Thanks to the 100,000 point welcome bonus offer that ended 5/15/25, you or someone close to you probably has a new Chase Sapphire Preferred card. Obviously, the first thing you should do is use the card enough to meet the spend required to earn the welcome bonus. Beyond that, there are many ways to get great value from this card. In this post, you’ll learn how to maximize point earnings, how to use your card’s perks to save money, and how best to use your card’s rewards.

Earn more points

Use your card to pay for dining & food delivery

The Sapphire Preferred card offers 3 points per dollar at restaurants, coffee shops, and food delivery services. Since it has no foreign transaction fees, the card is a great choice to use for dining worldwide.

Use your card to pay for Netflix, YouTube TV, Hulu, and other streaming services

The Sapphire Preferred card offers 3 points per dollar for select streaming services. In my house, we use my wife’s Sapphire Preferred card to autopay streaming services such as NetFlix and YouTube TV. It’s a great “set and forget” way to earn 3 points per dollar for all of that spend.

Use your card to pay for grocery delivery

The Sapphire Preferred card offers 3 points per dollar for online grocery purchases. This includes both online purchases made directly with grocery chains and through services like Instacart.

Use your card to pay in-app at grocery stores

The Sapphire Preferred card doesn’t specifically offer a bonus for shopping in-person at grocery stores, but if you check out through the grocery store’s app, you are likely to earn 3 points per dollar since it is equivalent to an online order.

Use your card to pay for travel

The Sapphire Preferred card offers 5 points per dollar for travel booked through Chase Travel℠, 5 points per dollar for Lyft (through 9/30/27), and 2 points per dollar for all other travel purchases.

The card also offers very good travel protections when you use it to pay for your trip:

- Primary car rental coverage

- Trip cancellation and interruption

- 12-hour trip delay

- Lost luggage

- Baggage delay

- Travel accident

Caution: Before booking travel through Chase Travel, please see this section below where I describe a number of reasons why booking travel through portals can be problematic.

Automatically collect your annual 10% point bonus

Each account anniversary you’ll automatically earn bonus points equal to 10% of your total purchases made the previous year. For example, if you spent $20,000, you’ll get 2,000 bonus points. This means that the card effectively earns 5.1X for travel booked through Chase Travel (2.1X all other travel), 3.1X for dining, select streaming services, and online grocery, and 1.1X everywhere else.

Refer family & friends

If you have family members or friends interested in applying for the Sapphire Preferred card or the Sapphire Reserve card, you can earn refer them from your Sapphire Preferred account. If they’re approved, you’ll earn 10,000 points and they’ll earn whatever the welcome bonus is at the time that they apply.

Apply for no-annual-fee Ultimate Rewards cards

Several Chase no-annual-fee cards earn Ultimate Rewards points even though they are advertised as cash back cards. The trick is to earn “cash back” points with these cards and then move the points to your Sapphire Preferred card to make them more valuable. Once moved to your Sapphire Preferred card, you can redeem points through Chase Travel at enhanced value when a Points Boost is available, or you can transfer to select airline and hotel programs for even better value.

Here are some no-annual-fee “cash back” cards to consider:

- Freedom Unlimited: Earn 3 points per dollar for dining and at drugstores, and 1.5 points per dollar everywhere else. Since the Sapphire Preferred card only earns 1 point per dollar outside of its bonus categories, the Freedom Unlimited is a great companion card. Use it wherever the Sapphire Preferred doesn’t offer a bonus.

- Freedom Flex: This card earns 5 points per dollar (up to $1,500 per quarter) in categories that change each quarter.

- Ink Business Cash: This card always has a great welcome bonus. Plus, it earns 5 points per dollar at office supply stores and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually). If your internet, TV, and cell service providers accept credit cards, then this is an awesome way to automatically earn 5 points per dollar for all of that spend! If you’re not sure that you have a business or would like more information about applying for this card, see: How to apply for Chase Ink cards.

Earn more with Bilt Rewards

Bilt Rewards is a free-to-join rewards program. Bilt points are similar to Chase points in that they share many of the same transfer partners. With either Chase points or Bilt points, you can transfer points 1 to 1 to Hyatt, United, British Airways, Air France / KLM, Air Canada, and more.

Bilt offers an easy way to automatically earn rewards for many types of purchases. Simply add your Chase cards (or other credit cards) to your Bilt Wallet and you can earn Bilt points in addition to your usual credit card rewards at the following merchants:

- Participating restaurants

- Participating fitness clubs

- Lyft

- Walgreens

- More coming soon…

You can also pay your rent through Bilt using your Chase card. Bilt will charge you a 3% fee to do so, but you’ll earn 1 Bilt point for every $2. With the Sapphire Preferred card, you would earn 1.5 transferrable points per dollar (1 Chase point + 0.5 Bilt points) for that 3% fee. While I wouldn’t recommend that for ongoing rent payments, it could be an excellent option for quickly meeting the Sapphire Preferred card’s minimum spend requirement for its welcome bonus.

