In the comments on a post last week, a reader named Andrew mentioned the fact that they found Southwest Rapid Rewards to be a “valuable and unique” transfer partner. The justification for that rationale was as follows:

If you’re a 2 player household really hitting the Southwest Companion Pass hard then that can still be a valuable and unique transfer partner for UR. Being able to book all your tickets as BOGO brings the value of transferred points to Southwest up to around 2.6 cpp.

Andrew makes a common error in this analysis that we’ve debunked before, but I thought it was worth another pass at this both for those who aren’t familiar with the error in this thinking and for those who haven’t yet been convinced. Note that I am not writing this post to pick on Andrew (and I hope he understands that!), but he makes an argument I have seen many times before and his comment offers an excellent reference point for this discussion. It is also worth adding that when I explained the core ideas that led to this post, Andrew immediately understood the rationale, so I’m not writing this post to argue with him but rather to help other readers who might have the same notion in mind.

The foundation for the (incorrect) argument for a 2.6c per point valuation

I have often said that the Southwest Companion Pass is the best deal in domestic travel, and I re-analyze that each year in this post. Once you earn 135,000 Southwest Rapid Rewards points in a calendar year, a companion flies for free with you every time you fly, whether your ticket is purchased with points from your Rapid Rewards account or cash or even points redeemed from someone else’s account. You can read more about this in our Southwest Companion Pass Complete Guide.

Andrew’s number is based on the assumption that Southwest Rapid Rewards points are worth about 1.3cpp (note: cpp = cents per point) toward paid airfare (our Reasonable Redemption Value is actually 1.4c per point, but we probably need to refresh our number on that and we have previously shown that there is some variance due to taxes on international routes). For simplicity, let’s run with Andrew’s number, because the math makes the point no matter what the points are actually worth. So let’s accept Andrew’s premise that Southwest Rapid Rewards points have a base value of 1.3c per point.

In other words, let’s say that you wanted to buy a single ticket that costs $130 in cash — the price in points will be about 10,000 points.

However, if you have the Companion Pass, Andrew is asserting that your points are worth double (2.6cpp) since you get two tickets for the price of one. The foundation of Andrew’s argument therefore is that you get $260 worth of airfare (two tickets that would individually cost $130 each) for just 10,000 points, a valuation of 2.6cpp.

Unfortunately, that argument is wrong — you don’t get 2.6cpp, and if you buy into that theory, you will make poor decisions that cost you money in the long run.

The Companion Pass is effectively a discount code that works with points or cash equally

The heart of the argument as to why Andrew’s premise was wrong is the fact that the Companion Pass applies equally to tickets purchased with cash or points (or even someone else’s points).

Going back to the example from the previous section, let’s say that you want to buy airfare on a route that costs $130 in cash or 10,000 points:

- If you want to buy one ticket, 10,000 points saves you $130.

- If you want to buy two tickets and do not have the Companion Pass, you’ll need to pay either $260 or use 20,000 points. In that case, using 20,000 points saves you $260 — a valuation of 1.3cpp.

- If you want to buy two tickets and you do have the Companion Pass, you’ll need to pay either $130 or use 10,000 points. In this case, using 10,000 points saves you $130, which is still a valuation of 1.3cpp.

The 10K points don’t save you $260 because those tickets don’t cost $260 for a Companion Pass holder, they cost $130. In other words, if you had zero points, you wouldn’t pay $260, you would pay $130 for two tickets. Using points instead of cash keeps $130 in your bank account. You are essentially trading away 10,000 points in order to avoid spending $130.

To suggest that the 10K points are worth $260 is to suggest that every $130 in your bank account is worth $260 as a Companion Pass holder. That’s not true — it won’t buy you $260 worth of anything. It just buys you two tickets on Southwest Airlines as a Buy One Get One Free type of coupon. If your grocery store runs a Buy One, Get One free coupon on a dozen eggs, the $5 in your wallet doesn’t suddenly become “worth $10”, you’re just effectively getting each dozen eggs for $2.50. You get more stuff for your money, you don’t get more money for your money.

It is worth noting that Andrew would be right if the Companion Pass only applied to award tickets. In other words, if you could only got two tickets for the price of one when using points and not when using cash, then your choices would be to spend 10,000 points or $260, a valuation of 2.6cpp. But since the Companion Pass applies equally when using cash, your actual choice is between spending 10,000 points or $130 in cash, a valuation of 1.3cpp.

