Paceline is a free app that rewards you for exercising (more on that below). Now, they’ve added a not-free ($60 per year) credit card to the mix. This credit card offers amazing cash back rewards… if you work out at least 3 times per week. When you meet the app’s exercise goals, the card earns 5% back for grocery, drugstore, and more; and 3% back everywhere else. Any week in which you fail to meet the exercise goals, you earn half that (2.5% and 1.5%, respectively). To me, this is a really cool gimmick for encouraging people to exercise more. When you exercise enough, your card becomes one of the most rewarding cash back cards on the market.

The Paceline App

In order to understand the Paceline credit card, you need to understand the free Paceline app first. The app requires an iPhone and a synced fitness tracker: Apple Watch, Fitbit, or Garmen. The app uses the fitness tracker to monitor your “eHR minutes” (elevated heartrate minutes). The goal is to complete 150 eHR minutes each week (and note that you can’t earn more than 50 eHR minutes in a single day).

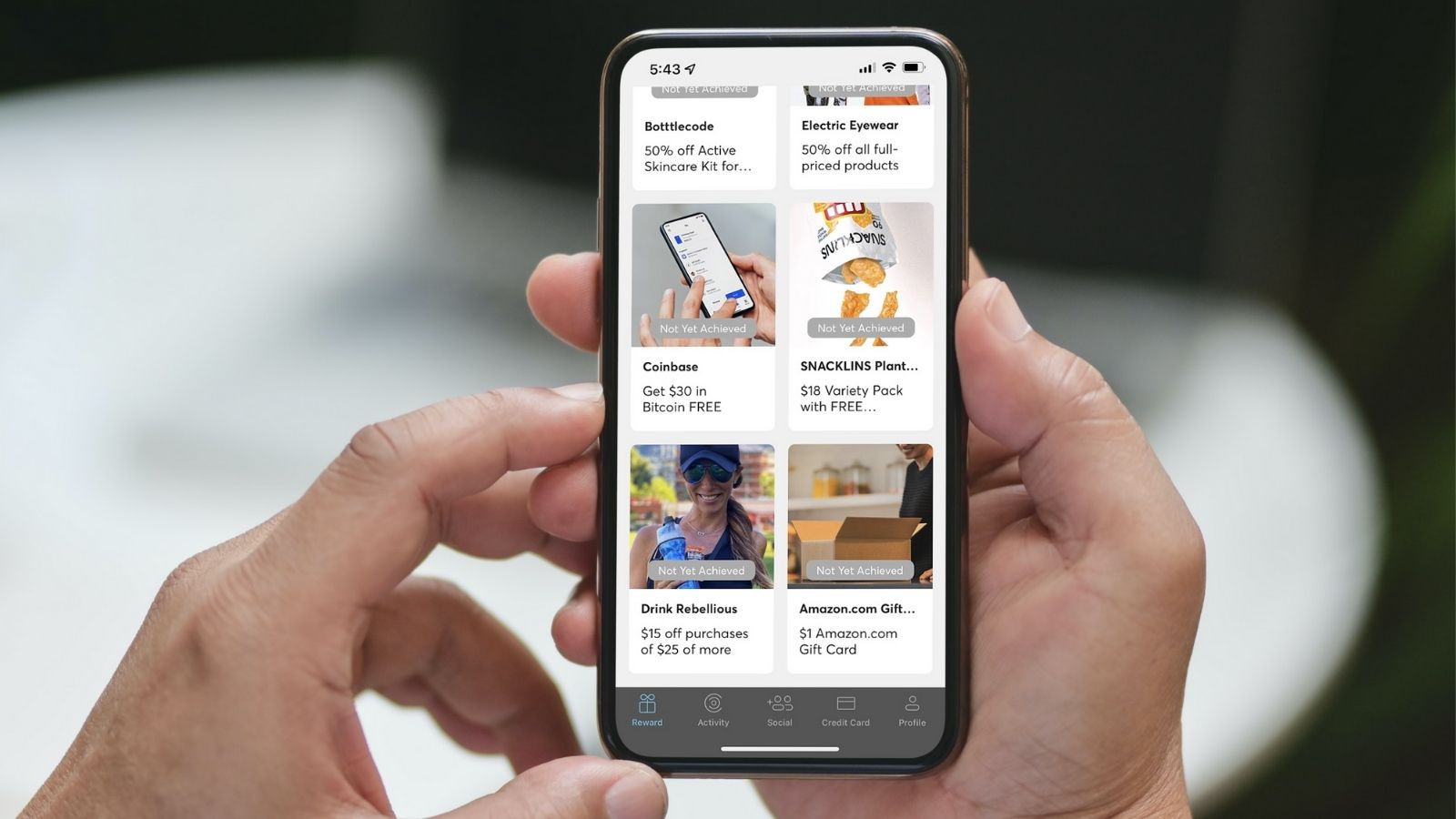

Once you complete the weekly circle, you can select a reward:

I’ve been playing with the app for a few days, and as far as I can tell, most of the “rewards” are basically junk ads designed to get you to sign up for stuff. You can probably find equal or better offers by searching your email’s spam folder. But at the bottom of the list of rewards you’ll find a $1 Amazon.com Gift Card. That’s not much, but hey, this is a free app! If the Amazon gift card is always an option (I don’t know yet if it is), then you could earn up to $52 per year just by exercising regularly. I realize that’s a paltry reward, but its not nothing and I think it has the potential to make a difference for someone who needs just a tiny nudge of encouragement to get out and work out.

My Experience with the App

Last year, as time was ticking away for me to use up the Dell credits that come with the Amex Business Platinum card, I bought a Fitbit Luxe watch on a whim. And for the next few months, it sat around waiting for someone to wear it. Finally, once I learned about the Paceline credit card and the Paceline watch, the Fitbit got its chance. My thinking went like this: 1) The credit card sounds awesome if people can easily meet the exercise goal each week; 2) I can test out how easy it is to meet the weekly exercise goal by using the app even without applying for the card; and 3) I need a fitness tracker to make all that happen. Boom. I installed the app and put on the Fitbit.

Interested in trying out the app yourself? Use a friend’s referral link to get the app (or enter their referral code after installing the app) and you’ll get a $5 gift card (and your friend with get a $20 gift card). Here is our referral link to get you started:

- Frequent Miler’s referral link (Code: FREQUENTMILER)

I installed the app last week, and learned the following from my experience so far:

- The app automatically counted minutes when I went for walks. On two days, I completed the maximum daily 50 eHR minutes simply by walking 50 minutes or more.

- The app did not count minutes vigorously exercising at Pure Barre. Last Saturday was one of my most intense exercise days ever and yet the app didn’t think I completed more than a few eHR minutes that day. The problem was that I didn’t tell the watch that I was doing a workout and there’s no way to manually correct the error afterwards.

- This morning, the app did count Pure Barre minutes when I clicked a button on the watch to tell it I was exercising. Today’s Pure Barre class easily exceeded the max 50 eHR minutes allowed in one day.

- The App’s week ends on Sunday. I didn’t earn a reward last week because I fell a little short of 150 eHR minutes. That said, it should be very easy for me earn a reward this week since the app week starts on Monday and I already have one 50 minute eHR day for the week (I’m writing this on Monday afternoon by the way).

I do exercise regularly and so I think it will be very easy for me to earn rewards every week with the Paceline app. As a result, I think it would be easy for me to earn the maximum rewards available with the Paceline credit card if I were to sign up for it. Note that I’m still playing with my X1 card and so it may be quite a while before I add something like the Paceline card to my wallet.

The Paceline Credit Card

| Card Offer and Details |

|---|

ⓘ $-60 1st Yr Value EstimateClick to learn about first year value estimates None This card is no longer available$60 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 2.5% for groceries, drugstores, sporting goods, fitness, and athletic apparel ✦ 1.5% everywhere else. Earn double (5% or 3%) each week when you meet fitness goals. Base: 1.5% Grocery: 2.5% Other: 2.5% Card Info: Visa Signature issued by Evolve. This card imposes foreign transaction fees. Noteworthy perks: Earn double rewards when you complete fitness goals (150 minutes elevated heartrate per week). Requires a fitness tracker: Apple Watch, Fitbit, or Garmin. Currently only available for iPhone users. |

The $60 per year Paceline credit card, by default, offers ho-hum rewards, but those rewards double each week in which you complete 150+ eHR minutes. For those interested in cash back, I don’t believe there is any other card with as much uncapped cash back potential, but you really do have to work out for it!

