NOTICE: This post references card features that have changed, expired, or are not currently available

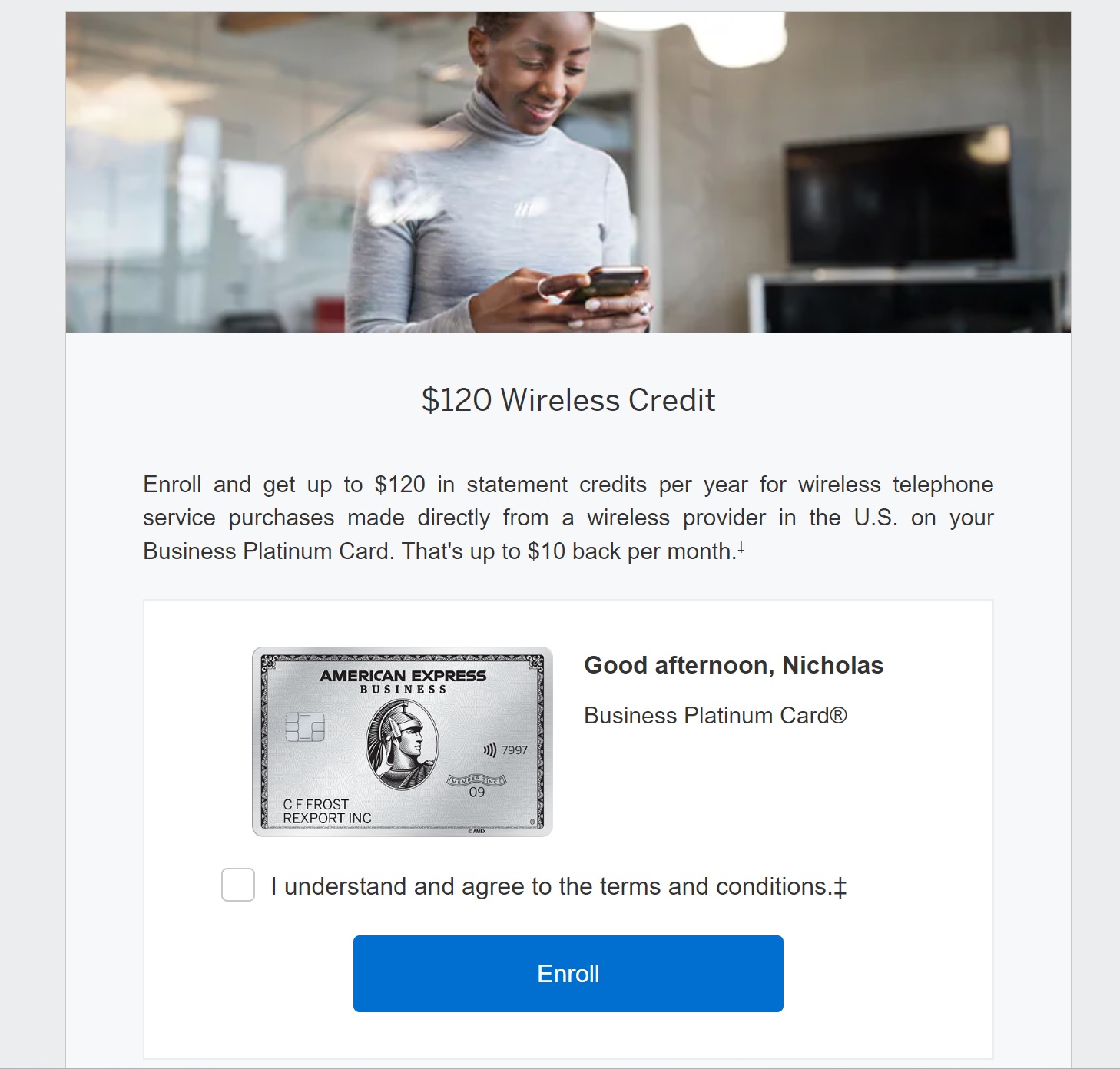

Given that December is a great month to open Platinum cards and many readers may be taking advantage of the targeted Business Platinum card & business checking bundle or one of the great offers on consumer Platinum cards, I wanted to publish a quick reminder that some Platinum card benefits require enrollment. For instance, I was about to use my brand new Business Platinum card at T-Mobile yesterday expecting to trigger that card’s monthly statement credit benefit for wireless services. Luckily, before I submitted payment at T-Mobile, I got distracted by something else and just happened to log in to my Amex account and look at card benefits, where I realized that I needed to first enroll in the wireless credits:

I had completely forgotten that those credits aren’t automatic. That certainly is not not the only Platinum card benefit that requires enrollment.

