NOTICE: This post references card features that have changed, expired, or are not currently available

I have for years called the Southwest Airlines Companion Pass the hands-down best deal in domestic travel. Getting two passengers for the price of one every time you fly, whether on a paid ticket or award ticket, even when the primary passenger’s ticket is paid for with someone else’s miles, has been a no-brainer massive value for anyone who can accept Southwest’s boarding process / lack of assigned seats. However, on a Frequent Miler on the Air broadcast late last year, I said that the value of the Companion Pass has decreased from my perspective. That led me to consider the question: is the Companion Pass still the hands-down best deal in domestic travel? Is it worth pursuing in 2020 and beyond? The answer here will certainly vary, but this post is about why I was questioning it early this year. Of course 2020 has not turned out the way anyone expected and those of us who earned a Companion Pass early this year and expected to get 2 years of use out of it have been disappointed since there has been no extension to our December 2021 expiration date. While that indeed is disappointing, the fact is that I was surprised at the conclusion of this post when I wrote it pre-pandemic and looking back at it and forward to what I expect will be more domestic travel in the coming year or two, the conclusion still holds.

Advantages of Southwest

From the outset, Southwest has some advantages that make it attractive as compared to American, Delta, and United. Flexibility is one of the things I value most highly in travel plans and Southwest offers the ultimate flexibility: tickets can be cancelled up to about 10 minutes before departure for no penalty (I think the closest I’ve ever actually cut this is about 30 minutes before). If you book an award ticket, that means you can cancel up to shortly before departure and immediately get your points back and request a refund of the taxes to your credit card (though you do need to specify that you’d like a refund of the taxes rather than having them held as a credit for future travel). If you booked a cash ticket, you can similarly cancel up until just before departure and you’ll get a credit that is valid for a year from the date of booking. You would need status with the other major carriers to get that kind of flexibility, and even then I’m not sure you can cancel as close to departure without penalty.

One particular advantage of the Companion Pass benefit is that it works on both paid and award tickets. This means that you can add your companion for just the taxes (usually $5.60 one-way within the US, more for international destinations) whether you paid for your ticket on your credit card, you used your Rapid Rewards points, your company bought your ticket, or great aunt Suzy used her Rapid Rewards points to buy your ticket. That’s been a nice deal in two-player mode since you can even use the companion’s rapid rewards points to book a ticket for the primary traveler and then add the companion for free.

A third advantage that could be huge for those who pack heavy is that Southwest includes two free checked bags per passenger. While you might be able to get one free checked bag by having the right credit card with the other airlines, you’ll always get two with Southwest. You’ll also always get a free carry-on — there is no basic economy.

A final strength of the Companion Pass in terms of award travel has long been that it is possible to get a great deal when planning far in advance. While the major loyalty programs have traditionally charged 12,500 miles each way for a domestic economy class ticket, Southwest has long had a more revenue-based program. This has meant that I have scored tickets to fly across the country more than once for fewer than 10,000 points one way. With the Companion Pass, that is less than 5,000 points per passenger. For a transcon flight, that has long been a steal.

Pressure from the big guys

However, what was long a steal just isn’t the same steal anymore. The domestic award travel landscape has changed pretty dramatically over the past year, thanks to the following three things:

- It is possible to book United domestic awards via Turkish Miles & Smiles for 7.5K each way

