On last night’s Frequent Miler Live: Ask Us Anything, Grant of Travel with Grant asked us to name an underappreciated sweet spot or credit card and a reader named Matthew asked about where to find outsized value in a game that (to some) feels like it is constantly diminishing. Today I’m going to both take advantage of a sweet spot that gets less consideration than it should and the reason I’m going to do it is to help protect myself against diminishing value: I’m going to cash out a chunk of Membership Rewards points via the Schwab Platinum card and put the money into US Treasury I-bonds given a pretty appealing opportunity to lock in a great guaranteed rate of growth. To be clear, I am not a financial advisor and this post is not meant to be financial advice, just take it for its entertainment value and consult your own financial advisor if you need help determining what makes sense for your goals.

Schwab Platinum: Redeem Membership Rewards points for 1.1c per point

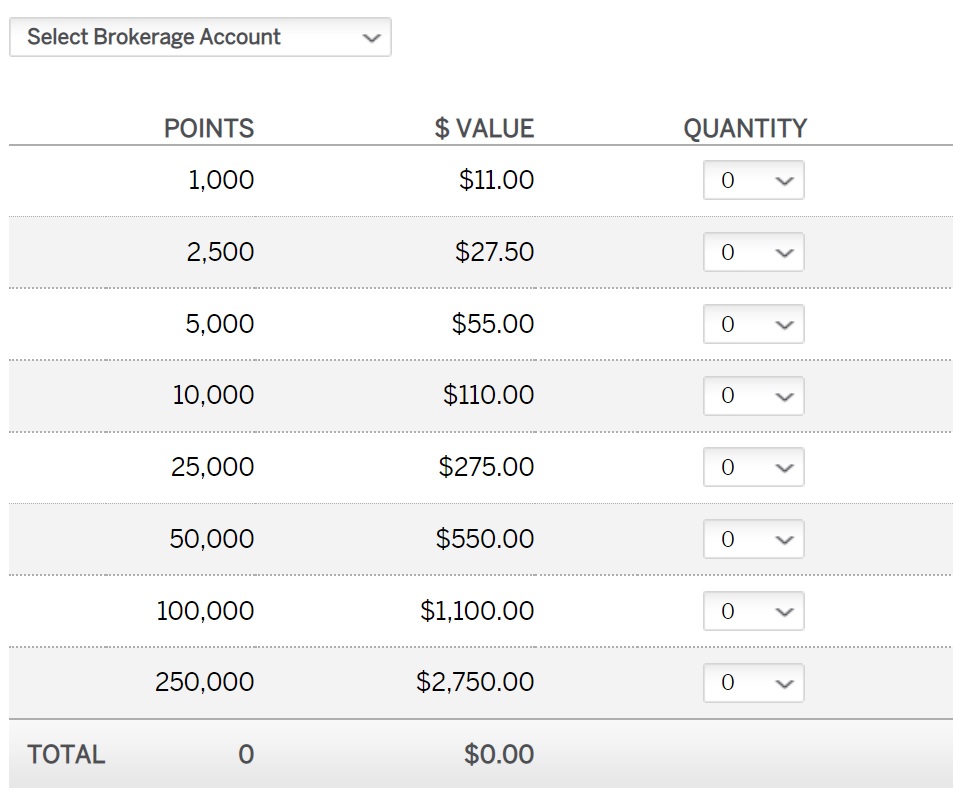

The Schwab version of the Amex Platinum card comes with the ability to redeem Membership Rewards points for a deposit in your Schwab brokerage account. When you redeem points for a deposit, you get a value of 1.1c per point. We’ve covered the mechanics of this redemption in the post: How to convert Amex Membership Rewards to cash with the Schwab Platinum card.

Our Reasonable Redemption Value for American Express Membership Rewards points is 1.55c per point. If you think I have either lost my mind for entertaining the notion of redeeming points for so much less value, I can understand that. Still, I’m going to cash out some points today.

