NOTICE: This post references card features that have changed, expired, or are not currently available

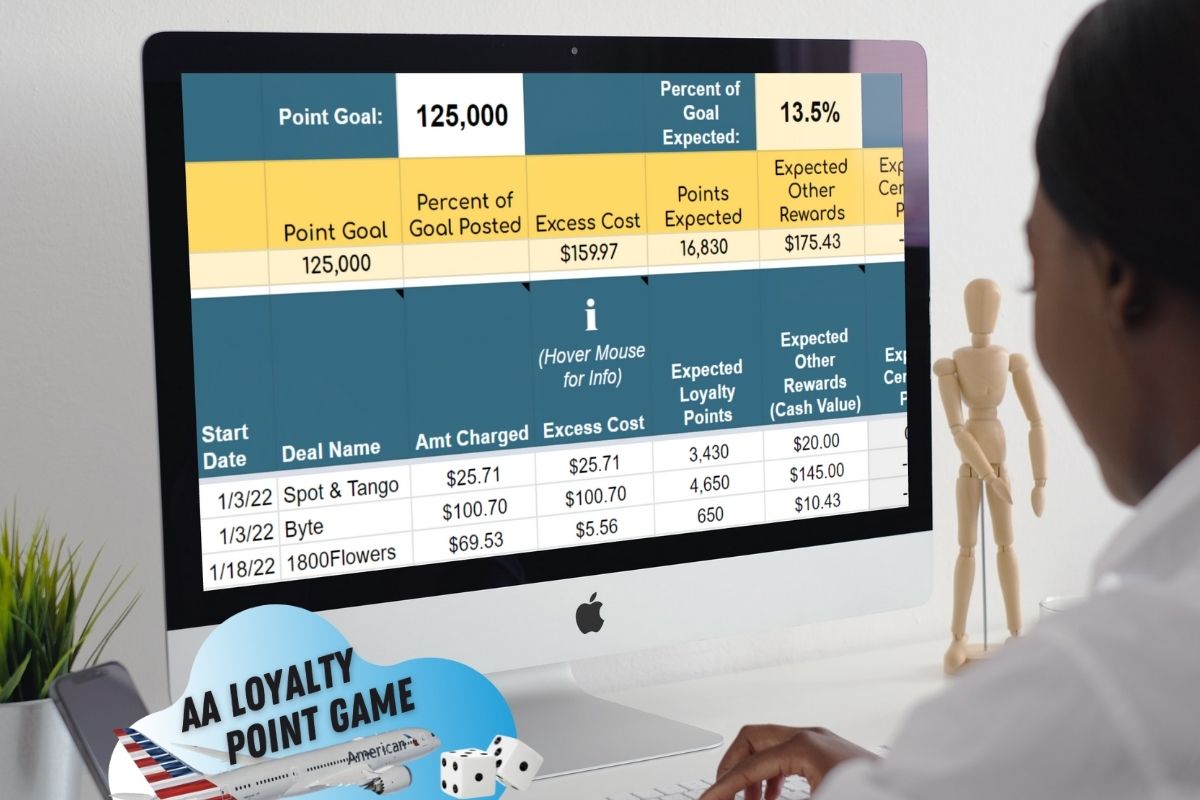

Are you playing the AA Loyalty Point Game? If so, you’ll want to grab a copy of our AA Loyalty Game Scorecard. The AA Loyalty Point game is all about earning high level American Airlines elite status without flying. The goal is to earn AA Loyalty Points as cheaply as possible. Your reward? The fun of the hunt, elite status bragging rights, a better experience when flying AA or partner airlines, and lots of redeemable AA miles for free flights. For complete details, see: AA’s Loyalty Point Pursuit game.

The hardest part of the AA Loyalty Game is finding the best deals. Fortunately, we’ve made that part easy. We publish many deals as independent posts, but even better, we catalog all of the best deals in our AA Loyalty Game Cheat Sheet. The cheat sheet includes a list of easy to do deals, tips for stacking deals, and a list of deals that should be avoided.

The second hardest part of the game is keeping track of the deals and your progress to-date. That’s where this Google Sheets Scorecard comes in!

