Chase has unveiled a new fee-free Marriott Bonvoy card: Bonvoy Bold. Is the new card worth getting? Is it worth keeping? Let’s dig in…

Confusing Bonvoy card names

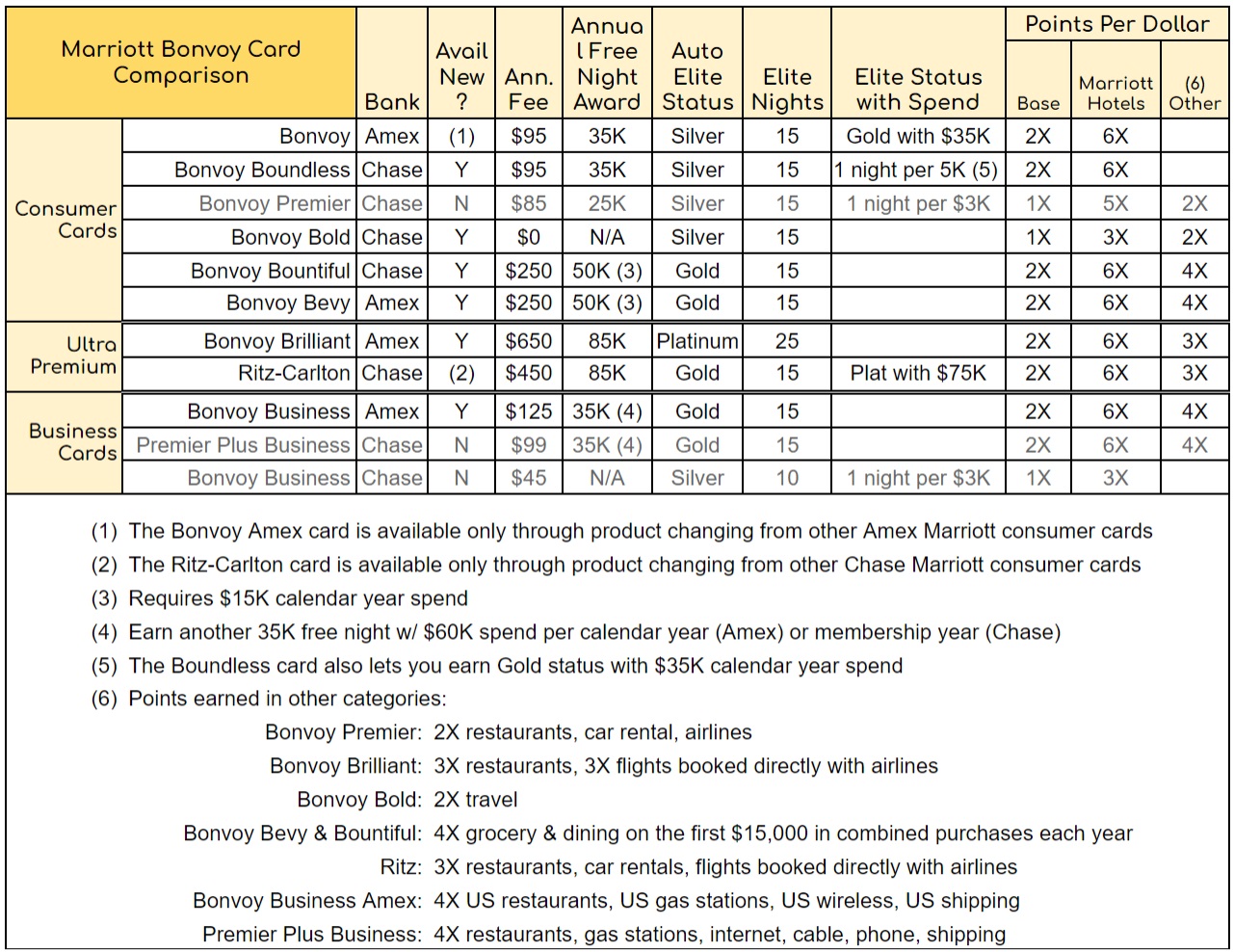

Why do credit card companies love alliteration? This just confuses customers. Consider the currently available Marriott Cards: Bonvoy Bold, Bonvoy Boundless, Bonvoy Business, Bonvoy Brilliant. Can you keep track of which is which? Nope. I can’t either. But my Marriott credit card comparison chart should help. This has been updated with the new Bonvoy Bold:

Confusing Bonvoy signup rules

If you have any other Bonvoy cards, or if you’ve received a bonus for one in the past 24 months you probably won’t qualify for a new bonus for the Bonvoy Bold. This chart may help you figure out if you would qualify:

| Card You Want | |||||||

| Cards You've Had (Or Recently Applied For) | Chase Bonvoy Bold | Chase Bonvoy Boundless | Chase Bonvoy Bountiful | Amex Bonvoy Business | Amex Bonvoy Brilliant | Amex Bonvoy Bevy | |

| Chase | Ritz Carlton | ✅ | ✅ | ✅ | ✅ | ⚠30 | |

| Bonvoy ($45 card) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Bonvoy Premier | ⚠24 | ✅ | ✅ | ✅ | ✅ | ||

| Bonvoy Bold | ✅ | ⚠90 ⚠24 | ⚠30 ⚠90 ⚠24 | ||||

| Bonvoy Boundless | ✅ | ||||||

| Bonvoy Bountiful | ✅ | ✅ | ⚠24 | ||||

| Bonvoy Business ($45 card) | ✅ | ✅ | ✅ | ⚠30 | ✅ | ✅ | |

| Bonvoy Premier Plus Business | ✅ | ✅ | ✅ | ⚠90 ⚠24 | ⚠30 | ||

| Amex | Bonvoy | ⚠30 | ⚠30 ⚠90 ⚠24 | ✅ | ✅ | ✅ | |

| Bonvoy Business | ⚠90 ⚠24 | ⛔ | ✅ | ✅ | |||

| Bonvoy Bevy | ✅ | ✅ | ⛔ | ||||

| Bonvoy Brilliant | ✅ | ⛔ | ⛔ | ||||

| Eligibility Key | |

| ✅ | You are eligible for this card and welcome bonus |

| ⚠30 | You're are not eligible for a welcome bonus if you have had the card on the left within the past 30 days |

| ⚠24 | You will not be approved if you currently have or if you've received a welcome bonus in the past 24 months for the card on the left |

| ⚠90 ⚠24 | You are not eligible for a welcome bonus if you were approved for the card on the left within the past 90 days; or if you've received a welcome or upgrade bonus in the past 24 months. |

| ⚠30 ⚠90 ⚠24 | You are not eligible for a welcome bonus if you've had the card on the left within the past 30 days; or if you were approved for it within the past 90 days; or if you've received a welcome bonus or upgrade bonus for it in the past 24 months. |

| ⛔ | You are not eligible for a welcome bonus if you've ever had this card before (but the system seems to "forget" that you've had the card about 5 to 7 years after you cancel) |

5/24 is still a thing

Don’t forget that Chase now applies 5/24 rules to all of their cards. This one is surely no exception.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Bonvoy Bold has no free night

The best feature of most of the current Bonvoy cards is that they offer a free night each year. I like to keep these cards open because I can usually use the free night award towards much better value than the card’s annual fee.

The Bonvoy Bold doesn’t come with a free night. But that’s OK since it doesn’t have an annual fee either.

Bonvoy Bold is bad for spend

This card offers only 1X rewards for most purchases and only 3X at Marriott properties. You can do much better with almost any other rewards credit card. See: Best Rewards for Everyday Spend.

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X grocery stores, rideshare, select food delivery, select streaming, and internet, cable and phone services ✦ 1X everywhere else |

Who is it good for?

I actually think that this card does make sense in certain situations…

Poor credit bonus seekers

The welcome bonus for the Bold isn’t as good as the bonuses on other cards. That said, it is likely that Chase will approve the Bold more easily than the Bonvoy Boundless card. So, if you have mediocre credit and/or a low income, it could make sense to signup for the Bold. It also helps that the Bold has a lower spend requirement.

Of course, you would probably do better with any number of other credit cards out there. Checkout our post “Best offers for low spenders,” for ideas.

