Over the years, I’ve used many shopping portals to great success. I’ve certainly used most of the major airline and hotel shopping portals (my first Southwest Companion Pass was earned entirely via their portal), but I’ve also successfully used plenty of cash back portals like Rakuten, TopCashBack, BeFrugal, MrRebates, and more. On the “cash back” side, Rakuten had become my favorite in recent years thanks to the ability to earn Membership Rewards points instead of “cash”. I’ve earned a lot of points through Rakuten over the years and Rakuten had become my most-preferred portal thanks to the chance to earn good payouts in the form of a transferable currency. But my perspective is changing and I find myself using Rakuten less and less — and it’s not Rakuten’s fault. Rakuten is as good as ever — but competition is heating up.

The opportunity cost of using Rakuten

Don’t worry, I’m not looking to deprive anyone of more Joy of Free by making a long-winded argument about how, when you choose to earn Membership Rewards points rather than cash back, you’re turning down 1 penny for every 1 Membership Rewards point you receive. Greg will tell you that the Membership Rewards point isn’t costing you 1 cent, but I’ll tell you that it feels to me effectively the same as being given one cent and told that I can buy a Membership Rewards point with it or keep the money. I won’t belabor that argument.

But that argument is relevant to the reason I have been pivoting away from Rakuten and other points portals. Rakuten is a bit of a special use case because of the fact that you can earn Membership Rewards points, which are almost like the best of both worlds (cash back and points). We have a Schwab Platinum card, so we can redeem points for 1.1c per point. That makes it worth earning 10 Membership Rewards points over 10% cash back since we can easily redeem the 10 Membership Rewards points for 11 cents via Schwab if we ultimately wanted cash, though of course many people value Membership Rewards points even more highly than that.

Part of the reason that earning more Membership Rewards points has become (somewhat) less appealing is that Amex has kept the Points Parade marching on over these past couple of years and my family has been able to keep a healthy enough number of Membership Rewards points on hand or incoming so as to be able to book plenty of 2023 travel and still be fairly well set up for trips next year as well.

But more importantly, I’ve been able to earn “cash back” at a rate that has made Membership Rewards points unappealing by comparison.

Our Reasonable Redemption Value for Membership Rewards points is 1.55c per point. For argument’s sake, imagine that I subscribed to that value (more in a moment on why you may use that number or may use a number that is higher or lower). Let’s further imagine that my shopping portal options for a purchase look like this:

- Rakuten: 10x Membership Rewards points per dollar spent

- Alternative portal: 17% cash back

If those were my options, and I valued Membership Rewards points at 1.55c per point, then the Rakuten return would be akin to getting 15.5% back in the form of Membership Rewards points. In that scenario, I should choose the cash back portal.

On the other hand, imagine it looked like this:

- Rakuten: 10x Membership Rewards points per dollar spent

- Alternate portal: 14% cash back

In that case, if I value Membership Rewards points at 1.55c per point, by the same logic used above, I should choose the Membership Rewards points since I can reasonably expect to redeem those points for a little more value than the cash back.

Those are the simple types of comparisons that many of us do each day when selecting a shopping portal for a purchase.

In reality though, things aren’t quite as black-and-white. Our Reasonable Redemption values are meant as a benchmark of how much value you can reasonably expect to receive without much effort at maximization, though it is obviously possible to get more value or less value out of your points depending on how you redeem them. Experienced award bookers know that you can do much better than the Reasonable Redemption Value when you redeem for an international premium cabin ticket. On the other hand, I’ve argued before that you should consider the fact that those Membership Rewards points can redeemed for 1.1c per point to a Schwab brokerage account if you have the Schwab Platinum card and think of that opportunity cost. When I redeem for a fancy premium cabin ticket, I have to also think about the cash that could have been in my pocket.

Let’s pivot for a moment to a related concept.