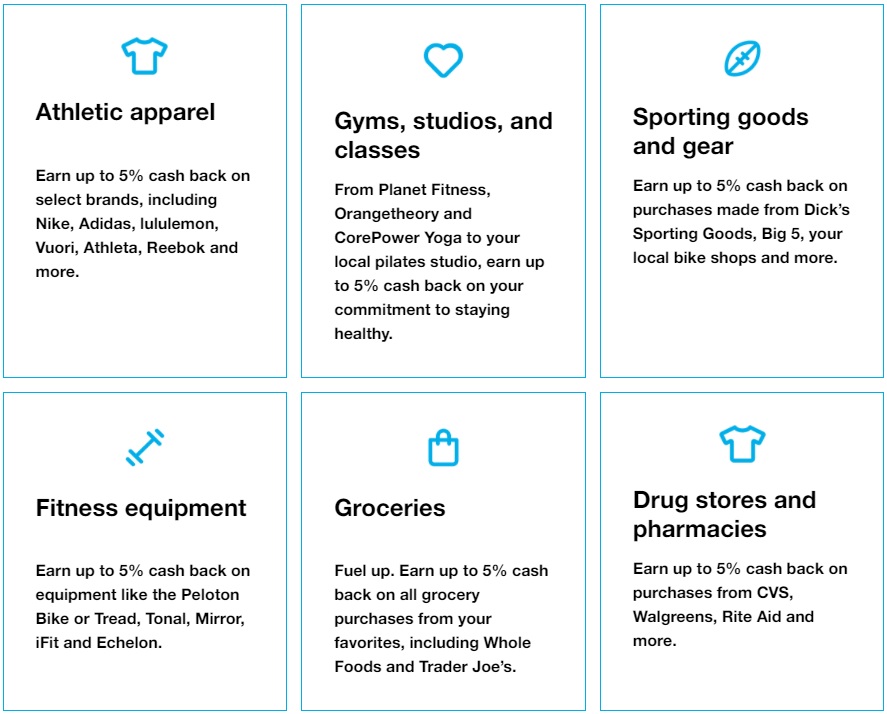

5% Categories

As you can see in the image above, with enough exercise, you can earn 5% for purchases at grocery stores, drug stores, sporting good stores, fitness stores, gyms, and athletic apparel stores. If you don’t meet the goal of 150+ eHR minutes in a week, you’ll earn only 2.5% back in the above categories. That’s not terrible, but if you don’t exercise often enough, it’s not good enough in my opinion to make this card a keeper.

While the display above lists specific stores (such as Whole Foods and Trader Joe’s for grocery stores; and CVS, Walgreens, and Rite Aid for drugstores), the online details about the card specify that qualifying purchases are based on merchant category codes (MCC). That tells me that any store that is coded as a grocery store or drugstore (or gym, or fitness store, or sporting goods store, etc.) will work

3% Everywhere Else

It’s interesting to compare this card to the Discover It Miles card which offers 3% back only for the first year. With the Paceline card, you can get 3% back every week forever (or until they realize they need to cap this benefit) as long as you exercise three days per week! That’s pretty incredible.

The Welcome Bonus

The Paceline card doesn’t have a normal welcome bonus. Instead, it offers to pay you back when you use the card to purchase an Apple Watch. Buy the watch with your card and then each week in which you complete 150+ eHR minutes, they’ll refund 1/52 of the purchase price. So, over the course of a year, it’s possible to get your full purchase price back, up to $429.

Bottom Line

The Paceline credit card offers amazing cash back rewards for those who exercise at least three times per week. If cash back is your thing and/or you could use a nudge to keep on-task with your exercise, this could be a great option for you. If you already have a compatible fitness tracker (Apple Watch, Fitbit, Garmin), then I recommend starting with just the app to make sure that you can complete your circles each week before signing up for the card. If you fly past that hurdle, and if the card’s 5% categories and 3% everywhere else earnings appeal to you, then go for the card.

If you don’t have a compatible fitness tracker, you might consider rolling the dice on your future exercisey-self: sign up for the card, use it to buy an Apple Watch, and work out enough to earn 150+ eHR minutes per week for the next 52 weeks to get your money back. Who’s in?

[…] 3% cashback everywhere and 5% cashback on groceries, pharmacies, and more (see Doctor of Credit or Frequent Miler for reviews). It also came with a free Apple Watch sign-on bonus in a form of a weekly rebate […]

Another fi-tech card bites the dust. I wonder how much longer X1 and Curve will last.

I am cashing in my X1 points as fast as I get them. THey cap to 7500/M in spend at 3X. I did great with Paceline and got all my credits. The last two watch credits will be coming this month. Regular spend. no MS nothing like that.

How do you see what your cash back and credits are every time I login to the Paceline card on the app it crashes I can’t even pay my bill

Your monthly statements show all credits as they always have. The app works perfectly. Still does . Reinstall it if you have issues. I assume you are on IOS. I never had an issue ever . It still works for me.

Awesome. Now we can stop exercising !!

I was thinking I’d have to wait till my doctor said I had a deadly illness; I didn’t consider my credit card shutting down would be just as good, and I don’t have to die so soon!