For reference, here are the current Bonvoy welcome bonuses:

| Card Offer Mini |

|---|

Marriott Bonvoy® Brilliant® American Express® Card Up to 150K Points ⓘ $634 1st Yr Value Estimate$300 dining credit ($25 per month) valued at $270 Click to learn about first year value estimates |

Marriott Bonvoy Business® American Express® Card 3 x 50K Free Night Certificates ⓘ $692 1st Yr Value Estimate3 Marriott 50K Free Nights valued at $912 Click to learn about first year value estimates |

Marriott Bonvoy Bountiful™ Card 85K points ⓘ $333 1st Yr Value EstimateClick to learn about first year value estimates |

Marriott Bonvoy Boundless® Credit Card 5 x 50K Free Night Certificates ⓘ $1346 1st Yr Value Estimate5 Marriott 50K Free Nights valued at $1520 Click to learn about first year value estimates |

Marriott Bonvoy Bold Credit Card 60K points + Free Night Certificate ⓘ $713 1st Yr Value EstimateMarriott 50K Free Night valued at $304 Click to learn about first year value estimates |

Marriott Bonvoy Bevy® American Express® Card Up to 135K Points ⓘ $665 1st Yr Value EstimateClick to learn about first year value estimates |

Status seekers

If you want Marriott elite status, but you don’t want to pay an annual fee, this card can help. The card offers 15 elite nights towards status each year. That’s enough on its own to give you Silver status, for what that’s worth (not much). But it also gives you a considerable leg up towards higher level status:

This may actually be the perfect card for those who travel a lot for work. If that’s you, you probably earn enough Marriott points from paid stays so that you don’t need the annual free night certificate that the premium Bonvoy cards offer. The Bold will help by giving you 15 elite nights each year so that you’ll get to Platinum, Titanium, or Ambassador elite status faster.

Before you ask: No. If you get multiple Bonvoy cards, you won’t get more than 15 nights credit towards elite status.

Those who want to say bon-voyage to Bonvoy, but maybe not forever

If you have a Chase Marriott or Ritz consumer card and you no longer want to pay the annual fee, I highly recommend product changing to the Bonvoy Bold instead of cancelling your card. Once you cancel, it can be very difficult to get that card again. But if you product change down to the Bold, it will most likely be possible to upgrade sometime in the future to the Ritz card, or to the Bonvoy Boundless, or to the not yet announced but inevitable Bonvoy Badass card.

In other words, the Bonvoy Bold is the ultimate Bonvoy parking lot card. If you’re sick of everything having to do with Bonvoy, but you’re not 100% sure the breakup will be permanent, then switch to the Bold. Make sure to put a few dollars spend on the card every 6 months or so. Otherwise they may cancel the card for non-use.

Conclusion

Bonvoy Bold is a decidedly “meh” card. That said, it does make sense for a select few. In fact, I wouldn’t be surprised to find lots of readers interested in using it as a no-fee Bonvoy parking lot card.

If you have questions about Bonvoy credit cards, free nights, shortcuts to elite status, etc., please checkout our all-inclusive post: Marriott Bonvoy Complete Guide.

If you don’t have any of the Bonvoy cards and never have, would it be possible to apply for the both Bonvoy Bold and Bonvoy Brilliant at the same time and receive both bonuses?

Thanks!

Maybe. I don’t know for sure.

[…] With little fanfare, Chase launched their entry level Marriott Bonvoy credit card this week, the Bonvoy Bold. Greg from Frequent Miler asks if the card is really good for anyone? […]

[…] the query Is the new Bonvoy card good for anyone? is answered with nicely, probably not. Solely if you’re actually bored…I […]

[…] the question Is the new Bonvoy card good for anyone? is answered with well, not really. Only if you are really bored…I […]

I don’t think anyone can say for certain that the card is subject to 5/24. Remember when everyone thought that about the Marriott Business card that was going away? One DoC reader suggested it might not be, was lambasted, and then approved despite all the criticism (subsequently leading to many others over 5/24 getting approved before it was taken down). Obviously, there is a good chance it is subject to 5/24, but unless you have a inside source to confirm, I don’t think anyone can say for certain. It’s also very unlikely anyone over 5/24 is going to try for this card, save for the bravest and most curious points enthusiast.

Bonvoy Badass. Heh.

I already have 2 amex bonvoy cards, 1 chase bus. bonvoy card. Is it worth doing just for the sign up bonus of 50k marriott pts if I qualify?

one word answer to post title: NO!!!!

I don’t think one can get approved with badish credit. It’s still a Visa Signature card.

So the signup bonus is good for about one night?