 4th Night Free for details.

Starting September 1, though, you’ll be forced to book 4th Night Free reservations through the ThankYou portal. This means that you’ll get a 25% discount off of Citi’s rate. Since the discount is calculated before taxes and fees, the total discount is already less than 25%. If you then include the fact that Citi charges almost 10% more than they should, the discount is worse.

For example, if taxes and fees are 14%, but the base prices are equal, then the 4th Night Free discount equals 22%. However, if Citi charges 8.3% more for the base rate, then the total discount for the 4th Night Free on a 4 night stay drops to 15%.

What this means for Citi Premier 1.25 point value

The Citi Premier card offers 1.25 cents per point value on travel booked through the ThankYou portal. This can equally be thought of as a 20% discount on points required (when points are worth 1 cent each). If Citi charges more than they should for hotels, though, the real point value (or discount) isn’t as good.

I found that if Citi charges 8.3% more than they should, then the real point value is closer to 1.15 cents per point. Or if you prefer to think of it as a point discount, it drops to about a 13% discount.

Combo value (Premier + Prestige)

The Prestige 4th Night Free benefit plus Premier travel benefit combine to give you up to 1.67 cents per point value, or a 40% point discount if you prefer to think of it that way. How much value do you get if you account for higher hotel prices through the ThankYou portal, as well as hotel taxes which are not discounted with the Prestige benefit?

With the assumptions from above, it looks like we are left with a bit under 1.5 per point value or approximately a 30% points discount.

Conclusion

When booking hotels through the Citi ThankYou portal, you can expect to pay, on average, almost 10% more than you would when booking through other online travel agencies. This diminishes the value of ThankYou points when applied to hotel stays. Chase and Hotels.com, meanwhile, seem to offer competitive pricing in most cases.

Keep in mind that the above analysis compares online travel agency prices only. I did not take into account hotel member pricing, discount codes, or any other means of reducing hotel costs. Also keep in mind that booking through an online travel agency means that you will not earn hotel points or elite credits for your stay. And, in many cases, your elite status (if any) won’t be recognized by the hotel during your stay.

Greg – Prestige offers 5x on travel agencies. Does that apply to the Thank You portal? Is it a “travel agency”? Could that be why the prices are inflated?

Hmm, yes if you pay for travel with the Prestige credit card rather than points through the ThankYou portal I’d expect that you’d get 5X, but I’m not sure of that. I doubt that’s why prices are higher though. I’m just guessing but I bet the prices were just as high before the Prestige gained the 5X benefit.

YEP. Everyone of my 5 hotels im staying in soon, CITI travel prices when using points were all HIGHER. $10-20 per day. On top of it, some of the hotels were not even offered on the site. Time to ditch CITI.

[…] One big caveat: prices for hotels, cars, etc. are often more expensive when booked through the ThankYou portal than when booked through other means. This can completely wipe out the advantage of getting 1.25 cents per point value. Airfare is usually (but not always) priced competitively, but hotel prices are usually awful. See: How bad are Citi ThankYou hotel prices? […]

It will interesting to see similar analysis with respect to US bank’s travel portal (i.e. Are Altitude reserve points really worth 1.5 cents towards travel?)

Altitude reserve are as close to face value as you can get because you don’t have to book through their proprietary portal to redeem. You can book direct with hotels, airlines, even Uber/Lyft and redeem at 1.5 cents using real time rewards text redemption.

Problem is “real time redemption” only works within the US (as it requires text verification) and cannot be used outside the USA.

I only have experiences with Chase – for international properties (Japan, Italy, Australia) UR prices are 10 to 15% higher than the same properties shown on Booking.com. UR is even 5 to 10% higher than on Expedia, despite UR is “powered by Expedia). An UR portal rep told me the 2 have different inventory even on identical property.

That means CSR does not get 1.5c but rather 1.35c or less. We have a large UR balance so we still use it to book the inde hotels. But truth be told CSR does not get you 1.5x which is really a marketing gimmick by Chase. Same also applies to booking international flights.

The only time in our usage that UR has not had a jacked up pricing is to book Celebrity or Royal Caribbean cruises.

I once found a better rate at the Element in Amsterdam. I thought it was actually the regular rate until I called Concierge and found out otherwise. The AAA rate wasn’t bad, but TY was still cheaper. I ended up booking through Concierge anyway to earn SPG points, although it might have been smarter to go with TY.

You forgot to mention Rewards+ 10% back in points.

Greg,

Thanks for the comparison. However, what I find more interesting from your comparison is that even though Chase Ultimate Rewards uses Expedia as their travel supplier now which owns Hotels.Com and the rates are usually exactly the same when using the branded websites of Expedia and Hotels.com, Chase is pulling slightly different pricing. Since there are really only 2 OTAs out there: 1) Booking.com which owns Agoda, Booking.com, Kayak, Momondo, Priceline, Rocketmiles, and Tripfuel, and 2) Expedia which owns Cheapflights.com, Expedia, Hotels.Com, Hotwire, Orbitz, Travago, and Travelocity.

Lastly, yes I have found that Connextions Loyalty which runs the Thankyou.com website charges higher rates not only for hotels but also airfare, car rentals and experiences such as tours. That is why it is so hard for me to use my ThankYou points outside of transferring to partner programs. IF Citibank would dump Connextions loyalty and instead add Expedia, the program would become far more valuable. As it stands today, I am getting rid of my Prestige and Premier cards when their annual fees come due because of the lack of overall value.