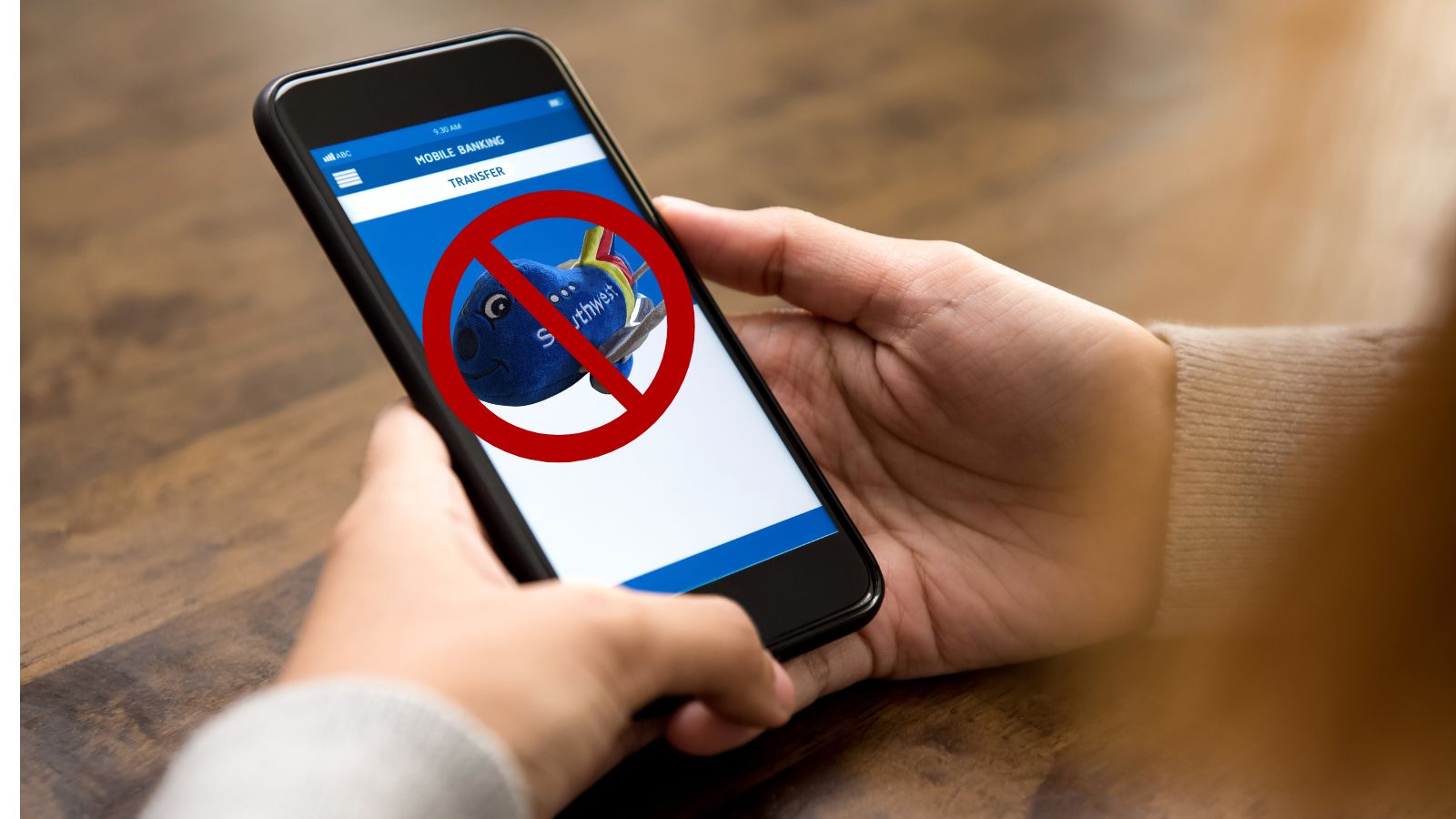

If you’re not convinced, consider this (1x vs 2%)

Let’s ignore my argument and pretend for a moment that Andrew is right and points are worth 2.6cpp when you have the Companion Pass.

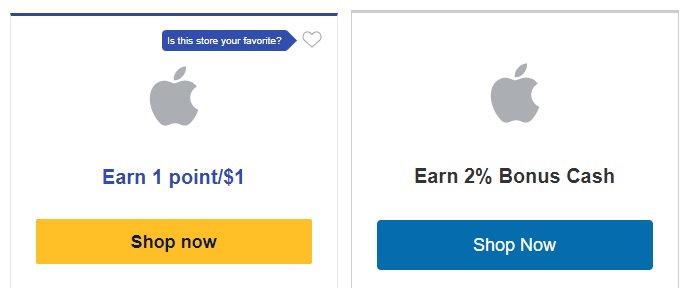

Let’s imagine that you have a large purchase to make through a shopping portal. To keep the numbers simple, let’s say it is a $10,000 purchase. Let’s further say that you have the choice between earning 1 Southwest Rapid Rewards point per dollar spent or 2% cash back.

If Andrew were right, we should choose 1 Southwest Rapid Rewards point over 2% cash back since 1 point would be the equivalent of 2.6 cents. That is clearly more than the 2 cents represented by 2% back.

But the math doesn’t support Andrew’s opinion. If you made that $10,000 purchase and earned 1 Southwest Rapid Rewards point per dollar spent (1x), you would have 10,000 points and you would therefore be able to buy $130 worth of airfare at 1.3cpp. If you have the Companion Pass, you’ll get the two tickets with your 10K points and have nothing left over.

If you made that $10,000 purchase and earned 2% cash back, you’d earn $200 cash back. With your $200 in cash, you could buy the same two tickets for $130 and have $70 left over. Earning 2% cash back (2 cents per dollar spent!) gets you the same two tickets and $70, whereas earning Southwest points would have only gotten you the two tickets. The points clearly are not worth 2.6c per point — in fact, earning 2 cents per dollar spent (2% cash back) is about 50% more valuable since it leaves the extra $70 in your pocket.

And that holds up exactly with my premise above: the points are only worth about 1.3c per point whether or not you have the Companion Pass. That’s important because if you mistakenly think of them as being worth 2.6cpp, it would lead you to make poor decisions like choosing the Southwest shopping portal at 1x over earning 2% cash back or choosing to use a Southwest card to purchase airfare at 3x Southwest points over using a card like the Chase Sapphire Reserve that earns 3x points that are worth 1.5cpp for that purchase.

Transfers to Southwest get you a fixed ~1.3cpp, which is low for Chase points

One of the relatively poor decisions you might make if you imagine points to be worth more than they are is that you might consider transferring points from Chase Ultimate Rewards to Southwest Rapid Rewards with the justification that the points become “more valuable” as a Companion Pass holder. As shown above, the points do not become more valuable with a Companion Pass.

If you transfer 10,000 Chase Ultimate Rewards points to Southwest Airlines, using those 10,000 points will save you $130 whether you use them for one ticket or two (since two tickets cost the same as one for passholders). While that certainly isn’t the worst possible use of Chase Ultimate Rewards points, it is at the low end of what I’d find acceptable.

This is particularly true of you have the Chase Sapphire Reserve card. That card enables you to use points to book travel through Chase Travel at a value of 1.5c per point. Unfortunately, Southwest Airlines flights do not show up via Chase Travel. That said, it may be possible to book Southwest flights over the phone with Chase Travel — Greg showed during our 40K to Far Away challenge that Chase Travel is able to book some travel providers over the phone that aren’t offered online. I haven’t personally tried to do this, but we reported several years ago that it was possible (See: Book Southwest through Chase Ultimate Rewards again). In that case, you would get 1.5cpp toward the purchase and also earn Southwest Rapid Rewards points on the flight, paying 8,667 Ultimate Rewards points for a $130 flight rather than transferring 10,000 points to Southwest and earning points on the flight. Again, I’m not sure whether or not this is still possible, though it was a couple of years ago.

Regardless of whether or not you can book Southwest flights through Chase Travel over the phone, I would be unsatisfied transferring to Southwest in most instances because of the fact that those points will have fixed value, with no chance at getting outsized value. Whereas transfers to Hyatt or even Chase’s other airline partners like could yield far more than 1.3cpp, transfers to Southwest can not (excepting the situations with international Southwest fares where the taxes are a high percentage of the ticket price as shown in this post). If it were an option to do so, in my previous examples, I would rather spend $130 and keep 10,000 Ultimate Rewards points for a future use at higher value since there are plentiful opportunities to do that. There is an argument to be made against that philosophy if you have an endless supply of millions of Ultimate Rewards points withering away since your money can grow (via interest / investment growth) whereas your points remain stagnant (and almost always devalue over time), but given the speed at which I burn through Ultimate Rewards points at higher-than-1.3cpp-in-value, I just don’t think I would generally accept the lower value of Southwest.

To be clear, our Reasonable Redemption Values are meant to be a floor value of how much value you can expect to get when redeeming points without much effort at cherry picking the best value. Those of us who do cherry-pick the best values with Chase points (see our recent podcast episode Chase Ultimate Rewards points: Best ways to get great value) very frequently get far more than 1.5cpp in value out of Chase points. It is common for decent Hyatt redemptions to be worth well more than 2cpp and premium cabin international award tickets can be worth far more yet. We can argue about how much some of those premium experiences are actually worth, but in many cases the value is pretty objectively higher than the equivalent of 1.3cpp.

Let’s be clear about this: a transfer to Southwest Rapid Rewards beats most non-travel redemptions of Chase points. Getting 1.3cpp in airfare generally beats things like redeeming points for a statement credit or gift cards or physical products. Transferring points to Southwest isn’t the worst use of your Ultimate Rewards points, it just provides no opportunity for outsized value and rather offers lower value than what is possible through other partners.

Are there situations where it might make sense to transfer to Southwest despite suboptimal value?