–> Click here to get your own copy of the Scorecard <–

How to use the Scorecard

1) Create your own copy

When you click the link in this post for the Scorecard, Google Sheets will ask you if you would like to make a copy. Click the “Make a copy” button. You do need to be logged into Google to do this.

2) Name your Scorecard

Your copy of the Scorecard will initially be named “Copy of AA Loyalty Game Scorecard”. I recommend naming it something personal. For example, my personal copy is “Greg’s AA Scorecard”.

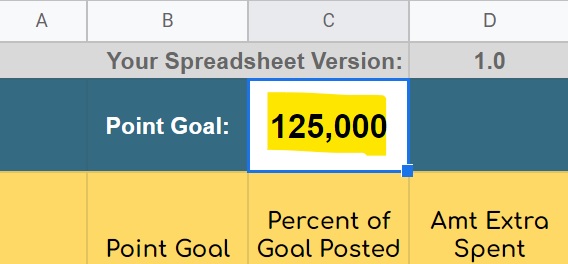

3) Set a goal

How many Loyalty Points do you want to earn during the elite year? Put that number into the Point Goal as shown above. The current elite-earning year ends Feb 28, 2023. Keep in mind the following AA requirements for elite status:

- Gold: 30,000 Loyalty Points

Primary benefits: OneWorld Ruby, free upgrades on short flights (<= 500 miles), 40% mileage bonus, complimentary Main Cabin Extra Seats at check-in, complimentary Preferred Seats, 1 free checked bag. - Platinum: 75,000 Loyalty Points

Primary benefits: OneWorld Sapphire, free upgrades on short flights (<= 500 miles), 48-hour upgrade window, 60% mileage bonus, Complimentary Main Cabin Extra and Preferred Seats, 2 free checked bags - Platinum Pro: 125,000 Loyalty Points

Primary benefits: OneWorld Emerald, complimentary upgrades on American and Alaska Airlines, 72-hour upgrade window, 80% mileage bonus, Complimentary Main Cabin Extra and Preferred Seats, 3 free checked bags, 1 Loyalty Choice Award (if you also complete 30+ AA flight segments). - Executive Platinum: 200,000 Loyalty Points

Primary benefits: OneWorld Emerald, complimentary upgrades on American and Alaska Airlines, 100-hour upgrade window, 120% mileage bonus, Complimentary Main Cabin Extra and Preferred Seats, 3 free checked bags, 2 Loyalty Choice Awards (if you also complete 30+ AA flight segments).

4) Input deals

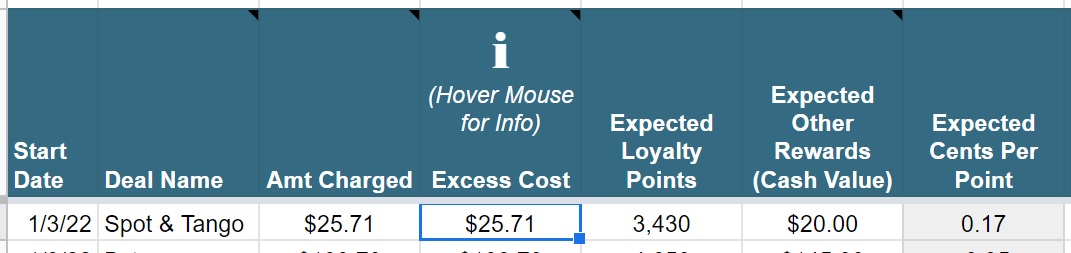

As you participate in deals that will hopefully earn AA Loyalty Points, enter each deal into a new row in your sheet. Here is how to fill in each column:

- Start Date: This is the date that you first initiated the deal. e.g. if you clicked through a portal to buy something, enter the date when you clicked through and made the purchase.

- Deal Name: Enter whatever name you want that will help you remember the deal. I like to use the merchant name.

- Amt Charged: How much (if anything) was or will be charged to your credit card? Note that if you purchased a repeating subscription and plan to pay for multiple weeks or months, then enter the total amount you’ll pay altogether.

- Excess Cost: This is one of the most important things to enter, but it’s also potentially the most confusing. The idea of this cell is to enter the amount you paid (or will pay) that exceeds what you otherwise would have spent if you weren’t pursuing AA elite status. This column represents your best estimate of your cost of playing the game. Examples:

- If you bought something you don’t want for the sole purpose of earning points, then put the full purchase price into this cell. For example, I spent $25.71 for dogfood that I don’t want or need, so I put the full purchase price in the cell.