When it comes to valuing credit card perks like Uber credits, we often say that you shouldn’t value those credits at face value sine you wouldn’t pay full price for a credit that you may or may not use. For instance, if I were selling a $100 Uber credit, you wouldn’t want to pay me $100 for it, otherwise what’s the point in buying the Uber credit and locking your dollars into Uber money? Therefore, when valuing credit card perks, we decide that something like a $100 Uber credit should be valued at less than face value. The amount by which we reduce the value of benefits like that varies based on how restrictive they are, but generally speaking we tend to discount them by 10-20%.

So then I’ll argue that if you’re going to accept points (which are less flexible and can be devalued at any time) instead of cash back, you should be getting a premium over the cash back alternative.

In other words, let’s imagine this scenario:

- Rakuten: 10x Membership Rewards points per dollar spent

- Alternative portal: 15.5% cash back

Which should I choose if I value Membership Rewards points at a value of 1.55c per point? You may at first be tempted to think both options are equal, with 10x Membership Rewards points being worth 15.5% back — but is that not akin to paying $100 for the $100 Uber credit?

In truth, it is not exactly “akin” to the Uber credit example first because the Uber credit has a finite maximum value of $100, whereas the Membership Rewards points have no measurable maximum upside. Amex points could be worth far more than 1.55c per point, which is what makes earning 10x Membership Rewards points an appealing portal payout. By contrast, the 15.5% cash back rate is worth 1.55c per dollar spent, no more and no less. But when you earn that cash back, there is no risk of getting less than face value out of the payout. In other words, if I spent $1,000 and I earned 15.5% cash back, I’d have $155 with no chance of only getting any less than $155 in value from it. By contrast, if I earned 10x Membership Rewards points (10,000 points), I might ultimately redeem them for a Schwab deposit and get only $110 or transfer them to Hilton where I may only get about 1.3c per point in value even with the current point transfer bonus ($130).

I would therefore argue that I should want a significant amount of greater upside from the points to make it worth accepting (far less flexible and prone to devaluation) points over cash back.

Backing up to reiterate, if I were making a $1,000 purchase with the figures above, I would earn:

- $1,000 x 10x Membership Rewards points = 10,000 Membership Rewards points

- $1,000 x 15.5% cash back = $155 cash back

If I could have a sure $155 in the bank, it would only make sense to take the points if I knew I would get significantly more value from the points. If I were only going to redeem the points for 1.55c per point at some unknown time in the future, it wouldn’t have been worth giving up the cash back in the first place (and certainly if there’s a chance that I might only redeem them for 1.3c per point, it would be like gambling away my $155 to only end up with $130).

Again, if I’m going to lock up my rewards in the form of points rather than cash, I want to do that because I know I’ll get significantly more value out of the points. Let’s say that I’m willing to give up the opportunity for cash in exchange for earning Membership Rewards points if I’m very confident that I’ll get 10% more value with points than I would with cash. In that case, if I had the chance for 15.5% cash back, I’d want the number of Membership Rewards points I’m earning to be worth 17.05% back (that’s 10% more than the 15.5% portal payout).

That means that if I value Membership Rewards points at 1.55c per point, I’d want to be earning 11 Membership Rewards points per dollar spent in order for the points to be worth more than 15.5% cash back.

However, if you value Membership Rewards points higher or lower than 1.55c per point, you’ll have to adjust up or down. I might argue that if you really think you’ll redeem right around 1.55c that you’d want even more upside over cash in order to choose points over cash back, but that will vary with your circumstances. For instance, if you don’t yet have enough points for the next premium cabin redemption you’re envisioning, those points you’re earning now probably have a higher chance of being used for high value (better than 1.55c per point) than if you already have hundreds of thousands more points than you anticipate using this year (and the points would therefore sit unused for an unknown amount of time)

Personally, I’ve earned enough Membership Rewards points over the past couple of years that I’ve redeemed some points for brokerage deposits with Schwab. In other words, I’ve accepted just 1.1c per point for some quantity of points in order to put more cash away for the long-term (last year I wrote about how doing that would enable me to put more into I-bonds while rates have been high). If there is a chance that I would continue to do that, then I need to be a bit more conservative in terms of choosing between cash back and Membership Rewards points. I like that the Schwab Platinum card offers a floor value. That is to say that if I accept 10 Membership Rewards points per dollar spent, I know I’ll get at least 1.1c per point. That’s enough of a bump for me to be happy earning Membership Rewards points instead of cash back through Rakuten, but it means that my comparisons against cash back portals mean that if the cash back portal is paying much more than the rate Rakuten is showing, I should probably accept the cash back.