I have to admit that on the surface I am not excited about the prospect of redeeming points at such low value. After all, I play this game to maximize. There are few things I love more than a good sweet spot and I love the flexibility of being able to pounce when award availability opens up.

However, the Amex points parade of the last couple of years has left us flush with Membership Rewards points. I earned more than half a million points with a single purchase earlier this year and have continued to take advantage of opportunities for more points. Most recently, my wife received an offer to open another Business Platinum card for a total bonus of 160,000 points. She’s also been getting offers for 100K on a Business Gold and I’ve been eying that 90K + 20% back on restaurants offer on the consumer Gold card. My point is that not only did Amex run some great offers in 2020 and 2021, but they continue to offer plenty of opportunities to replenish points.

And so we find ourselves with more Membership Rewards points that will definitely go unused over the next year. We also have a lot of American Airlines miles in addition to having Chase Ultimate Rewards. Capital One miles, and points in various other programs. We aren’t points gazillionaires by any stretch, but we have more points than we will use in the next year or two. Points sitting idly in an account are generally only going to diminish in value as those programs devalue. They certainly don’t earn any additional value. I suppose that if those programs pick up additional high-value uses you could think of your points becoming more valuable, but the bottom line is that unused points are very likely to diminish in value over time. Given the current situation with I-bonds, I think that holding as many points as we are is an expensive proposition.

The interesting position of US Treasury Series I bonds

Series I bonds are a type of US savings bond that earns interest on a variable composite rate that accounts for inflation. Forbes Advisor has an article that summarizes I bonds as follows:

I bonds are safe investments issued by the U.S. Treasury to protect your money from losing value due to inflation. Interest rates on I bonds are adjusted regularly to keep pace with rising prices. In addition, series I bonds are exempt from state and local income taxes, which makes them an even better low-risk investment for investors who live in high-tax states and cities.

Investors can buy up to $10,000 worth of I bonds annually through the government’s TreasuryDirect website. You can purchase another $5,000 with your tax refund, upping the annual total purchase amount of series I bonds to $15,000 per person.

You can read that entire article here.

Doctor of Credit and The Wall Street Journal also recently covered the short-term opportunity in buying I bonds. You buy them from the US Treasury website and you can read more from those other sites about the process of buying them (you can’t buy with a credit card but rather need to link up a checking or savings account, so there is no play for rewards on the purchase to my knowledge).

The short story is that I bonds earn monthly interest based on a rate that changes every six months (in May and November). The current rate at the time of writing (April 2022) is 7.12% interest. This means that if you buy I bonds today (April 28, 2022), you will earn 7.12% interest for the first six months you own the bonds and then you’ll earn the new May 2022 rate for the second six months you own the bonds. That May rate change is set to become 9.62%. That means that if you buy bonds today (April 28, 2022), you will earn 7.12% interest on the bonds for the first six months and 9.62% interest for the next six months after that. To say that you can’t beat that with most savings products on the market would be a large understatement.

Note that you earn interest for the entire month in which you purchase the bonds, but the purchase doesn’t settle until the next business day after you buy. This means that if you buy today (April 28, 2022), you will receive the bonds tomorrow (April 29, 2022) and earn 7.12% interest for the month of April and the next 5 months, then 9.62% for the six months to follow that. If you buy after today, your purchase won’t settle until a date in May and you will therefore earn 9.62% for the first six months and then whatever the new rate becomes in November for the next six months to follow. That makes today the day to buy if you want to lock in a minimum of 7.12% and 9.62% for the first year.

There are just a couple of key “catches” with I bonds: first, you can not cash them out for a minimum of one year. You are essentially locking the money up without the ability to withdraw it for a year. If you do cash out the bonds in fewer than 5 years, you pay a penalty of the last 3 months of interest. In other words, if you buy the bonds and only keep them for one year, you will only get the interest from the first 9 months — you lose the interest from the last three months.

The other key limitation is that you can only buy $10,000 worth of electronic I bonds per calendar year per person (and you can buy a max of $5,000 in paper I bonds per person with your tax refund — you’d have needed to have selected to receive your refund in bonds when you filed).