Within an hour of the publication of this post, I suspect you will need to look no farther than the comments of this post to find arguments in favor of transferring points to Southwest. At the end of the day, if transferring to Southwest makes your heart happy, don’t let me steal your sunshine. And while my opinion is that this is a relatively low-value use of Ultimate Rewards points, I can recognize that there are a few instances where I might consider transferring to Southwest:

- If you don’t have quite enough points to make an award redemption, it could certainly make sense to top off your account. Southwest doesn’t allow you to pay partially in cash and partially in points, so if you want to book an award and have most of the points but not quite enough, a transfer could make sense.

- If you are very points rich, it could make sense to accept slightly suboptimal use of points in order to keep cash invested / growing as you spend down your points balance (which does not earn interest, etc).

- If the current cash savings is of significance to you, it could make sense to transfer. I’d caution a bit against the “I don’t pay for travel” mentality if transferring points now so you can say your flight was “free” is going to cost you more later when you don’t have the points to cover a hotel where you would have gotten better value, but I could nonetheless imagine a multitude of reasons why immediate cash savings could matter more than long-term higher-value uses of the points.

- If you highly value the flexibility of using points for a specific redemption, a transfer could make sense. Some will argue that the flexibility of an award over a that of a paid ticket makes points more valuable than the cash equivalent. In other words, in our theoretical example, if you paid $130 for your flight and later had to cancel, you’d get a credit that may be set to expire depending on the type of fare purchased and potentially tied to a specific passenger (though there are ways around this with Wanna Get Away Plus fares). On the flip side, if you cancel a flight booked with points, you’ll get the points back immediately and they don’t expire. If you’re just booking a backup flight or a situation where you are highly uncertain about travel, I could see the added appeal of an award flight.

Given the added flexibility of Wanna Get Away Plus fares, I would be less swayed by the flexibility of points these days, but I certainly recognize that there are situations where one of the above applies. And while the title suggests that I think you should never transfer points to Southwest, the truth is that I know this game is one with few absolutes.

Earned Southwest Rapid Rewards points (not transferred points) are more valuable before you have the Companion Pass

One quick side argument that I’d like to add is one that Greg has made before me: Southwest Rapid Rewards points earned from their credit cards and shopping portal and other associated earning activity (which is to say not from transfers) are actually worth more before you have the Companion Pass than after.

That’s because before you have earned the required 135,000 points to get a Companion Pass, each point you earn from paid fares or Southwest credit card welcome bonuses or spending or the shopping portal not only buys 1.3c worth of airfare, but it also gets you 1 point closer to the 135K required for the repeatable Buy One Get One Free coupon that is the Southwest Companion Pass. How much a Companion Pass is worth is a subjective analysis that varies so much that I won’t even try to quantify it except to say that whatever it is worth adds some sort of value to the points you are earning en route to the pass.

For simple math, let’s say you were willing to buy a Southwest Companion Pass for $1,350 (you can’t buy it, this is just theoretical). That means that each point earned en route to 135K effectively buys you 1.3c toward airfare (as Rapid Rewards points) and 1c toward the Companion Pass (again, you can’t actually buy the pass, so this additional value is entirely subjective and meaningless except to say that the points get you closer to an object of value – the Companion Pass).

Once you have the Companion Pass, you no longer have that added value with each additional point you earn, so the points you earn from that time onward are only worth 1.3c per point.

While none of this section has anything to do with transfers from Ultimate Rewards (since transfers do not count toward the Companion Pass), I make this distinction to argue against my shopping portal premise above and say that you may choose the Southwest shopping portal at 1x over earning 2% cash back if those points will help you earn a Companion Pass and you highly value that Companion Pass (if you want to do the math, you’d have to value the Companion Pass at $945 or more to make up for the difference versus 2% cash back, but let’s not muddy things further with that math).

Note that I saved this section for last because it isn’t actually related to transfers from Chase, but it was tangentially related enough to my shopping portal point above that I wanted to include it for completeness.

Bottom line

Southwest Rapid Rewards points have relatively fixed value and that relatively fixed value is less than the Reasonable Redemption Value of Chase Ultimate Rewards points, which I think makes them a generally poor transfer partner (albeit still better than most non-travel redemptions). Given Chase’s transfer partners, there are a plethora of opportunities to get more value by transferring to almost any of Chase’s other partners. Importantly, the value of points transferred to Southwest does not double when you have the Companion Pass; the purchasing power of Southwest points remains constant as compared to the cash cost you will incur as a Companion Pass holder since that pass is effectively a repeatable Buy One Get One Free coupon that applies the same to cash as it does to points. I love the Southwest Companion Pass and I love Chase Ultimate Rewards points, but maximizing both of those things means understanding that the Pass does not make Ultimate Rewards points more valuable when transferred to Southwest.

Nick, I understand that in you’re argument, you’re comparing Southwest points to cash for a person that has CP. I hadn’t really thought of it that way, so I’ll have to re-evaluate my spend, i.e. SW CC vs cash back CC.

However, IMHO, your argument fails to take into account the increased purchasing power that CP gives you when using either points or cash. Not taking into account the purchasing power may lead to incorrect comparisons to other points systems. For example, if the value of SW point is 1.3c and the value of an AA mile is 2.0c, then that’s not really a fare comparison as to which point has more purchasing power. Having the CP doubles the purchasing power of either the SW point or dollar. That would be a farer comparison to the AA mile.

Even in the cashback situation, it seems to me that cash back that is destined for a SW purchase is more valuable then cashback destined to dine out. The reason being, that the purchase power of that dollar is higher with a SW purchase.

For us c students that went to public school….

Is the Southwest deal better than any other point deal with the other domestic airlines? If not which domestic is a better deal to transfer to for our economy seats?

Original commenter from the other article here. Not checking the site for a few days I was surprised to come back and find Nick has made a whole post in response to my comment (and that the article has blown up with its own comment section from the looks of it)!

Nick I appreciate the time you took to write this out. Your response on the other post quickly made me realize where my valuation error is, but I think the multiple ways of explaining it here help if the first explanation doesn’t click immediately. For me it all boils down to that an award booking is not required to use the Companion Pass (which I know, I’ve booked cash flights with it before).

Luckily for me this was all a quick theoretical idea when I thought about “what other Chase transfer partners are unique and valuable?”. Our family is on our second Companion Pass and we’ve accumulated so many Southwest points over time that we haven’t ever actually considered transferring UR to Southwest. Between card SUBs, referral bonuses, 5X and 10X targeted spending offers, and the annual points earning from holding a card you can somewhat easily earn in the realm of 200K points in a year (or more) which if you are booking Companion Pass flights on points is a lot of value to spend down. With no first class and the flights all being domestic that’s more flying than we do in a year even with a month of vacation time from our jobs.

I can somewhat see the argument in feeling like the points are more valuable in Nick’s points #2 and #3 on possible reasons to transfer anyway, in that if you are points rich but cash strapped the UR points transfer may be the difference in being able to take the trip at all (in essence you are required to make an award booking to take advantage of the Companion Pass, otherwise you just won’t fly). But your talking a pretty extreme example there where you’ve already covered other travel expenses like hotel on points and the couple hundred dollars for the one cash ticket is going to make or break the trip. If you were going to pay cash for the hotel there’s a good chance you could do better booking a Hyatt on transferred points and using that cash to buy the Southwest flight instead.

