Each of us took a swing at predicting what will happen with loyalty programs and credit cards in 2024. Some of it will surely prove to be absolutely hogwash — other predictions will prove to be cat bath. Wondering what that means? Watch or listen to Frequent Miler on the Air to find out.

Each of us took a swing at predicting what will happen with loyalty programs and credit cards in 2024. Some of it will surely prove to be absolutely hogwash — other predictions will prove to be cat bath. Wondering what that means? Watch or listen to Frequent Miler on the Air to find out.

Elsewhere on the blog this week, Greg shares his elite status plans for 2024, I share how I’m planning to trim a few thousand dollars in annual fees, Carrie publishes a fun little game for music fans or those who like to get a peak at the personalities behind the people, Tim reviews a card with a hot bonus that’s ending soon, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

Podcast

00:00 Intro

01:30 Giant Mailbag

10:42 Award Talk: An Aeroplan cautionary tale

14:20 Follow up on Bonvoyed Awards

16:56 Follow up on Deal of the Year

18:24 Main Event: Spit-shining our 2024 crystal ball

18:30 A look back at 2023 prediction results

22:04 Nick’s predictions: Hogwash or cat bath?

24:39 Greg’s predictions: Hogwash or cat bath?

28:52 Carrie’s predictions: Hogwash or cat bath?

30:38 Stephen’s predictions: Hogwash or cat bath?

34:15 Tim’s predictions: Hogwash or cat bath?

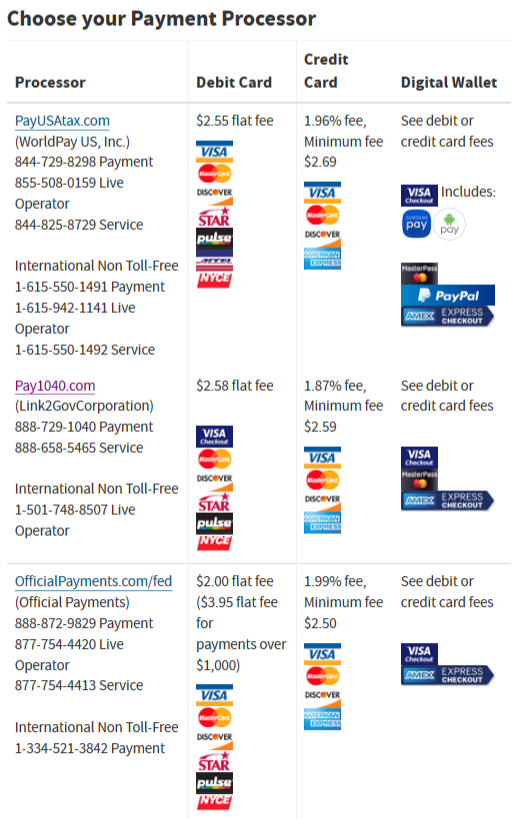

46:24 Question of the Week #1: Should I reduce withholdings to make estimated tax payments with a credit card?

49:18 Question of the Week #2: Does it ever make sense to apply for a card knowing that you’ll not get the welcome bonus?

50:49 Question of the Week #3: Have you considered releasing Ask Us Anything as a podcast?

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Frequent Miler’s 2024 Predictions for Points, Miles and Travel

Each of the Frequent Miler team members made bold predictions about what we will see in credit cards and loyalty programs in 2024. Some of these predictions will no doubt come true and many others will surely turn out to be utter hogwash (and on this week’s podcast above you can hear Greg and I separate the cream from the wheat from the chaff — or read the post and decide for yourself which of our predictions are most likely to come true this year.

My elite plans for 2024 (On my mind)

With a new year come new plans for elite status — and a major shift in Greg’s elite status plans. I have to admit that I’m a little surprised that Greg isn’t considering re-upping either of the statuses he got from matches away from Delta. Instead, he might spend his way toward . . . IHG status? Are ya feeling OK, Greg? Those had better be some tasty Kimpton breakfasts, that’s all I’m sayin’. As for me, I have very limited (as in almost zero) plans to pursue status in 2024.

