NOTICE: This post references card features that have changed, expired, or are not currently available

Update 1/1/22: It is now too late to make use of your 2021 Fine Hotels & Resorts credit. If you let this one slip away last year, skip down to the section about sub-$300 properties within the US and make sure you don’t miss out on this deal again.

Happy speculative booking day!

As today is the final calendar day of the year, I know that many of us are scrambling to make last-minute use of calendar-year benefits. A number of comments that I’ve seen on Facebook have led me to think that there is a common misconception about how Amex calendar-year credits work, specifically the Fine Hotels & Resorts credit on the Amex consumer Platinum card (as a reminder, the consumer versions of the card, including the Schwab and Morgan Stanley versions, now have a $200 annual calendar-year credit for FHR bookings). If you have a qualifying Platinum card, it (probably) isn’t too late to use 2021’s $200 credit on a 2022 stay. This post explains why I think that and then gives some examples of sub-$300 domestic US properties for the procrastinators.

As a reminder, see this post for more of your Amex FHR questions answered: Amex Fine Hotels & Resorts Guide: Your FHR questions answered.

I’m not an expert on payments technology, but the information to follow in this post is based on quite a bit of personal experience over the years and my educated guesses based on that experience.

Many people seem to think that since a charge made today (12/31/21) will be pending on your credit card statement for a few days and thus move from pending to posted during 2022 it is too late to use your 2021 hotel credit. That reflects a generally incorrect understanding of the way Amex calendar year credits work.

Amex counts the transaction date for the purposes of calendar year or calendar month credits. That is to say that the date the merchant finalizes charges your card is what matters.

In the past, I have been able to use my annual airline fee credits by making charges on either 12/30 or 12/31 that have correctly drawn from the fee credit bucket for the calendar year in which I made the charge. For instance, last year, I made charges on 12/30 that didn’t post on my Amex statement until the first of the year and those charges were reimbursed by Amex on 1/2/21.

This stands in contrast to the way things usually work if you buy something from a store.

For instance, if you try to use your Saks Fifth Avenue credit with an online order today, chances are good that you will be out of luck. That’s because while Saks will run a pre-authorization today, they won’t finalize the charge with Amex until the day your order ships. That’s typical when buying stuff from merchants online. Some of us ran into precisely that problem with the SimplyMiles deal where we ordered merchandise during the period of validity but the merchant didn’t ship for a couple of days and didn’t finalize the charge until they shipped.

To be clear, I’m using a few different words that I’m not sure are scientific but that I typically use to differentiate concepts:

- Preauthorization: This is what happens when you hit the “submit” button to buy stuff from a merchant. Similar to the way a restaurant will swipe your card and pre-authorize an amount to make sure you have the available credit to pay the bill plus tip or a gas station will do the same to make sure you have enough credit to pay for your gas, this is the merchant’s way of checking your payment method to make sure it’s valid and you have the credit to pay.

- Pending: The time between whenever you swipe or hit submit and the completed charge shows up on your credit card statement.

- Finalized: the time when the merchant confirms to the credit card company that you in fact did buy $X worth of stuff and they want their money. Note that this point happens sometime between the preauthorization / pending stage and before the charge is posted and this is the key step for procrastinators

- Posted: A charge that shows up on your credit card statement and is no longer in the “pending” category. Note that this may not be for a couple of days after the charge is finalized. The date next to the transaction when it is posted is what usually matters.

The thing here is that most online stores that sell “stuff” first preauthorize your card and then finalize the charge at some point thereafter (usually when they ship) and then it shows up as posted. The date shown next to the transaction when the transaction is posted is the date that the merchant finalized the transaction (I think).

In most cases, when you buy stuff in person at a store, the charge gets finalized right away as you’re walking off with your stuff. But when you buy online, you can have that lag between preauthorization and finalization. I assume this has to do with the cost of transactions and a retailer having a preference to only finalize when they can confirm that they have sent you the stuff (maybe it is free to drop a preauthorization if they have to cancel your order but they incur some nonrefundable credit card fee that they don’t recover if they run out of stuff and have to refund you).

As an example of this, let’s say I bought something at Saks on September 3rd. The transaction would get preauthorized right away and show up on my Amex online statement as “pending”. Next, they ship on September 5th and finalize the charge (note that I don’t see this step, I just get a shipping confirmation email) and then on September 6th or 7th I see the transaction is no longer pending but is now “posted” in my online statement and it shows a transaction date of September 5th. September 5th is the date that the charge was finalized and is the date that matters for Amex fee credits.

All that complexity is to say that there is always some chance that a transaction doesn’t get finalized in the moment, most especially when the transaction is for physical stuff.

