Being organized is one of the keys to winning at the games we play, but I have to admit that I’d gotten lazy. When my wife and I recently counted up the number of currently-open credit cards we have, I was a bit surprised by the answer. We had fifty-three open cards. The cumulative in annual fees is staggering (though keep in mind that in some cases it is easier for someone like me to justify keeping a card given the fact that I write about credit cards and their benefits for a living). Still, I needed to create a plan of attack to reduce both the stress of tracking so many cards and the amount we’re paying in annual fees. The Platinum cards were a natural first target given their high annual fees.

Getting organized

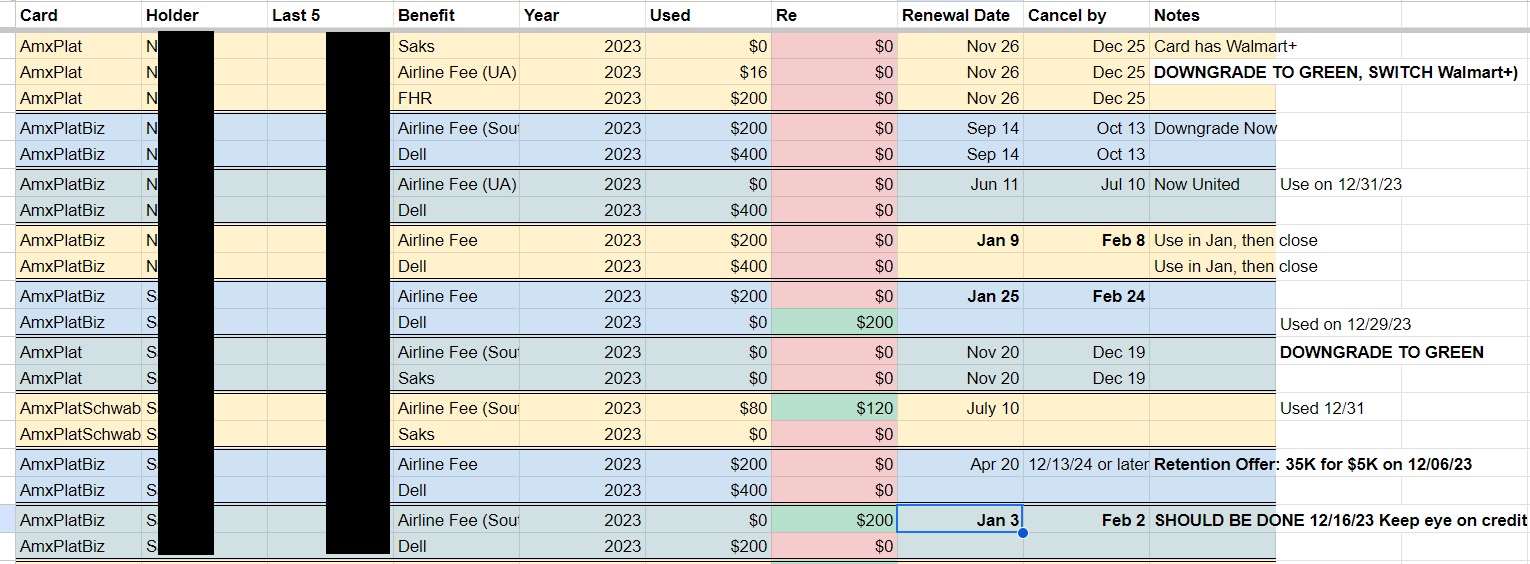

The first thing I did last month to reduce some of my mental stress was create a spreadsheet to track various “spoiling inventory” in the sense of annual credits, monthly credits, annual free night certificates, and other similar things across our cards. I created one tab just for Platinum cards that includes which of us holds the card, the last few digits of the card number, the key statement credit benefits and how much we have used / how much is remaining on each.

The sheet also has tabs for our Business Gold cards for their $20 monthly credits and for our free night certificates. I also created a tab for card-linked offers we should use where I’ll track Amex Offers that we should use or have used and that sort of thing.

That all helped make things visual and it has reduced the potential for mistakes in using, downgrading, or canceling the wrong card since I can see which credits are associated with which card, which airline has been chosen (I’ll probably break airline selection out into its own column), etc. I added a column for notes at the end where I could write reminders like the fact that I need to change our Walmart+ payment method before I get rid of the Platinum card currently associated with that charge.