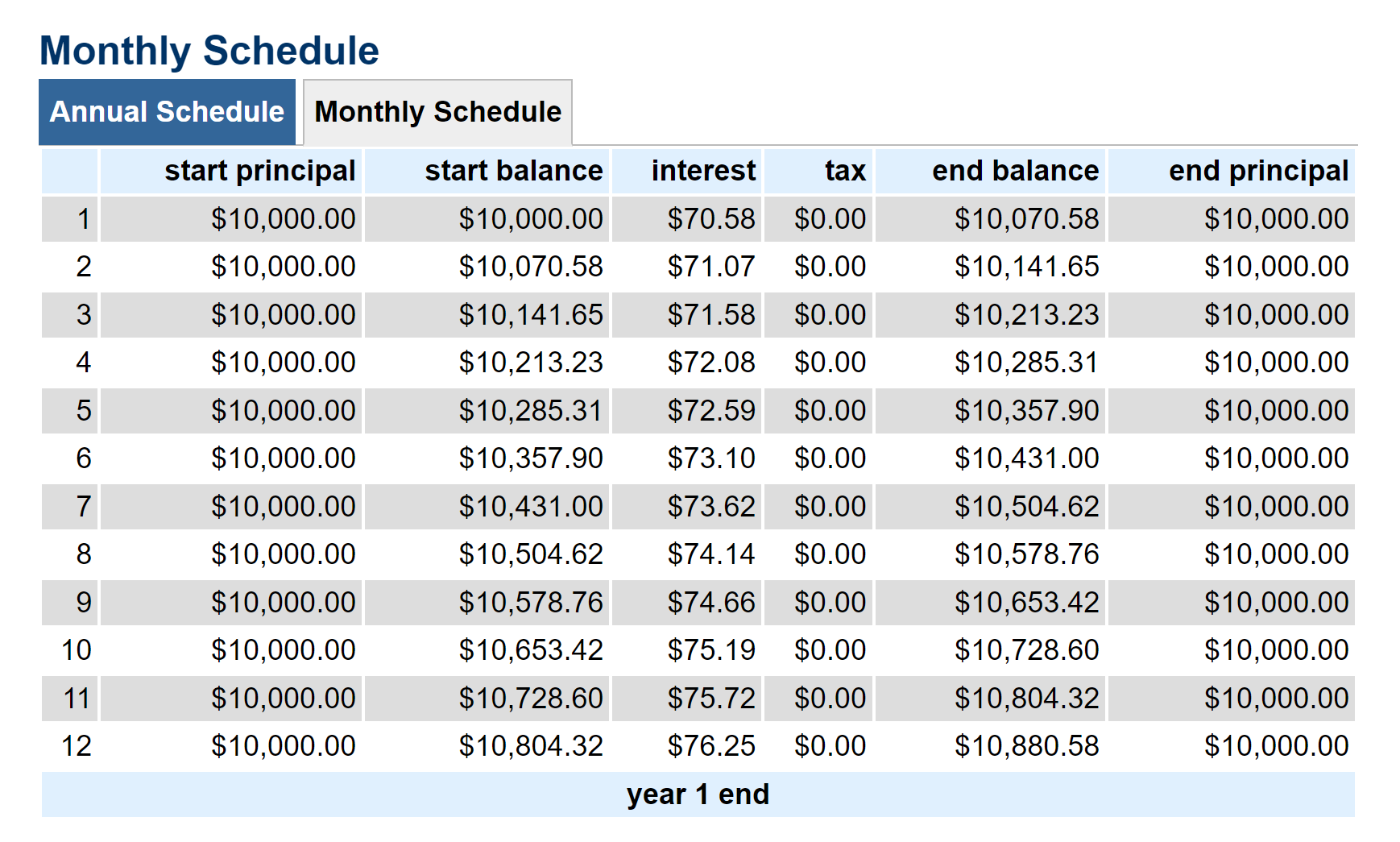

Still, if you put $10,000 into I bonds today and cashed in the bonds in 1 year, even after forfeiting the last 3 months of interest, I believe you would have earned about $653.42 as per the schedule shown below (you would essentially stop on month #9 if you cashed out after 12 months). Note that to generate the schedule below, I averaged the rate between 7.12% and 9.62%, but that isn’t entirely accurate since you’ll earn different amounts of interest during the first six months that will then compound into a lesser principal amount for the next six months, but this chart is meant to be an approximation.