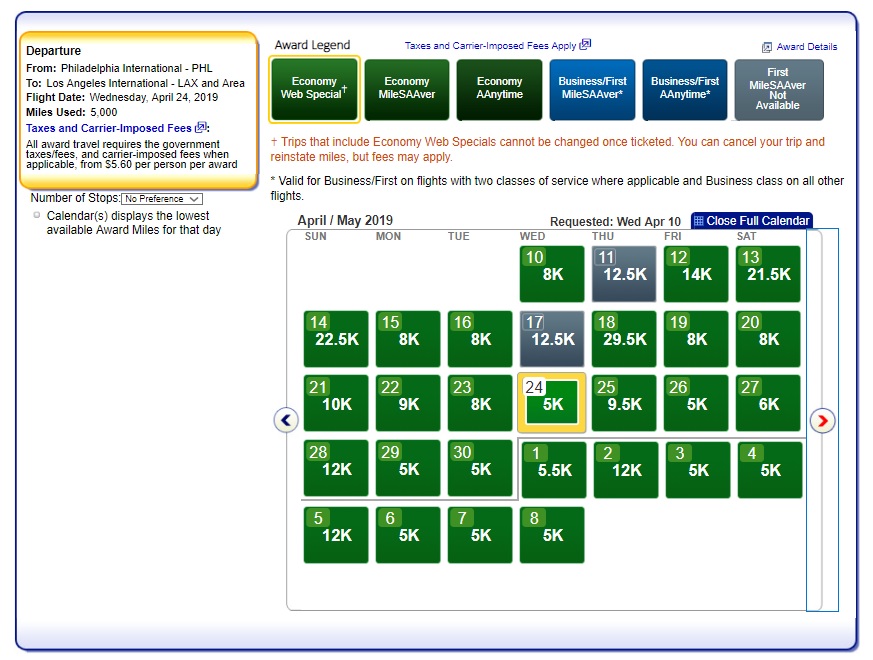

- American Airlines has gone to dynamic pricing with frequent web specials from 5K each way

- Delta has continued dynamic pricing and increased the frequency of flash sales from 10K round trip

Each of these three points comes with its caveats (Turkish can be hard to book, AA web specials can’t be changed, Delta’s best prices are basic economy), but they are hard to ignore. While Southwest enthusiasts will rightly point to the fact that Southwest flights offer predictable value in terms of the number of points required as compared to the cash price (whereas dynamic pricing on the major carriers can be truly dynamic rather than always revenue-based), the fact is that there are now opportunities to book domestic awards for competitive rates on the major carriers and economy class availability can be decent on all three (though of course nearly nonexistent at peak travel times). Add in the fact that close-in travel with Southwest is likely to cost an exorbitant number of points whereas a domestic United saver flight is still the same 7,500 miles plus $5.60 through Turkish whether booked 3 months in advance or 3 days in advance and you have some argument to be made for the major carriers if you want to be able to plan or change flights close to the date of travel.

How useful you find AA’s economy web specials or the Turkish sweet spot will obviously depend on where you’re based and prefer to fly, but the bottom line is that Southwest no longer enjoys the huge advantage in terms of award cost that it once did.

Comparisons

I am no computer programmer. Perhaps someone with the skills to write the right script could somehow scrape all of the necessary data to make a full comparison, but I’m relying on old fashioned searching, much like my more hunt-and-peck style of typing (which I’ll note is a pretty fast hunt-and-peck, but still much less efficient than those who were smart enough to take a keyboarding class back in the day). However, I wanted to make a quick comparison to take a look at the value of the companion pass for travel for two people versus simply being diversified in terms of having points in various programs.

I decided to search from five airports – my “home” airport of Albany, NY (both because this comparison is useful for me personally and because it represents a smaller market that is served by all of the major carriers), New York and Los Angeles because of the fact that they represent two major US markets that are kind of “hubs” for everyone, Chicago because it is both a major market and a hub for both Southwest and United, and Dallas as it is both a major market and a hub for both Southwest and American. I searched a random date a few months in advance (before the pandemic hit) for travel from these cities to three destinations: Orlando, San Francisco, and Omaha. I picked those three destinations in order to have one major destination on each coast and one additional destination somewhere in the middle of the country that is served by all the major carriers to represent domestic travel to/from a smaller or more mid-sized market.

My sample size here is admittedly tiny. I literally searched one date, I intentionally picked a weekday (since I figured I could count on the lowest saver award availability from the major programs) and I didn’t discriminate in terms of the desirability of connections or anything else. I simply wanted to see whether or not Southwest was still competitive considering newly dynamic pricing and the Turkish sweet spot. My expectation as I wrote the paragraphs above was that Southwest might be better in some instances but likely not by much in those instances and that they would be behind in others.

Here are my results for one-way travel in total points for two passengers on the cheapest option with each carrier on a random weekday (examined pre-pandemic). I’ve bolded the cheapest option for two passengers in each instance.