I’m looking forward to reading the long comment section on this one. In case anyone pointed out I can’t math – yes on a snap post on this one I definitely miscalculated the cpp value. It’s funnier because I instinctively know that UR transfers don’t make sense for our situation and hadn’t considered it but didn’t fully think through the math on how that plays out in valuations.

So, while this question isn’t directly about the cpp of UR points transferred to SW, I think it’s close enough to the present discussion to ask it here.

Let me grant Nick’s 1.3cpp take here for UR points transferred to SW. If one is only focused on points redemptions for flights (not hotels), and only economy flights at that (would never be willing pay more in points for more luxurious flights, even if you’d be getting “outsized value” in terms of cpp), then is SW still a bad transfer partner?

Guess I’m wondering how much of Nick’s “SW is a bad value transfer partner” take is based on his willingness (like many) to spend more points for more flight luxury. For those of us who won’t ever pay more than you have to to get from point A to point B, is SW a good option to transfer points to? (Again, ignore other transfer options like hotels. Just economy flights.)

Even as I write that question, I have a sinking suspicion someone is going to point out that there’s something “wrong” or confused about my question. But I’ll ask it anyway, as someone who has often transferred UR points to SW and would never pay more for added luxury on a flight.

In any given situation, it may be better or worse than transferring to other airlines. That doesn’t make it a “good” transfer partner in the sense that you won’t get more than 1.3cpp in value, but it certainly might be better than a partner offering only 1cpp or 0.5cpp. Again, the fact that others are worse in a situation doesn’t necessarily make Southwest a “good” value.

Ignoring Southwest, let’s imagine that every airline except United was offering 0.5cpp or less and United was offering 0.8cpp. Is United a good transfer partner? It’s better than the other options, but it isn’t “good” — in that spot, you could just cash out Chase points at 1cpp and buy your United flights for fewer points.

The heart of my argument with Southwest is that there is zero opportunity for outsized value. It’s only ever 1.3cpp. There are many ways to get better value than that out of Ultimate Rewards points. Again, there are times when that 1.3cpp might be better than your other options — and if you want to transfer to Southwest, so be it. But I think a common misconception is that if you have the Companion Pass, it is making Southwest worth more than 1.3cpp and therefore you should transfer to Southwest (and then you might also choose to earn Southwest points — like in the shopping portal scenario — based on this fallacy of Southwest points being worth more than 1.3cpp). That is not true.

Maybe this is the example I should have led with:

Let’s say that a Southwest flight is 10,000 points or $130 (1.3cpp)

A United flight that you consider equivalent with Southwest is $50 or 4,000 points (a value of 1.25cpp).

In that spot, Southwest points are more valuable against the cash fare that Southwest is charging — and if you believe that having the Companion Pass increases their value even more (i.e. beyond 1.3cpp), then you would clearly transfer to Southwest and that would give you more value, right?

Of course you wouldn’t. The United flights are $50 each or 4,000 points per seat, so you could have two seats for $100 or 8,000 points. The Southwest points don’t increase in value whether they buy one seat or two.

But are the United miles more valuable than the Southwest points? No, they are less valuable. They only only buy stuff at the rate of 1.25cpp in that situation.

Which transfer partner is better in that case? If you’re going to blind yourself to the cash that the points save you and you will only use points and not consider using cash, United is the better transfer partner than Southwest in that case — however I would say that if you have the Sapphire Reserve, neither is a “good” transfer partner since you could buy the two United tickets for 6,667 points.

Again, you could come up with scenarios where at 1.3cpp Southwest is a better option than your other domestic award options — in fact, if your primary focus is flying domestic economy class, I have shown time and again that you’ll use fewer points with Southwest than with other airlines if you’re flying two passengers. But that doesn’t make Southwest a better transfer partner — really, it means that you should probably be either using URs at 1.5cpp to book those flights with the CSR (assuming you’re booking enough of them to offset the increased annual fee of the CSR, which, assuming you are a CP holder is probably true) and/or focusing on a strategy that offers opportunities for cash back at a better rate (for instance, getting a Bank of America Premium Rewards card if you have Platinum Honors status and earning 2.625% cash back on your “everywhere else” purchases instead of using a Freedom Unlimited if your ultimate goal is booking Southwest flights since at best those Freedom Unlimited points are going to get you 1.95c per dollar toward Southwest if you’re transferring to Southwest or 2.25c toward Southwest if you’re booking through Chase at 1.5cpp.

If you have any interest in international travel (even in economy class), then there are a plethora of opportunities to get far better than 1.3cpp out of your Chase points. The same is true if you’ll ever use points for Hyatt stays (even and maybe even especially Category 1 Hyatt stays). I think Southwest is a comparatively poor transfer partner against all partners except JetBlue unless your only aim ever is to fly domestic economy with your points — and then, while it will sometimes be comparatively better than other transfer partners or comparatively worse, I’d still assert that it isn’t what I’d define as “good” since the value is statically and categorically less than our Reasonable Redemption Value.

All that out of the way, like I said, if 1.3cpp is the best deal available to you and forsaking other opportunities to get more than 1.3cpp is acceptable to you, then by all means transfer to Southwest. It certainly beats cashing out at 1cpp. My point is to make readers aware of the consistent valuation of Southwest points that does not change with the Companion Pass — that’s important to understand so as to avoid for example, using the Freedom Unlimited for dining at 3x (which is going to get you 3.9c per dollar spent toward Southwest flights if you transfer) if you had some other card that offers 5% back, the chance to earn 5c per dollar spent.

That last part is exactly why this matters to me: If you buy into the fallacy that points transferred to Southwest become worth more than 1.3cpp because you have the Companion Pass, you might use the Freedom Unlimited at a restaurant for 3x over using a card that earns 5% cash back. The 5% back will buy you more in flights than 3x transferred to Southwest will, companion pass or not. You will get more flights out of the 5% cash back rewards than 3x Southwest points no matter whether or not you have the Companion Pass.

Wow. Amazing that you could respond with all of that that quickly, Nick. Thanks! I think I’m following you here.

That said, in reading your response, I think I realized my true question (which isn’t really about the impact or non-impact of SW CP on points valuation, as interesting as that discussion is) is very tailored to my specific preferences and criteria: (1) don’t spend cash for flights when points are available (unless I could literally cash out the points I would have to use for that flight and use that cash to pay for the flight while having change left over, which I assume is basically never the case), (2) don’t spend more points to get from A to B than you need to (within reason; not going to take more than one layover on a typical flight just to save additional points; but, again, never going to pay more for a more luxurious flight), (3) yes, focused on domestic travel only (which is really what I look to SW for).

You don’t need to further answer (though I certainly won’t object if you do), since I’m sure it’s too much to try and address every idiosyncratic question from readers. But my question, again, isn’t so much about the core companion pass issue you were addressing (though I do have a companion pass), as much as whether I’m an idiot for transferring UR points to SW, given those said preferences/criteria. (I do in fact use UR points most often for outsized Hyatt redemptions, as I’m much more willing to pay extra points for hotel luxury than flight luxury. So I get that I get the most bang for my buck, er, point by just channeling my UR points to Hyatt. But assuming I still would really rather use points for my flights rather than cash …)

If it makes any difference, I have a good amount of both UR and Amex MR points, when it comes to what I have available to draw from. (Haven’t really tried the other types of cards yet.)