My new favorite portal keeps knocking it out of the park

In reality, I haven’t been doing nearly as much comparative analysis as the above would suggest because the most poorly-branded shopping portal on Earth has been blowing Rakuten out of the water this year. I’m talking of course about the no-you-don’t-need-a-Capital-One-card-or-account Capital One Shopping portal. I say it’s the most poorly-branded portal in existence because we frequently hear from readers or listeners who have just realized that you don’t need a Capital One card to use the Capital One Shopping portal. It’s confusing because Capital One has a number of different shopping options, one of which does require having a card, but the actual Capital One Shopping portal, app, and browser extension — which often feature targeted offers that are the best cash back rates of any portal — does not require having a Capital One card. See: C is for confusion: Capital One Shopping vs offers vs travel offers for more disambiguation.

The downside of this portal is that the payouts only come in the form of gift cards. So while we often refer to it as “cash back”, it doesn’t actually offer cash. The Capital One Shopping portal only offers the ability to redeem rewards earned for gift cards (if you’re tempted to say “I’ve gotten it as a statement credit”, please read this post to understand the difference between what you’re talking about and the Capital One Shopping Portal). Recently, Capital One has been shuffling the gift card redemption options and Walmart and Safeway have disappeared. That stinks, but now that Hotels.com, DoorDash, and GrubHub are gift card redemption options (among many other popular options), I’m happy enough to collect rewards through the portal. Still, it means that I don’t quite value the returns through Capital One Shopping at face value, but rather I think of them being perhaps 10% less than what is shown (you can sometimes buy some of the gift card brands at a greater discount, but the variety of choice means that I’ll probably usually be able to choose a gift card redemption that is valuable to me in the moment).

Greg and I have both written about the insane targeted offers we’ve received from Capital One Shopping. I keep using those offers….and I keep getting more. Check out these cash back offers I received in a single email just yesterday (I’m noting these here because I saw a section on the Capital One Shopping website yesterday mentioning limited-time travel offers, so other readers may want to check for targeted offers as explained in this post, though I should note that I don’t see most of these on the Capital One site but would rather need to click through my email to activate them).

Choice Hotels: 30% back

TripAdvisor: 30% back

TripAdvisor: 30% back

Keep in mind that TripAdvisor offers activity bookings. They also offer hotel reservations. It would instinctively seem unlikely to me that you could earn thirty percent back on hotel bookings, but when I went to the Capital One Shopping website, they certainly seemed to suggest that in my targeted offers section.

I also had 24% back at IHG and 30% back at Extended Stay America.

And if that wasn’t enough in terms of travel offers, I also had 24% back at RVshare and 15% back at Avis.

I was really hoping for a Hotels.com offer since I intend to redeem Capital One cash for Hotels.com gift cards for a specific booking that I’m looking to make. Unfortunately, I haven’t seen an offer for Hotels.com. I did receive 10% back at Booking.com though, which might be intriguing for some.