Just before the end, there is a column with the date that the last annual fee was charged and a “cancel by” column to note the day about a month later that would be the approximate cancellation deadline (I didn’t figure those quite exactly at 30 days). My long-term plan is to get this entire sheet added to our normal monthly expense / budget-tracking spreadsheet, but I started it separately and haven’t yet perfected it. Still, it was instrumental in getting my stuff together. I’ll be the first to admit that I’m not a terribly good spreadsheet-maker, but I’ll also readily tell you that working for Frequent Miler has helped me realize just how useful a spreadsheet can be.

I should add that Platinum cards have additional benefits like the Uber credits and digital entertainment credits that aren’t shown here. That’s because I end up using all of our Uber credits on a single dinner order once a month, so I don’t need individual tracking for those, and I don’t currently use the digital entertainment credits (my mistake on forgetting to change my Disney+ membership to monthly before it renewed at the annual rate!). I just don’t use the rest of the qualifying services at all.

Our Amex consumer Platinum card plan of attack

My wife and I currently have 3 consumer Platinum cards and six Business Platinum cards between us. That’s far too much Platinum at a $695 annual fee for each.

We have a Schwab Platinum card, which we keep for times when we decide to cash out points given that you can redeem points for a deposit to your brokerage account at a value of 1.1c per point. We also each have a regular “vanilla” Platinum card that we opened under incredible welcome offers during the pandemic (you may recall that I bought a car and earned over half a million points). We kept those consumer Platinum cards because Amex has targeted subsequent new cardmember referral offers to some customers and we have each had a turn or two where one of these cards has referred to the best available Platinum card offer, so we’ve each maxed out our referral points on these cards for the past couple of years.

We’ve made decent use of the benefits on these cards: we had no trouble using our Fine Hotels & Resorts / The Hotel Collection benefits (last year, we ended up using those during our extended stay in Las Vegas and we used credits from the previous year for a stay in Brussels, Belgium over the summer). We used our Uber credits for Uber Eats in every month but one and we used our airline incidental credits between United and Southwest as outlined in our post about Amex airline fee reimbursements: What still works?. While I wouldn’t value those benefits at face value, when combined with the referral points earned from each card, the math has made them worth keeping.

At least, that was true until I looked at a spreadsheet with 53 active credit cards, 9 of which are Platinum cards. The calculus has changed on that as we haven’t had referral offers at all on our consumer Platinum cards recently and I know that we will still likely have opportunities to pick up some referral points with other cards. I decided that we each need to drop a consumer Platinum card.

The 30-day window missed: downgrading for a pro-rated annual fee

My wife and I each had a consumer Platinum card that renewed in late November. We had until late last month to cancel without having to pay the annual fee. Unfortunately, I left our airline incidental credits until late in the year to use up. As fate would have it, the credits posted one day after the 30-day mark from the date the annual fee charged, so we couldn’t avoid paying the new annual fees entirely. If we canceled those cards more than 30 days from the date the annual fee posted, we wouldn’t get anything back — we’d have just lit $695 on fire (times two!).

However, the fact that the credits were slow in posting is only a small bummer since the airline incidental fee credits and Fine Hotels & Resorts / Hotel Collection credits are calendar year benefits. By holding these cards an extra couple of weeks beyond when we intended to cancel them, we’ll get a chance to each use our $200 Fine Hotels & Resorts credit for 2024 and our $200 airline incidentals benefit for 2024. I haven’t yet seen something that strikes my fancy at Saks Fifth Avenue, but we have a trip coming up this month that will put us in the vicinity of a Saks store, so we’ll probably each buy a $50 gift card in-store to use the January-to-June Saks benefit. To be clear, that credit is not supposed to work for gift cards, but in practice gift card purchases made in-store have credited like any other purchase.

Once the credits for all of those purchases post, we’ll each downgrade to a consumer Green card. Because we are beyond the 30-day window since the annual fee was charged, Amex will no longer refund the annual fee in full. However, they will pro-rate the annual fee if we downgrade. Therefore, we’ll both look to downgrade to a consumer Amex Green card. When we do, I expect that we’ll each get refunded about $580 and then get charged about $125 for the prorated Green card annual fee (I’m assuming that we’ll get charged for 2 months of Platinum card membership and 10 months of Green card membership).

A need for Green before we downgrade

Neither of us have ever had the consumer Green card. That presents a further wrinkle: Amex application terms indicate that you can not get the welcome bonus on a card that you have or have had previously. Therefore, if we downgrade our Platinum cards to Green cards, we will not be eligible for welcome bonuses on the Green cards in the future.

