NOTICE: This post references card features that have changed, expired, or are not currently available

Until recently I haven’t given the Marvel Mastercard much thought. This no-fee card issued by Synchrony Bank offers 3% cash back on dining, select entertainment, and Marvel shops. While 3% cash back for dining is pretty good, there are plenty of cards that offer equal or better returns. And while the card-art options are super-cool, you’d have to be a ridiculously huge Marvel fan to gain much from 3% back when shopping with Marvel.

Where things get interesting with this card is in the “select entertainment” category. According to the card’s cash back terms (found here), “select entertainment” includes all of the following:

- Movie Theatres: Establishments that sell tickets and refreshments for movie productions.

- Video Rental and Game Stores: Merchants that rent DVDs and/or games and related equipment for consumer use, including online video rentals.

- Theatrical and Concert Promoters: Merchants that operate live theatrical productions or concerts, and include ticketing agencies.

- Amusement parks (including zoos, circuses and aquariums): Establishments that operate parks or carnivals and offer mechanical rides and games and/or live animal shows.

- Digital Entertainment, Games, and Software: Merchants that provide digital games and content for computers and mobile devices.

- Music: Establishments that sell CDs and related items, including online records and digital music.

- Books and Newsstands: Establishments selling reading material both digital and physical formats (includes comic stores).

- Toys and Hobby Stores: Establishments selling toys and games, including video games.

There are several interesting 3% categories here. Digital Entertainment, Games, and Software, for example, seems like a very broad category. More interesting to many may be 3% for Books. Presumably this includes Amazon.com purchases.

College Savings 3%

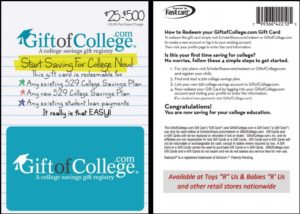

The most interesting 3% category in my mind is “Toys and Hobby Stores.” This must include Toys R Us, right? And we know that Gift of College gift cards can be bought at Toys R Us stores nationwide.

Gift of College gift cards can be used to save for college through 529 plans, or to pay for college by paying student loans. For everything you need to know about this option, please see: Miles for College.

Gift of College gift cards incur a $5.95 fee. When you buy $500 at a time, that fee amounts to just under 1.2%. If you use the Marvel Mastercard to buy these, you’ll clear over 1.8% cash back with each Gift of College gift card purchase.

Bonus

The Fuel Rewards Network often offers bonus fuel rewards when you link your Mastercard to your Fuel Rewards account and make purchases at certain types of stores (the store type changes periodically). In the past, toy stores have been a bonus category and I’ve successfully earned those bonus points by buying Gift of College gift cards at Toys R Us. Hopefully the toy store category will return soon!

More Details

For more details about the Marvel Mastercard, click here. For the record, we do not earn any commission or referral benefits for this card.

Some reports that this is now available in about 46 Barnes and Nobles stores – Not sure which ones, I believe this would be available across all B&N stores starting mid/late oct. The denominations however seem to be upto $200 only

Or use JCB Marikai card for 3% cash back on everything.

If you happen to live in one of the few states that are eligible. https://frequentmiler.com/best-rewards-for-everyday-spend/

[…] A super card for college savings. […]

Just got back from toys r us and they said they no longer take CC for 3rd party gift cards.

That’s unfortunate. That is probably an individual store decision or a misinformed employee

Yesterday I used a VGC to purchase GoC at a BRU (I opened the VGC packaging right in front of the cashier). Bought the VGC at a grocery store with AX BCP 6%cb. Netted $38 on $1000 529 contribution, i.e. 3.8%. And BRU coded w Citi MC (used to pay the fee) as Hobby,Toy/Game Shop.

can you claim a state income tax deduction on 529 contributions made this way?

Yes, if your state allows income tax deductions for 529 contributions. Mine does – PA – up to $14,000 per parent with income (that is, if only one parent has income, only $14k, if both have income over $14k, then you can deduct $28k). The Gift of College gift cards get put into your 529 account, and it “counts” the same as if you sent a check to your 529.

paying for college? thats so last century of you

Strip clubs come under entertainment.

“Mom, where is dad ?”

” Honey, he has gone out, saving for your college fund. Bless that man’s heart.”

See you near a pole soon.

God help us

Marvelous!

Great benefit. I don’t remember a bonus category at toy stores. I couldn’t locate the Gift of College cards at my local Toys-R-Us. Time for a return trip.

Is there a way to liquidate the 529, or are you just using it to pay for your son’s college?

When looking for the card at Toys R Us, keep in mind that gift cards can be found in a number of places:

-Within random halways

-In the electronics / videogames section

-In each check-out lane

I use Gift of College to pay for my son’s college

I went to a ToysRUs store and couldn’t find the cards so I asked someone and she helped me find them. They were not prominently displayed. Then, when I checked out, the cashier asked me what it was. I had another cashier ask the same question a week later.