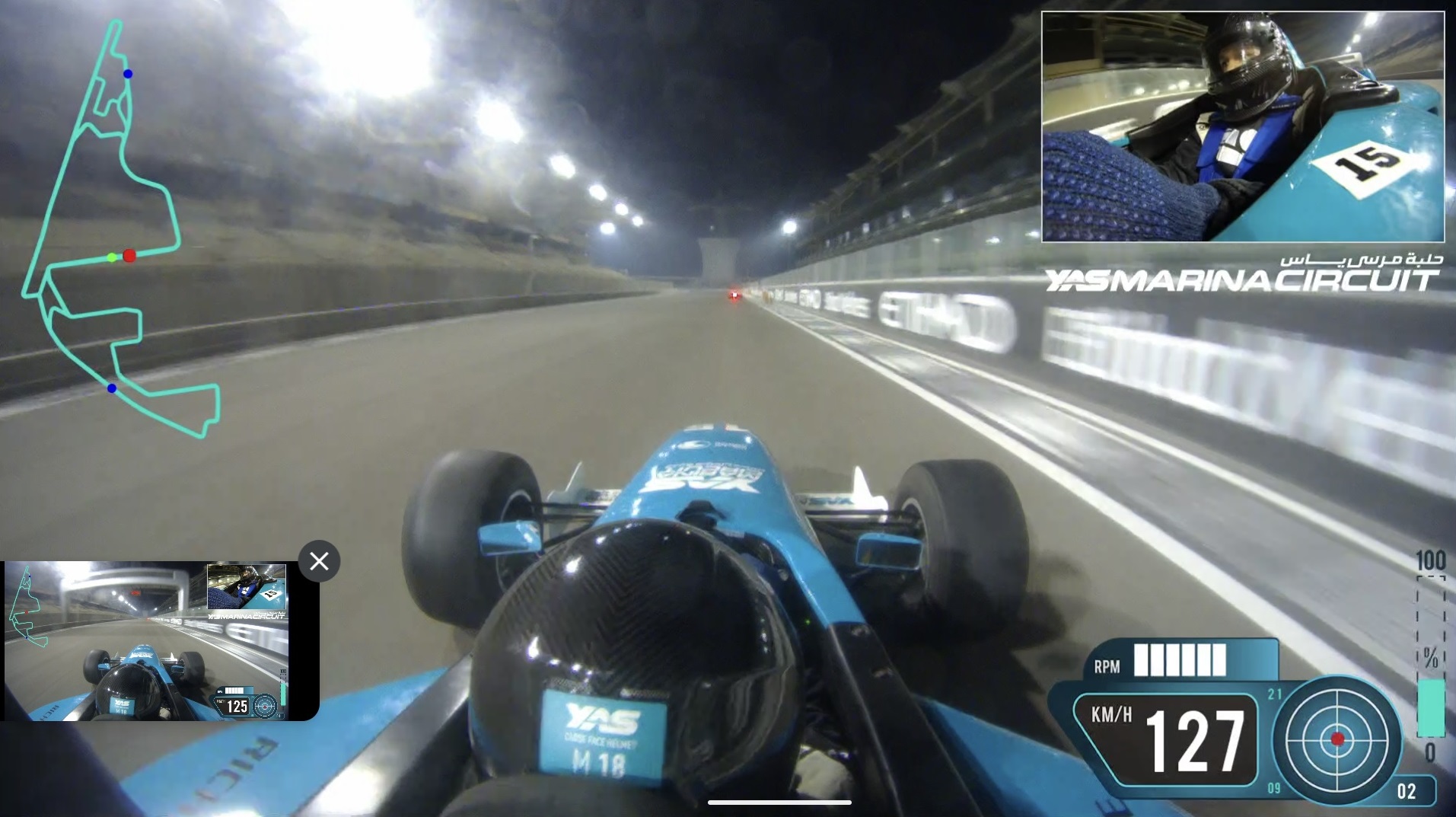

It’s worth a reminder though that you never know which Capital One Shopping avenue will have the highest rate of cash back. Though you can see above that the email offer I received was good for 15% back at Viator, when I went to the Capital One Shopping website and scrolled down to my targeted offer area (again, read this post to see where to find these targeted offers), I had an offer for 30% back at Viator. I’m not a big fan of Viator, but with 30% back I’d probably give them a try for something like driving a race car in Abu Dhabi (they even price-matched and it didn’t disturb my Capital One Shopping rewards).

I have had an offer for 30% back at Hertz for at least a month. I also have 30% back at Dollar Rental Car.

I’ve got targeted offers for so many stores at 24% back that I could hardly count them, but a couple of examples include StubHub and Macy’s.

While I haven’t gotten an offer quite as good as Greg has for GiftCards.com, I’ve had an offer for 18% back at GiftCards.com for a month already.