While neither of us are excited about the current Green card welcome offer at the time of writing, we each have at least one current Amex card offering 20,000 Membership Rewards points per referral. Keep in mind that Amex allows cross-referrals, so if my Business Gold card shows a bonus of 20,000 Membership Rewards points when a friend is approved, I can create a referral link from my Business Gold card to refer my wife to a consumer Green card. See more details and a video explaining this in more detail in this post: How to create cross-brand Amex referrals.

That means that if I refer my wife, she’ll get the current Green card welcome offer and I’ll get 20,000 points when she is approved. The same is true the other way — she can refer me and earn 20,000 points on top of the welcome offer that I earn. Between the two of us, that’s like a bonus third welcome offer for both opening the Green card with each other’s referral links. While Amex family language prevents those who have or have had a Platinum card from getting a Gold card, there is no such family language on the Green card at the time of writing.

Again, the current welcome offer on the Green card is low. I wish we could wait for a better welcome offer (or that we had jumped on a better offer over the last couple of years!). However, given that we each want to downgrade a Platinum card imminently, the time is now for us each to get a Green card with a welcome bonus. Maybe I’ll give it a few more days or a week just in case the offer changes, but I’ve got no reason to expect that it will in the near-term.

That means that we’ll end up paying either a prorated or new annual fee on four Green cards between the two of us, but we’ll still spend at least $700 less than we would have if we kept the Platinum cards. And by each opening the Green card for a welcome bonus before downgrading a Platinum card, we’ll end up with 120,000 points between welcome offers and referral points. We’ll also trigger $400 in airline incidental credits, $400 in Fine Hotels & Resorts credits, and we’ll “bank” $100 in Saks credits between the two of us with our Platinum cards before downgrading. I imagine we’ll also each use our $15 Uber credits this month via Uber Eats. After a year has passed, we’ll likely both intend to cancel the Green cards we got by downgrading Platinum cards and we’ll likely look for a retention offer on our new Green cards to make them worth keeping.

That will take care of two consumer Platinum cards. We’ll keep the Schwab Platinum. But what about all those Business Platinum cards?

Amex Business Platinum plan

On the Business Platinum side, we each have three Business Platinum cards that we’ve gotten thanks to Amex’s repeated targeted “expand your membership” offers to open new Business Platinum cards without lifetime language. I like the idea of each of us keeping a Business Platinum card thanks to the 35% Pay-with-points rebate. While we haven’t used that extensively, we’ve used it at least once a year each of the past several years (most recently just last week to book flights on Spirit Airlines after our holiday plans went haywire). Still, we don’t need the six cards we currently have. While some will find it useful to have more than one Business Platinum in order to set them up with different airlines for the rebate on economy class flights, I’ve had no trouble changing my airline even after having partially used the airline fee credit, so I’ll just plan to hold one card each for the rebate.

Each of us has one Business Platinum card set to renew within the next few days, so these will be easy to handle. We’ll look to each use our $200 in airline incidental benefits and the $200 Dell credit for January-June within the next week and then we’ll cancel these cards before the annual fee comes due next month (within 30 days of the date the fee is charged). That will drop us to four Business Platinum cards (which is still too many!).

We have another Business Platinum card where the annual fee will come due late next month. We’ll likely also look to use the benefits on that card one more time and then cancel it outright as soon as the annual fee is charged. And then there were three . . .

Last month, my wife tried to cancel one of her Business Platinum cards. That card had renewed all the way back in April. While it wouldn’t have made a ton of sense to cancel right before calendar-year credits renewed in January, we were looking to make progress toward the goal of fewer cards and had decided to sacrifice the shot at one more round of credits in favor of getting one card off the chopping block. She chatted with support to cancel and to my surprise, she was given a retention offer of 35,000 points with $5,000 in purchases. That’s effectively 7 additional points per dollar over the 1 point per dollar that the card ordinarily earns on most purchases. If you assume that we would have ordinarily earned at least 2 points per dollar on that $5K in purchases if we had put the purchases on a different card, you could account for it really feeling like an additional 6 points per dollar spent. That was enough to make it worth keeping that Business Platinum card since we have enough in ordinary expenses to meet the spend without sacrificing anything else. That leaves us with two more Business Platinum cards to deal with.