Very good research here, thanks FM.

I’m confused on one thing though – you say the premier card gets 1.25x value when used for the TY travel portal. But the Citi Premier signup page only mentions 1.25x towards AIRFARE, with no mention of the 1.25x for other forms of travel booked through the TY site. Do people have some other grandfathered version of the TY premier that does 1.25x for all travel?

You skipped over what is even worse. On the Thank You portal, the prices they show depend on which credit card/TY-point-bank you come through. I have both the Premier and the Prestige. When I go to book TY travel, it makes me select one or the other. If I go through the Prestige card’s points, the prices shown are about 25% more than if I go through the Premier, totally wiping out any savings from the alleged 4th night free. Did you see this? I have always seen highly inflated prices through the Prestige entry.

The Premier TY portal prices I have seen are probably comparable to what you tabulated — maybe a little higher than other OTAs, but at least competitive.

So what exactly do you mean when you write “ThankYou portal” above?

I have never actually booked a 4th night free stay, partially (mostly) because I haven’t paid cash to stay 4 nights in the same place in the 2 years I have had the Prestige, but also because of the booking engine prices.

It sounds like you don’t have your points pooled, which explains the difference you’re seeing. If your ThankYou points aren’t pooled, you’ll see different point prices because the Premier’s points are worth 1.25c towards hotels, whereas the Prestige’s points are worth 1c each.

See this post that Greg linked to in the first paragraph for more on pooling the points to combine the values:

https://frequentmiler.com/up-to-1-67-cents-per-point-value-from-thankyou-points/

As for 4th night free bookings, the thing is that it *only* makes sense to book them through the portal (what you’re calling the booking engine) if you have both the Prestige and Premier *and you have the points pooled*. Otherwise, you would want to book via the Prestige Concierge over the phone or via email. In that case, you would need to be paying a cash rate rather than using your TY points, but you can then apply the AAA rate, AARP rate, corporate rate, special hotel promos, etc and also qualify for elite status / benefits / hotel points. See our Complete Guide to the Citi Prestige 4th Night Free for more info:

https://frequentmiler.com/the-complete-guide-to-citi-prestige-4th-night-free/

I believe Chase travel portal is powered by Expedia and Citi powered by Connexions. I would surmise that Connexions doesn’t have the scale to get some of the negotiated discounts that Expedia would. I doubt it makes as big a difference on major chains, but when you get to independent properties there can be a large difference between OTAs. And perhaps by using Kayak (owned by Booking group, aka Priceline) as your “source of truth”, using their default search results, you are inherently biasing your comparison to the hotels are predisposed to discounting on the major OTAs? I don’t disagree with your conclusion, just giving my perspective on potential underlying dynamics.

And when you factor in corporate booking rates, which I think a lot of us have, the difference is another 10-20% worse.

Just looked at 3 different booking options for a hotel:

1. $880 on hotel website

2. $900 on sites in the Expedia Group (including Ebates Hotels)

3. $995 on ThankYou Portal

Assuming 1.2 cpp for TYP and 1.5 cpp for MR (both values based on real redemptions for me):

The hotel points earnings would’ve been about 2.5% of the total rate; a portal would’ve gotten me 3.3% of total rate in cash back on top of that; paying with the Premier would’ve added another 3.6% at 1.2 cpp. Don’t have (or care for) status at this chain, so no lost benefits or extra opportunity cost. Net cost = $880-9.4% = $797. Also, these earnings are a combination of cash back, hotel points, and TYP.

Ebates Hotels was giving back 10X = 8.3X on the total rate = 12.5%; again, the Premier adds 3.6%. Net cost = $900-16.1% = $755. Earnings in MR and TYP.

On the ThankYou Portal, it would’ve cost me $995/.0125 = 79,600 TYP, and I would’ve gotten 10% (7,960) back from also having the Rewards+. Net cost = 71,640*$.012 = $860. Or valuation = $755/71,640 = $0.0105.

Nice job Greg. I have both Citi prestige and CSR. Next month my prestige annual fee is due and I am debating on focusing on one program only. Does anyone know a link where you can compare these two cards side by side?

If you’re planning to focus on one program only between Ultimate Rewards and Thank You points, I think the answer is unquestionably Ultimate Rewards. I like Thank You points more than most people (and look forward to showing more examples that illustrate why), but if I could only earn one currency TY wouldn’t be it.

That’s for a number of reasons, but not the least of which is that you can easily earn 1.5x everywhere with a no-fee Chase card and 5x on many purchases with an Ink Cash card. There are just too many cards / opportunities to generate points with Chase to focus on only Citi. Furthermore, Citi has no hotel partners. Chase has Hyatt. Marriott and IHG can also be useful in select spots.

If you’re talking a card-to-card comparison, it’s more complicated. But if you’re talking about dumping one program for the other completely, UR is the one to keep there.

Great analysis! Does the value proposition for Hotels.com further increase with the 10% rebate in the form of a free night after 10 stays or did you take that into account?

Also, Greg, did you use Hotels.com’s regular prices or the slightly discounted “secret” prices that they provide to members (or email opt-in subscribers)?

Edit: Disregard. I should have read your last paragraph more closely.

Also, you can purchase Hotels.com gift cards at 15% off pretty easily. You give up elite benefits, you don’t earn reward points with the hotel, but a cash discount is a discount and the 10% rebate on top of a 15% discount on gift cards is pretty hefty

And you can often apply coupons to get 10-15% off on Hotels.com, Orbitz, etc.