NOTICE: This post references card features that have changed, expired, or are not currently available

Update 4/25: The 75,000 point offer is back up-and-running via referral links (h/t: DOC). We’ve updated the Best Offer Page accordingly and left the public 60,000 point offer up as an alternate offer. How long the 75,000 point will remain available via referral is anyone’s guess.

The 75,000 point bonus on the Chase World of Hyatt Business card is going away as of 4pm ET tomorrow. This has been the public offer since the card was launched last year and is quite generous in comparison to the personal card’s current 45k bonus. I got the card earlier this year as I can easily use the twice-yearly $50 credits and I value the ability to manufacture 1 elite night per 2k in spend. For those interested, we’re republishing Nick’s original review here.

If you’re just looking for Hyatt points, don’t forget about the bonuses on the Chase Ink Business Preferred, Ink Business Unlimited and the Ink Cash cards, as Hyatt is a 1-1 transfer partner with Chase Ultimate Rewards.

Today World of Hyatt and Chase have announced a brand new World of Hyatt Business Credit Card. I was ready for Chase and Hyatt to serve up a decadent delight of a luxury card that would demand indulgence and so my first reaction was disappointment when I sunk my teeth into what initially tasted like a nothingburger in the announcement of the business card. However, after attending the launch event in New York City yesterday and having some time to digest the changes, I realize this card may be a great fit for big spenders who want a (slightly) easier path to status — and especially for those small business owners who plan to redeem a lot of Hyatt points. This card won’t offer the most points per dollar of spend, but the benefits may make it more valuable for some.

New Card Details & High-Level Summary

| Card Offer and Details |

|---|

ⓘ $816 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K after $5,000 spend in the first 3 months.$199 Annual Fee This card is subject to Chase's 5/24 rule. Recent better offer: 60K points after $5K in the first 3 months + Category 1-4 Free Night Certificate after $15K total in the first 6 months. (Expired 3/6/25) FM Mini Review: Great for its initial welcome offer and for Hyatt enthusiasts to spend toward status and rebate on award stays. Earning rate: 2X on fitness clubs and gym memberships ✦ 2X in the top 3 spend categories each calendar quarter. Eligible categories include dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping ✦ 4X Hyatt and Mr & Mrs Smith Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Get 5 elite qualifying night credits every time you spend $10,000 in purchases. ✦ After $50K spend in a calendar year, get 10% back on redeemed points for the rest of that calendar year (Up to 20K points back per year). Noteworthy perks: Discoverist elite status ✦ Ability to gift Discoverist to up to 5 employees (they do not need to be cardholders) ✦ Up to $100 each cardmember year in Hyatt statement credits: Spend $50 or more at any Hyatt property and get a $50 statement credit up to two times per year ✦ Hyatt Leverage membership with no minimum stay requirements. ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit |

The card comes with a reasonably strong welcome bonus of 75K points. Beyond that bonus, the key benefits of the card are:

- An “adaptive” 2x that rewards you for the three categories in which you spend the most each calendar quarter through 12/31/22 (and then top two categories thereafter).

- 5 elite night credits with each $10K spend

- 10% back on redeemed points after spending $50K in a calendar year (Up to 20K points back per year). Note that the rebate kicks in on stays completed after reaching $50K in purchases.

- Up to $100 in Hyatt credits: Spend $50 or more at any Hyatt property in the world and get a $50 statement credit up to twice per cardmember year.

- Discoverist status for the cardholder and the ability to gift that status to 5 employees (those employees do not have to be employee cardholders)

Many will notice that this card does not come with an annual free night certificate or annual elite night credits. That certainly differentiates it from the consumer card. Note that you can have both the consumer and small business versions of the card if you qualify / are approved by Chase.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Analysis

Update: We are now told that there is a cap of just 20,000 points back per calendar year. That is surprisingly low and changes the analysis significantly. A further update to this post is coming.

At the outset, I was underwhelmed by this card’s bonus categories and disappointed that it lacks a free night certificate or automatic annual elite night credits. It has an innovative-ish adaptive bonus category system where you automatically earn a bonus in the three categories in which you spend the most each quarter for the first year and then only the two categories in which you spend the most thereafter. I call this only innovative-“ish” because Citi stole the thunder on that idea with their Custom Cash card (albeit on the consumer side). I should note that Citi wasn’t the first to offer that type of feature, but the first of the major transferable currencies to do so.