I have not used every offer above, but I’ve been pleasantly surprised at how well many of them have tracked over multiple purchases. I have also been very happy that you do not need to buy the specifically-advertised product (shown in the email or in those buttons above) in order to earn the advertised cash back percentage. In almost all cases (with some limited exceptions noted in the next section), buying any product from the associated site has triggered the advertised payout. I continue to earn far more in money that can be redeemed for gift cards as I need them than the value of comparable Membership Rewards payouts for the same merchants if I had gone through Rakuten (which would generally be my alternative preference, though I also use TopCashBack when they have a great payout). That’s true even if I discount the value of Capital One Shopping rewards by 10-20% (viewing, for example, a 30% payout as “only” being worth 24% in “money” still puts it comfortable ahead of comparable payouts via Rakuten in most cases).

Capital One Shopping portal shortcomings

Capital One’s shopping portal hasn’t been all rainbows and sunshine for everyone. Some readers have reported multiple problems with orders failing to track.

In my own experience, I’ve had quite a few orders track perfectly as expected where I’ve earned north of $300 in “cash back” from a single order. However, I did have one large order that initially tracked as expected (I earned about $400 back from a laptop purchase that was about $1400), but then the cash back was later reduced to just a few dollars. I followed up by submitting an inquiry with Capital One Shopping and much to my pleasant surprise, they credited me with the hundreds of dollars I was due without any hassle. Others have reported mixed experience contacting customer service. I don’t know why some have trouble with orders tracking and some have poor luck with customer service. By and large, Greg and I have both had positive experiences with orders tracking as expected. I do keep screen shots of everything — from the purchase flow to the tracking cooking number in the shopping history when the purchase tracks and goes pending in the portal.

Truth be told, we frequently hear complaints about every shopping portal, with some readers swearing off this portal or that one for a deal gone wrong. It’s hard to know what has caused the disconnect in those situations, but in my experiences almost all portals I’ve used have tracked and paid out as expected the vast majority of the time. I’m careful to use one browser for “shopping” (browsing / trying coupons / etc) and another browser for “buying” (going directly from the portal to the retailer and loading my cart and checking out in one smooth motion) and things just generally work. Now with Capital One Shopping, I buy in the browser where I have the extension installed and the extension usually pops up to activate the advertised rate. I always take a screen shot of that popping up in my shopping cart and again when it says “activated” after I click it just in case I need to follow up.

The one big area of frustration with Capital One Shopping is that their IT seems to randomly display example products that don’t always make sense. I’ve seen times where the display is completely wonky — like in my targeted offers section it will show 30% back at Hertz and the example product will be a luggage set from Walmart (clearly just a computer glitch). But more frustrating is that they sometimes show products that I know won’t work to trigger cash back. For instance, I’ve had offers for 15% back at Office Depot and Capital One Shopping has shown a Visa Gift Card as the example product. Because of years of experience with portals, I know that Office Depot doesn’t directly process gift card purchases made through its website, so clicking through from a portal and buying a gift card from Office Depot will not trigger cash back from any portal.

That’s annoying because most people don’t know nuances like that and if I made a purchase of the example product Capital One Shopping displays (a Visa Gift Card from Office Depot in that case) and customer service later told me that the example product they showed doesn’t qualify for rewards, I would be unhappy (and indeed we’ve heard from a reader or two in a situation like that). Those situations are fairly limited, but highly annoying if you run into them. In the vast majority of cases, we’ve found that clicking through an offer banner from Capital One Shopping tracks with any purchase from the associated site (for instance, I clicked through a banner advertising a luggage set with 10.5% cash back from Walmart and I ultimately purchased an oven hood and I got the 10.5% cash back rate as expected).

But for those who are experienced enough in shopping portals to recognize those random exceptions like a website that doesn’t process gift card purchases, the wins can be quite large. We have had readers report success in earning the big portal payouts on purchases like Macbooks and iPads, which are often otherwise excluded from earning cash back.

The biggest issue with Capital One Shopping at this point (aside from poor branding!) is the inconsistency in gift card offerings. While Walmart and Safeway had long been options for redemptions, both were removed without warning or announcement. Safeway later came back and disappeared again and I have noticed small changes in the gift card offerings multiple times over the past couple of weeks. On the whole, there are far more options now than before — but if Hotels.com, DoorDash, and GrubHub got removed, I’d be far less excited (though I’d still be able to make use of eBay and Lowe’s, so all would not be lost).