In my experience, when buying or paying for digital stuff, the charge usually gets finalized right away. If I pay my cell phone bill today, the transaction date shows up as today even when I make the transaction late at night (I’ve done so at the end of the month many times before). If I send an Amazon gift card to someone today, the transaction date will also show as today — which stands in contrast to the situation if I buy a physical thing shipped and sold by Amazon, which typically shows the ship date as the transaction date since Amazon only preauthorizes the charge initially and then finalizes when they ship (though if you buy an item sold by a 3rd party on Amazon the charge gets finalized right away). Confused yet?

The key here is that most digital stuff I’ve ever purchased / paid for shows up dated with the transaction date when it I entered my payment info. So when I’ve made those airline charges on 12/31, they have only posted to my statement several days later, but they must have finalized on 12/31 because they show a 12/31 date and I’ve gotten calendar year credits for the previous year successfully.

I therefore fully expect that making a prepaid hotel reservation through Fine Hotels & Resorts or The Hotel Collection today will finalize today and post with a 12/31 transaction date even though it won’t move from pending to posted until early 2022. While I can’t predict the future beyond a shadow of a doubt, I feel confident enough that when Fine Hotels & Resorts charges from today post to our statements in a few days they will be dated 12/31 and receive the 2021 Fine Hotels & Resorts credit. I’m putting my money where my mouth is on that: I’ve booked several Fine Hotels & Resorts reservations today.

Assuming that my 2021 credit gets applied properly, the conundrum will be that I won’t be able to change the bookings. If I cancel, I won’t get to keep the $200 credit as Amex will claw it back. That is unfortunately just how the cookie crumbles.

If I am wrong about all of this and my 2022 credit actually gets applied to these bookings, then I will be able to cancel and rebook using my 2022 credit. I really have nothing to lose since I had credits left to use that will be lost if I don’t try.

For those who will scream that this is why you can’t value the Fine Hotels & Resorts credit at face value — many of us are scrambling for a last-minute booking right now — I concede that you are right but I simultaneously counter that in any normal year I would have used these credits much sooner. We’ll see what 2022 brings.

Where are the cheap FHR properties?

For those wondering where to use these credits since “everything is expensive” through Amex FHR, I say “that’s true in expensive markets”. If you want to find things that will be covered or nearly covered by the credit, you need to look in cheaper markets, off-peak seasons, or midweek days. There are lots of cheap foreign markets — for example, several members of our Frequent Miler Insiders group recommend Portugal. I can also vouch for the United Arab Emirates having some great cheap luxury options (we stayed at the Four Seasons Abu Dhabi for $201; the Ritz-Carlton Abu Dhabi was $136 on the same date).

However, I imagine many people might be hesitant to book speculative international travel. If you’re looking to stay domestic and you’re willing to do travel during off-peak seasons and/or midweek dates and/or less popular destinations, here are some places I’ve seen in the past 24 hours. Note that I almost exclusively focused on places that were less than $300 per night but included a couple over with no rhyme or reason as to why.

- Vermont:

- Woodstock Inn: From $249 on weekdays (lots of them in March and April in particular)

- Hyatt Residences Stowe, VT: $299 on many mid-week days into June. I’ve booked this a bit cheaper in the past.

- Boston:

- Encore: From $247 on many Sunday/Monday nights in winter

- The Liberty (Marriott Luxury Collection: From $305 on several Sunday/Monday nights in winter

- Washington, DC:

- Ritz-Carlton Tysons Corner: I stayed at this property a few weeks ago. This one is outside of DC on the Beltway. It’s nice and it is connected to the upscale Tysons Galleria shopping mall (think stores like Louis Vuitton and Gucci and a Maclaren on display). FHR rates as low as $199 in February or $249 on many weekends throughout the year.

- Ritz-Carlton (in DC): Winter dates from $309

- Park Hyatt: Winter dates from $329. I booked this one for less than $250 pre-pandemic, so it’s worth keeping an eye on rates.

- Florida

-

- Several Florida properties can be reasonable Sunday through Thursday during off-peak seasons. For instance, I found Hotel Effie Sandestin from $209. A number of the Miami-area properties are sometimes around $300.

-

- Texas

- La Cantera, San Antonio: I saw rates in fall from $258

- Colorado:

- Gateway Canyons Resort: As low as $249 over the winter

- Viceroy Snowmass: $275 on many fall 2022 dates

- Kimpton Hotel Born (Denver): As low as $259 during the winter (I bet it might even get cheaper at some times)

- Nevada:

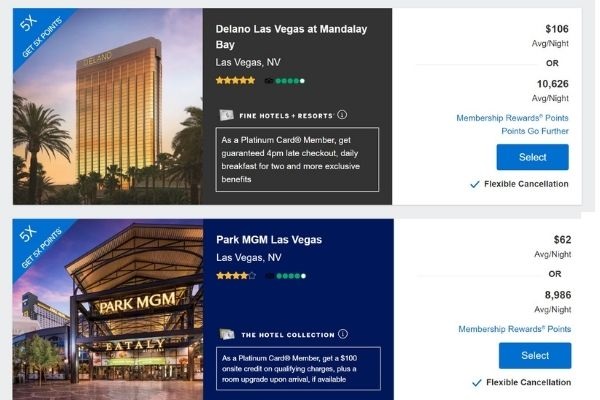

- Delano: From $106 Sunday-Thursday during some fall 2022 dates. Note that there is a resort fee you pay at the hotel (so that’s $44 per night that can’t be prepaid and covered by the credit). With tax, this comes to $120 per night prepaid plus $44 paid at the hotel. Delano offers breakfast as a $60 credit each day for either the restaurant downstairs or room service plus you get a $100 property credit that can be used at many of the restaurants at Mandalay Bay or at Delano’s steakhouse. I booked a two-night stay for $240 today. I’ll be out of pocket that $40 plus $88 at the desk. My wife booked a single-night weekend night to follow and it came to $203 prepaid with $44 to be paid at the desk (higher rate on a weekend night).

- NoMad: From $135

- Conrad: Fall nights from $139 with a $125 property credit (a bit more property credit here)

- Bellagio: Fall nights from $162. With tax that’s right around the $200 mark (plus resort fee at the hotel)

- The Hotel Collection: I saw two-night stays at Park MGM starting at $62 per night before tax and resort fee, Mirage from around $85, and some others just over $100 per night. Keep in mind that The Hotel Collection includes a $100 credit, but no breakfast or late checkout.

- Hyatt Regency Lake Tahoe: A reader pointed this property out because some dates start at $199. I booked a fall 2022 stay for $229 (plus tax it came to about $258).

- Washington (state)

- Fairmont Olympic Seattle: Many dates this winter were $300, but I saw at least one midweek date for $280

I’m sure there are many more. Keep in mind that you can search an entire state with something like “Texas, United States”. However, for some reason, some properties don’t show up when you do that. For instance, the Ritz-Carlton Tysons Corner doesn’t show up when you search Virginia, United States.

Happy hunting and best of luck to those of us who waited.

Booked FHR prepaid on 12/30 for stay on night of 12/31 for 1 night. Went pending on online statement on 12/30, posted on 12/31, $200 credit posted on 12/31. I’m an authorized user, credit posted on primary cardholder statement.

Hi Nick – were you able to tell what year the credits applied to? I booked on Dec 31 2021 for FHR and Clear. My credits got posted on Jan 1 2022 (processed as Jan 2). Thanks!

Not yet, but I’ll probably know tomorrow. I made an FHR booking on 12/31 and got the $200 credit dated 1/1. Then I made another reservation on 1/1. No credit yet, but I expect that tomorrow or the next day I’ll know whether I got the $200 credit for 2022 also. I expect I will — all of my airline fee credits seem to have posted without using any of my 2022 allotment, so I’m willing to bet the FHR credit works properly.

Very interested to hear the results from this! In same situation as Katie.

Any updates on this, Nick?

Yes, I’m sorry – I had so many reimbursements that until I just checked again I thought I hadn’t gotten the credit a second time. However, I did. I made a reservation on 12/31/21 that got the $200 credit on 1/1 (using my 2021 credit). Then I made a new reservation on 1/1/22 and got the $200 credit on 1/2/22 (using my 2022 credit).

Worked as expected!

Thanks so much! Appreciate all you do at FM!

I used the FHR credits to book a couple of stays abroad where I need to stop by for personal business. The rates included breakfast and enough amenity credit at the properties for dinner that my meal costs are mostly taken care of right there; and the 4pm late checkout means I can have breakfast in the morning, go get my personal business done during the day at the government offices in the morning and afternoon and then go back to the hotels to check out and hit the road.

By the way, even in markets where hotel rates typically are advertised inclusive of tax at initial search, Amex doesn’t seem to do it that way for properties in at least some of those markets.

I’m definitely in the “don’t count this at face value” camp although I wouldn’t say I “scream” about it (I think “talk shrilly and more frequently than is strictly necessary” would be more accurate).

First off, if you are already a user of FHR or similar programs, or routinely book hotels in the $300 or $400 range, then I think this credit is pretty much as good as cash to you. But if, like me, you rarely pay more than $100 for a hotel room then it’s simply not worth the full $200 value.

For instance, I made good use of last year’s credits for a trip this coming spring at the Palacio des Cardosas in Porto, Portugal, booking back-to-back P1 and P2 nights for $37 out of pocket. The experience credit here is lunch or dinner (plus the standard free breakfast, room upgrade, etc). That’s a great deal, and I’m happy with it. But Porto has plenty of well-rated hotels at $80 a night which is where I would have stayed if I were paying cash. And food costs would have been perhaps $25 a person. So I’m paying $37 instead of $130 a night — the cash value to me is $93.