Our last two Business Platinum cards are set to renew later in the year — one in June and the other in September. I’d like to keep one open for future 35% rebates, but I don’t need both cards. Therefore, I intend to use the airline fee credits and Dell credits right away on the card set to renew in September and then I will downgrade that card to a Business Green card as soon as possible, intending to cancel it when it comes up for renewal next September. The reason I’ll look to downgrade that card ahead of the other one is because it has been used for three fewer months, so I expect to get an additional ~$175 back when I downgrade that card over what I would get for the card set to renew in June.

Here’s what I mean:

- The card with a June anniversary date is now 7 months into the cardmember year. If I downgraded today, I would expect to get a prorated refund for 5 months of the $695 annual fee (5/12 of $695 is about $289).

- The card with a September anniversary date is now 4 months into the cardmember year. If I downgraded today, I would expect to get a prorated refund for 8 months of the $695 annual fee (8/12 of $695 is $396.67).

In short, I’ll get an additional $100+ back if I downgrade the card with the later anniversary date. I’m still not getting a remarkable deal since I’ve already long ago paid the annual fees, but I’d rather get an extra hundred bucks back than not get it back.

I won’t look for a retention offer right now on whichever card I close because that would lock me into keeping the card for another 13 months — meaning that I’d be stuck in another mid-year downgrade/cancel crisis 13 months from now. I’d rather just clean up the mess.

The points parade has been a lot of fun, but now it’s getting expensive and I need to make sure that I get off the hamster wheel before it takes me for a ride.

Bottom line

After carrying out the plans laid above, we’ll each have one Business Platinum card and my wife will also have a Schwab Platinum card – reducing our Platinum portfolio from 9 Platinum cards to 3. That’s a pretty significant savings that makes a nice dent in our cumulative annual fee outlay. I still have plenty of work to do to thin the herd of credit cards in our stable before the fees thin our savings more than we’d like, but these Platinum plans are important to handle sooner rather than later so that we can take advantage of calendar year benefits without stretching the downgrade and cancellation process farther than necessary since time definitely equals money in fees we’ll be charged or lose. In the future, I hope that my new spreadsheet will keep me a bit more organized so that I’m not scrambling with 30-day deadlines at the end of a cancellation window and we can be sure to avoid letting any benefits go unused. Again, organization is a major key to winning the games we play.

@Nick Reyes Any chance of sharing the spreadsheet?

Is no one concerned about getting into pop-up jail with so many closures? Isn’t that the ultimate end to the Amex points parade? Every time I close an account I’m petrified that my next application will show that Amex has sidelined me. It doesn’t stop me from closing accounts I don’t benefit from any longer, but it does stop me from opening too many in the first place. Am I being too cautious??

No one really knows how the popup algorithm works. Some people that even spend a lot with Amex get the popup. I wouldn’t worry about it since it’s not clear what we can do about it.

Whenevere you get a retention/upgrade offer make sure to put that date (and 365+ days – so they don’t claw back the bonus. Also you can upgrade that green after 3-11 months and it resets all the credits (i.e double/triple in December).

I look at our AF as a super flexible Time Share without the maintenance fees – but one that includes airfare/food & bev /spa/massage credits. I just added up what we pay in AF almost $6K. But we easily get 2-4x cash value but we never woukd spend that or even take the trips other than for special milestone events.

That said we had a stay in October hat we would have never spent $3K for a weekend at Arizona Biltmore ($700 in F&B alone) but we had $100 in airline credits leftover to boot and earned points on our stay an Airfare and walked to Biltmore mall Saks to bank our Saks credit for BF (earned 16x plus $75 GC for use in December). As well member year fell after 10.19.2023 so we used the $250 resort credits 2X in 2023 as well as the extra $50 Airline (my Aspire was FYF from that one day deal 11.4.2019).

We also have six 35k-85K FNA with IHG/Marriott and two Hilton standard room reward (upto 120K) .

We will PC to a 3rd Aspire so we will have 3 HH FNC – it makes the most senses to hold 3/4 Aspire cards to maximize the split resort credit with 2 night stays (with 3 cards you can use $600 (3X$200) for the 2nd night (this setup is ideal use at All inclusive – since F&B is included).

We get great value out of our four Plats especially the FHR & Airline and Uber/Eats credits easily cover the AF – we do use partially use Clear/HULU/Peacock credits – me may order 2-3 walmart deals a year but typically use Amazon Prime.

