Stephen checked into a Hilton property the other day and when he connected to the hotel WiFi, he was redirected to a page with increased offers for the Hilton consumer credit cards. As these are the best publicly available offers for each of these cards, we have updated our best offers page accordingly.

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $291 1st Yr Value EstimateClick to learn about first year value estimates 80K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $2K spend within the first 6 months of card membership. Terms apply. Rates & Fees No Annual Fee Recent better offer: 100K points after $2K spend in first 6 months (Expired 1/14/26) FM Mini Review: This card isn't particularly rewarding, but it's good to keep primarily for targeted Amex upgrade offers to the Surpass card. Earning rate: ✦ 7X Hilton eligible Hilton purchases ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Gold elite status with $20K in eligible purchases in calendar year Noteworthy perks: ✦ Free Silver status; Gold status with $20K in eligible purchases. ✦ Terms Apply. |

| Card Offer and Details |

|---|

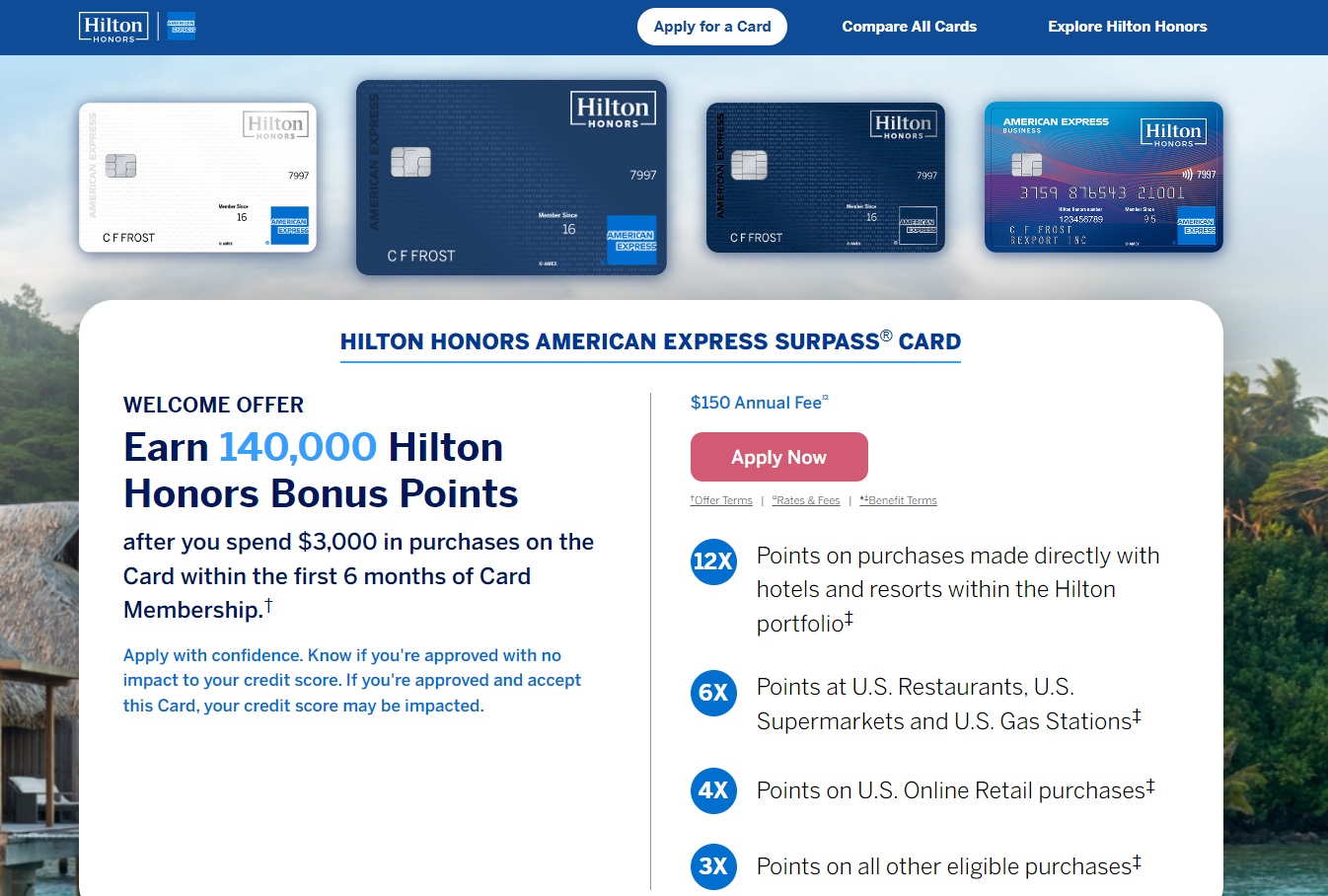

ⓘ $477 1st Yr Value Estimate$200 Hilton credit ($50 per quarter) valued at $150 Click to learn about first year value estimates 130K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 130K points after $3K spend within the first 6 months of card membership. Terms apply. Rates & Fees$150 Annual Fee Recent better offer: 130K points + free night certificate after $3K spend within the first 6 months. (Expired 4/29/25) FM Mini Review: Easy way to secure Hilton Gold status (which offers free breakfast among other perks). Those who want Diamond status may be better off with the Aspire card. Earning rate: ✦ 12X Hilton spend ✦ 6X U.S. restaurants, U.S. supermarkets, and U.S. gas stations ✦ 4X U.S. Online Retail Purchases ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: ✦ Free night award after $15K in eligible purchases in calendar year ✦ Hilton Honors™ Diamond status with $40K in eligible purchases in a calendar year ✦ Terms apply Noteworthy perks: Automatic Hilton Honors™ Gold status. Hilton Honors™ Diamond status w/ $40K in eligible purchases in a calendar year. ✦ Up to $200 in Hilton credits ($50 per quarter) ✦ Terms Apply. |

| Card Offer and Details |

|---|

ⓘ $811 1st Yr Value Estimate$400 Hilton resort credit ($200 per six months) valued at $280, Hilton Free Night valued at $418, $200 airline credit ($50 per quarter) valued at $160 Click to learn about first year value estimates 150K Points + free night certificate ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K after $6K spend in first 6 months of card membership. Free night certificate every year - first certificate is awarded 8-12 weeks after approval. Terms apply. Rates & Fees$550 Annual Fee Recent better offer: 175K point after $6k spend in first 6 months (Expired 1/14/26) FM Mini Review: This card is loaded with valuable perks that are more than worth the card's annual fee if you stay in Hilton resorts at least twice per year. Earning rate: ✦ 14X Hilton spend ✦ 7X US restaurants, flights booked directly with airlines or amextravel.com, select car rental companies ✦ 3X on all other eligible purchases ✦ Terms & Limitations Apply. Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Additional free night awards after $30K and $60K in eligible purchases in calendar year Noteworthy perks: ✦Annual Free Night Reward every year upon renewal ✦ Free Diamond Status ✦ Up to $400 Hilton Resort Credit per calendar year ($200 semi-annually) ✦ $200 Flight Credit (Up to $50 per quarter for purchases directly with airlines or via Amex Travel) ✦ Up to $209 CLEAR (R) Plus fee credit per calendar year ✦ Up to $100 on-property credit w/ Aspire Card package ✦ Terms Apply. See Rates & Fees See also: Amex Hilton Aspire In-Depth Review |

Quick Thoughts

These offers each add 10,000 points on top of the previous public offers. Based on our Reasonable Redemption Value of Hilton points (0.48c per point), that’s worth about $48. That’s not a huge increase, but it is obviously better to get more points than fewer.

That said, if you’re in a two-player household, you’ll almost certainly be better off using a referral link from your other player. For instance, if Player 1 has an Amex Gold card (just as an example) that offers 30,000 Membership Rewards points per successful referral (YMMV, check your own referral offers in your account), they could refer Player 2 to a Hilton card and although Player 2 would receive 10,000 fewer Hilton points, Player 1 would earn 30,000 Amex Membership Rewards points for that referral, which we value at 1.55c per point, which comes to a Reasonable Redemption Value of $465 for that referral (and if you really prefer Hilton points, you could transfer those Membership Rewards points to Hilton and end up with far more Hilton points). It would be totally worth forgoing 10K Hilton points in exchange for a big referral bonus like that if you’re in a multi-player household.

It is also worth a mention that we sometimes see more interesting offers via Hilton WiFi. We have sometimes seen an offer for a couple of Hilton free night certificates on the Hilton Surpass in lieu of a points-based bonus. Points are certainly more flexible, though if you would more highly covet free night certificates, it might be worth periodically checking the offer when connected to Hilton WiFi (and let us know if it changes!).

Evidently only US hotels, which makes sense. I guess 5/50k Marriott biz it is for now.

Also try referral links. My Amex biz plat (most days) has been generating 100k offers for the no annual fee card & 150k for the Surpass. Same spend.

I am waiting for the FNC offers to come back.

Hopefully this summer.

Is there any correlation between increased consumer bonuses becoming available and the business card bonus also being updated?

Are Hilton cards worth considering for slh now? Don’t have any at the moment

Surpass is a no-brainer for me. $150 AF is more than offset by the $50/qtr rebate and I expect to get the full $200 even if I don’t step foot in a Hilton property for a year. Plus the ability to get FNA after $15K spend, in conjunction with bonuses for Hilton AU cards makes the spend attractive value (6x grocery/4x online). With new partnership with SLH, those FNAs could become valuable if SLH allows FNAs to be used for their properties.

Anytime a company pays me to keep a card, I’ll gladly accept.

How would you get the full $200 without stepping foot in a Hilton?

Those who ask Reddit shall see the light

what are the AU bonuses? I’m not sure 15k spend for one free night vs other subs is worth it for me