Bottom line

I have long loved shopping portals — I resold products for years before becoming a blogger, so shopping portals have thus long been on my radar and in my rotation. Over the past few years, Rakuten had become my favorite portal by far thanks to the ability to earn Membership Rewards points. However, as I’ve amassed more Membership Rewards points, I’ve thought more about the opportunity cost of earning more of those points over “cash back”. More importantly, Capital One Shopping has been knocking it out of the park with targeted offers. I have consistently been targeted with rates far above what I could earn through other portals. Note that it should be that way since I’m limited to redeeming Capital One Shopping rewards for gift cards — the rewards earned through Capital One Shopping are not as flexible as cash. Still, with the consistent targeted offers of 20-30% back at retailers that commonly offer far less back through other portals, I have a hard time getting excited about 10-15x Membership Rewards points these days. I don’t imagine that these ridiculous Capital One Shopping payouts will last forever, but for now I’m striking while the iron is hot — and it certainly has been hot with the targeted offers of late.

I received a 30% offer for Viator that I plan to use soon. The Capital One site also found a 15% off promo code that it auto populated in the promo code box. I see the terms say that “shopping rewards will not be paid out on orders where a promo code is used.” I suppose I should delete the lesser value promo code but does anyone have any experience where both tracked?

I had a 10% code and it tracked with the 30%. The browser extension routinely offers to search for coupon codes and applies them while confirming that you’ve activated the cash back. I’ve not had a problem using such a coupon code and also getting the advertised rewards.

Seems like C1 portal has been pretty heavily nerfed in the past few days. My 30%s have turned to 12%. I also had 15% at Walmart for a while, now that’s down to 1% in emails.

I’m confused at to how it track with the hotel chains. I have a Earn up to 23% in Shopping Rewards at properties like: Hyatt Regency Maui” The email says click offers and when I do it brings me to a list of hotels on Capital one shopping. Eventually after a few clicks it goes to price line. Does that mean no elite credits, benefits, etc?

Yes, in your case, the 23% offer was for booking through Priceline and yes, that probably will result in no elite credit.

I never saw an offer for booking Hyatt direct but was targeted for IHG direct 24%, Choice direct 30%, and Marriott direct 8%. I was also targeted for 30% booking made on TripAdvisor, and other different amounts through Priceline or Hotels.

In my experience, “Earn up to” emails were usually for third party channels where direct offers were for a fixed % back in the solicitation.

Anyone have issues with Tripadvisor hotels booking 30%? It seems only hotels can direct booking through Tripadvisor are eligible and very few hotels have this option?

Have you cashed out these gift cards at walmart and safeway and then used the walmart or safeway gift card to buy different gift cards at the big boxed stores since they have so many options?

You lost my interest after the part, “Over the years”.

Anyone considering $$$$$ shopping through Capital One may be interested to know that after my balance grew over $40K, they closed my account without notification or explanation. A few weeks prior to this, I had attempted for the first time to redeem a small portion of my ~$30K balance that showed available for 6 gift cards (3 stores x 2 each). This is after getting email notifications from them:

“Your $X,XXX in Shopping Rewards is ready to redeem for gift cards.”

The points were debited but my gift cards were never activated. A week later I opened a support ticket about the gift cards never activating and received this reply:

“After reviewing your account, I was able to see that your e-gift card redemption is currently on hold pending confirmation of your Shopping Rewards from the merchant. Shopping Rewards may be pending while still within the order return or cancellation window, and can be on hold for up to 90 days.”

So, I waited.

A couple weeks later, I could no longer log in to my shopping account and the browser extension was giving me an error. There have been no messages of any kind from Capital One Shopping about this.

So, I contacted their support again about not being able to access my account and got this back:

“We regret to inform you that your Capital One Shopping account has been terminated. We reserve the right to terminate your Capital One Shopping account and services at any time for any reason not prohibited by law. Additional information on our policies and practices can be found in our Terms of Service. Please see our instructions for how to uninstall Capital One Shopping on your specific browser type.”