While on the one hand adaptive bonus categories might be useful for a small business owner (Chase presented this as a good option for a new business that might be spending more on advertising one quarter to get the word out about the company and more on shipping the next to get the product out to customers), the problem some will see is that the bonus categories almost entirely overlap with the Chase Ink Business Preferred. Worse yet, while the Chase Ink Business Preferred offers three Chase Ultimate Rewards points per dollar spent (that could be transferred to Hyatt or kept as flexible Ultimate Rewards points that are transferable to a number of programs 1:1), the World of Hyatt Business card will only offer two World of Hyatt points per dollar spent in the categories in which you spend the most (and 1x everywhere else other than at Hyatt).

However, as a Chase executive pointed out when I questioned why someone would choose this card over the Ink Business Preferred, the choice here is a business decision. The Ink Business Preferred will give you more points. The World of Hyatt Business card will give you an accelerated path to elite status and milestone benefits and a 10% rebate on award redemptions after you spend $50K in a calendar year. Which option makes more sense will come down to how much you value elite status, milestone benefits, and that 10% rebate.

For those who redeem a lot of Hyatt points (and who can comfortably meet $50K spend relatively early each year), I could see this card being worth the trade-off.

For example, let’s say that you intend to redeem 500K World of Hyatt points. If you spend $50K in one or two qualifying categories on the World of Hyatt card, you would have 100K points from spend (at 2x). If you complete that spend before completing your stays, you’ll get 50K points back — essentially having earned 150K net Hyatt points on $50K spend.

Update: We have been informed that there is indeed a cap on the number of points back each year. My first question at the press event was whether there was a cap on the 10% rebate and how it worked. We were surprised to find out today that there is a 20,000-point cap on points back. That means that you will only receive the 10% back on the first 200K points redeemed after reaching $50K in purchases. To be clear, you only get 10% back on stays consumed after reaching $50K in purchases — the rebate isn’t retroactive.

This update changes much of my original math. If one spends $50K in a 2x category, they would earn:

- 100K points at 2x

- Up to 20K points back if they redeem 200K points after reaching $50K in purchases but during the same calendar year

That comes out to a sort-of net 120K points on $50K spend assuming you do redeem 200K points in the same calendar year. Given that one could earn 3x in many of the same categories on the Ink Business Preferred (or 3x on dining with other Chase cards), it may alternatively be possible to earn 150K Ultimate Rewards points on the same spend. If you would have transferred those points to Hyatt anyway, you are essentially forgoing 30K points in exchange for picking up 25 elite nights for $50K spend on the Hyatt business card. That could be an acceptable trade in some circumstances.

The 25 elite nights earned from $50K spend on the World of Hyatt Business Credit Card puts you most of the way to Explorist status (which requires 30 nights) and a Category 1-4 free night certificate (a 30-night milestone benefit). It isn’t a slam dunk, but I’m sure that will be worth it for some.

I don’t love the $199 annual fee. That is of course in large part because of the way that annual fee creep has infected the industry; it is becoming very expensive to carry all of the cards you might want. On the other hand, I would guess that most people who would spend enough on this card to make it worthwhile are likely also spending more than $50 twice a year at Hyatt hotels. If you are within the market for whom this card actually makes sense, it’ll likely feel more like a $99 card. Sort of. You can’t really value that $100 in credits as though it were worth $100 since, if given the opportunity to buy an annual subscription to such a thing, you wouldn’t pay $100 for two $50 Hyatt credits that expire in a year. You’d want a discount if you were going to lock up your money in advance. So the effective annual fee is more like $125 in my opinion since I value those credits around $75.

It seemed a bit odd to me that this card comes with neither an annual free night certificate nor the ability to spend toward one. When asked about that decision, a Chase representative basically said that Chase wasn’t looking to create a card that people would get and keep for the free night certificate and never use. They want people to use the card. While I would prefer free night certificates, I understand that perspective. Chase’s trend has clearly been toward bonusing ongoing use of their cards rather than giving you something that just makes you not want to cancel the card (in the form of a free night certificate).

