NOTICE: This post references card features that have changed, expired, or are not currently available

Bank of America’s new card was originally expected to be an ultra-premium card. Rumors were that it would compete in the $450 / $550 space with the Chase Sapphire Reserve, Amex Platinum, Citi Prestige, US Bank Altitude Reserve, etc. But… Either the rumors were false, or Bank of America changed course along the way. The new and creatively named “Premium Rewards Credit Card” is just $95 per year.

| For full details about the Bank of America Premium Rewards card, including tips for getting approved, please see our Bank of America Premium Rewards Credit Card Complete Guide. |

At $95 per year, this new card seems to take aim at the $95 per year Chase Sapphire Preferred. Like the Sapphire Preferred, the Premium Rewards card offers 2 points per dollar for travel and dining. And it trumps the Sapphire Preferred by offering 1.5 points per dollar everywhere else (the Sapphire Preferred earns just 1 point per dollar everywhere else).

That said, the meaning of “points” here is very different. With Bank of America, a point is worth a penny of cash back. Period. Yes, you can use points to pay for travel or gift cards, but you’ll still just get 1 cent per point value. You’re better off redeeming points for cash back and then earning more points by paying for travel and other things with your card. With Chase, on the other hand, points are potentially worth far more than a penny each since they can be transferred 1 to 1 to airline and hotel programs (see: Chase Transfer Partners). Or, points can be used to purchase travel through Ultimate Rewards Travel for 1.25 cents value per point.

Since BOA Premium Rewards Card points are just pennies, I think it makes more sense to compare this card to best-in-class cash back cards such as Citi Double Cash, USAA Limitless Cashback Rewards, and Alliant Cashback Visa Signature Card. And, compared to those cards, at first glance this one does not fare well:

| Card | Annual Fee | Earning Rate |

|---|---|---|

| Bank of America Premium Rewards | $95 | 2% Dining & Travel; 1.5% Everywhere Else |

| Citi Double Cash | $0 | 2% Everywhere |

| USAA Limitless | $0 | 2.5% Everywhere (if you have $1K of direct deposits each month) |

| Alliant | $59 | 2.5% Everywhere (3% first year) |

As you can see above, you can earn more cash back for a lower annual fee with a number of other cards. That said, the Premium Rewards card also offers a few premium features:

- $100 in airline fee incidental reimbursements each year (checked bags, for example)

- Global Entry or TSA PreCheck reimbursement every 4 years

- Travel Insurance protections. Surprisingly, coverage includes emergency evacuation and transportation. This is a feature usually reserved only for ultra-premium cards.

If you make full use of the card’s $100 in airline fee reimbursements each year, you can argue that this card is effectively a no annual fee card (you pay $95, but get $100 in credits). Still, unless it earns a higher cash back rate than other no-annual fee cards, it isn’t worth bothering with this card (after securing the 50,000 point signup bonus of course!).

Fortunately, for those fortunate enough to have $100K in savings, this card is quite special once you throw in Bank of America’s Preferred Rewards…

Preferred Rewards

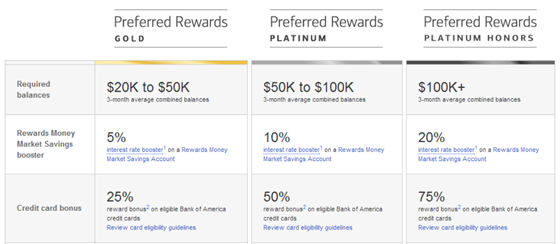

Preferred Rewards is Bank of America’s own customer elite program. Benefits vary depending upon the total amount of money you have on deposit and/or invested with Bank of America, Merrill Lynch, or Merrill Edge . Customers must maintain a 3-month average combined balance at the following amounts for each elite level:

Preferred Rewards is Bank of America’s own customer elite program. Benefits vary depending upon the total amount of money you have on deposit and/or invested with Bank of America, Merrill Lynch, or Merrill Edge . Customers must maintain a 3-month average combined balance at the following amounts for each elite level:

- Gold: $20K

- Platinum: $50K

- Platinum Honors: $100K

These translate into the following earning rates with the Premium Rewards card:

- Gold ($20K on deposit): 25% bonus = 2.5X travel & dining; 1.875X everywhere else

- Platinum ($50K on deposit): 50% bonus = 3X travel & dining; 2.25X everywhere else

- Platinum Honors ($100K on deposit): 75% bonus = 3.5X travel & dining; 2.625X everywhere else

While other cards offer better returns for travel & dining, 2.625% cash back everywhere is a remarkably high rate of return on spend.