I was mostly buying stuff for my business with some personal shopping too, I believe in compliance with their terms.

Their terms of service say:

“Limited commercial use of the Services is permitted, only as described in Section 3 below, by authorized representatives of companies, entities, or other organizations that are retailers, online sellers, or merchants engaged in ecommerce (“Merchant(s)”). If you use the Services on behalf of a Merchant, then you represent and warrant that you: (a) are an authorized representative of that Merchant with the authority to bind that Merchant to these Terms and (b) are bound by these Terms on behalf of that Merchant.”

Some of my purchases were excluded from qualifying according to the merchant cashback offer fine print and I was pleased and initially surprised they still had tracked to my account and were available to redeem after 30 days. I would understand if Capital One had reversed the earnings on any of those purchases if the merchant wasn’t going to pay them but just closing my account with no rewards paid is another matter.

Anyone else in the same boat?

Stay away from CAP1.

That isn’t my take away. Rather, stay small.

Don’t use it for frequent $$$$$ purchases, even if you normally use a portal for that kind of purchase and the Capital One offer is by far the best rate of return.

For anyone wondering: Nothing I bought is cash equivalent; this is not MS. I own and manage a low margin reselling business in an ultra competitive niche that spends $$$$$$$ on inventory and we routinely earn portal cashback on some of our purchases and maximize credit card rewards, key to our profitability.

All of these particular purchases would have been made anyway but I could have used a different portal. I have earned far more from Rakuten and TopCashBack many years and those portals thank me for my business.

I thought that trying to redeem just ~5% of my ~$30K available Capital One balance for gift cards was a reasonable place to start. Do you think anything would have been different it I had just tried 1 gift card at a time?

If Capital One had not closed my account, we would have used the gift cards towards the purchase of further inventory, keeping the $ in the business. No need to sell them.

I think a lot of this over-philosophizing comes from the fact that you guys are sitting on mountains of points through some combination of MS, referrals, and the ability to maximize no-NLL and other Amex “deals” (like buying a car from a small business on that Amex Plat), some or all of which are completely beyond the capacities for most readers (I’d wager).

Of course that changes your math and/or priorities.

Yup.

Yeah, I have really begun to feel like both nick and Greg have kind of lost interest in the site… I have felt that way at least for the last couple of months. Tim and the British guy are basically holding it together for the most part these days. I’m hoping that Tim becoming full-time will get the blog a little more “back on track”.

Lost interest in the site? What makes you think that?

Very surprised to hear someone think that as I spend most of my day every day working on morning posts 3 days a week, the podcast, social media channels, responding to questions and comments, updating resources, testing things out, writing QDs one day a week, Saturday Selection around-the-web posts when I can, etc. As my wife and kids can attest to, it is rare that a waking hour passes in which I haven’t spent part of the time working on something here except for the weeks I’m on vacation :-). In the car, on the road, etc — I’m on here all the time! Certainly haven’t lost interest — again, just surprised to hear that you’ve had that impression!

I think Daphne and lot of casual readers frustration comes from the fact that we do not have access to liquidation methods that allow you and Greg to churn multiple NLL offers or Greg with the 90K INK referral with P1,P2 and P3 a month or so ago. The vast majority of us are not sitting on million plus points in the flexible transferable currencies so there is definitely a growing disconnect even though you guys are dedicating the same if not more time.

I have learned quite a bit from the blog and appreciate everything you do but have resigned myself to only focus on what’s attainable for me and my family in the current economy and not be envious of what you guys are able to do but it does get hard at times!

Hope this feedback helps in some way and I am looking forward to your team challenge.

A wonderful thing about this site is that it actually shows readers how to maximize no-NLL and other Amex “deals” (like buying a car from a small business on that Amex Plat). The idea is to bring stuff like that within the capability of readers.

One of the reasons I love this site is that it does not just cater to beginners and helps those wiling to invest a lot of time and effort to get deeper into this hobby, upping their points earning to millions a year for those with sufficient motivation and dedication.