We have 2 VenX since launch and just used the Premier collection $200 Credit from Nov 2nd. This past week for New Years – I do prefer the guarnteed

4PM late check-out with FHR. But IHG elite credits stacked, as well as Kimpton secret password. (The breakfast for two a was coupon/voucher vs $60 bill credit – also didn’t include tip or alcohol but the brunch menu was surprisingly reasonable had to work to spend the full $60 between us. But they did charge a $34 amenity ($10 credit, 2 waters and bogus includes Newspaper, landline local calls, bicycle useage). But did earned points/nights on the stay.

We recently add a pair of IHG cards (mainly for an upcoming EU trip in 2025. Been on our list forever (kicking myself that we didn’t get when it was $49) .

We had Biz Plats during the Pamdemic but after the stop selling TVs, Drones, cameras and phones. We are Dell’d out after three laptops, two 32″ 4K monitors, BT mice/ergo keyboards, bose headphones, soundbars and other sound gear. Never got in to the reselling X-box GC. The NLL offers MSR were more than we could swing meeting other SUBs at the same time.

If someone told me 15 years ago I would be spending $6K on AF I would have said they were crazy – I think its crazy that people will pay that and more in CC intrest.

Thanks for sharing this. When you downgraded to green or upgraded back to platinum, did the card number change both times?

@Nun

Our card numbers don’t change on Expiration date (also have to add the new upgraded card with new expiration to Uber/Eats – sometimes you get an extra dip ). I think the only time I have gotten a new card number is when they replace when fraudulent charges).

Doesn’t impact 5/24

As we all try to cancel or downgrade the multiple biz platinum cards, let’s all hope that NLL train comes back…

I look at retention offers like I would a welcome bonus. If the Biz Plat had a welcome bonus of 35k MR for 5k spend on a $695 card with credits, I wouldn’t apply. For that same reason I wouldn’t accept the retention offer. Maybe that’s why I’m in pop up jail!

I think that’s a big difference — I wouldn’t apply for that *as a “once in a lifetime” welcome bonus — as an additional bonus on a card where I already got a welcome bonus of 150K points, I look at it a lot differently.

Why not downgrade Platinums to Gold? Assuming you think that $150 fee for downgraded green card is sunk cost, you can actually get some value out of Gold card path through Uber credits and monthly dining credit – that way, the downgrade isn’t costing you $150 per card.

Not to mention, this solves your other problem of having to unnecessarily apply for two new Green cards when you don’t really need them right now at lower intro offers.

If my math is correct, when accounting for all the airline/FHR/saks/Uber/Dining credits(valued at 50%) at face value (like you are doing) for plat/gold, you end up with a net $75 profit per card (so $150 total) when going through the Green downgrade (and green apply) route with 120k MR points added to your kitty whereas you end up with a net $307 profit per card when going through the gold downgrade route. So, by choosing the green downgrade route, you are buying 120k MR points for $464 (at 0.39 cpp), which isn’t terrible, but I am sure we all can do (and have done) much better than that. Plus, the green downgrade route wastes a 5/24 slot on your credit file, which we all will value differently.

I think Nick has written in the past that he doesn’t highly value the Amex Gold dining credits because he lives in a rural area not really served by Grubhub/Seamless (and the other options don’t work any better for him). Plus you can’t use multiple cards on a single Grubhub order to my knowledge, whereas Uber cash does aggregate when you link multiple Amex cards to your account. So the dining credit is likely worth less than even 50% of face value to him.

Yeah, this could certainly be a sound strategy.

I didn’t try to reverse engineer your numbers and it wasn’t immediately clear where you were getting them without thinking about it, but here’s my initial thought:

I rarely ever use the GrubHub/Cheesecake Factory/et al credit, so that one I value very close to zero because we probably don’t use it more than two times a year. We use the Uber credit each month, but even if I valued that at face value (and you shouldn’t), that’s not bringing me quite even. Assuming I pay 10 months of Gold AF, that’s about $208. And I’d get 10 months of $10 monthly credits. Let’s say we value them at 75% face (which is generous). That’s $75 worth of credits. I can’t remember the last time I used GrubHub (there’s nothing near me and very little in areas I travel to regularly on GrubHub), but when I end up in a mall that has a Cheesecake Factory I try to pop in and grab a gift card. That usually happens about twice a year, but let’s say I make a more concerted effort to get there at least 5 times this year and I value those $10 gift cards at 50% of face value (roughly accurate since my wife loves Cheesecake Factory and I don’t), so that’s another $25. So That’s a “net” $108 per Gold card. That does beat the Green card plan and avoids the need to apply for the Green card with a weak bonus. On the flip side, I need to convince P2 that we really ought to spend an extra hundred and sixty bucks “now” in order to save $20/mo for 10 months, get a free meal at Cheesecake Factory, and then have to remember to do something with these cards before they get charged $250/ea again next year. You’re right that it’s probably a better plan on paper though. We’ll see.