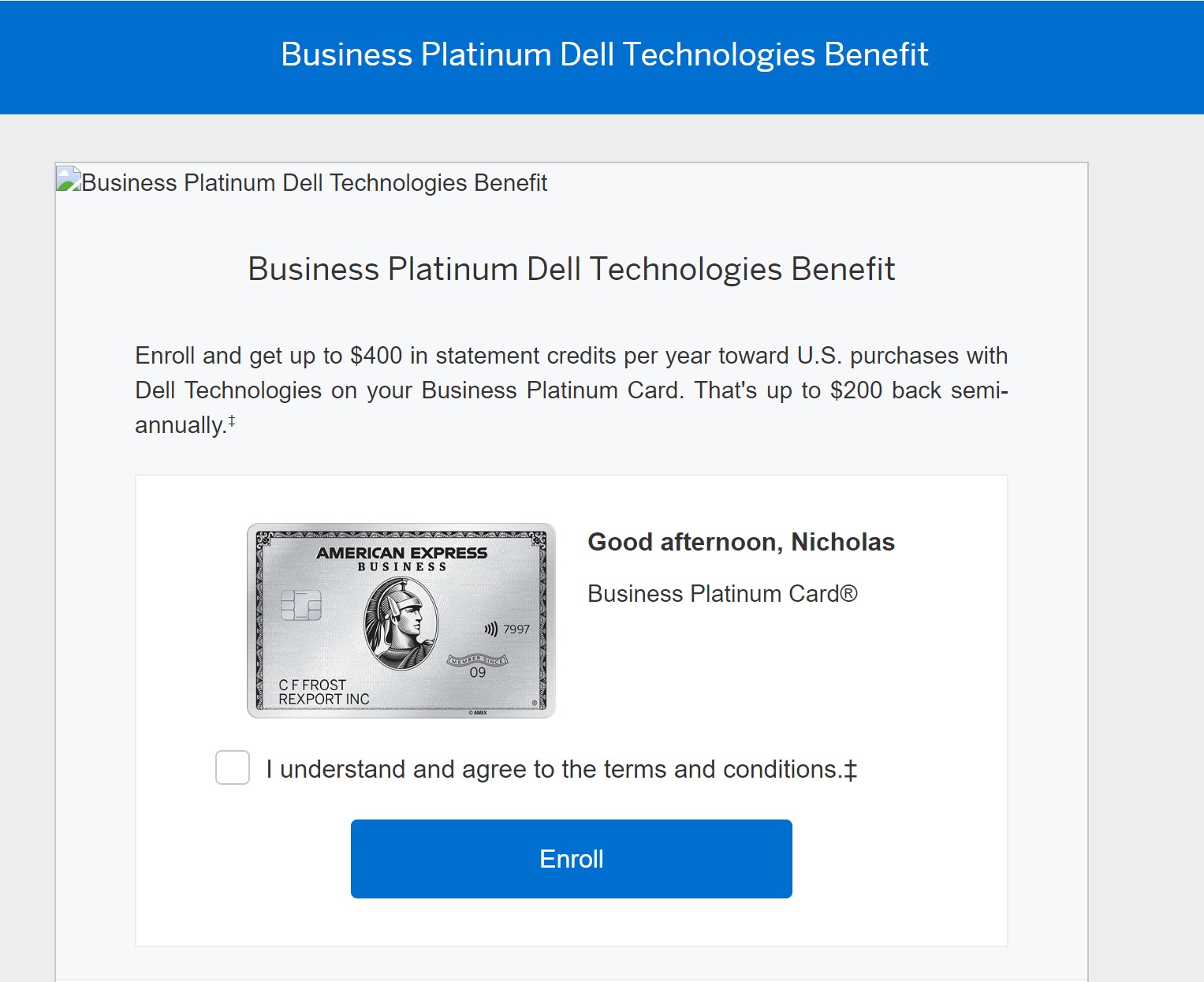

Since I just opened the Business Platinum card, I also want to use the card’s Dell statement credit benefit before the end of this month (as a reminder, this card offers a $200 statement credit twice per year, once from January to June and once from July to December). I wanted to be sure to use that now, before December 31st, knowing that I can get that benefit again two times next year (and maybe again the January after) before my next annual fee becomes due. Don’t forget that benefit also requires enrollment.

Both business and consumer Platinum come with benefits like elite status that require enrollment and you don’t want to forget to enroll.

What I know I should have done was check out this excellent resource post: How to maximize value with your Amex Platinum Card. Specifically, the checklist section of that post is clutch. I know that Greg last updated and republished that post just last month. But, if you missed that post because you didn’t anticipate the points parade dropping another bundle of points in your lap, this is your reminder to make a list and check it twice — because not getting those calendar-based benefits before the end of the year certainly wouldn’t be nice.

Can you book a prepaid room in 2023 and end up getting credit this year for that booking?

Yup! But if you cancel next year, they will claw back the credit.

Thanks. Appreciate the full details.

If you use the phone credits from multiple cards, are you still covered by the insurance? I thought I read that the bill had to be paid in full by the credit card? Would splitting the charge between the AmEx (credits) and Ink card be better or just pick one? Thank you.

I forgot and didn’t enroll for the Dell credit until my transaction was already pending. In fact, the transaction went from pending to posted just a couple of hours later, but I still got the $200 credit by the skin of my teeth!