- If you bought something you do want, but you paid more in order to earn points, then put the price difference in this cell. For example, if you did want dog food, but you could have bought it locally for less, put only the price difference here (an estimate is fine).

- Opportunity cost: If you earned AA miles + Loyalty Points but you could just as easily have earned cash back or other rewards, then put the amount you would have earned here. For example, I clicked through the AA eShopping portal instead of a cash back portal to order flowers and so I put the amount of cash back I gave up here. Do not add together opportunity cost with either of the real costs described above. Pick whichever is most relevant to your situation. In general, you should only apply an opportunity cost for something you were going to buy anyway and where you had an equal opportunity to earn AA miles or other rewards.

- Expected Loyalty Points: Enter the number of Loyalty Point qualifying AA miles you expect to earn from this deal. For example, with the Spot & Tango deal, I expected to earn 2,500 miles from AA eShopping and 930 miles from SimplyMiles. Rather than calculate the total separately, you can let the spreadsheet do the work for you by entering the following: =2500+930 [the equal sign tells the spreadsheet that you are entering a formula].

- Expected Other Rewards: Many deals involve earning other rewards in addition to AA miles. For example, with the Spot & Tango deal I was able to stack a Citi Merchant Offer of $20 back so I put $20 into this cell. If you earn multiple other rewards from a single deal, add the cash equivalent values together.

The next cell, Expected Cents Per Point is automatically calculated for you. This is simply your Excess Cost divided by the number of Loyalty Point qualifying AA miles you expect to earn. As a rule, I like this number to be less than 1.0.

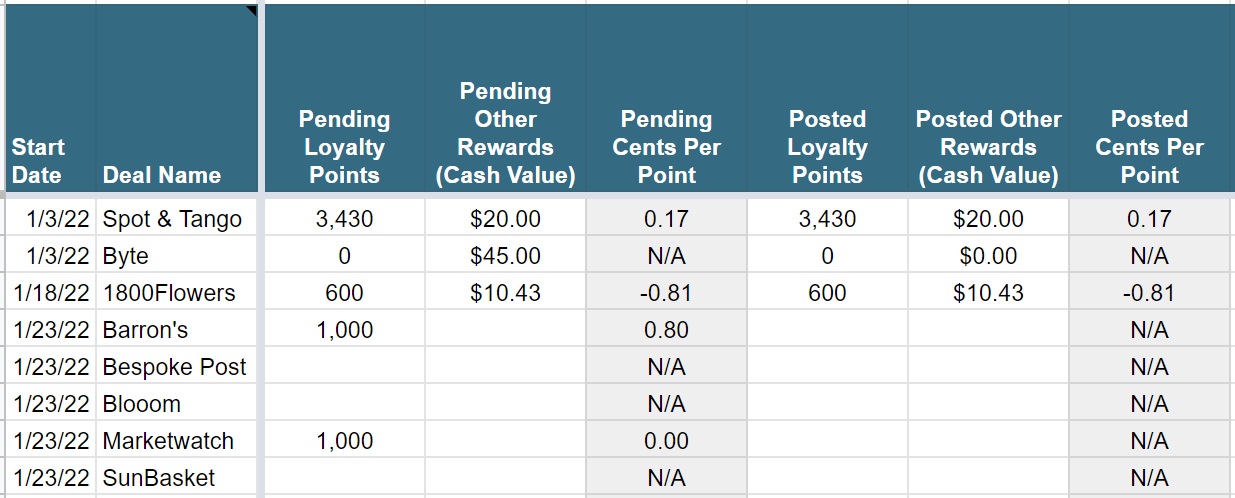

5) Track deals from Pending to Posted

After you initiate a deal, it’s important to keep track of what works and what doesn’t. In some cases you may have to contact a rewards issuer for help if you don’t earn the rewards you expected. The next sets of columns are for tracking “pending” points and other rewards, and “posted” points and other rewards.