I hear you can use the credit for GoldBelly (not sure if its the GH or UE).

Also Also you can upgrade that PC’d Green card after 3-11 months and it resets all the credits (i.e double/triple in December) AF is also prorated.

The math for Gold is something like this

695 – 200 (FHR) – 200 (Airline Fee) -50 (SAKS) – 15 Uber for Jan – 580 (pro-rata refund) + 208 (pro-rata gold fee) – 75 (10 months of uber credits at 75%) – 32.5 (10 months of dining credit used for buying $25 wine.com GC and reselling those at 75% face value, netting $3.25 profit per month – ask me how!) = Net $249.5 profit

The math for Green is something like this

695 – 200 (FHR) – 200 (Airline Fee) -50 (SAKS) – 15 Uber for Jan – 580 (pro-rata refund) + 125 (pro-rata gree fee) + 150 (new green card fee) = Net $75 profit

That’s a net difference of $175 per card. At two cards, you are saving $350 by chosing Gold downgrade while foregoing 120k MR points. So by choosing Green path, you are buying MR points at 0.29cpp

Also, not sure if I understand this part – “ I need to convince P2 that we really ought to spend an extra hundred and sixty bucks “now” in order to save $20/mo for 10 months, get a free meal at Cheesecake Factory, and then have to remember to do something with these cards before they get charged $250/ea again next year”

Aren’t you spending $125+$150 = $275 for Green path vs. $208 for Gold path?

Also, I think the point of having to remember about the next year’s annual fee will remain no matter what path you choose, so in my view, that worry is a “wash” for comparison purposes

Nick, I believe you can cancel the platinum card before the airline credit hits as long as you had made the purchase with the card. I have canceled a platinum before a saks credit hit once and my account was still credited after the card was closed.

I believe you are right. As a side note, I cancelled my CLEAR membership a few months after I cancelled my Platinum card. To my surprise, CLEAR refunded me for the unused portion of my membership, then Amex later sent me a check for the credit.

That’s interesting. Last year I added 2 family members to Clear, but just removed them this month about a week before renewal. I received ~$1 credit each from Clear for that. A few days later Amex clawed back those ~$1 credits. I hadn’t used my 2024 Clear credit yet. It’s weird they’d do that yet mailed you a check.

We’ve had mixed DPs in our Facebook group on this. My hunch has been that there is a lag in time between when the system realizes that you’ve triggered the credit and when it displays on the user end that you’ve triggered the credit and so long as you’re past the point where the system recognizes that you’ve triggered it, you’ll get the credit even after closing / product changing. I just didn’t think there was a way to determine that. A couple of readers below report that a chat rep can tell you. Personally, I’m skeptical — I’d think that a chat rep might just look at your airline selection and charge and give you a “yeah, you’re good to go” without actually knowing behind the scenes that it’s triggered.

I would not risk it – I make an online purchase with Saks a week before cancelling the card, and the Saks credit never posted.

Actually, why green card and not the amex preferred at no annual fee, and 3X for groceries (I upgraded my gold to platinum in one of my prior merry go rounds)

The Everyday Preferred card is not part of the same card family as the Plat, Gold, and Green cards, and so it is not a downgrade path for a Plat. You cannot downgrade a charge card to a credit card with AmEx. The only cards you can downgrade a Plat to are the Gold and Green cards.

Exactly what AcctualMichael says — it’s not a downgrade option.

A few thoughts on a piece I daresay many of us can relate to: 🙂

Thoughts:

1) Multiple BizPlats: Yeah, I mentioned that’s why you might want multiple. We rarely pay for flights (we don’t travel very much domestically and when we do it’s usually on Southwest with points we earn from referrals or limited-time spending offers on the cards). And I also mentioned in the post that I’ve not had trouble changing my airline, even after using some of the credit. In fact, I had a card on which I used $16 of my credit on AA, then switched to Southwest and used the rest of the credit and then just before the end of the year we had to book last-minute flights on Spirit, so I got the airline selection changed to Spirit and used the 35% rebate for that. While I wouldn’t count on an unlimited number of switches, I probably wouldn’t need the 35% rebate on more than two airlines in a given year, so one switch a year would probably take care of all of my needs. I’ve more often used the rebate on Business Class flights, where airline selection doesn’t matter.