- Albany

- To Orlando

- American: 20,000

- Delta: 13,000

- Southwest: 6,863

- United: 15,000 miles (via Turkish or 20K via LifeMiles)

- To San Francisco

- American: 20,000

- Delta: 27,000

- Southwest: 12,480

- United: 15,000 (via Turkish, 27K via LifeMiles)

- To Omaha

- American: 20,000

- Delta: 23,000

- Southwest: 10,594

- United: 15,000 (via Turkish, 20K via LifeMiles)

- To Orlando

- New York City

- To Orlando

- American: 12,000

- Delta: 9,000

- Southwest: 6,168

- United: 15,000 + $11.20 19K via United)

- To San Francisco

- American: 12,000

- Delta: 18,000

- Southwest: 8,490

- United: 15,000 (via Turkish or 25K via United)

- To Omaha

- American: 12,000

- Delta: 22,000

- Southwest: 6,168 + $11.20

- United: 15,000 (via Turkish or 20K via LifeMiles)

- To Orlando

- Chicago

- To Orlando

- American: 12,000

- Delta: 10,000

- Southwest: 5,630

- United: 15,000 (via LifeMiles)

- To San Francisco

- American: 16,000

- Delta: 16,000

- Southwest: 6,863

- United: 15,000 (via Turkish or 25K via United)

- To Omaha

- American: 20,000

- Delta: 15,000

- Southwest: 7,184

- United: 15,000 (via LifeMiles)

- To Orlando

- Dallas

- To Orlando

- American: 20,000

- Delta: 10,000

- Southwest: 5,992

- United: 15,000 (via Turkish or 20,000 via LifeMiles)

- To San Francisco

- American: 12,000

- Delta: 14,000

- Southwest: 6,095

- United: 15,000 (via Turkish or 25K via United)

- To Omaha

- American: 20,000

- Delta: 14,000

- Southwest: 6,821

- United: 15,000 (via LifeMiles)

- To Orlando

- Los Angeles

- To Orlando

- American: 20,000

- Delta: 20,000

- Southwest: 14,077

- United: 15,000 (via Turkish or 25K via United)

- To San Francisco

- American: 10,000

- Delta: 9,000

- Southwest: 3,235

- United: 13,000 (via LifeMiles)

- To Omaha

- American: 25,000

- Delta: 13,000

- Southwest: 7,546

- United: 15,000 (via Turkish or 25K via United)

- To Orlando

That result surprised me. I expected Southwest to ring in better in a few instances. I did not expect Southwest to win every one of those searches, nor did I expect the margins in some cases even though I knew I was searching a weekday in a non-peak travel season. Again, I did that on purpose as I thought it would give an advantage to the major carriers. Saver availability is often harder to come by during peak summer travel dates or school breaks; I thought that by choosing an off-peak date, the major carriers would have a greater opportunity to return a cent-per-mile rate that would be closer to Southwest than it turned out to be.

What do the results of the above mean?

I’m not sure they mean a ton for everyone. Again, the sample size was pretty small. However, I still find it very intriguing that Southwest came out on top every single time. Before running the above searches, I had been convincing myself that perhaps the Companion Pass isn’t so important to me now that I can fly on United for 7,500 miles anywhere in the US (pending UA saver availability) and now that I’ve seen cheap web specials from both AA and Delta pretty regularly. I was questioning whether or not I would continue to pursue the points for the Companion Pass and when I sat down to write this post I expected to convince myself that the Companion Pass didn’t really matter much to me. For me, the opposite happened: the results confirm for me that the Companion Pass is still a worthwhile pursuit and for many people and situations may still be the best deal in domestic travel.

Unfortunately, the new cardmember bonuses on the personal cards have been at a low point for while now, making the Companion Pass a bit harder to achieve through two welcome bonuses, which has been the traditionally easy path to the necessary points.

However, this year the Companion Pass requires fewer points in response to the COVID-19 pandemic: Southwest is giving everyone credit for 25,000 points toward the Companion Pass, meaning that a member needs to earn an additional 100,000 points during 2020 to have a Companion Pass through the end of 2021.

Each member is now limited to a single personal card every 24 months (Update: As pointed out by YoniPDX in the comments, the terms on the business card applications only preclude you from the bonus if you have had that particular card before. This means that for those under 5/24, it should theoretically be possible to get two business cards to earn the Companion Pass as long as you apply for two different products (i.e. the Premier business and the Performance business). That said, the bonus on the Southwest Performance Business Card has been high enough during 2020 to earn the pass with just the welcome bonus from that card alone — though it’ll require a lot of spend. See more detail below.