Considering that this is a US-backed savings bond, that looks like a great return. Is it possible to play the stock market right and beat that return? It certainly may be. Again, I am not a financial advisor, so make your own decisions about how and where to put your money.

However, looking at that chart makes the prospect of holding Membership Rewards points feel pretty expensive, particularly since I know without a doubt that we currently have more points right now than we will use in the next 12 months. We will certainly have a quantity of Membership Rewards points that will sit in our accounts unused during the next 12 months.

Let’s imagine a scenario where I had 909,000 Membership Rewards points that I was confident I would not use over the next year. If I redeemed those points through the Schwab Platinum card, I would have $9,999. To make the math easy, let’s call that $10,000.

If I then put that $10,000 in I bonds for one year, I would stand to earn about $653.42 in year one. It is not possible to convert that cash back into Membership Rewards points, but if we think of that money in terms of each 1.1c representing one Membership Rewards point, that $653.42 could be thought of as though it is a “bonus” of 59,401 Membership Rewards points that is unlocked by redeeming the points and putting the money into bonds.

In other words, keeping those points as Membership Rewards points rather than taking advantage of this opportunity costs me the sort-of equivalent value of 59,401 points over the next 12 months. Cashing out and buying bonds essentially earns me the cash equivalent of 4,950 points per month. Note again that these numbers aren’t entirely accurate because of the way I blended the rate for the chart above and since I can’t convert the cash back to Membership Rewards points, those numbers are meant for mental accounting rather than actual points. Still, that’s a lot of potential value that my points could earn if I convert them to cash versus earning nothing if they remain as points.

Put another way, if I redeemed 909,000 points today, I would have a cash value equivalent of 968,450+ points a year from today. Suddenly it feels better than redeeming at 1.1c per point if those points would have otherwise sat untouched in a Membership Rewards account for that time.

And that’s assuming that I cash out the bonds after a year. If the rate remains high enough for me to keep the money in bonds beyond that time, I’ll continue earning interest at whatever the newly-announced rate is come November of this year and still only forfeit the last 3 months of interest whenever I cash out the bonds (meaning that I’d keep a larger proportion of the ~$880.58 that I would be scheduled to earn in the first 12 months for every month I keep the bonds thereafter. I’d keep all of the interest earned if I kept the bonds for at least 5 years).

Compare the rate of return there to something like Bask Bank, which awards American Airlines miles rather than interest, and the I bonds win by a large margin (though of course they are much more restrictive given that you can’t withdraw in the first 12 months).

Obviously if you have the cash on hand and interest in buying I bonds, you may “have your cake and eat it too” in the sense that you may be able to buy whatever amount in bonds you want without redeeming your Membership Rewards points.

In my case, because I’ve moved a lot of my long-term savings into investments over the past couple of years and because I have recently tied up some cash in other endeavors, I’m not in position to max this out without cashing out some amount of rewards to replace the money I decide to put into I bonds. Note that cashing out via Schwab is not instant. It takes a few days. If you literally don’t have enough cash to buy I bonds today, cashing out via Schwab won’t work quickly enough to get you the cash to buy the bonds (which I believe must be purchased by ACH payment). In my case, I do have enough cash to cover the purchase of the bonds I want, but I’d need to replace that cash in the near-term, hence my interest in redeeming Membership Rewards points for a deposit in a Schwab account. I’m therefore going to redeem some quantity of points today. I haven’t decided exactly how many I will redeem, but it makes sense for me to do this with some of our current excess.