From some of what you wrote, I’m gathering that it’s at least often still pretty reasonable among domestic economy flight options to transfer UR points to SW (even if compared to other things you could do with those points, which you might value but that I might not, it’s not a great redemption). But I could be off.

An idiot? No. Is it an objectively “good” decision? Well….I think the danger in saying “well, in my situation it’s a good option” and justifying transfers to Southwest (or any program) by saying “I don’t want to spend any cash for flights” is that it can lead you to making poor decisions on the earning side, because then you are “spending” cash with your potentially faulty earning choices. I use the word “spending” in quotations there and loosely to mean this: If I’m going to earn 3x dining on my CFU and transfer to Southwest for 3.9c in value rather than, for example, use my US Bank Altitude Reserve with mobile wallet for an effective 4.5% back, then sure I can use the Southwest points and put my hands over my ears and say “But I’m not spending any monnnnneyyy!”, but the reality is that I’m leaving 0.6c on the table for every dollar I spend and also the points I could earn on the cash tickets when using the cash back. Compounded over years and other similar decisions, that adds up to you “spending” money in the form of money you essentially turned away from in order to feel like you weren’t spending it. There is something to be said of the Joy of Free, and if most of your Chase points are earned from welcome bonuses or spending in 5x bonus categories, then by all means accept the 1.3cpp if that’s your highest-value option. Like I said, it’s not the worst use of Chase points. But I’d also examine how often you’re booking flights and if it is a lot I would be considering either using the Sapphire Reserve for 1.5cpp instead or the Amex Business Platinum 35% rebate, which is good for up to I think a million rebated points per year and yields a bit more than 1.5cpp net, though the Business Platinum strategy hinges on whether it makes financial sense to have a Business Platinum card, which might not be the case for you (in which case the CSR is what I’d be thinking about).

Man, thanks again for these lightening speed replies. Indebted.

And got it. Yeah, I wasn’t fully getting what you were saying about the earning side. But I see it now.

That said, it is in fact the case that virtually all of my Chase points are earned on SUBs or 5x bonus categories. So I guess that makes my transfers to SW a bit less painful, if I’m hearing you right. Still I’ll keep what you’ve said in mind as I continue to evaluate stuff.

To your questions, my family of four probably flies 3-4 times per year these days, mostly domestic (including an annual Hawaii trip). We do have a Business Plat and will keep the 35% points refund in mind. (Though last time I inquired I could have sworn that even after the 35% back, I’d still be out more Amex points than I would be transferring Chase points for the same SW flight. I remember thinking that for some reason it was like Amex had different inflated pricing for the same flights. But maybe I was off. Travel planning and booking is often occurring in the middle of the night in our house, when all cylinders aren’t always firing.)

Hey, thanks again.

This article is a good example of why I read and recommend Frequent Miler over other travel blogs. I love the rational valuations with correctly applied logic and explanations.

In my particular case, flying Southwest is the best fit for my family less than once a year, so their Companion Pass isn’t something I chase after. If our travel patterns change and their Companion Pass would become a bigger money saver to us, I would prioritize earning 135K Southwest points via card spend, sign up bonuses, or shopping portal. My business has high CC spend and directing $135K of our annual spend to a Southwest card each year could make sense (absent other available options). Continuing to spend on the Southwest card vs a 2% cashback card after having earned the required 135,000 points to get a Companion Pass would be a poor choice.

I think the problem that many of the “points are worth 2.6cpp” crowd is having is that you are comparing the number of points that a Companion Pass holder has to use vs the cash price that a non-Companion Pass holder has to pay. That doesn’t make any sense. If you are a Companion Pass holder, you should be comparing the number of points necessary if you pay with points to the amount of cash you pay if you pay cash to determine how many cents per point you’re getting.

A non-companion pass holder pays 20K or $260 for two tickets (1.3cpp).

A companion pass holder pays 10K or $130 for two tickets (1.3cpp)

Saying that 10K is getting you $260 in tickets is like someone without the Companion Pass saying that they are only getting 0.65cpp because they have to pay 20,000 points for two tickets that only cost a Companion Pass holder $130. It just doesn’t make any sense to compare that way.

And as I said in the post, this matters because if you just take the “oh, well, I get my free flights so I’m happy” approach, then you’ll make bad decisions like using the Southwest portal at 1x rather than earning 2% back — a mistake that is small at that scale but gets bigger at differences like 4x vs 10% back. If you believe that points are worth 2.6cpp, then 4x would yield 10.4% back and you might choose the Southwest portal over 10% cash back — but that’s an awful decision over the long-haul. Take that over $100,000 in purchases and you’ll have 400,000 Southwest points, which will buy you $5,200 worth of airfare — whereas you could have had $10,000 if you had used a 10% cash back portal, buying your $5200 in airfare and still flying two people just as much as if you had taken the points, but having $4800 left over in your pocket. No, most people aren’t going to spend $100K through a shopping portal in one year or two years or even probably five years, but an example like that shows that the mistake really compounds over time if you continue to follow the wrong numbers.

When I first saw this article, I thought “Duh, that’s a lot of words to explain such a basic concept as comparing apples to apples.” Then I read the comments…

It’s hard to pinpoint the disconnect because your article is quite detailed, but it feels like some commenters feel like you are attacking SW so feel the need to defend an indefensible position.

Maybe the concept that’s unclear is not that Companion Pass enhances the value of your points but that UR transfer to SW is not a great deal (better to just get cash back)?

I think you’re up against the same type of people who will argue crazy high CPP on international awards with unrealistic circumstances. I can’t count the number of times I’ve had someone tell me they got 30cpp value on two separate one way crazy routing international F awards, when the realistic flight they would have booked for cash in F or J brings that number way down. People get hung up on trying to justify their high CPPs and you just have to smile and move on.

Your article disregards the inherent value of the Companion Pass, which is only offered by Southwest (excluding single use CPs from airlines like Delta/Alaska). In that regard, Southwest is a more valuable transfer partner than other airlines. For instance, if you had 100,000 UR and could transfer to either Southwest (with CP) or United (no CP) and the flights were roughly the same quality from a time and route perspective, you would come out ahead transferring your UR to Southwest over United by almost double the value (assuming United miles are worth roughly the same cpp per point as Southwest miles). Choosing United in this scenario costs you roughly double the UR and there’s no way to say that doesn’t mean anything from a value standpoint.

If every single airline offered the Companion Pass feature, then your argument starts to make more sense in how you calculate value. Ignoring the value of the CP and strictly valuing miles may be good for calculating cash saved (e.g. the couple only saved $130 because if they didn’t take the trip at all they would only have +$130 in their bank account), but it lacking when looking at value (United comparison above).

Of course you would book Southwest over United if you could pay $65 per ticket with Southwest over $130 per ticket with United, but the bottom line is that the 100,000 points replaces $1,300 worth of cash, companion pass or not. That doesn’t make Southwest a better transfer partner or points worth more than 1.3cpp, it just means you get a better price on the Southwest flights than the United flights, regardless of whether you transfer points for it or not. Sure, the Companion Pass is great – we’ve had one in my household for the past 9 years, but it has absolutely zero influence on the value of the points.