Alternatively you could open one business and one personal card. Typically, the best time to apply is from late fall into early in the new year since it gives you the opportunity to meet minimum spending requirements (and therefore earn the new cardmember bonuses) early in the year, the purpose being to accumulate the necessary points as early as possible in order to have the Companion Pass for as long as possible (if you earned the new normal requirement of 125K points in January, you’d have the pass for nearly 2 years since it is valid for the rest of the calendar year in which it is earned and the entire following year). But if you picked up one card already this year and find yourself within a reasonable distance of earning the pass thanks to one big welcome bonus, keep in mind that you can fill the gap via purchases, via the shopping portal, via referrals, or via points earned from flying Southwest when travel resumes (See our Southwest Companion Pass Complete Guide for more in each of the above). Note that you do need to be under 5/24 to get approved for a new Southwest card — and if you’re starting from zero, you would be better off waiting until the end of 2020 to apply so that you can earn a pass early in 2021 that will be valid until the end of 2022. Timing is everything.

For more information about the Southwest credit cards, click any of the card names below to go to our dedicated pages for those cards.

| Card Offer |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $533 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$99 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

ⓘ $483 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 50K points after $1K spend in the first 3 months$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) |

ⓘ $403 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$229 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

Bottom line

Southwest is no longer a runaway winner for value. It might be great and certainly can still be a great value, but dynamic pricing and cheap partner awards on the major carriers has put pressure on Southwest. A newly increased 125K requirement doesn’t help, though flights to Hawaii perhaps do. <–That was the conclusion I wrote at the outset expecting that Southwest would not turn out to be the best value in all of my searches. I got a laugh when I got to the end of this post with a completely different conclusion than I expected. The bottom line for me is that I did go after the Companion Pass for 2020/2021 after all — in my case through a combination of referral points and spend. With Southwest ringing in as far below the others in my test searches, I stand to save even more when adding a third passenger now that my son has passed his second birthday, so you’ll still mostly find me on Southwest domestically in the coming years.

[…] Given the high anticipated demand for domestic travel in the summer of 2021, I wanted to revisit my 2020 comparison to answer the question, “Is the Southwest Companion Pass still worth it in 2021?”. The […]

Do you expect ways to get the SW companion pass through card sign ups to continue into 2021-2022

I don’t have any reason to suspect they won’t. They just this year increased the requirement in terms of the number of points (from 110K in previous years to 125K this year) and they’ve not only offered it for years but made it easier several times (with an offer last year that gave away a 1-year Companion Pass as part of the welcome bonus and an offer on one of the business cards right now that provides enough points for the companion pass after meeting minimum spend on one credit card rather than two). It seems to me that they’ve been making this path easier, so it doesn’t appear that this is something Southwest is looking to discourage. Of course, I have no crystal ball, so I’m making an educated guess.

I am new to the SW companion pass – and applied for business and personal card (110,000 bonus pts.) in December of 2019 in the hopes of getting a 2020-21 companion pass (125,000 pts.). I started spending for the min. spending requirement and put some fairly large charges on it in Dec. – only to discover that those pts. posted in my account in Dec. and that my pts. towards companion pass have started over on Jan.1 So although I will get the bonuses in 2020, I have even more to spend toward the requirement (11,000 approx. instead of 9,000 more). Is this new? Because all the strategies I heard about getting the pass were to get the cards in the fall (Oct. Nov.) to spend and then acquire the companion pass in Jan. utilizing it for almost two full years. If I had known I would have waited to put big charges on in January. It’s not a big deal but will take me longer to get to Companion Pass and therefore having it for less time. I am just curious if anyone knows more about this.

Oh no! I’m very sorry to hear that. The strategy has long been to open the cards any time after October 1st and then to wait until January 1st to meet the spending requirements. In fact, I have always advised those who can make the necessary purchases within a short time period to wait until January to spend on the cards at all for two reasons: the first is your situation — points that won’t help you reach the pass will post early (you need to earn all the points you need to qualify for the pass in the same calendar year). Second, if your card was subject to fraudulent purchases or even a merchant mistake where you were overcharged, you run the risk of crossing over the spend threshold early and having a sign up bonus post in December. I’d always rather not do the spend until January.

As you have found, points post to your Southwest account when your statement cuts. Just as you knew that completing the spending requirement in January would mean that the welcome bonus points would post with your January statement, any spend you did before your December statement cut date naturally posted to your Southwest account in December. The good news is it sounds like you did not spend enough to meet the requirement to trigger the intro bonus on one card early — that could have been a much bigger issue. While meeting the extra $2K in spend is obviously a hassle, it is less of a catastrophe than finding yourself suddenly 60,000+ points short.