In my opinion, the target market for this card has to be small business owners who spend plenty to hit the $50K mark early enough in the year to maximize the rebate on redemptions and who strongly value 25 elite nights (from that spend).

Folks who would naturally only hit around 35 nights per year and who can spend $50K on the card may also find it worthwhile for the milestone benefits that they will reach thanks to those elite night credits. In fact, from my perspective, the card becomes closer to a slam dunk for someone in that position. If you otherwise wouldn’t reach the 40, 50, and 60-night milestones, think about what you get by dedicating the spend on this card:

- $100 Hyatt credit or 5,000 points at 40 nights

- 2 suite upgrades at 50 nights

- 2 suite upgrades and a Category 1-7 free night certificate at 60 nights

- Globalist status at 60 nights (free breakfast or lounge access, free parking on award stays, waived resort fees, and more)

However, keep in mind that if you have the consumer card, the same $50K spend will still get you 20 elite nights from spend plus 5 annual elite nights from having the card (25 total elite nights) — the same net result and you’ll have a Category 1-4 free night certificate thanks to $15K spend on the card. The trade-off becomes these things:

- Category 1-4 free night certificate with $15K spend on the consumer card vs 10% back on redeemed points with the business card (after spending $50K in a calendar year and only until the end of that same calendar year and only up to 20K points back)

- Annual Category 1-4 free night certificate on the consumer card vs annual $100 credit on the business card (split into two $50 credits)

- $95 annual fee on the consumer card vs $199 on the business card

A direct comparison of the two shows that if it were a choice between the two cards, it would really depend on how much you value the 10% back on redeemed points.

However, for those looking to keep business and personal expenses separate, it isn’t necessarily an either/or situation. Having both cards could work out to be worthwhile for someone heavily invested in the Hyatt ecosystem. Imagine this scenario:

- Spend $15K per year on the consumer card to get a total of 11 elite nights (6 from spend + 5 annually from having the card) plus a Category 1-4 free night certificate from spend (and an anniversary free night certificate in subsequent years).

- Spend $50K on the business card for an additional 25 elite nights (plus the 10% back on redemptions)

- That’s 36 elite nights plus 1 Category 1-4 free night certificate from spend on the consumer card, 1 Category 1-4 free night certificate each anniversary on the consumer card, and 1 Category 1-4 free night certificate as a 30-night milestone benefit

Assuming you use all of the certificates in the same calendar year as earning the elite nights from both cards, that puts you at 39 nights — one shy of a 40-night milestone choice and just 20 more beyond that to Globalist status. If you value Hyatt and its benefits enough that you would consider dedicating $65K spend on Hyatt cards, I imagine you would likely be planning to spend at least that many nights in Hyatt hotels annually to reach the 60-night milestone benefits and Globalist status.