It also challenges readers to think rationally about their miles and points valuations and opportunity costs.

Great work, FM team!

I have a love/hate relationship with the Cap One portal. On one hand, they have some great rates. On the other, they clawed back a 30 percent discount with a large shoe purchase I made with Asics over Christmas, so I had a negative balance for awhile because I had already converted the cash back to gift cards. Now, I recently used them for a purchase at Ebay where I clicked through a Cap One email sent to me with a specific rate, and the purchase still hasn’t tracked, which makes me think it didn’t go through.

I had the “did not track” issue for the last 2 Cap One portal offers I’ve attempted to take advantage of… I’m a veteran of using these portals, so I know how they work and what normally can disqualify a purchase. I have a feeling this is a failing of Cap One, not me.

One thing to consider about Membership Rewards points is the frequent transfer bonuses anywhere from 25 to 40%. With Rakuten offering 10% and more on a regular basis, I will happily take 13 to 14 airline miles per dollar of spend after the transfer.

Nick, you would make a good appellate judge. It’s about the reasoning process. Each person will apply that reasoning process to one’s own circumstances and identify the best portal for oneself. Great article.

Couldn’t disagree more – guess it comes down to the fact I’m happy to add to my Membership Rewards balance, and find it much easier to redeem those for good value vs several gift cards I’d find difficult to consistently redeem. I’m also one of the people that has had several issues with Capital One Shopping tracking, and it’s just not worth the hassle to deal with customer service 1 out of every 3 or 4 times. Appreciate the point of view and thought exercise though!

Out of curiosity, what retailers have you had an issue with? I’ve had an issue with one out of many dozens of purchases. Curious if there’s a pattern with a particular retailer / retailers.

Dell most recently. Completely separate, but also had an issue with Cap 1 Offers for a big VRBO purchase last fall, so I’m just kind of sour on all things Capital One at the moment.

For me, it’s a purchase from Viator. Used a targeted 30% offer on 2/28 and in tracking it’s showing a “Shopping Savings” amount, which is the discount you get from a C1 provided discount code. The “Shopping Rewards” did not track at all and there’s no order number associated with it. I reached out to CS on 3/17, they responded 2 days later that they were “investigating”, and more than 2 weeks later I’ve heard nothing. It’s close to $50 due and I never would have booked with Viator without it.

I guess that’s where you might want to draw the line: if the cash back makes a difference in whether you’d actually make the purchase at all, you’re probably better off not making it. In my case, I could have booked it with the vendor directly for a much better rate. It’s definitely turned me off from using them in the future unless it’s just a “nice to have” discount and not the decisive factor.

Did you complete the activity yet?

Yes, completed the activity a few days after purchase.

I had an offer for 24% at Cole Haan. Stacked it with the $25 off $125 Amex offer.. came to a nice discount on a pair of shoes.. originally it didn’t track. I submit proof of my purchase and within 2 days the 24% Cashback was credited. So far their Customer service has been great. But very anecdotal

You’re lucky! My dell purchase didn’t track, but showed up as a shopping trip. I submitted all the documentation after 30 days, they made me wait 60 days before crediting me. In the end I got the cash back, but took several emails over 60 days.

How long do Capital One purchases take to go from pending to posted? It’s been over 2 weeks for me and I’m getting antsy!

Usually 30 days. Most portals are anywhere between 30-90 days to go from pending to posted (I think it often depends on the retailer — if a retailer offers returns for 90 days, they aren’t going to send a commission check to the portal in 2 weeks because you might return the stuff and then they’re stuck trying to get their money back from the portal, who is stuck trying to get it from you — that’s why the delay in stuff becoming payable at any portal).

I have a Walmart from December 12 and a TripAdvisor from January 13 still pending.

Agreed — CapitalOne Shopping rates are well above market even with a discount applied due to their limited redemptions. That said, I’m surprised not to see any mention of eBay as one of their best/easiest gift card redemptions. I realize YMMV but it’s pretty easy to use for necessary purchases there whether from individual sellers or corporate sellers (e.g., Adidas).

Has anyone else had issues with Extrabux taking months and up to a year to post transactions?