More about Bank of America Preferred Rewards can be found here.

Who has $100K sitting around?

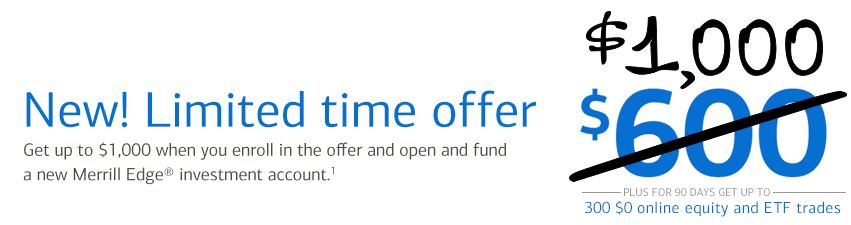

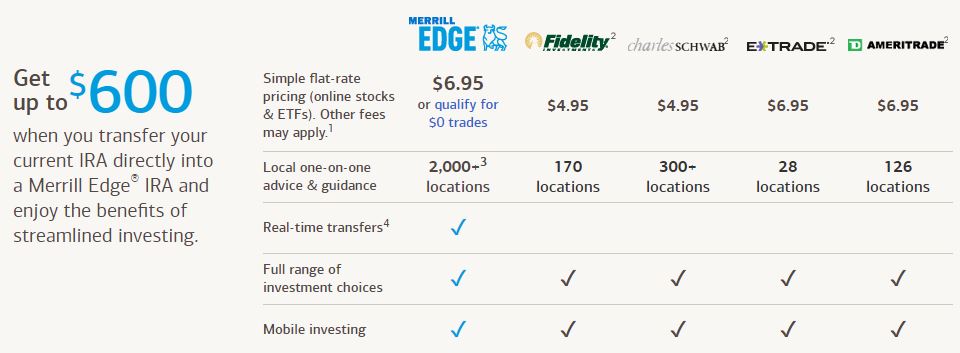

I expect that a number of readers may have $100K sitting around… in the form of retirement accounts. If you have an IRA, or something similar, you may be able to simply transfer management of the funds over to Merrill Edge. Here’s a Merrill Edge page that describes how. My understanding is that this transfer won’t change the value of your investments in any way. And a nice bonus: Merrill will kick in $250 if you transfer $100K or $600 if you transfer $200K.

But.. you might want to wait! Late last year (2016), Merrill offered an even bigger bonus: $500 for $100K and $1000 for $200K. If we hear of a new bonus like this, of course we’ll publish the details.

What about the no fee Travel Rewards card?

Bank of America also offers a no fee Travel Rewards Card (details here) which earns 1.5 points per dollar everywhere. With Preferred Rewards Platinum Honors status, this card also offers 2.625 points per dollar on all spend. The main difference is that this card does not earn extra points for travel and dining, and Travel Rewards points must be used to offset travel, otherwise they’re worth less than a penny each.

So, while the Travel Rewards card has the upper hand by having no annual fee, the Premium Rewards card offers points that are easier to cash out.

My Take

The new Premium Rewards card offers a nice easy $500 signup bonus. That alone makes the card worth getting the first year. And, if you’re not interested in keeping it past year one, you can rack up $100 in airline fee reimbursements twice: once this calendar year, and once next calendar year before cancelling.

For me, this card may be a keeper. Last year, I took advantage of the opportunity to earn a cash bonus by funding a Merrill Edge account (see above: “Who has $100K sitting around?”) and I now have Preferred Rewards Platinum Honors status with Bank of America. That means that I would earn 3.5% cash back on travel & dining and 2.625% cash back everywhere else with the Premium Rewards card.

I’ll continue to use my Sapphire Reserve card to earn 3X Ultimate Rewards points for travel & dining, so if I keep this new card it will really just become my “everywhere else” card. This would be the card I’d whip out when I can’t earn 3X with some other card. I used to use the 1.5X everywhere Freedom Unlimited card as my everywhere else card (see: FU Sapphire Reserve), then I moved to the 2X everywhere Amex Blue Business Plus (see: The new king of everyday spend: Amex Blue Business Plus). Both cards are great for this purpose, but both charge foreign transaction fees so I have to be careful not to use them when traveling abroad. I like that the Bank of America Premium Rewards card has no foreign transaction fees and is therefore good to use at home and away.