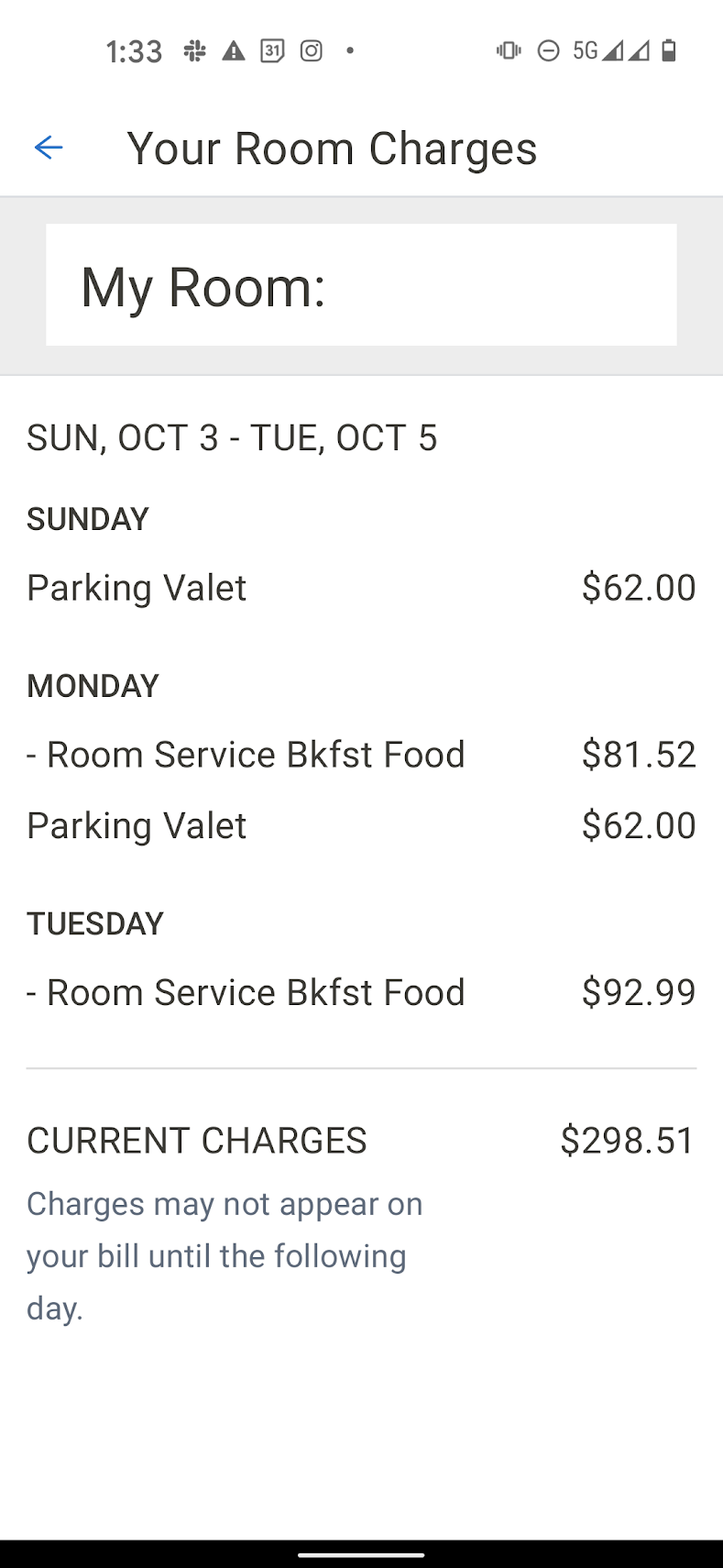

Again, this isn’t going to be for everyone, but I could see it making sense for some who really value Hyatt benefits. For example, I spent a two nights at the Andaz 5th Ave this week (an award stay using 25K points per night) and this is what my folio looked like before checking out for ancillary charges:

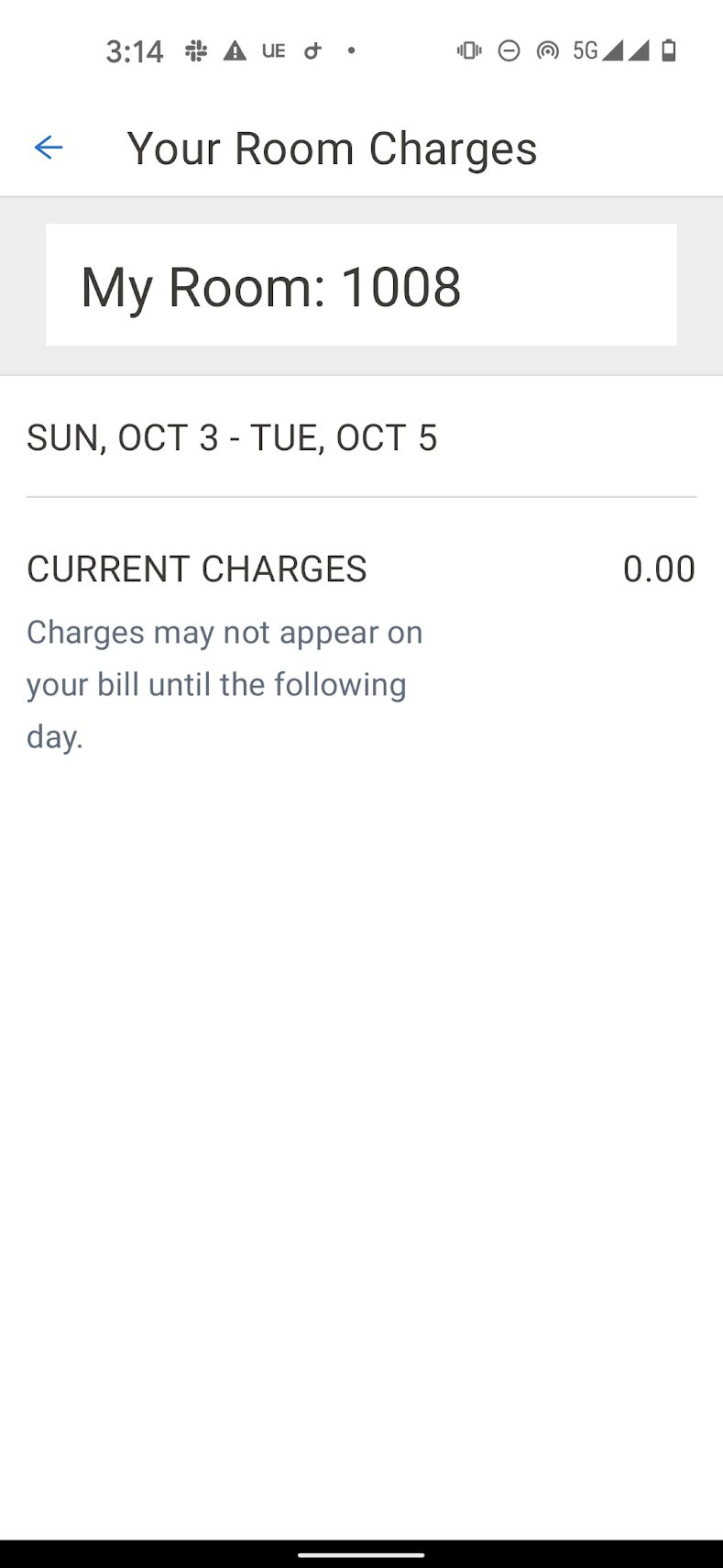

This is what it looked like after checkout:

Some will make enough use of benefits like free breakfast and parking on award stays to make the juice worth the squeeze.

Answers to questions

At the media event yesterday, we had the chance to ask some questions and to hear answers to questions posed by others in the room (and then we followed up with additional questions). Some valuable takeaways that are likely to answer common questions:

- Q: When does the 10% back on redemptions kick in?

- A: Immediately after $50K in purchases post to your card, but it can take up to 8 weeks to get the points back.

- Q: Do Guest of Honor stays booked for others get 10% back?

- A: Yes! After you reach $50K in purchases in a calendar year, you get 10% back on redemptions including points you redeem to book a Guest of Honor stay for others (if you have Globalist status).

- Q: Is there a cap on the 10% rebate?

- A:

No, there is no limit on how many points you will get back during your eligibility period.Update: We are now told that there is a cap of just 20,000 points back per calendar year. That is surprisingly low and changes the analysis significantly. - Q: Will stays booked before spending $50K but consumed after spending $50K get 10% back in points?

- A: Yes. You get 10% back on points redeemed for the rest of the year after spending $50K on purchases. Note that the 10% comes back after your stay, so your stay needs to be completed in the same calendar year that you reach $50K in purchases.

- Q: Materials introduce the “World of Hyatt Family” of cards. Will the family expand?

- A: When I asked about whether the family would expand to include additional cards, I was met with the answer that they were there to discuss the business card. Honestly, I didn’t get the sense that an additional card is planned in the near-term, but I’d be glad to be wrong.

- Q: Is the normal 50-night requirement for the Hyatt Leverage program waived for business cardholders?

- A: Yes. The Hyatt Leverage program is a small business discount program that we’ve written about before. It ordinarily requires crediting 50 nights per year in order to stay in the program but that requirement will be waived for World of Hyatt Business Credit Card holders.

Bottom line

The new World of Hyatt Business Credit Card isn’t the wildly compelling ultra-premium consumer card that some have hoped for, but it is a card that can make sense for those with high spend and a strong value for Hyatt elite nights. I’m not enthusiastic about the card’s annual fee or the fact that it leaves out annual perks like a free night certificate or automatic elite nights and I am disappointed in the surprisingly low cap of 20K points on the 10% rebate on redemptions, but I recognize that Chase’s aim here is to get people using the card as a go-to small business card. Those willing to put this card at the top of wallet for its spend benefits might find it to be a nice sweetener to accompany the consumer card in their wallets.