For most people, points are finite. If I’m getting twice as many tickets for the same amount of points on Carrier A as compared to Carrier B, but then you say Carrier A is not a more valuable transfer partner, then I’m going to wonder how you define the word valuable.

Very simply: it’s based on the cash value. It buys $X in airfare with Southwest. How many seats doesn’t influence the value you’re getting from the points. Hear me out because I think if you consider the math here it is very logical. The equation is simple:

total cash price ÷ total number of points or miles = cents per point or mile. That’s how much cash value you’re getting regardless of how many seats we’re talking about.

If Southwest is charging $130 for one ticket (which would mean alternatively 10,000 points) and United were charging $32.50 per ticket or 3,250 miles, it doesn’t matter that you could buy 3 United award tickets or 4 United cash tickets for the cost of 1 Southwest ticket — you’re getting 1.3cpp for your Southwest points ($130 ÷ 10,000 points = 1.3cpp) or 1cpm using United miles for the United tickets (you take the cash cost you would have to pay for one ticket at $32.50 and divide by the number of miles you would have to pay, with is 3,250 and $32.50 ÷ 3,250 miles = 1cpm. If you need two tickets, the equation goes to $65 ÷ 6,500 miles and it’s still 1cpm). If you need 3 tickets, with United it is $97.50 / 9,750 miles). *It doesn’t matter that you could get three United tickets for fewer miles than 1 or 2 Southwest tickets* — those United miles are less valuable toward that United flight than the Southwest points are toward the Southwest flight. In that specific instance, United is a poorer value. The fact that you get more “free” tickets doesn’t make the United miles worth “more” than the Southwest points. It’s still a *low value* for Ultimate Rewards points in that spot.

I’m not saying that I’d transfer 10,000 points to Southwest in that case over transferring 3,250 (or however many for the seats I needed) to United — in that case, I wouldn’t want to waste my points at 1cpm, I’d just pay United $32.50 per seat that I needed (and indeed I do that when United is significantly less expensive than Southwest, which does happen a decent chunk of the time for flights from my home airport these days). I’m not going to burn my Ultimate Rewards points at 1cpm (particularly when I could otherwise use them at 1.5cpp through the Chase portal to buy the same United flight for fewer points yet — in which case I *would* consider paying 2,167 Chase points per United ticket and I could buy almost *five* tickets for the cost of one or two on Southwest). Southwest points just aren’t more valuable than 1.3cpp.

Again, I could call Chase and use 8,667 points to book that same $130 Southwest ticket (whether I need one seat or two seats) at 1.5cpp. It doesn’t make sense to transfer 10,000 points to Southwest to buy that $130 flight when I could buy it for 8,667 Chase points *and earn miles* and if I have a Companion Pass I can still add my companion or not add my companion, it doesn’t matter. Obviously 1.5cpp gives you more value for the points since it requires fewer points to offset the same amount of cash.

Regardless of the number of tickets, the cash value you get is the cash price you would need to pay divided by the number of points or miles you need to use to avoid parting with your cash. Whether or not you have the Companion Pass is 100% irrelevant to that equation.

I’m not trying to be disrespectful, but your opening sentence is completely wrong, which is why I think we look at this differently. You said,

“It buys $X in airfare with Southwest. How many seats doesn’t influence the value you’re getting from the points.”

If I need 2 airline seats for me and my traveling companion and I have 10,000 UR that will get me 2 seats on Southwest, but only 1 seat on United because only Southwest offers the Companion Pass feature, then how many seats absolutely influences the value you’re getting from the points. Of course, certain conditions have to exist before the value is weighted in Southwest’s favor such as 1) Traveling with a companion, 2) Finding a preferred/equal route on Southwest and 3) Having the Companion Pass unlocked. But, because you can *only* unlock it on Southwest, it’s not a factor you can ignore when pronouncing the best airline transfer partners.

Forget airlines for a moment. This same argument could happen with Hyatt and Marriott. If you had the same 10,000 UR that could be transferred to Hyatt or Marriott, most choose Hyatt. Why? Because of categories and non-dynamic pricing. That’s a feature that’s unique to Hyatt now that Marriott, Hilton and the other big chains have transitioned away from flat category pricing. Within the Hyatt ecosystem, the cpp value can vary, but generally speaking you can stretch Hyatt points transferred from UR to more overnight stays than you can with Marriott.

Again, certain conditions have to exist: 1) Hyatt with availability at your destination, 2) A desire to stay in the Hyatt hotel and 3) Some factor whereby your ability to stay overnight is bound by your point pool (e.g. You’re not sufficiently wealthy to stay anywhere you want on cash at all times) and 4) Overnight stay is a necessity, rather than a luxury.

You’re not wrong when you stated in your article that the Companion Pass doesn’t transform the cpp value of cash saved from 1.3 to 2.6, but the effective cpp of a Ultimate Reward point transferred to Southwest for someone with the Companion Pass is doubled assuming that flying Southwest is equal in preference/quality to that of another carrier to said person.

If you’re strictly using the term valuable to mean cash saved, then we agree on that definition. But, the title of the article is about valuable transfer partners and calling the Companion Pass irrelevant in that determination seems unfair to Southwest.

You’re arguing quantity. I’m arguing cash value. 10,000 points gets you $130 worth of airfare. It doesn’t matter whether that buys 1 seat or 2 seats or 200 seats or 15,000 seats. It is $130 worth of Southwest fare. 10K points replaces $130. It doesn’t matter whether you have a Companion Pass or don’t have a Companion Pass or there is a mistake fare enabling you to buy every seat on every Southwest flight for the rest of eternity for $130 — 10K points or $130 = 1.3cpp. That makes it a poor value transfer partner. If I could buy every seat on every Southwest flight for the rest of eternity for:

1) 10K Ultimate Rewards points transferred to Southwest

2) $130

3) 8,667 Ultimate Rewards points through Chase Travel

I certainly would not pick #1 under any circumstances. Why would I? I’d rather use fewer points at 1.5cpp through Chase Travel or use my $130 cash knowing that I will have opportunities to get better than 1.3cpp with any UR transfer partner except JetBlue.

I understand the math behind the calculations in the article. We all get it; it’s obvious. But here’s the thing, we don’t shop for travel like that. And I would argue, most everyday points enthusiasts don’t. You look at the product you are considering in the context of all other available options: the market.

The market is absolutely a valid determiner of points’ value, even in terms of cpp. This Christmas we are considering Cabo. Here are the flights from Denver to Cabo on December 21:

AA: $534 or 55k (.97cpp)

Delta: $579 or 38k (1.5cpp)

United: $754 or 40k (1.8cpp)

Southwest: $302 or 18.6k (1.6cpp)

We are a family of 4 with 2 companion passes. If we wanted to get the most “value” for our UR points pegged to the highest cpp as defined in the article, we would transfer them to United and pat ourselves on the back for a responsible use of our UR points…but this is obviously a stupid choice. Transferring to Southwest will net us several thousand more miles flown per point. Talking about Southwest points’ value in terms of what we could have paid with cash is meaningless. We aren’t looking to pay the least amount of money. We’re not going to pay any money. We must talk about them in terms of what we would have paid with other points in the market, because points were the only option that were ever on the table. And in this case the Companion Pass has, in fact, doubled the value of the points.