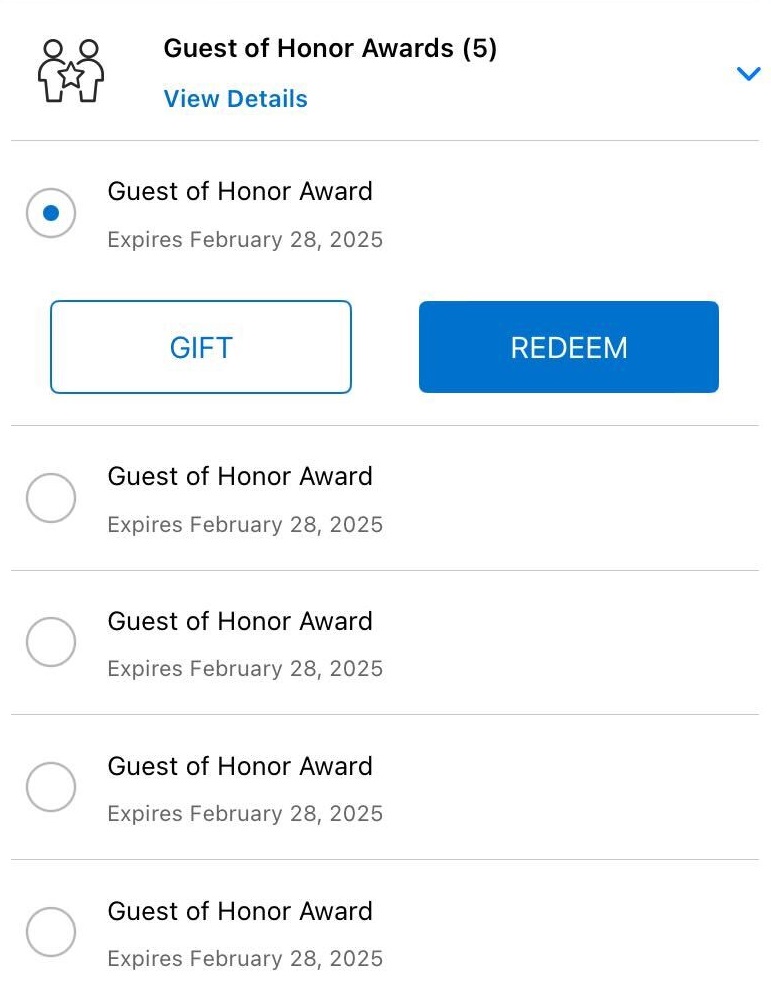

Shortcuts to Hyatt elite status and Milestone Rewards

Hyatt has really changed the game for 2024 with the changes to Milestone rewards (See: (Update: Now live) Huge (mostly positive) changes to Hyatt’s Milestone Rewards) and the ability to easily gift them online. Whereas we long said that the only level of status worthwhile was Globalist status, it now could make sense to go after just 40 elite nights for the associated Milestone Rewards. Between spend I need to do on the credit for to complete my welcome bonus spending and earn this year’s Category 1-4 free night certificate and stays I already have booked, it looks like I’ve got at least 20 nights locked up so far. I’m sure I’ll make some more travel plans this year and while I probably won’t requalify for Globalist, I might make my way to 40 nights for a Guest of Honor stay and a suite upgrade award.

Chase Ink 90K offers now available online (last call)

The end is nearing for the incredible Chase Ink 90K offers. While I don’t usually include credit card bonus posts in our week in review, these big offers on cards that feature no annual fee are worth the attention. If you can meet the spending requirements, it’s worth tapping into your entrepreneurial spirit. Keep in mind that your business does not necessarily need to be large or even making a profit yet to qualify for business credit cards. See our Chase Ink Business Cash Credit Card Review (2024) for more detail about why you might want that card in your wallet long-term.

Chase Freedom Unlimited: Uncapped double cashback for one year (ends soon)

I couldn’t write about the Ink offers above without also mentioning that the end is nearing for the current Chase Freedom Unlimited offer. While I don’t usually think it’s worth applying for a Freedom Unlimited card (if you’re eligible, you’d usually be better off applying for a Sapphire Preferred or Reserve and then downgrading to a Freedom Unlimited after a year since the welcome bonuses on the Sapphire cards are much better), but this offer could make a difference given that it would offer you a ton of points over the first year depending on your spending patterns. The bonuses on pharmacy and restaurants would be particularly good, though “everywhere else” spend is also solid with this offer.

Pay taxes via credit card, 2024 edition

If you’re looking for ways to meet minimum spending requirements for your new cards, the tax man (or woman) cometh. It’s that time of year when it is time to think about how to make your tax money work for you by strategically using credit cards to pay your dues. Whether you’re making estimated payments, payments you owe, or overpayments just in case you owe more tax, you can use this time of year to pick up easy spend (and if you file promptly, you’ll hopefully get back any refund owed within a reasonable amount of time.