This is THE most comprehensive page I’ve found on the Chase Hyatt Business card. I’ve been on the phone with Hyatt and Chase trying to find out about my 10% rebate on a points stay. They are still very confused about what the rules are. I’m waiting for 10% bonus to post from a stay I had June 4-9. I’ll give them some more time to figure that out. THANK YOU FOR THIS INFO!

Looks like the referral is back to 60k

I just applied and was approved in the last 30 minutes. I even called and confirmed that I will receive the 75k for $7.5k spend in 3 months, so the offer isn’t quite dead yet. I just hope that I don’t wake up to learn that the bonus is up to 100,000 tomorrow! You never know with these things…

Way to go!

I’d rather get my 250,000 points a year on Ink Plus by getting Visa gift cards. Seems better for me unless you know an easier way?

Just tried to get this using the link and Chase rejected the offer bc it’s expired! No longer working 🙁 hopefully a new offer is coming soon!

That’s the key here ” High Spend ” ..I have no hotel cards but will wait for a better offer.

Key is to have both cards. I started the year putting exactly $10k on the biz card for the 75k points, 5 elite credits, & $100 Hyatt credits. About that time, our personal cards had some great spending bonuses so I switched to them til those were tapped. Now I’m working on the next $10k on my biz & then stop & see where I’m at with actual stays &/or addtl elite night promos that might surface on our personal cards this summer.

By fall I’ll finish my $15k spend on the personal card & collect those addtl 6 elite credits. Then see what my remaining year stays look like & finish what I need with spend on either the biz or the personal, all depending on what’s needed for Goobalist/Milestones.

I like the addtl flexibility this card provides in pursuing Globalist another year but certainly was hoping for some promos by now to further inspire me to spend like the personal card has.

That’s a good strategy, I’m on the same boat. The question I’m thinking through is whether to keep it for year two or just do everything on the personal card. The credits are almost like cash for me, but is the additional $99 worth it simply to get an extra night credit every 10k?

I agree – I look at the $99 as an insurance policy premium. If I get to the end of this year & the Biz card is the fastest way to finish up (likely) a 70+ nt Milestone reward for more Suite Upgrades, then it’s there to put in play, or not.

Worth it to me, at least, since I didn’t blow a 5/24 spot to acquire it + I’m getting an aspirational use from the SUB. And the CRAZY value from even ONE several night Alila stay with a lovely suite & gourmet breakfast – I’m convinced since extrapolated to several stays is $10k easy.

AND I gotta think surely there will be some spending perks not yet enacted. Like my British Airways card (but hopefully not take so long) – got in 2009 with (at the time a first) 100k Avios and now the fabulous spending promos over the last couple years leave me very, very happy I didn’t ditch since I get such significant value with AA from those points.

So what I am thinking about is using it for estimated tax payments at the beginning of 2023, to $10,000, to get that extra night credit while I’m still on the initial $199 AF (which, like in your case, is for me effectively $99, because I do stay at Hyatts, enough to guarantee that I have two stays where the bill comes to >$50). Then, when the card is up for renewal later in the year (2023), I can reassess.

Putting a value on an extra night credit is not easy. From 59 to 60, it’s high! From 58 to 59, it’s $0. When I try to come up with a tactical, practical evaluation, I get numbers ranging from $20 to $50. I usually use $20 when I am “mattress-running the numbers” for a discretionary stay, like at an airport hotel before a flight the next day, where I could stay home or further away, or whatever.

Glad this is going away tomorrow. It’s not the crappiest offer in the world, but it’s not v good. (I’m a fine one to speak…I just applied for Amex Blue Business Cash b/c, well, b/c I could. And b/c its has no AF, and I used referral from spouse. I have every card under the sun and Amex is easy and business cards don’t count and…).

Ha! I know the feeling, Hank. 🙂

Agreed. There are very few use cases where a CIC or CIU wouldn’t be a better option. No AF, flexible currency. Try again, Hyatt and Chase.