Helpful Links (Frequent Miler may earn a commission if you use our links):

Save money

Save with DoorDash

Sapphire Preferred cardholders are eligible to get complimentary access to DashPass – a membership for both DoorDash and Caviar. This unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate by Dec 31, 2027

Additionally, DoorDash members get up to $10 off a month for non-restaurant DoorDash orders.

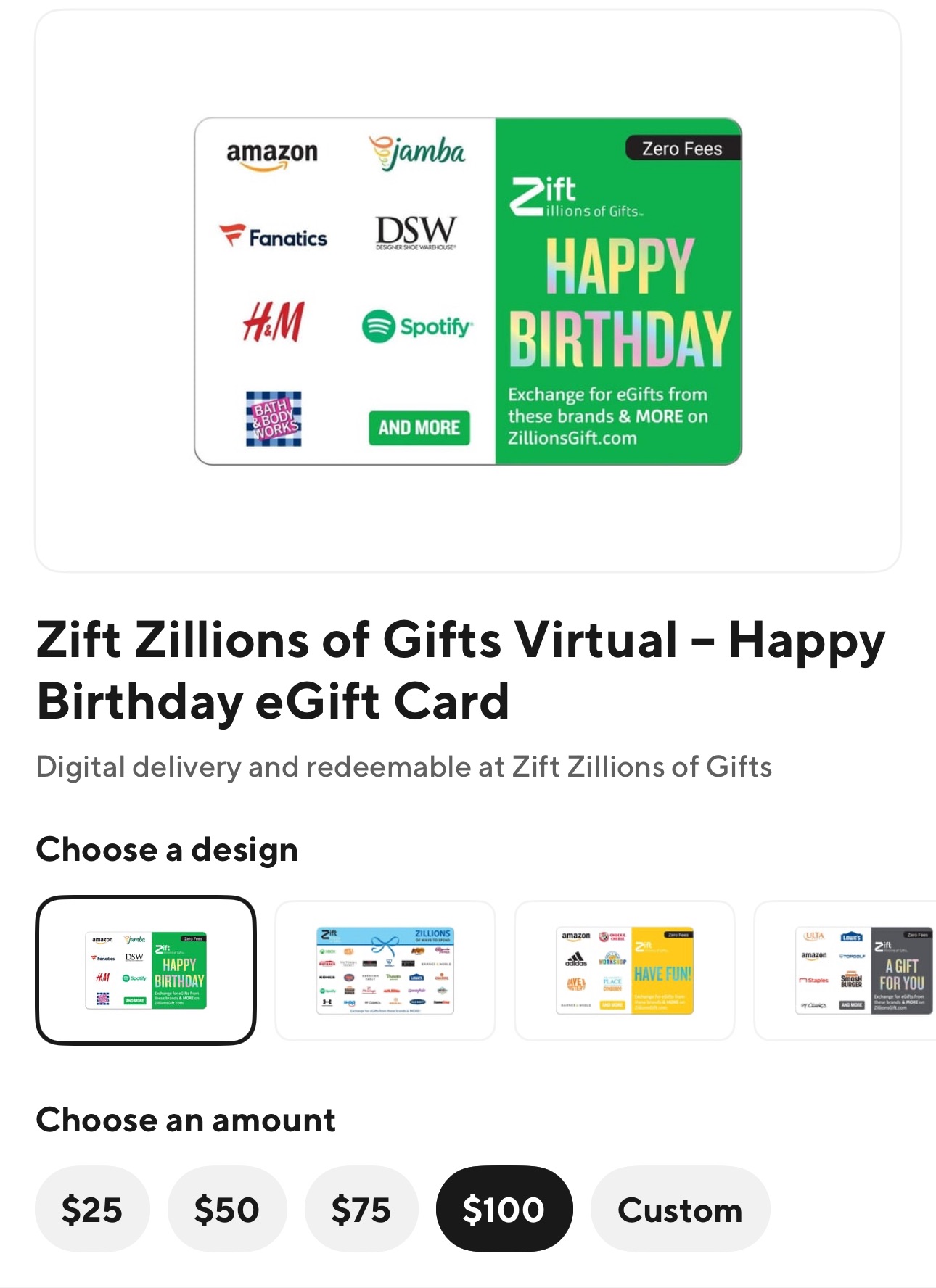

Save on gift cards (including Amazon)

DoorDash offers its DashPass members the ability to buy many digital gift cards at a discount. This includes select Zift Zillions of Gifts cards that can be redeemed for Amazon credit (make sure to pick one that shows Amazon as one of the merchants) and many other merchants. Discounts are usually limited to around $200 worth of gift card purchases. Details can be found here.

