ABOUT KIVA

Kiva is a nonprofit organization that provides micro-loans to enterprising individuals around the world so that they may earn their own way out of poverty. By making loans through the Kiva website, you can be part of the solution to poverty AND earn points and miles. This post will show you how to do the most good and earn the most points and miles along the way.

The trick is simply to use a rewards credit card to “purchase” loans. When you receive payments back from your loans, cash them out and make new loans of the same amount, but again with your credit card. The following steps give more detail:

STEP 1: SIGN UP AT KIVA.ORG

Kiva loans are not tax deductible, but almost all loans pay back 100% of what you put in.

STEP 2: (OPTIONAL) JOIN THE KIVA MILEPOINT TEAM

This is a group of like-minded frequent travelers who are eager to pay it forward via Kiva. By joining, you will help this group meet its ambitious donation goals, and you may even be rewarded with a team shirt! For help with joining the team, check out this MilePoint link.

STEP 3: DECIDE HOW MUCH TO “BANK”

You can think of Kiva as a savings account where, instead of interest, you earn credit card rewards, and you help make the world a better place. How many banks can offer that? Note that, if you choose to, you will have the option to withdraw the money once the loans are repaid, but it can take as long as a year for all of the repayments to complete.

STEP 4: FIND THE “BEST” LOANS

Really, the best loans are the ones you feel best about giving! However, it is a good idea to find loans that are safest (e.g. most likely to pay back) and pay back soonest. The reason for preferring earlier payback is that the more often you are paid back, the more often you can use that same money to fund new loans. This will both help more people and give you more chances to earn credit card rewards. For many great tips on how to find the best loans, checkout this MilePoint forum. If you’d prefer to figure it out on your own, this site will help: http://www.kivalens.org/.

STEP 5: FUND YOUR LOANS VIA REWARDS CREDIT CARD

After adding loans to your Kiva “shopping cart”, it is time to check out. You might notice that Kiva will, by default, add a suggested donation amount to your tab to cover operational expenses. Unlike the loans, this amount is truly a tax deductible donation (at least in the US), but it is up to you whether or not to donate this or any other amount. If you have a US Bank Flexperks card, I’d suggest you decline giving a donation as part of this transaction and separately donate to Kiva (if you’re inclined to) via Flexperk’s charity link which will give you 3 Flexperks points per dollar. See my related post Give to Charity, Fly Free.

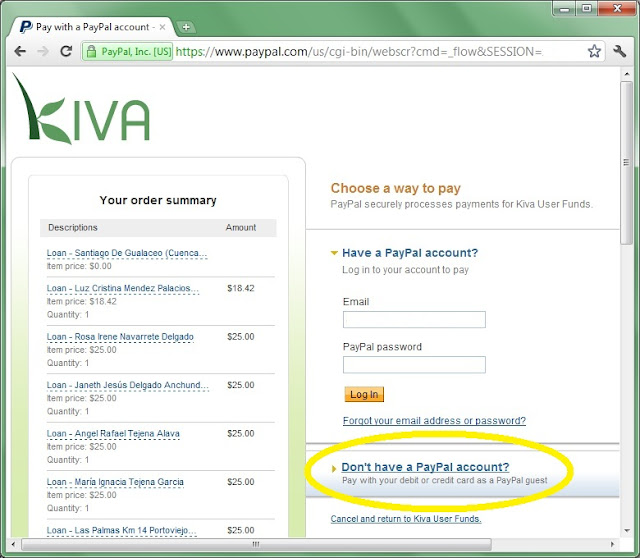

In order to use your credit card to pay Kiva, click the link under “Don’t have a PayPal account?” (even if you do). See below:

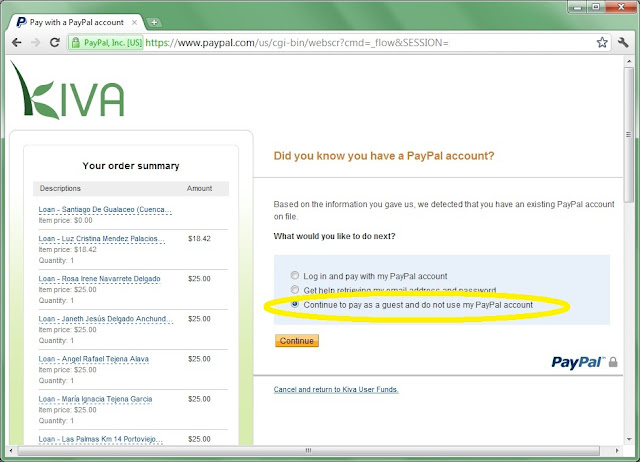

Then, if PayPal finds your account anyway, select “Continue to pay as guest and do not use my PayPal account”. See below:

STEP 6: WITHDRAW AND RE-LOAN

As loans get paid back, you can keep the cash in your Kiva account and re-loan the money at any time. This is the easiest way to do it, but it won’t earn you any more credit card rewards. To maximize your credit card rewards, withdraw your funds each month and purchase new loans with your credit card. Loans are paid back on the 15th of each month, so consider making this a monthly ritual and you will continually earn points for yourself and loans for those who need them.

FEEDBACK

Do you have other suggestions for maximizing rewards and virtue from Kiva loans? If so, please comment below. I would love to enhance this post over time with your best suggestions.

[…] PPM would also somehow do some good for the world, not just for the recipient of the points. Kiva loans are a great example of this, but the number of points that can be accrued annually is limited by […]

Admiring the hard work you put into your site and in depth information you offer.

It’s good to come across a blog every once in a while that isn’t the same out of date rehashed material.

Fantastic read! I’ve saved your site and I’m including your RSS feeds

to my Google account.

[…] Many of my fellow bloggers have touched on how you can give and EARN points by doing the right thing like Summer, Gary and Greg. […]

Ben: yes you can pay for new loans with your credit card at any time even if you have done so previously or if you have a balance with Kiva.

Hi, FM, can I confirm that we can load our account as many times as we like with a credit card (see step 6)? I remember reading somewhere that we can only load our account once with a credit card. Thanks.

[…] money back over time (Kiva reports default rates under 1%). For more information, see “How to maximize points and virtue through Kiva loans,” and “Minimum spend requirements? Kivalens to the […]

My concern was more about getting a deposit out via check instead of PayPal. Has anyone had experience actually getting their money out via check?

R: Yes, try emailing them to ask for your payments via check. I don’t know if they will do that for everyone, but it might be possible.

R: Yes, unfortunately the withdrawals are a manual process and can take some time.

FrequentMiler: I just now went to the withdrawal page on Kiva to check out the withdrawal options (I received my first repayments recently) and it says the following:

“PayPal processes all of Kiva’s financial transactions, so it is necessary to withdraw funds into a PayPal account. Kiva cannot send you a personal check or deposit the funds into a bank account.

Your funds will be deposited into your PayPal account in 1-3 weeks.

If you do not have a PayPal account, please create a PayPal account at http://www.paypal.com. If you have any issues in creating or updating your PayPal account, you can contact PayPal at 888-445-5032 (Toll Free US) or 402-952-8811 (International), Monday through Friday, 8 a.m. to 5 p.m. CST. These phone numbers are staffed by PayPal employees who are specially trained to help Kiva lenders.” :s

[…] How to maximize points and virtue through Kiva loans […]

R: Yes, simply contact Kiva and ask them to send you checks from now on for your withdrawals. That shouldn’t be a problem for them. You can even tell them that your PayPal account was closed if you want to.

I’m not planning to churn with this, but do you know if there is any way to withdraw my funds from Kiva once my loans have been repaid (still several months away)? PayPal closed my account and said I’m not welcome to use their service. Their reason (I have read their TOS and was not in violation of ANY terms) was “it’s nothing you did…I can’t tell you why because it’s proprietary information.” My suspicion is that it is because I opened a dispute with my credit card company after a PayPal CSR told me to do it!

[…] The Frequent Miler explains Kiva Loans. […]

What a wonderful idea! Thanks for all the info. I have joined and will make some loans!

Thanks for the quick reply! I have joined the team and made some loans. Nice.