Are we still getting 1.6cpp if we reference them to what we could have gotten if we transferred to cash and bought the tickets. Yes, and that’s a valid argument to make; I get that. But if we reference them to the points market we are most definitely getting double the value (3.2cpp) and that is how many—I would argue even most—people shop because they are not interested in spending money on flights, and that is also a valid argument to make.

This thread had given me a better understanding is why half the people in my analytics department are from overseas

Seems like we’re splitting hairs here. I got the CP and utilize it to subsidize flights I was going to do anyways. Whether optimal value or not in terms of CPP, I find incredible value transferring some points over to make my trips $11.20 and a few thousand points vs a few hundred dollars. Whether I’m getting 2.6 CPP or it just being a coupon, the outcome is the same. While all of us in the points and miles game want to get good to great value, seems like we’re in the weeds unnecessarily here.

Excellent analysis. The 1x vs 2% example definitely makes the point.

Another wrinkle to add here is the SWA gift cards are often discounted 10%-14% (Costco, Chase offers, etc). The $130 theoretically becomes $112. In the 2% example, you’re now pocketing $88 instead of $70.

If you spent $22500 on a 2% card, you’d have $450. You then spend that $450 on a discounted $500 gift card. You’d be able to buy almost 4 of the $130 flights (500/130 = 3.8).

If you spent that money at 1x, you’d have 22500 SWA points which would get you 2 of the 10K flights (22500/10000 = 2.25).

The 2% gets you 1 full flight more than the 1x. And your companion goes along with you on that flight.

Is the value of Southwest points math or is it philosophy? If it is math there should be a simple equations that calculates their value. When you bing in discussion items like are WN points are more valuable when you are earning the companion pass then when you have the companion pass it seems like philosophy. Something is more valuable when you are earning the thing then when you have the thing.

The difference is not philosophical. There is an actual value difference that should be applied by those aiming to maximize their return on spend.

If one gets great value from a Southwest companion pass, it is rational to value some points higher based on the companion pass being earned by those particular points. After the threshold has been met, this benefit from earning more Southwest points is no longer there.

WN points have value only when used. The companion pass has value only when you use it. It is fake math to count your chickens before they hatch. You can not apply value to something until you have it and if WN points have their own value and the companion pass has its own value you cannot say in some instances they impact the value of the other but not in all instances. Cash is an appreciating asset with value every second you hold it. WN points are a depreciating tool with no value until used. Do I transfer UR to WN – never.

Hypothetically, if Southwest offered an option to purchase a companion pass for $50, would you buy it?

If yes, and as you say it has no value, why would you part with $50 USD for it?

I suggest a companion pass does have value to an individual based on how they anticipate using it.

Hypothetically, if Southwest offered an option to purchase 100,000 points for $200, would you buy it?

If yes, and as you say the points have no value, why would you part with $200 USD for the points?

We should value things based on their future anticipated use to us, not just our past gain.

Earning Southwest points instead of other points or cash rewards is irrational if we do not value the points we are earning.

When choosing which option to earn, we need to value each option in relation to the others.

For example, continuing to spend on the Southwest card vs a 2% cashback card after having earned the required 135,000 points to get a Companion Pass would be a poor choice.

My wife’s parents earned hundreds of thousands of BA miles in anticipations of going to Europe. They never went to Europe or spent 1 single of those miles. What was their value? Anticipated value is a good tool for making decisions but the actual value of any points or miles is not real until the moment you use them. The only thing that is real is cash.

Analogy time:

Let’s say I bought a brand-new manual car thinking I would learn to drive manual. Then I never learned and let the car sit in my driveway forever.

What was the value of my car?

You would say 0.

I would say what I paid for it as I would not have paid those $ for it if I did not think the car was worth that much.

What was the value I received from my purchase?

This might be 0 if I waste what I have.

Not using something of value does not mean there is no value to be had; it just means I did not take advantage of the value available to me.

————————————

May I assume that you (like most of us here) have earned points/miles from credit cards, shopping portals, and other promotions where cashback could have been an alternative option?

If those points/miles have no value, how is it not stupid to earn them instead of the alternative cash?

Sorry but a car is an asset owned by the purchaser. You cannot compare an asset you own to a loyalty account that is owned by the loyalty program and they can decide at any moment to change the rules or even close your account. Also I would not say the car value is zero in your example since it is an asset that can be sold.

I focus on earning points and miles I have a relative good idea I will use in the next 18 months. I do not want to be a hoarder of points because of devaluations. When I start to get a lot of points I do switch to a cash back rich strategy. I do not focus very much on CPP and more on accomplishing what I want to do. I have made lots of poor redemptions and I have also had plenty of really amazing ones. When my stash of MR points gets too big I will not hesitate to cash them out to my schwab account.

So in summary, Companion Pass doesn’t give you better cpp when looking at ways to redeem Chase points because it also lowers cash prices for flying with a companion. If you have a redemption in mind that is >1.3cpp, do that instead of transferring to SW.

However, CP does increase the value you get when spending SW points (or cash for that matter). It is fair to say, “Using CP, I got 2 flights for the price of one flight in SW points. That was a great deal.”

tl;dr Companion Pass makes SW points more valuable but does not make them a better cash alternative or transfer redemption alternative.

One more thing to add though. I fully believe that sometimes it is better to pursue suboptimal redemptions if they feel great. Let’s say a pair of flights costs $260 but only $130 with CP. If you use 10,000 points you only save $130, not $260. But spending only a few points and fees to get both flights feels awesome and I would look back on that redemption with fondness. Another example: I used 100% of my discover cashback on Chipotle gift cards. I could have chosen a higher-value gift card but I know they wouldn’t make me as happy as the fact that I haven’t used my credit card at Chipotle for the last 6 months lol

I always feel better getting more value than less but maybe what you’re getting at is that something used provides more value than something that isn’t used. A $100 Chipotle gift card that you’ll use up in a month is more valuable than a $200 Bass Pro Ship gift card that you might not use at all. In that case, the $100 Chipotle gift card is actually the optimal, not the suboptimal redemption. Your points valuations should be based on what you’ll actually use them for, not what you hypothetically could but won’t.

I agree with your point but what I really meant was that getting $100 of “free” food from Chipotle for repeated visits in a row just feels better than getting $110 off of a TV at Best Buy (that I was already going to buy). It is purely an illogical, emotional argument

To be pedantic, why don’t you just redeem your Discover cashbacks as cash? You are missing out on earning points from using a credit card (either spending towards a SUB, dining, or even Amazon/office supply store for gift cards).

I didn’t mention that Discover allows you to redeem cashback for discounted gift cards. If it was face value, I’d just be prepaying for my food and that would make me much less happy

you got it…sometimes gotta go for the feel good factor.

too much “logic” and “optimization”

throw caution to the wind!

I have a Southwest $100 gift card I bought a few years ago (At the grocery store or something like that – effective 20% back in MR points, I don’t remember anymore.).

It’s still collecting dust. Have flown Southwest since then…but I had eCredit that I used (And still have). Have some points too…but I don’t remember how much w/o logging in.