Hi! Any data on how this impacts 5/24? (I’m over, but prob should get back under at some point .) I work out a lot and would love a new watch but trying to decide if it’s worth it…

[…] (see Miles per Day) may lead to shutdown. I suggest you check external reviews (Doctor of Credit | Frequent Miler) of this […]

[…] drugstore. It got a decent coverage from various big blogs (see reviews from Doctor of Credit and Frequent Miler) but as of 2 week ago or so, the 5% earning on groceries and drugstore is nowhere to be found. I am […]

After 4 weeks of using the Paceline card, it’s one of my favorite cards for general use. 3% on everything and 5% on groceries is pretty good. Here’s how the weekly Apple Watch credits and rewards work. Every week, I get $8.25 in Apple Watch credit (for 52 weeks total) plus a $1 Amazon gift card plus a $5 Amazon or Target gift card after hitting the 150-minute weekly exercise goal for 4 weeks in a row (a streak). For the month, that adds up to about $50 in credits or $600 for the year. Moreover, they offer a one-time $50 Lululemon statement credit for purchases of $50+ in the first 3 months

Do you have to buy Apple watch from app or can i buy from amazon using the card and i will get Apple watch credit?

I believe you have to buy it directly from Apple

You start on the Paceline app, which then takes you directly to Apple. From there, everything is done directly on Apple’s website – picking your watch style, bands and checking out. You usually get your Watch within 2-3 days directly from Apple.

Hi @Lexi. I’ve seen many people have problems with opening their card and being flaged for fraud. Any tips on how to avoid this?

I dont see 5% groceries or drugstore (CVS, walgreens) in the app when click to apply. Is this removed ? All i see is 5% Health and wellness and 3% everywhere. What am i missing or did they change it and we missed it?

It is not that exercising is a lot of work, but there are so many “catches” for getting the full 3%. I would assume many people do not actually get the full 3% because of some “catch.” There are many other cards or a combination that have easier ways to come close to this.

What catches besides the required exercise?

I got the card. Its easy to make the exercise requirement. Walking will get you to the minutes needed. As far as I know you must order the watch via the app and my guess is you can order the more expensive watch but the max reimbursement will be as shown. I would confirm this with them. Also you wont get the watch for free until a year is up. So the weekly watch credit I just got the first one. I assume the monthly cash back will credit your charges on the card, but the watch is approx 8.25 per week credited to the account as long as you meet the exercise. So this week I did 50 mins three days in a row and wed it triggered the watch credit inside the app you can see that and the cashbacks. Ask any questions and I can comment. The exercise part should be easy for anyone to do.

Hi, do you get your watch credit in your first week (week you purchased the watch)? I completed my circle this week, if I applied and purchased apple watch, do I immediately get the first credit at the same week?

You get the credit once you trigger the 150 mins. If you look in the IOS app the credit should be there already. It seems to post immediately.

Great info, thanks!

Greg, I just used your referral code.

Thanks!

Looks like you have to buy the Apple Watch through the app. Do they have all the options? Could I get a stainless steel model and get reimbursed for $429 of it?

What makes you think you need to buy it through the app? The terms just say that you have to pay for it with your Paceline credit card: https://paceline.fit/legal/paceline-qualifying-fitness-device-purchase-reimbursement-terms-and-conditions/

Step 2 on this page: https://paceline.fit/credit-card/

I see. It says “Select your Apple Watch model in the Paceline app and use your Paceline Card to purchase.” I was thinking that it simply meant that you had to tell the app which model you were planning to purchase, but you could be right.

it says $500 reimbursement in the terms, so that should be accurate right? I want to get the cellular apple watch

I reached out to their support team (super nice crew!) They’ll reimburse up to $429 as that’s the MSRP for the bigger screen, basic Apple Watch. You can get any Apple Watch (including Stainless Steel or cellular), but you’ll only get credits for up to $429. Also have to order via their link in app once you’re approved/accept the offer.

I found out $500 is listed in terms and conditions in case Apple releases a newer watch at a higher value that they want to include in the program without needing to go through a legal review to move it from $429 to a higher value.

I know it’s a little confusing but their logic around flexibility to include other models in the future is nice.

Who are these folks? It sounds Like they make their money by data mining.

Greg, WOW, this sounds like a win-win! What a motivator! Never got around to the Schwab special, just have the Citi double cash so this is a definite for me. Great article!!!

Thanks for the review; I am going to try out the app for sure since I need a little motivation to get out winter couch potato mode. I looked a little more at the Paceline website, to get a better understanding of how they measure elevated heart rate and accumulate time. From what I read, it seems like: 1) Paceline requires 150 minutes of exercise/week, but does not need to a minimum of 50/minutes day, 2) for people who have certain (older?) Fitbit models that track “Active minutes”, the Paceline app algorithm is based on that. My Fitbit tracks this with minimum increments of 10 minutes of continuous activity, including normal pace walking, but does not always track time doing at home workout programs that mix cardio, strength training, and stretching.

I think you’re right about not needing to do at least 50 minutes in a day, but rather 150 minutes total per week (with a daily limit of 50 minutes counted). I’ll update the post tomorrow.

Updated