Again, the sense of urgency here for me is that today is the last day to lock in the 7.12% rate for the first six months. We know that the May rate (for the next six months you own the bonds) will increase to 9.62%. We don’t know what the rate will be in November. It certainly may increase, in which case I could keep the money in bonds for longer than a year if I want. If it decreases, I’ll be happy to have locked in 7.12% for the first six months of ownership (and that will essentially remain true for as long as I own the bonds). Any way you shake it, this is better than I could reasonably expect to earn in any other product with comparably low risk.

Bottom line

I won’t necessarily be looking at redeeming 900K points today (particularly because I do intend to use some Membership Rewards points for premium cabin flights in the next few months), but since I know we have more points than we will use in the next 12 months and we have some easy targets to take down more points in the near-term, we will redeem some Membership Rewards points for a Schwab deposit today. To be clear, that deposit won’t clear soon enough to literally use that money to buy the bonds, but rather it will replace the money we put into bonds today. I don’t love redeeming points for value far below the reasonable redemption value, but it seems hard to accept the points sitting idly in a Membership Rewards account when I know that I could put them to use for what is essentially a locked-in rate of return. It seems like a poor-value use of points in today’s dollars, but the juice should become worth the squeeze within a year or two, particularly if the Amex point parade marches on.

![Amazon: Save when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

[…] At the end of April I’ve decided to do something a little bit risky. There was an opportunity to lock in a high interest rate (averaging over 8% for 12 months). In fact, it’s still a good time to consider I Bonds, though there is a bit more uncertainty when it comes to return after the first six months (read this post on Frequent Miler) […]

Anyone knows if only the points associated with CS platinum can be redeemed or any other amex card points not associated with CS can be, too?

All Amex MR points you earn (whether from Personal or Biz cards) pool together, and can be cashed out using the CS Plat

Harry Sit with Finance Buff has incredibly detailed information on this topic. It’s worth studying.

I just went to purchase I Bonds and lock in the 7.12% rate…But when I reach the ‘Purchase review’ screen it states:

“Purchase Date(s): We may have changed your purchase date(s) to the next available business day.

04-29-2022”

Does anyone know if this mean this will not settle until Monday and I will miss out on the 7.12% rate?

That’s normal. 4-29-22 would be ok but you better pull the trigger soon or the purchase date will be Monday, which is May and changes the interest rate. Which probably won’t be the end of the world but I’d prefer to get in this month.

Hmmm, spent 200,000 points on Emirates flights recently that the value was $27,000. To me, that is a better return than the I-bonds. Think I will just hold on to my points.

Great redemption, but cash ticket price = “value” only if you’d have considered paying that cash price for that seat.

Personally I’ve had such award availability issues lately that I can’t value MR any higher than the 1.53 cpp Biz Plat pay-with-points-get-35%-back rate.

I hate CS so much, I would have cashed out at the old 1.25 rate let alone the 1.1 rate. Never can get approved (then again, amex won’t approve me for the vanilla plat either). 5 biz cards in 1 year including 2 different biz plats? No problem

Cashed out $17k this year, took the MR balances down to almost nothing. No regrets.

Nick, I’d be curious to hear your thoughts about doing this instead of the Roth IRA again. I guess this is money you want to have access to before you’re 59.5? To me, the Roth is still the way to go. An index fund historically gives better returns than the current 1-year I-bond rate, and that return will surely sink much lower over time. Plus zero taxes. To me, it’s a no-brainer to push those MR points into a Roth IRA again. As long as you’re going to cash out, why not put it into the no tax longer-term higher yielding investment?

Pretty sure Nick makes way more than the income limit for directly contributing to a Roth IRA.

Back door Roth then! Which I’m sure he does too

Or YOLO it in out of the money AMC and GME calls.

Just kidding. Not financial advice.

I’ve now evolved into redeeming points more often for real money value vs theoretical money spent at a hotel that sets its own theoretical prices. Kudos to you

Anyone else remember the days when you could buy these with a credit card without any fees? That was fun! I still have some of those I bonds as the conservative part of my investments. You only had to hold them for 6 months back then.