I just don’t fly Southwest often enough.

If one takes the effort to get a Companion Pass — there is a sunk emotional cost that one should use it while they have it. Thus transferring over points….

…if one has no particular alternative for them (Don’t stay at Hyatt/don’t like Hyatt or flush with Hyatt points – or can pay cash for cheaper; no other airline programs are relevant, etc..)

When you get in this game – it’s very easy to overthink (said it before). Or even end up traveling to places that you don’t really care to – but just did because it was a “good deal.”

12,000 UR points transferred to SW w/ Companion Pass can get me $312 worth of flights which Nick deems not valuable.

12,000 UR points transferred to Hyatt to save me $308/nt for a random Cat 3 Hyatt Regency I quickly searched & Nick deems that valuable.

—

The point is: if I have an SWCP then saving $312 worth of airfare by using UR 12k UR points is pretty freakin’ close to the same feeling when I save $308 at the Hyatt. So even if @Nick Reyes Reyes(whom I think is a super swell guy) doesn’t deem them to be equitable use of my UR, my sweet little bank account gives it a big fat

The whole point is that you aren’t saving $312 by using 12k UR. You’re saving $156. Your UR account should be thanking Nick for correcting your math.

No. If companion pass gets you $312 worth in flights, your cash cost would be only $156 ($312 ÷ 2) because you got the second flight for free. So, you’re redeeming 12,000 UR points to pay $156, NOT $312.

Say you have $312 and 12k UR and want to do both?

If you use the UR for SW, then pay $308 for Hyatt you have $4 leftover.

If you use UR for Hyatt and pay cash ($156) for SW then you have $156 leftover.

Which one do you pick? If you use the UR for SW then WHY, because you just gave up $150?

Alright, that does make a lot of sense. I mainly engaged because I thought it’s more of a perspective value than actual value–I’m super flush with my darling RR from other methods.

However, I do still see how one can look at it & say that because they used 12k UR they did offset $312 worth of flights but it’s helpful to also be able to look at it the way Nick(& later you) describe.

It would be funny to see that same kind of scrutiny applied to the perceived value of breakfast, rooms & parking at a Hyatt.

My 20,000 pts plus Globalist offset $400 worth of room & $100 worth of breakfast + $80 in parking…I’ll ignore the fact that the value of that room & food & parking was overinflated and I could have paid a lot less in cash than what $630 that Hyatt told me it was valued at. I’ll still perceive that my 20,000 UR was put to great use! 🙂 In both cases, you can apply an emotional feel of the value you got & still be able to do some math to prove the contrary.

Nick is right but his explanation is lengthy. James–your example is succinct and gets the point across perfectly.

Imagine you log into your UR account and are surprised to see only 2 options for redemption:

You have companion pass. Which do you chose? If you can answer correctly, you agree with Nick.

I’m not sure what you’re trying to say. There is no option to cash out at 2 cpp. You could cash out for a statement credit at 1cpp and then spend it on SW flights, effectively netting 2cpp. That would be a Very Bad Deal, as Nick illustrates. You could cash out at 1.25 cpp with CSP or CIP, or 1.5 cpp with CSR, if Chase allowed you to purchase SW tix over the phone. The latter would yield 3 cpp given your CP. Getting 1.25 cpp would be worse than getting 1.3 cpp if you transferred 1:1.

You’re missing the point of John’s hypothetical. His hypothetical is aimed at the crowd who would argue that points are worth 2.6cpp.

John is saying to imagine a fictional world where you only have two options with Ultimate Rewards points: transfer 1:1 to Southwest or redeem for 2c per point for a statement credit. In that make-believe world, if Southwest points are worth 2.6cpp, you would transfer to Southwest.

But his point proves that they aren’t worth 2.6cpp with the Companion Pass. Take my example $130 airfare — you would have to transfer 10,000 UR points to Southwest at 1:1 to book that, but in the fictional world where you could trade in Ultimate Rewards points for 2c per point, you could trade those points for $200, buying your two tickets have having $70 left over. Obviously 2cpp is worth more than Southwest points — so those Southwest points can’t be worth 2.6cpp.

Well but that’s double counting, if you could spend it on Southwest; because in that case, you’re not getting 2cpp, you’re getting 4cpp. Add in the qualifier that you can’t spend any cash on southwest during the 23 months of CP, so that your option is really just cashing out for 2cpp, and that’s a fair question.

And that is what it boils down to. The cashback option is superior *only if you can use it for the BOGO offer* – let me repeat. Only if you can use it, or fungible equivalent funds, on the BOGO coupon. You can’t use a BOGO on Hyatt, so that UR is worth what it’s usually worth, maybe 1.5 or 1.9 or 2.3 – but it’s not doubled. If you could cash out URs for over 1.3 cpp then it would be worth it, but only if you could use for SW. Of course, if you were going to plunk down 1k per night at the Park Hyatt, then those Hyatt points maybe are fungible into RR – and I know we’ve got some people who read this who probably do pay cash sometimes. They’re not the ones normally flying SW. but the point is that Hyatt isn’t fungible into the BOGO offer of CP unless you’re spending actual cash or equivalent.

To illustrate my point another way: you can’t cash out for 2cpp! Indeed, unless the CSR works to call in for a southwest purchase, as you hypothesize, you would have to get a very good Hyatt or UA redemption to to get as much value from a UR. (If you can get 1.5cpp on a Southwest purchase with CSR, as I’ve said throughout, I agree that is a superior option.)

I think the error comes in because you’re looking at cpp as a cash amount on one side of the ledger, and as actual value on the other side. You can’t eliminate a-priori the way you get points, because UR earning is far superior to normal 2% cashback (due to signup bonuses, referrals, and bonused spend). And you can’t mix and match between URs (that can only be cashed out at 1cpp) and 2% cash back. If you look at it all, in context, URs transferred to SW are the equivalent of 2.6% of value, and the transfer can thus make great sense. (Of course with the normal caveats about it being relative to your situation. If I’ve got 300k rr then another 10k in RR is not so beneficial…)

PS – what would make sense for 2023 would be moving to Aeroplan and using their PYB – because you get 1.25 cpp from their PYB, plus a 10% transfer bonus if you move 50k+. Even better with the 20% bonus they had in July… but even without that you get 1.375 cpp – plus whatever amount of points you would earn from SW (6x)!and the Chase card (1x).

Put another way, while you have the companion pass and are buying SW tickets ,

1 UR/SW point buys 2.6c of airfare, while 1$ buys 2$ worth of airfare.

The value of points increases while the value of money is also increased

🙂

No, it doesn’t buy 2.6c worth of airfare! See the shopping portal example.

“the value of money is also increased”

If your cpp calculation involves modifying the value of the US dollar, you’re doing something wrong.

If I have a coupon for 50% off at Dell, I don’t then say the dollars in my bank account are worth 2 cpc (cents per cent).

How you’re supposed to us CPP (RRV): Compare points to cash to determine whether to earn/redeem points or cash in a given situation.

How people like to use CPP: Compare a points redemption to a hypothetical cash redemption that no reasonable person would ever pay or that doesn’t even exist (e.g. cash redemption when someone with CP doesn’t have CP).