Note also that in the past, the Companion Pass only required 110,000 points earned in a calendar year and it was not uncommon to be able to get two cards with 60,000-point bonuses or one with a 60,000-point bonus and one with a 50,000-point bonus, so your situation of having spent some early wouldn’t have made a difference as long as you didn’t finish the spending requirement until January since the bonuses alone were enough to earn the pass (though for the reasons stated above, I’ve always been wary of that approach). Nowadays since the bonuses have not been enough to reach the pass threshold on their own for a while (unless you do two business cards), you are absolutely correct that when you complete that spend is quite important.

Yes thank you for your reply. That is interesting – I did not get that little part about opening the cards but then doing the spending in January or at least after Dec. statement – but probably as you say, things have changed a bit, since before you could get the pass with the bonuses from the two cards alone with less extra spending and so when you started spending was less important than when you finished the required amount and those bonuses posted. Oh well – thank you that helps me to understand the process and next time I’ll know! And you’re right — better to be couple thousand down that being out an entire bonus. I also wished I had searched out an ad for a 50,000 bonus on the personal card (at airports?) that would have saved me a lot of time. As I said, I am new to all of this and the only way to learn is by wading in and figuring it out.

Nick-

How does this logic sound… wasn’t sure if there are any datapoints on self referrals as well as applying for personal and biz in same month (as well as the application order).

I was planning to do the following:

Get an inflight 50k personal signup link (2k min spend)

After approval do self referral for performance biz (10k self referral points)

Do 70k biz signup (5k min spend)

Assuming there aren’t any issues, this would yield 137k points and the pass. Worst case I could drop the self referral and still be 127k.

Absolute huge proponent of the companion pass since we live in the DC area. Been enjoying the benefit since 2013, probably 50+ roundtrips. Would love to lock in for another 2 years.

I’m new here. I have the SW Companion Pass for 2019 & now 2020, wondering about the future and getting the wife a Companion Pass for 20 & 21 or delaying until the end of 2020 and getting the points to land in Jan/Feb of 2021 to maximize the use of the pass into 2022. She’s got the room in the 5/24 rules and a Business account for the cards but we’re concerned about rule changes and reduced sign on bonuses.

So I’m wondering what people might think about Southwest’s Future plans. They’ve already raised the required points to get the pass and lowered some of the sign on bonuses. Should we wait until we can get a 21 & 2022 Pass or get the Pass now and just have an overlap for this year. Reading Tea Leaves and Crystal Balls can be difficult.

My husband and I have loved the Companion Pass. There is nothing better than a quick nonstop hop to LAX in the winter for a quick getaway. From SLC, it’s usually 9K-11K round trip, so for 2 people it has been a steal. We have even done a day trip. We enjoy the food and sun without planning a bigger trip, and those prices are over the weekend.

Everything stated here is true, but I’d note that perhaps the most important factor to consider is how much WN service you have from your home airport. If WN is not already your best airline option, you probably won’t use a companion pass very often. I’d also note that if you live near an airport served by Frontier, you can often buy domestic airfares for a tiny percentage of the cost of a WN ticket. The service isn’t as good as WN, but it’s a much better deal.

I think a valuable and perhaps an overlooked sweet spot of the SW CP is SW’s Caribbean and Central America footprint.

While in 2020 we will use the CP much less now with the recent passing of my Dad which was not part of my orginal plan when slating getting a CP, but my kid sister – is likely getting married after she and her fiance grad from college as we do have other relatives out here on the west coast, as well as Family in HI (but we also have a pair of AS CPs).

But now considering using the CP in 2021 primarily for Aruba, PR and/or other Caribbean/Central America travels during the Winter/Fall- I do think that a SW CP is truly YMMV depending on if your home hub has ample SW flights.

Nick, I used to agree and did the Companion Pass option years ago. But stopped after 5/24 – running the numbers it no longer made sense. As you show, WN awards are low enough to simply MS any points needed. For example, MSing via Freedom Unlimited 1.5x effectively costs ~$15 for every 10K points using easily available, year-round methods (options to earn negative-cost points also widely available, but only during promotional periods). Yes, some time and gas to cash out, but for those who do regular MS, such activities slide right in.