Yep, I did well with that! It was a sad day when they stopped accepting credit cards.

Omg, did this over and over and over again with SPG Amex. I think I bought them, held them for 6 mos(?), dumped them and rinse/repeat. Excellent ROI.

In one sense it be better to dump UR with pay yourself back at 1.5cpp but I know you must have more MR than UR and that Hyatt is so valuable to you. Is there any formula you know of that can quantify diminishing value with the more points you have kicking around? I know in general MR is less valuable for this reason but wish I could be more precise about it.

Chase Chase PYB isn’t categories that make that easy to do right now. And yes, I have far more MR than UR and can not get enough Hyatt points right now. You’ve got it on all accounts here and your desire for more precision is an interesting question that’s worth pondering, but I don’t have an answer yet.

Thanks for this info. While I won’t be doing this with points, it’s a good reminder of the deadlines for the rate changes.

Reading this article makes these bonds seems like magic. The unstated issue is that in low inflation (low CPI increase) environments these bonds can pay 0 % interest. That’s why Nick focuses on the short-term nature of the investment and the fact that today you can lock in good expected rates for the entire 12 month period that you must keep the bonds. It’s also why it’s desirable to lock in the lower 7% interest rate and then the 9 % rate — that way you’re not worried about the second sixth month period going to 0% and having to hang on to the bonds for the 12 month period at, effectively, 4.5 %.

Personally, my guess is that we’ll be in a period of reasonably high inflation for more than the next six months so that there will be a few more periods of desirable interest rates on these bonds. My qualification for making that guess? I’m some schmo on the internet. So who knows?

Very inclined to put some cash into these tonight.

You did a better job explaining why you want to lock in 7% now rather than wait until Monday than I did on the phone with my dad this morning. Where were you when he called?

I am not a financial planner. This is not tax or investment or financial planning advice.

If you really think you might liquidate the I bonds in a year you need to consider taxes. Most points redemptions don’t require you to pay taxes. Bask bank interest is taxable, so that is more apples to apples. But if your effective rate in the year you redeem the bonds is 20 percent, then you are paying $126 for the privilege of using 900,000 points to generate $10,623 after 1 year instead of redeeming those points for value later without paying taxes.

This play makes more sense to me if you are planning to hold long term. The benefit of I bonds is not just the interest rate but the ability to generate compounding interest in a tax deferred instrument. You don’t pay yearly like with other bonds with coupons. Only when you sell. So it works like a retirement account if you anticipate lower tax rates in the future.

One other thought. This play may not make sense if you already hold ANY bonds in a non-retirement account or if you are holding any liquid fixed income products that you think will earn less than 9 percent next year. You could instead sell them to buy I bonds.

Good point regarding taxes!

I do indeed hold some small percentage of assets in bonds in non-retirement accounts and I think it was you who commented about this at some point last year and helped me see the light that it would indeed make sense to sell those bonds to essentially shift that investment into this. That’s part of the reason why I said I wasn’t sure how many points I would be redeeming and that it wouldn’t be 909,000 but rather some healthy chunk.

I used the example of selling in a year because I think that’s what makes it a no-brainer for many people who maybe wouldn’t otherwise consider parking a bunch of money in bonds long-term, but in reality I do intend to keep this money in the I bonds for as long as the party lasts in terms of rates that make the I bonds more attractive than other bonds (which may very well be a long time for all the reasons you stated).

I agree right down the line.

I was trying to read on bogleheads about methods to get additional I bonds if you form a corporate entity. It’s complicated and I’m not ready to dive too deep, but many people were kind of bristling at the idea of creating an entity or even just using a side hustle entity just to buy I bonds. It’s a funny intersection of the two hobbies. Stuff like that is old hat for us.

You can also buy additional I-Bonds in a trust. I don’t do that but there are articles on it for anyone that wants to buy more than the $10,000 per person limit.

Thanks for mentioning this. I manage a family trust, and it’s hard to find good interest-bearing instruments!

Good to know!