Credit card companies offer huge incentives for opening new credit card accounts. 50,000 point offers used to be considered big, but these days 60K, 70K, and 80K offers dominate. Most of these offers, though, require more than being approved for a new card. You must also meet big minimum spend requirements before you can get the bounty of rewards. See our Best Offers Page to find the best credit card deals.

What if you want a bonus but can’t easily spend the amount required? Below you’ll find easy options for increasing credit card spend. For a more complete overview, please see our complete guide to increasing spend.

Pay federal taxes

There are several options for paying federal taxes with your credit card. The cheapest is Pay1040.com which charges only 1.87% in fees. If you don’t have end of year taxes to pay, you can pay estimated quarterly taxes instead. If you can afford to float the money, there’s no penalty to overpaying. You’ll get back the difference after filing your year-end taxes.

For more details, see our guide to paying taxes by credit card.

Pay bills via credit card

Many bills that can’t usually be paid by credit card can be paid by credit card if you use a bill payment service. Plastiq is a bill payment service that lets you pay most bills by credit card for a 2.5% fee. Because of that fee, I don’t recommend using Plastiq for all bill payments, but if you’re trying to meet a new card’s minimum spend requirements or if you’re trying to earn a big-spend bonus, it can be well worth it.

For more details, see our complete guide to Plastiq credit card payments.

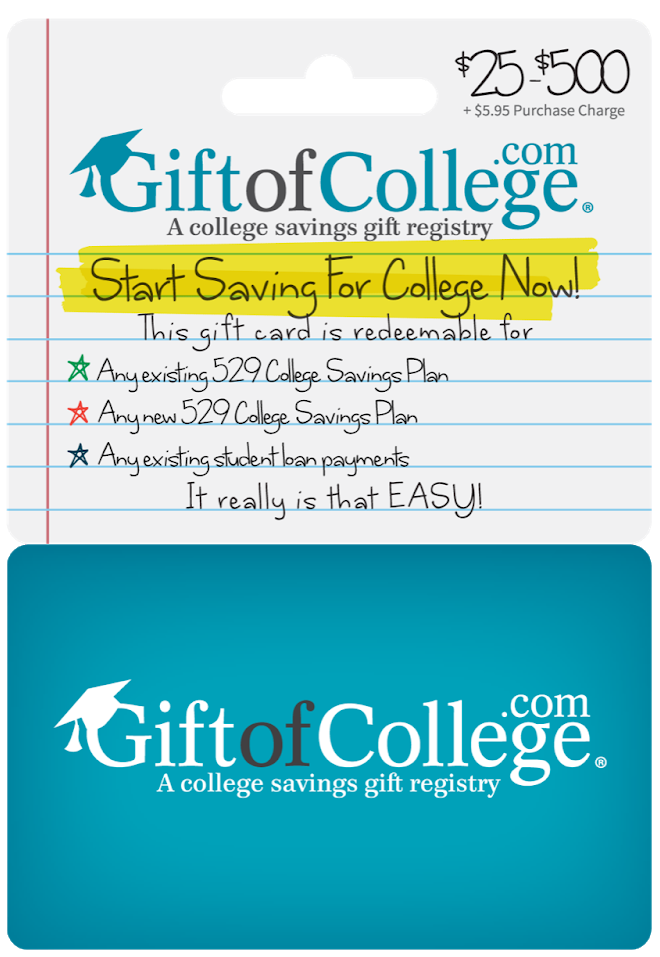

Save for college or pay student loans

Gift of College gift cards can be purchased at many different stores around the country. And most of those stores will let you pay with a credit card. This can be a good deal at stores that let you load up to $500 at a time. Each card has a $5.95 purchase fee, so you’ll want to load the full $500 in order to minimize that fee compared to the total purchase price. Once you have the card in-hand, you can use it to fund a 529 college savings account or to pay a student loan.

For complete details see: Miles for College and Best options for buying Gift of College gift cards.

Make loans & do good

Kiva is a nonprofit organization that facilitates micro-loans to enterprising individuals around the world so that they may earn their own way out of poverty. Kiva loans do not earn interest, but they can be paid for with a credit card. Credit card payments do earn rewards and do not count as cash advances. Kiva lets you filter to “safe” loans that are most likely to be paid back in full. While there is risk that you’ll lose your money, most loans do fully pay back in about a year or so.

For more details, including ways to filter to “safe” loans, see: Increase Credit Card Spend (and do good) with Kiva and Kivalens.

And for those wondering if loaning through Kiva is really doing good, please see: Why I love Kiva for earning rewards and doing good.

Organize events with friends

One great way to increase credit card spend is to become the social event coordinator for your friend group. Offer to get tickets to sports events, plays, concerts, rounds of golf, etc. Or go really big and organize travel. Have your friends pay you back electronically with options like Venmo or Zelle, or the old fashioned way with cash or checks.

Even if you’re not trying to meet credit card minimum spend requirements, this can be a great way to spend more time with friends and to earn extra rewards (especially if you use the best credit card for each type of purchase).

We like this one – paying for catering and supplies for our home owner’s association and getting reimbursed!

Couple of questions, one directly related and then one indirectly related:

1) If I use credit card to pay taxes at pay1040.com, will I get some sort of acknowledgement from the IRS that I have made a tax payment? I am an employee with normal W2 (I file individual taxes each year and not business taxes) and each year on my W2 my employer tells me how much tax they have withheld , and I get credit for any withholding when filing each April for the prior year. Anything similar in terms of acknowledgement from IRS when paying via pay1040.com?

2) Using FM’s links I am going for 2 SW companion passes (myself and wifey) via chase credit cards. All of our cc statements close on the 1st of the month (I have requested this). My goal was to meet all minimum spend ($12k maybe via pay1040.com based on answer to question above) in December 2019 with the intention that the points will all post with my Jan 2020 statement. This has worked for me in the past when I went after companion pass 8 years ago, but one of my friends says that my strategy is risky and that the statement could close early (my experience is that it won’t) or my points could post after the minimum spend is met and not when statement closes (my experience is that points always post with statement). Any more recent data points to get me comfort around my strategy? Or do you advise I finish min spend Jan 1-8 (before 90 day window expires) resulting in companion pass effective in Feb 2020 instead of Jan 2020?

Ali

I have been meeting the min on a new card by my 1/4 taxes .I pay print a copy then save the Email they send u 4 yrs now for me. Then I use to copy my cc bill but don’t now . I have a CPA never had any trouble doing this .

CHEERs

Nice picture from Crisler Center – Go Blue!