ATM I have 2 personal Platinums (vanilla + MS) and 5 business Platinums. With three Gold cards I’m maxed out at 10 charge cards. Is there still a limit with AMEX as to how many charge cards one can have?

Lukas, regarding the multiple Biz Plats and Gold Cards, were these simply for sign-up bonuses or do you intend to keep/renew them? If you plan to renew them, how are your justifying the annual fees? Thanks in advance for your thoughts.

Yes, these were simply for SUBs. I will cancel them upon renewal because I can get yet another SUB which is 3x higher than a retention offer.

Just upgraded Dear Wifes Gold for an upgrade bonus and the double dip.

PC from Plat last December- Gold AF just hit and I actually found a Few FH&R Resorts in Asia that will come in handy on an upcoming trip this winter.

P2 had a Biz Plat till October and closed a CS Plat in November (We had 6 plats during Lucrative Covid points parade).

But it actually pencils to upgrade an the timing we may even get a triple dip in January 2024.

Even the Sak credit is more

Valuable as I hit a B&M in SFO an got a $100 GC used it on BF with Rakuten 16% and $75 GC for spending $150 (can use the GC only this week starting tomorrow. Much easier to find items with $125 than just $50.

I hate that it is not automatic…every week you need to log in and check the list to add to your card and then there are the yearly add on…

I ended up closing one after I got my $35 Uber credit since my November annual fee couldn’t make it to January, I didn’t want to downgrade either since I have several platinums and golds. However next one will have to make it to the 13 months to try for the retention. Will be hitting all the credits Jan 1 pending decent portal rates!

JL100, what is it that you are doing that justifies an annual fee for several Platinum cards? (If they are personal, I’d rule out sign-up bonuses.)