There are intangible considerations, of course. Those other hotels are certainly not as nice as this one, nor as well located. And I’m sure the meals will be very nice. On the other hand, breakfast and dinner is going to keep me going for the entire day, so I’m going to “have to” forego eating in other places (to get the full “value” of the credit). Also, because of my wife’s limited available travel time and the fact that I couldn’t find a similar value in central Lisbon, we’ll have to travel from Lisbon to Porto on the same day we arrive.

For people who have to look for some destination to “burn” this credit I think the value is even lower. If you wind up coming out of pocket $100 to use the credit for a trip you didn’t really have an interest in taking in the first place I’d argue that you probably got negative value from the credit (it’s akin to buying stuff you don’t need or want — in this case, travel — to get points on a credit card). As my grandmother used to say “it’s a good sale, but I can’t afford the savings”.

Thanks for this list, it’s extremely helpful.

A few more options I found:

Good post. If you wait until the last week of the year to book for for a stay in spring summer or fall of 2022, in some parts of the country, you probably won’t get the best rates then if you booked right around the time of travel. Miami area properties can be booked sub $300 during the summer months. Booking for summer stay right before New Years will get you invariably a higher rate than doing so closer to the actual date of stay. But we learned something today, if you see a deal and want to use the credit, be ready to act !

My account shows this credit as expiring 6/30/22. Am I missing something – I thought the expiration was one year from when they made all the changes, which I believe was July 1.

i understand that if you cancel, the credit gets clawed back, but what if you just modify to different dates? would that still trigger a credit clawback? i booked an international property for april, but might need to move it around.

You can’t modify. I covered that in the frequently asked questions post that I linked to near the beginning. Many people have tried to get the hotel to move their booking, but I haven’t heard a single success story in doing that and Amex will make you cancel and rebook. That’s part of the reason I focused on domestic properties here. I just don’t know whether my international trips will work and didn’t want to risk the previous year’s credit on an international reservation since there’s no way to recover that credit later unfortunately. At this point, you’re locked in to use it or lose it on whatever you reserved.

With this year’s credit, you could obviously make a new reservation now and cancel and rebook as need be – you can use your 2022 credit and then cancel and it’ll get clawed back, but then you can make a new reservation and get the credit again. It’s when you’re trying to use a credit from a previous year in the new year that you have to be confident plans will work out.

What if one booked Delano for 2 separate stays, will one gets the $200 AMEX credit plus x 2 the Fine Hotel credits?

Yes, that should work.

Thank you for this reminder post.

I ended up booking Hyatt Regency Lake Tahoe Resort, Spa and Casino for $50 net a night in march. If I had not seen your post, I would have let this discount go past by.

I’ve heard the same type of thing from others today. I am legitimately surprised to hear how many people would let a $200 discount on a hotel that comes with free breakfast and a $100 credit go unused. I am glad you were able to make use – here’s to Lake Tahoe!

Thanks for posting this! I just booked this hotel, as I was trying to use my FHR credit for a road trip to northern California, and I wouldn’t have known about it if not for your comment 🙂

Nick – if you made a couple of speculative FHR bookings today and then cancelled all but one, would you still be able to keep the credit or would the credit be associated with a certain charge and then would get clawed back if that particular booking was modified or cancelled?

Nobody knows for sure, but I mentioned in this post that I linked to near the top that it’s a potential strategy to at least argue your way into manually getting credited if nothing else:

https://frequentmiler.com/amex-fine-hotels-resorts-guide/

As I note though, the downside is that you’ll have to float the money for the prepaid extra reservations.

Will be clawed back.

This is a very interesting question and (no offense intended to @CericRushmore) I’d love to get a definitive answer. If you keep the credit as long you you keep a single qualifying booking in the previous year this would be a good way to ensure using the credit in the next year.

On biz plat: sw fight made 28th and credited today. Dell xbox gift cards bought last night and received giftcard email still shows pending today. Personal Plat: saks gift card bought instore 29th and no credit. Sw flight bought yesterday and no credit yet and still shows pending.

What about booking a hotel in Europe where it’s already 2022?

Terms say 11:59 p.m. central time, so I think you’ll be fine.

The terms state bookings must be made by 12/31 11:59 pm central time.

Maybe dumb question but how do you tell which credit Am Ex applied – The 2021 or 2022? Just booked Hotel Effie based on your timely post!

if I was you I would probably ask amex if you have used your 2022 FH&R credit after you see the credit post.

Just book another hotel in 2022. If you get the credit again, you’ll know the 2021 credit applied successfully. Then you can always cancel and rebook the reservation that you made in 2022.