2) Opportunity cost: I’m not going to debate that there is always some sort of opportunity cost to everything, but I have easy ways to meet all the Amex spend I need, so that’s not been an issue for me. I’m happy with a decent retention offer, though as the heart of the post suggests, the annual fees are adding up to the point where even if I can manage to figure them as wins, the wins aren’t big enough to justify the overall level of expense. That is to say that I see your point overall — though I’m happy enough to take a retention offer here and there to avoid constantly applying for new cards. I’m fine with a handful of new cards per year — but you see where that gets us, right? 😀

3) Are Green cards worth it? This depends on your wants and needs I guess. I don’t want to risk my relationship with Chase because we have enough of a stable of 5x office supply stores that I don’t really want to put that perpetual points machine at risk — so I’m not willing to continue trying for Ink after Ink in perpetuity. We otherwise have the Chase cards we want and I don’t really want to have to call recon with them. Further, I more highly value Amex points in general. Yes, Amex points are easier to obtain en masse, but we also use them for the most expensive part of our trips (flights) and they put the world within reach at as good or better value than it would be with Ultimate Rewards points. I love UR points for Hyatt, but there are only so many Hyatts I’m going to stay at in a year — our current stable of 5x bandwidth takes care of that. So I’m not holding out on 5/24 slots since we’ve got what we want/need on that front. I’m not saying that I’ll turn down a Chase bonus when opportunity arises and we might yet open an Ink Unlimited in the near-term (before Green card applications), but I’m far less anxious over 5/24 than others in this space. That said, the Green bonuses are extra weak right now — I’d be far happier with 60K bonuses on those + 20K or 30K referral bonuses. Maybe I’ll consider downgrading to Golds for now.

I am a bit confused about the Green Card explanation and I find myself in a similar situation. I am wondering if the plan is to apply for a consumer Green Card through a referral and then subsequently downgrade your platinum card to a Green Card. My concern is that this approach will result in you having two consumer Green Cards – one new and one from the downgrade. can you clarify?

Can’t you just transfer your credit $ to the green card so your overall charging ability is not gone, and thus your credit card not affected? That’s currently my plan for next month…

The Plat, Gold, and Green cards are charge cards, not credit cards. They have no hard, preset limit. There is no credit limit to transfer. The question is also about the reason for holding multiples of the same card. It has nothing to do with concerns over credit limits.

Yes, that is what Nick is saying. He is only downgrading his Plat to a Green because he is beyond the 30-day window to cancel the Plat without penalty. If he cancels his Plat now, he will just be out the entire $695 annual fee of his Plat. If he downgrades the card to the Green card, he will at least recoup some of the card’s annual fee. AmEx will issue a prorated refund for downgrades, not for outright closing the card. That’s the only reason he is getting this second Green card. He also wants to open up a first Green card before he downgrades to the second Green card because of the strict lifetime rules AmEx has on their cards. If you open an AmEx card you’ve never had before, even if it’s through a product change any you don’t receive any kind of upgrade or welcome offer, you lose the ability to ever earn the welcome offer on it. He’s opening up the first Green card so he can get an extra welcome offer, plus the points his wife gets for referring him to the card. It’s a strategy to maintain eligibility for the most points possible while reducing / recouping annual fees as much as possible. Hope that all makes sense.

Makes sense now, thanks. And then next year cancelling one of the two green cards?

I’m assuming. There’s little value to having multiple Green cards unless you just have a whole bunch of people in your family who you buy a clear membership for (which is the primary way to recoup the Green card’s annual fee).

Correct — cancelling the Green cards next year.

So you can have two (or more?) of the exact same credit card? Ie you and your wife will each have two green cards?

Yes, AmEx allows you to hold multiples of the same card. You can get those multiples either through product changes or through opening the card without a welcome bonus. There is not much reason to hold multiples of the majority of AmEx cards, but some people hold multiples of the BBP or the Biz Gold to max out the spend limits on multiple cards if they have high business spend.

After getting sucked into the Amex points parade I’m going through a similar activity of going from 5 Amex Business Platinums down to 1. I’ve ended up with $1700 in the United Travel bank. I screwed up on the Delta GC+ add/collect by buying the card on Dec 30 – and getting killed by the 24 hour activation hold on Delta GCs, so despite purchasing the DL in the early hours of Dec 31 the charge has posted on 1/1. I guess that’s the H1/2024 spend on the card getting canned before Jan 21.