As such, I don’t find saving ~$10 in points a few times a year worth the opportunity cost of staying under 5/24. Plus I don’t have to worry about who is flying and can book cheap tickets for anyone. I’d rather have a stash of URs available than be locked in to one program anyway. When I had the Companion Pass, I took flights I’d otherwise book on other airlines because I felt compelled to maximize value. Life is more flexible without it, and not worrying about 5/24 has allowed me to take advantage of offers whenever they pop up.

MSer

Take a look @ Chase United card if ur worried about 5/24 got mine today .No fee will go for 65K in the 6 month $10k spend . SW $149 P card pays for itself (4x A-1-15 seats)too.

CHEERs

Great article, Nick. I’ve had CP almost continuously via 2 player mode since 2015 and we’ve used it over 20 times, including 8 to Mexico. Being able to change your companion 3 times per year has been nice too. This year I flew with 2 different companions within 1 week which was awesome.

Even *IF* say, United was cheaper than SWA in terms of points, it would still be the loser thanks to the crappy quality of seat (3 inches smaller than SWA) and horrible service all around. Not to mention trying to stuff your baggage in the overhead bins, slowing down the boarding/deplaning process and everyone is generally grumpier as well. SWA for domestic all day long.

Great analysis! You confirmed my disposition to go forward for 2020 companion pass.

Flexibility to cancel or change in air travel is the biggest advantage. It’s almost what the word location means in real estate. I cringe every time I’m forced to make a change with other airlines resulting in a huge penalty or a couple of throwaway tickets.

Great article! Given that any change is going to make the other airlines’ tickets throwaway tickets (except for maybe AA which allow cancellation of multiple tickets purchased together for a lower cost), that is going to make the comparison even better for Southwest. To me that flexibility is worth at least another 0.5-1 cent per point!

Interesting data. Surprising to me as well. I wonder how this would change on a weekend. WN at least from where I live (ORD/MDW) is usually considerably cheaper T/W/Sat than other days. More so I believe than its competitors.

Of course, it all depends on how often you fly with another specific person and also how much/little that second ticket would be if you had to buy/redeem for it. The actual money/points/miles saved over the course of a year is often less than anticipated. Traveling 3 RTs a year for me from MDW saving $100 each way with a CP is $600. Nice, but not life-changing. Free hotel nights from Hyatt, Surpass, Radisson, etc. from using their cards have value also. It’s a common occurrence that people overestimate how much they will actually use a CP.

CP value relative to the alternatives gets maxed out for a party of two. For any other number, it can change the proposition a lot.

And many posters in the WN forum at Flyertalk are noting that for cash tickets, WN seems to be slipping behind its competitors compared to some years ago. Some note that increasingly, buying two tickets on another airline can cost less than 1 plus CP. And WN seems to be selling out of WGA fares earlier than it has historically.

Another factor at play is the ease of MS now. We can go for more things these days than we used to be able to. Why not do it all?

But I like WN a lot. I agree that if you have the 5/24 situation in hand, can qualify for a business WN card, live in a WN city, have someone to serve as a Companion, and are ok with economy, it’s very likely to be worth using the 2 CC method to get the CP.

There are so many factors at play, though. It sure isn’t one-size-fits-all. Everyone needs to think through a lot of things to maximize.

yep, low WGA fares haven’t come around that often & not available long enough comparing to yr. ago; of course, they were gone quickly if not checking it often; in fact, noted the flights to & from popular dest like LAS, LAX had some empty seats at the desired / peak time comparing to a full flight of last yr

@Nick Reyes –

“…each member is now limited to a single personal card and a single business card every 24 months, which means that the easiest path to the pass is via one of each card.”

Is this a recent change, since October? Player 2 app’d the Performance biz at 80K last Oct, and we have about 2 weeks left to finish off MSR, was planning to have P2 app another Biz card, to save a 5/24 spot. Any DP on this IIRC the business card verbiage was per card.

I was wondering that as well. I got both business cards late last year. I should have 80,000 points post early in January and another 70,000 post within the next month or so once I do the $3,000 spend.

Joseph, 80k bonus from the perf. biz cc, butt a 70k bonus from which biz cc?? if u meant the premier biz cc, isn’t its bonus for 60k pts?

You are correct. It is 60k.

I’d like to know the same thing. Other posts say you can have multiple biz cards. Please Advise

I edited this a couple of hours ago. Looks like Yoni is right. See the post for the update above. Thanks, Yoni!

So I’m confused. CAN one have two business cards at the same time and get bonuses for both, or only one business and one personal?