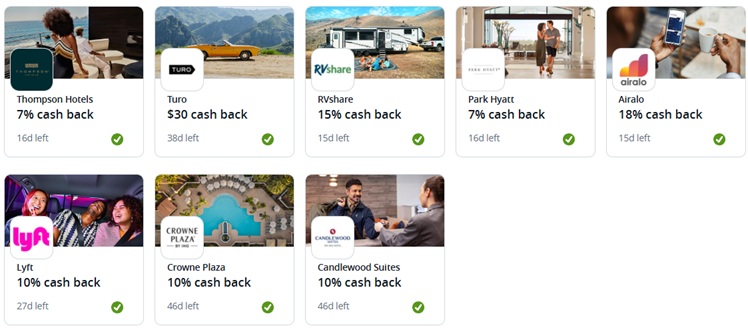

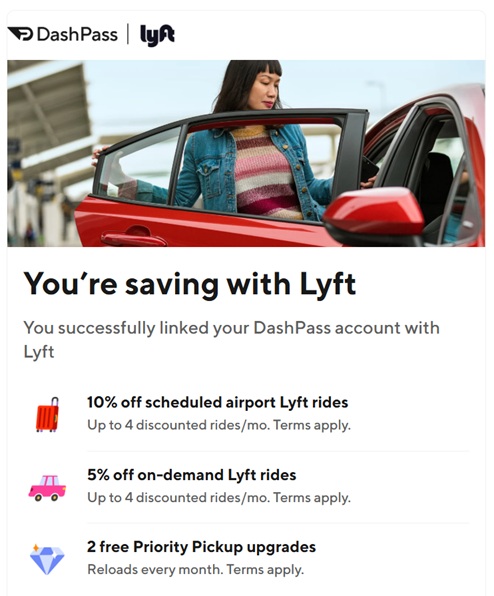

Save with Lyft

In addition to earning 5 points per dollar for Lyft rides through 9/30/27, you can get additional benefits indirectly thanks to a partnership between Lyft and DoorDash. Simply link your DoorDash and Lyft accounts here to qualify for Lyft discounts and priority pickup upgrades.

Save on a hotel stay each year

The Sapphire Preferred card offers up to $50 back per membership year for hotel stays booked through Chase Travel.

Save with Chase Offers

Chase Offers are rebates for specific merchants. Available rebates change regularly and you have to add the offers to your account before making an eligible purchase in order to receive the rebate. Use tools like CardPointers or SaveWise to automate adding offers to your card.

Redeem points for great value

Book travel through Chase Travel

Via Chase Travel℠ , you can use your points for more value (compared to cashing out your points for a penny per point). When Points Boosts are available, you can get the following value for your points:

- Flights where Points Boosts are available:

- Economy: 1.25x

- Economy Plus & Premium Economy: 1.5x

- Business & First Class: 1.75x

- Hotels where Points Boosts are available: 1.5x

Unfortunately, there are several downsides to booking travel this way:

- Airfare: If things go wrong or you need to make changes, the airline will likely tell you that you have to go through your travel agent. This can make things much more complicated. Also, if you have to cancel a flight, any residual value may be held with Chase Travel rather than directly with the airline, and so you’ll have to go through Chase again to use that credit.

- Hotels: If the hotel you book has its own rewards program, you won’t earn points or elite recognition when booking through Chase. You also cannot apply discounts that are available when booking directly, such as AAA, AARP, member rates, government rates, etc.

- Car Rentals: You cannot apply discounts that are available when booking directly. Plus, you won’t earn car rental rewards for these bookings. Further, if you have elite status with the car rental company, your status may not be recognized.

- Uncompetitive Prices: Sometimes, Chase Travel doesn’t offer the best available prices. It isn’t worth earning or redeeming points if it means paying a lot more.

If someone in your household has the Sapphire Reserve card, you can do even better by moving your points to their account. With the Sapphire Reserve card, points are worth up to 2 cents each via Chase Travel when Points Boosts are available.

Regardless of whether you can get up to 1.75 cents per point with the Sapphire Preferred card or up to 2.0 cents per point with the Sapphire Reserve card, it’s possible to do even better by transferring points to select airline and hotel partners…

Transfer points to Hyatt for hotel stays

When looking to book a hotel or resort, Check Hyatt’s website to see if there’s a Hyatt that fits your needs and is bookable with points. Hyatt points are often worth around 2 cents each, or more, for Hyatt’s own properties (note, though, that Mr & Mrs Smith hotels and other partner brands bookable with Hyatt points offer far less value).

Before transferring points to Hyatt, find a comparable hotel (or the same hotel) on Chase Travel to see how many points Chase would charge to book your stay. Compare that to the number of points that Hyatt requires to book their hotel with points. If you find that Hyatt’s point price is much lower than the price found through Chase Travel, then you can transfer the required number of points from Chase to Hyatt to book your stay.