One thing I don’t like is the $95 annual fee. Yes, I should be able to recover $100 per year by strategically using the card for reimbursable spend, but I don’t like the added pressure of yet another card like that. I already have to make sure to use up the airline fee reimbursements each year for my and my wife’s Amex Platinum cards, our CNB Crystal Visa Infinite cards, and my Citi Prestige card. As a result, I’m still on the fence as to whether or not I’ll keep the BOA card long term. It may be possible to downgrade it to the no-fee Travel Rewards card instead. Then, when I want to cash out the points, I could probably temporarily upgrade back to the Premium Rewards card.

The monkey wrench: Last night, Nick published a crazy idea that just might work to get 4.59% back on everyday spend with a combination of Bank of America cards (see: Can you earn 4.59% back on everyday spend with the new BOA Premium Rewards card?). To be clear, it is extremely unlikely that this will work, but if it does work then of course I’ll keep the Premium Rewards card and pickup a Cash Rewards card too. I’d probably even use the Premium Rewards Card for travel and dining at 6.1% cash back. But that’s a pipe dream of course. There’s just no way it will work. Never mind that one of Richard Kerr’s friends succeeded in a very similar trick.

For more details about the Bank of America Premium Rewards card, including tips for getting approved, please see our Bank of America Premium Rewards Credit Card Complete Guide.

I have this card and also a Cash Rewards card and another Travel Rewards card. I am also Preferred Rewards Platinum Honors (the highest tier).

I can confirm that the Cash Rewards cards are ineligible for point transfers from the Premium Rewards card. My other Travel Rewards card is eligible for point transfers, however.

This card is a no brainer if you already have a banking relationship with Bank of America and/or Merrill Lynch and are Preferred Rewards Platinum Honors tier. An added bonus is that at this tier you get 100 (to me this might as well be unlimited) monthly trades in your investment accounts at Merrill Edge, unlimited free ATM rebates at non-BOA ATMs, and mortgage interest rate reductions if you decide to open a mortgage at BOA. I stopped using my USAA 2.5% no-annual fee Limitless Cashback card and not I exclusively use the BOA Premium Rewards card. The $95 annual more than pays for itself….even if you take the 50,000 point sign-on bonus that pays for 9.5 years worth of annual fees right there.

[…] points, miles, and credit card world — including the launch of some new premium cards (See: Is it a keeper? My take on BOA’s new Premium Rewards Card and A new ultra-premium card, in-depth review: Amex Hilton […]

I have been going back and forth on this card and the CSRs that both of us have. DH has the Travel Rewards card, and his CSR renewal is coming up. I’m thinking of making him an AU on my CSR, and me an AU on his Travel Rewards card. That way both of us have 2.625% on everything else and 3UR on travel/dining for a $75 add’l fee. But passing up a $405-$500 signup bonus (not sure if I’m going to get use out of $100 travel credits the way BoA has it set up) just makes me feel bad, so I’m not sure which way to go on this. I have to make sure I’m under 5/24 by late next year so I can get the two SW cards, and I’m sitting at 4/24 right now and who knows if the two app/two browser technique will still work a year from now…

How about this:

1. Make him an AU on your Reserve card so that you’ll both get 3X UR travel & dining

2. If it fits w/ your SW card plan, both of you sign up for the Premium Rewards card for its 50K signup bonus. That way you get the signup bonus AND the 2.625% everywhere else.

3. A year from now either cancel the two Premium Rewards cards and sign up for Travel Rewards (for its bonus) or downgrade the PR cards to Travel Rewards so that you won’t get any more annual fees from BOA

Really don’t see a huge benefit than the BOA Travel rewards which also offers extra bonus as Preferred Rewards member and no foreign transaction fee. The $100 airline fee credit looks good but, unless it works on airline gift card, it is a headache. You don’t want to pay $95 for a headache. For a regular consumer, you can estimate how much “everyday expense” you have every year. The “2.625%” doesn’t offer really that more than the “2%”. Say if you have $10K everyday expense, the difference would be only $62.5 [=$10K x (2.625%-2%)]. Do I need to remind you the annual headache again?