Burning question, after running out of 32″ monitors, Bose headsets, Blink cameras… What are you guys buying this week from Dell?

If you haven’t upgraded your home yet, I’d start buying Nest products to make your home “smart”, It actually increases your property value if you can call your home a “smart” home, and in some municipalities, you can get a discount on your utilities if you have a smart thermostat.

google nests, fitbit, and I let my kids pick whatever gaming keyboard/mouse/mouse pad they want

Thank you. I’ll check out the fitbits. I wish they had the 2nd generation Pixel Watches because they appear to be a lot better than Gen 1. Nests are overpriced – our utility was practically giving away Ecobee thermostats last year.

I have this portable monitor and I love it: https://www.dell.com/en-us/shop/dell-14-portable-monitor-p1424h/apd/210-bhrq/monitors-monitor-accessories

My son actually decided to step on my backpack to see out of a hotel window last summer and he broke mine, so I got to buy a second one with another Dell credit lol.

I also use this mouse: https://www.dell.com/en-us/shop/logitech-mx-wireless-vertical-advanced-mouse-graphite/apd/aa303022/pc-accessories

I tend to knock mice off the table far more than I’d like, so I end up breaking one every year or two, so I bought several to be ready for future replacements. I love that it’s Bluetooth and can pair to three different computers — so it’s paired to mine, my wife’s, and our Chromebook and I can just hit the switch on the bottom to switch. I didn’t realize how much I wanted a Bluetooth mouse until I no longer had to deal with a dongle :-).

Greg has a power bank with wireless charging that has a built-in stand that he bought on Dell that he likes, but I don’t know which one it is.

It’s definitely overpriced, but I like this surge suppressor and I’ve bought a few of them now: https://www.dell.com/en-us/shop/apc-p11u2-surge-protector-ac-104-126-v-output-connectors-11/apd/a9799774/power-cooling-data-center-infrastructure

I’ve been wanting to buy this because a wish list item for me has been an external touchscreen monitor for my desk. I know that most people don’t use the touchscreen function, but I constantly find myself wishing that mine was a touchscreen. But I haven’t bought it because I haven’t been able to justify the expense when I have a perfectly functional one (that isn’t a touchscreen). I’m tempted though — I’ve been using a 3-screen setup (my laptop in the middle, the little portable monitor to the left and a cheap Dell 27″ to the right (it was $99.99 at Staples years ago and it isn’t a touchscreen). I’m tempted to get this for one side and just put my portable monitor in my bag for “on the go” use. https://www.dell.com/en-us/shop/dell-24-touch-usb-c-hub-monitor-p2424ht/apd/210-bhsf/monitors-monitor-accessories

With the last round of credits, I decided to buy a mesh WiFi system to try that out to see if it covers the house indoors & outdoors a bit better. We’ll see.

I bought a couple of these early last year and I like them. If I’m taking a road trip and I am going to be recording the podcast, I’ll toss this in the car to be sure I can have good lighting (I use a ring light at home). https://www.dell.com/en-us/shop/logitech-g-litra-beam/apd/ac752013/pc-accessories

I’m probably going to grab a couple more nodes or whatever they are called for the mesh WiFi this week. Maybe I’ll grab that monitor before I’m done with BizPlats for a while I guess. We’ll see.

I would be appreciative if you could share the spreadsheet.

Yes, please!

Any chance you would share the sheet?

FYI, you DON’T have to wait for the credit to post before canceling your card. As long as it’s “in the process”, you can cancel and it will still post. Simply chat and find out if the credit is pending.

I have done this twice in the past and am about to cancel 5 biz plats and not wait for the airline and dell credits to post. Eventually the canceled card will have a credit balance and you just chat amex and ask them to move the credit to one of your other cards

FWIW I have literally dozens of data points confirming Lukas’s and Todd’s experience here, Nick. No need to wait until the credits post to cancel.

The ONLY time I had an issue was once when I accidentally cancelled the card later the exact same calander day.

Just responding here to say that I also replied to a similar comment above to note that we’ve had conflicting data points in our Facebook group (this discussion just cane up within the past week). I noted above that I suspect it really just depends on when the computer system registers that you’ve triggered the credit. I haven’t tried chatting to see if the credit is pending, but I wonder whether they can actually see that or you’re just getting a response from someone who is looking to see that you’ve chosen the airline, made a purchase at the airline, and are within the window of how long it takes to get a credit and saying “it’s pending”. I’d rather just wait and see the credits post to be sure.