Transfer points to United Airlines for select flights

United Airlines doesn’t have fixed award prices. You can sometimes get great value for your points and sometimes awful value. For this post, I ran a random search for flights from Detroit to San Francisco and found that United wanted either $324 in cash for economy or 15,000 points + $5.60. Using points in that case would deliver an excellent value of over 2.1 cents per point. Paying with points through Chase Travel would cost a lot more: 25,879 points with the Sapphire Preferred card (or 21,600 points with the Sapphire Reserve card).

Transfer points to other airline programs

There are many airline programs that can offer great value for your points under the right circumstances. It’s possible to get great value from Air Canada, Air France/KLM, British Airways, JetBlue, Emirates, Singapore, Virgin Atlantic, and more. See this post for a complete list of Chase transfer partners.

I don’t recommend transferring your Chase points to hotel chains other than Hyatt. Marriott and IHG points are usually worth far less than Hyatt points.

For many ideas of how best to use points transferred to partner airlines, see: Best uses of Chase Ultimate Rewards

If I have a sapphire preferred card, and my wife is an authorized user on that card, can she apply for her own SP card using the same joint Chase account, or will she get denied because you’re only allowed one sapphire product per person?

She can apply for own card and will have her own account with chase, but chase lets you combine points.

List out the store apps allowing to pay for in-store purchases. Kroger is one ?

Thanks for the Hyatt vs Chase travel at .125cpp – kinda of late to the Hyatt bandwagon – diversified with Bonvoy Plat/IHG Plat/Radission Intl VIP (like Bonvoy ambassador but outside US) and Hilton Diamond.

Never really jumped on Hyatt in the past – wish I had when it was easy to get Globalist – but the footprint has always been hit/miss that is less of an issue with various hotel credits on different cards we hold now the $50 of Chase Travel Hotel with CSP, $100 United Hotel Credits (UA Biz $50 *2) and Renowned Hotels $150 +$100 +free brekkie for 2 (UA Quest -Card member Year), $200 Delta Stays on Delta Biz Plat, and Venx $300 is great for booking Premier Collection Hotels ($100 + free breekie for 2).

This is great for filling the gap for airport hotels arrival/departure – I hadn’t really played with Hyatt till I was booking a NE road trip for the leaves this autumn and a few days in Boston.

PSA rentals are considerably cheaper out of PVD than BOS and surrounding airports (Rhode Island must have cheaper taxes or something) but it super convenient to the terminal as well – plus PVD has two PP lounges for a tiny airport.

Toll transponders are cheapest out of Massachusetts for Eastern Seaboard.

I digress I was looking at hotels around PVD – I was comparing Fairfield Inn vs Hyatt Place both a short walk to the terminal and car rentals.

The Fairfield had Free Breakfast but charged for Parking (we planned on exploring Newport and Plymouth rock and spending one more night at PVD – have the Liberty, A luxury collection in Downtown BOS )

The Hyatt Place had free Parking but charged for Breakfast. Both were similar in price or points – both were inexpensive cash and I was thinking of the 10 Elite nights needed for 50 night award.

I was shocked at how inexpensive Points wise vs cash the Hyatts Places/Houses are – I had been disappointed a few years back when I had did some random checks for award booking – moved 1K pts in to account so I could search for points bookings.

Normally I try to save my MR/UR/Cap1 points for booking J seats on transfer partners for longer trips. But sometimes the Pts vs Cash for Hyatts just really make sense.

So I will now probably get a Hyatt card this Fall when we drop to 1/24 – We already have 11 FNC across various brands so one or two more Hyatts FNC -easily worth the $99 AF.

>> Collect your annual 10% point bonus

This happens automatically right? Like no action required to “collect”. If so, perhaps change Collect to “Dream about how you will spend …”.

OK, I’ve changed it to “Automatically collect…”

I got the offer, but I already have the Chase Reserve. Can I get the bonus for this Chase Preferred?

I don’t think so, and I don’t think that Chase has a pop up warning stating so like Amex does…

Has it been 48 months since you last received the bonus on the Sapphire Reserve? If it has been that long, you can downgrade the CSR to a Freedom product, and apply for the CSP 4 days later.

If you take a few minutes to read the linked article “Everything You Need to Know” you’ll find complete information about eligibility and the process to go through if you are able to make yourself eligible.

Some time ago I read the linked article to which you refer, and thought I was not eligible. However, those of us who have played this game any length of time know that YMMV. I received 2 helpful replies…. and then there was yours.

You can’t get the Sapphire Preferred while you have the Reserve open, but if it has been at least 48 months since you received a welcome bonus for the Reserve, then you CAN do this:

Info like this is available here: https://frequentmiler.com/sapphire-preferred-100k-qa-everything-you-need-to-know/

i get alots of information in this blog