A Platinum problem: Nick’s plan for reducing the weight of his wallet by eliminating some annual fees

With nine Platinum total cards in my household, you might think that I’m a major outlier in the game — but if you listened to our Ask Us Anything the other night, you know that I’m not even an outlier on the Frequent Miler team. Still, I don’t want to continue paying $695 a pop for so many Platinum cards, so I had to create a plan of attack to use up the annual credits and cancel or downgrade to save.

Ways we’re using Dell credits (and maybe making a dent in AA elite requirements)

One of the things I need to do before downgrading and cancelling Business Platinum cards is use my Dell credits for the first half of 2024. In this post, I list a number of the products that members of the Frequent Miler team have purchased. I’m definitely going to buy a 3-pack of Nest WiFi Pro devices for a new mesh WiFi system and I’ll probably buy the touchscreen monitor I guess. I’m not yet sure how I’ll spend the other $400 — perhaps on some more earbuds to sell.

Amex Green Card Review (2024)

Greg reviews the Amex Green card here, which is timely since I intend to probably end up with a few of these in short order. He calls the Green card Amex’s answer to the Chase Sapphire Reserve I’ve never really thought about it that way, but it makes sense given the bonus categories and ability to transfer to partners. I’ve never really been particularly keen on the Green card, but maybe I should be given that I prefer Amex transfer partners and have lounge access from other cards, so I don’t need the access granted by the Sapphire Reserve. In fact, I may just dump the reserve at next anniversary and keep one of the Green cards if I think I’ll spend enough on “free” cruises to make 3x worthwhile.

Marriott Bonvoy Choice Benefits. Which to pick? (Pick by 1/7/24)

Don’t forget to pick your Marriott Choice benefits now or let Marriott chose for you.

Music fans, we’ve got a game for you…

Whether you like music or you just like getting a peak at the personalities behind the people behind the blog, you might find this one fun. The Frequent Miler team members each took our 5 most-played songs of 2023 (according to our Spotify accounts) and put them into a playlist, then attempted to identify who had each song in their top jams of 2023. What I enjoyed most about the list was a combination of how many songs I didn’t know and imagining that it is the real-life soundtrack that accompanies the creation of a lot of Frequent Miler content (or at least did last year!).

Frequent Miler’s 2023 Featured Image of the Year

Wrapping up our looks back at 2023, Carrie ranked our featured images to sort through the best featured images of 2023. While Carrie is our Creative Director and does a lot of graphic design, each of the authors on the site tend to make our own featured images. Every now and then, one of them injects the right amount of humor — and you can see the contestants and share your own opinion(s) in the comments.

That’s it for this week at Frequent Miler. Keep an eye our for the first last chance deals of 2024.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

I have a bold prediction for 2024, the courts will allow the JetBlue Spirit merger to move forward and rule against the FTC by the end of the year as there are numerous low cost carriers in the market such as Frontier, Allegiant, Avelo, etc.. to pick up the slack for Spirit. This will light a fire under Southwest to do better. Competition is good for the markets.

Maybe Chase will include a higher level hotel booking chain option similar to what AMEX and Capital One are offering.

I’m with Greg and wish Choice still did the tiered award bookings like they did before 2018. I was always either Platinum or Diamond, so I was always booking 75 or 100 days, and I never had any problem with the award rooms already taken.

fyi cancellation of refundable chase portal tix paid with UR result in refund of UR to account. No statement credit.

The ad shown for the Freedom Unlimited card has as asterisk saying the double bonus is capped at $20,000. That wasn’t the terms of the original offer. Does anyone know whether Chase is still honoring that deal for those who signed up for it?

I don’t see that anywhere. On the contrary, up at the top on the landing page it clearly says there’s no limit. I went to the offer terms and I don’t see that mentioned anywhere either. Where are you seeing it?

Sorry for the confusion. The asterisk and capped offer is shown in the photo in the blog post above about the Freedom Unlimited Bonus offer ending soon, the third or fourth entry under “This week in the frequent miler blog.” (At least that’s what’s showing on my screen.). It looks like a photo of an ad for the offer. Perhaps it’s from a different offer, but in combination with a comment from a reader to that blog post about Chase telling her the offer wasn’t uncapped, it got me worried, as I’ve already spent well more than $20,000 in bonus points, and there’s no way to know what I’m actually getting until the 12 months are up.

Oh whoops! That was my fault. You’re right, that’s from an old offer. My mistake! I will fix that image

That sound you just heard all the way in upstate NY was my sigh of relief!