“Pending” is, for example, where a portal (or other rewards issuer) shows that a purchase was tracked but the rewards (AA miles, for example) haven’t yet posted to your account. Often you’ll get an email from a portal telling you that a purchase has tracked. You can then update the “Pending Loyalty Points” or “Pending Other Rewards” column for that deal. Note that sometimes the amount pending will be different from what you expected. For example, with a 1-800-Flowers purchase I made, I expected 650 miles, but the email from the portal said 600 miles. That’s not enough of a difference for me to throw a fit, so I simply entered “600” into the “Pending Loyalty Points” column. With portals and card linked offers like SimplyMiles you can log in and check your account to see which rewards are pending.

“Posted” is where the rewards have really been delivered. For example, if you see that AA miles have been added to your American Airlines account, then that means that those miles have posted.

It’s not unusual for some deals to take several days or even weeks before they’re pending, and to take even longer (months, sometimes) to go from pending to posted. Check your spreadsheet regularly to see what rewards you’re still waiting for and then log into the appropriate system to check for your points and other rewards.

6) View summary information

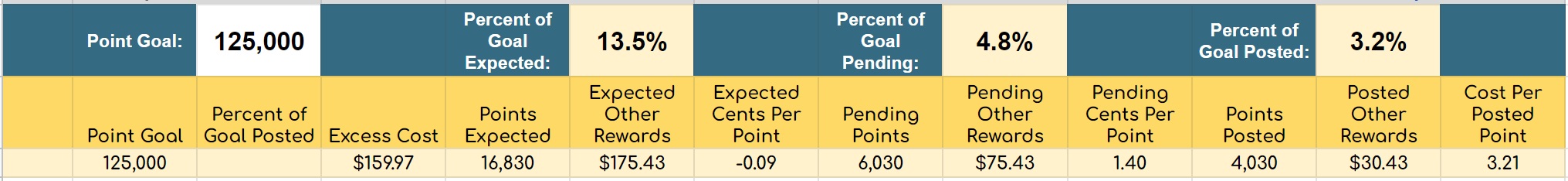

At the top of your spreadsheet you’ll always see summary information. Above is my summary as of the date of this writing. On the top row, I can see that if everything pays out, I’ll be 13.5% of the way towards my 125,000 point goal. For now, though, based on miles actually deposited into my AA account, I’m only 3.2% of the way there.

Two rows lower, you can see that, so far, this game has cost me $159.97, but if all goes well, I’ll get nearly 17,000 Loyalty Point qualifying AA miles and over $175 back. That would be awesome! Unfortunately, $100 of the expected cash back is from the Byte deal which doesn’t look likely to pay out. We’ll see.

Conclusion

The AA Loyalty Game Scorecard is a tool I put together to help you track your progress towards earning AA elite status without flying. In the comments below, let me know what you think and what future enhancements you’d like to see.

See also:

- AA’s Loyalty Point Pursuit game

- How to earn American Airlines Loyalty Points without flying [Cheat Sheet]

You better be careful creating something to track AA miles they may send you a cease and desist letter 🙂

Lol. I hope not!

Whats the 1800Flower deal? $10 reward

That was just me using the portal for a purchase I would have made anyway

@Greg – I will probably continue to tweak it, but do you have any interest in a modified version of your scorecard?

Right now I have a custom AppsScript so the only action (after entering the initial details) is adjusting the fill color of a cell to change things from pending to posted, etc. Ive also broken out SM/eShopping/Citi/other portal as that seems to be a common request and tracking individually can be useful.

I might be tapping out soon if merchants/banks do not hold up their end here…between Byte, Just for Dogs, Sun basket, etc. the headache is growing…Earning loyalty on AA is starting to feel just like flying AA.

Thanks for the tool! I’ve been thinking about the opportunity cost and I think simply entering the amount you would have earned in cash back is overstating the “cost” per point because it assumes you don’t value the redeemable AA mile that you earn at all.

So, let’s say I spend $100 at a retailer where I could have earned 4x miles through the AA portal or 6% cashback. The way it is explained now would mean that my opportunity cost was $6 or $0.06 per point. However, if I value a redeemable AA mile at $0.014 per mile, then I am earning a rebate of 4 x $0.014 x $100 = $5.60, meaning that my opportunity cost to earn 100 AA Loyalty Points is actually only $0.40 or $0.004 per point.

Or to take it even one more step, if my choice is between earning an AA mile or an Amex point through Rakuten, then my opportunity cost is just the difference in how I value those two currencies.

Does that make sense?

It does make sense, but I don’t think of it that way. By entering in either your true costs or opportunity costs, the spreadsheet tallies up how much you spent in earning these Loyalty Point qualifying miles. So then the cost per point (cpp) is that cost divided by the number of loyalty point qualifying miles you earned. The fact that you can also get value by redeeming those miles is just something to keep in mind when determining if you got a good cpp. For example, if your costs lead to 1.2 cent cpp but you value (i.e. would be willing to buy) AA redeemable miles at 1.4 cents each, then obviously you did really well. For me, my target is 1 cent per point where a “point” is the combination of both a loyalty point and a redeemable mile. The only time I’d account for AA redeemable miles separately is when they don’t come with loyalty points. That happens, for example, with a portal seasonal bonus. In that case, just estimate the cash value of those AA miles and enter it in the “other rewards” column

I see what you’re saying. So, if I wanted to quantify the benefit of the redeemable miles, I would enter it into the other rewards category to offset the opportunity cost. That makes sense. I think in the end we are just trying to answer the question of how much we are paying for elite status, so it does make sense to deduct the value of the redeemable miles.

This is great. I also have started taking a screenshot of the terms, the popup that shows I am tracking, and the popup that says congratulations (have to be quick, they fade away quickly). Since most of these purchases I wouldn’t have made if it weren’t for this game, and its not possible to return meal kits, wine, and motley fool, I want to make sure I get the points promised.

For tracking purposes it would be useful to split out the source of the points – e.g. AAdvantage Shopping vs. Simply Miles. Probably easiest to do it with multiple columns since some line items will have points coming from multiple sources.

You could always add additional columns to the right on your copy of the sheet for tracking particulars like that. Since there are many potential sources of points, I didn’t want to flood the sheet with columns.

Yes, that’s what I’ve done! I just have SimplyMiles, AAdvantage Shopping, Hyatt and “Other” since I only anticipate having three main sources.

What are you considering to be pending vs. posted? It seems that AAdvantage Shopping seems to list things as “pending” even after the activity has shown up in my AAdvantage account. I assume this is because they could still claw back the points?

Greg I am so impressed. I wonder if it’s possible to put a multiplier under Expected Loyalty Points and Expected Other Rewards to account for the possibility that some of these deals won’t make (for various reasons). Some of these deals are sure things (100%) but some of them are quite dicey (50% or less). It seems inaccurate to value them both the same (at least, until the points are actually awarded).

Interesting idea. Any thoughts on how one could display that so that it’s intuitive?

Whoo– I’m not a whiz at spreadsheets. Perhaps put a column to the right of both sections labeled “Risk Factor” and have the value pre-loaded at 0%. The next column would say “Adjusted Expected …” and be equal to the original expected value x 1/(risk factor).

Sorry- original expected value x 1 MINUS (risk factor)

We tracking flights in here too?

I wasn’t planning to, but I guess you could. I don’t really want to complicate the sheet by adding columns that are tuned towards tracking flight mileage

I noticed something interesting on the AA hotel site the other day (which is a white-label version of booking.com). Only one hotel showed up that actually offered AA points, 7k points for a $560 booking.

However, there was a second rate for the same room which was $280 higher and offered 21k points. The hotel had various rooms available and each one had a second offer which was always $280 higher for 14k additional points.

Assuming these are loyalty points it looks like AA is straight-up selling them for 2 cents each when combined with a hotel booking.

When I went back to book the next day, btw, the hotel was no longer offering AA miles at all — none of the hotels were. That was on day-of-arrival.

Not suggesting paying 2 cents but interesting to note that it establishes a price of $2410 or so for Platinum Pro.

Interesting find!

Is there somewhere on the AA website that you can tracking loyalty points? I have made a few purchases through the portal and don’t see anything about progress towards status.

The loyalty point tracker is supposed to appear in March (once the current EQ-X system is retired) and should at that point reflect all your January /. February activity.

Thanks!

Also, in most cases (like points awarded from the portal or SimplyMiles), any miles that show up in your AA activity as “base miles” will/should post as loyalty points

is there a separate column on the card for “clawed back” or do you just back out those miles/loyalty points and leave the costs incurred?

Just back them out and add a note in the note column.