| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

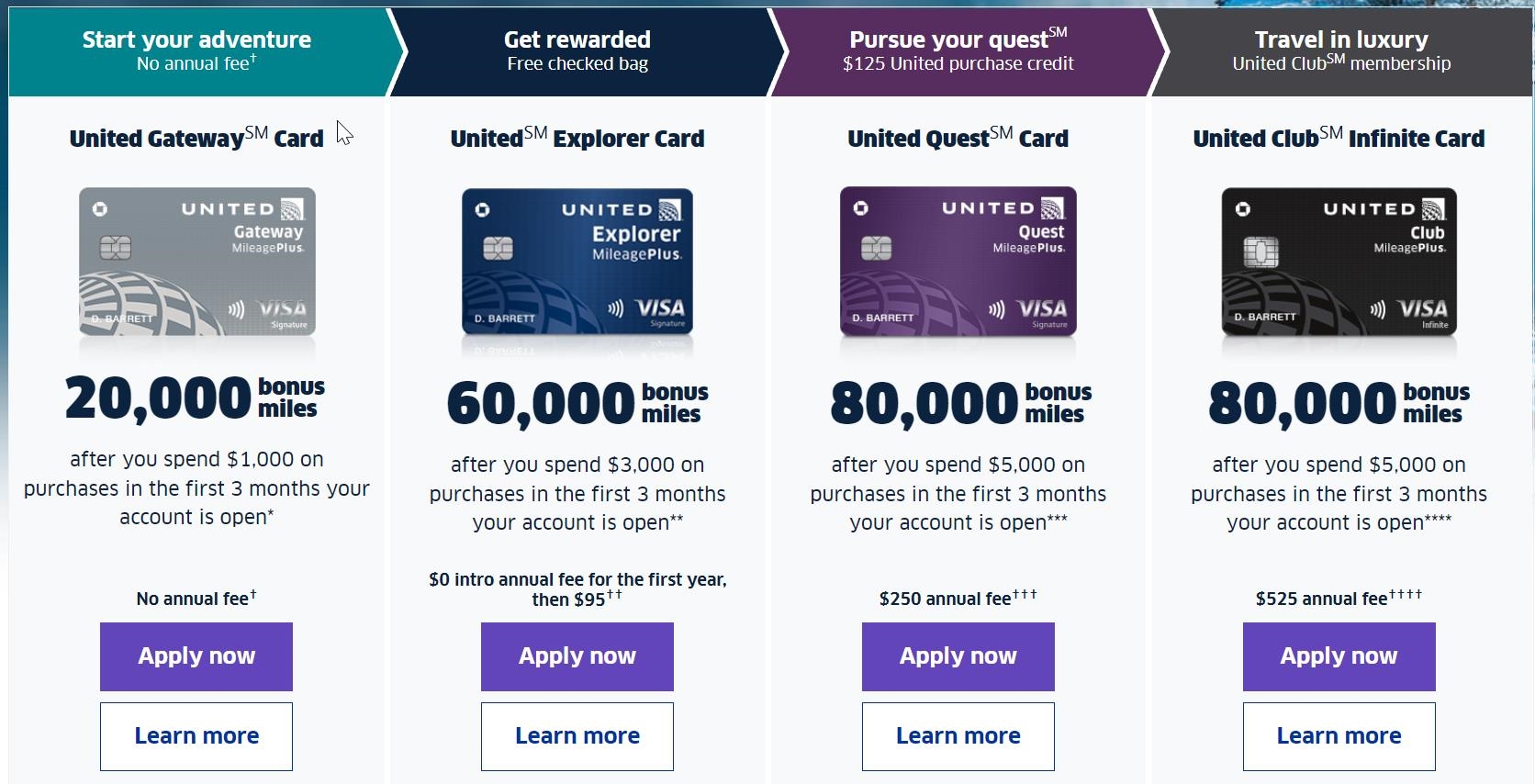

There are improved welcome offers available on the United Airlines Explorer cards as well as the United Airlines Quest card. These targteted offers went out by e-mail but appear to be available to some MileagePlus members by following the link and logging into their MileagePlus accounts. If you’re in the market for either card it’s definitely worth a look to see whether or not you’re targeted.

The Offers and Key Card Details

- Increased (targeted) offers on the United Explorer and United Quest Cards when using link and signing into MileagePlus account. Increased offers are good until 3/20/22.

The best, publicly available offers for each card are listed below:

| Card Offer and Details |

|---|

ⓘ $791 1st Yr Value EstimateClick to learn about first year value estimates Up to 65k miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: 60K miles after $3K spend in 3 months. Plus, earn an extra 5,000 miles after you add an authorized user to your account in the first 3 months your account is open.$0 introductory annual fee for the first year, then $150 Alternate Offer: There is currently an in-flight offer for up to 75K. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 80K Miles after $3K in spend (expired 5/8/25) FM Mini Review: Decent perks such as free 1st checked bag and 2 annual club visits makes this a keeper for some. Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $100 Travel Credit after spending $10,000 in a calendar year ✦ 10,000-mile award flight discount after spending $20K ✦ Earn up to 1,000 PQPs per calendar year: 1 PQP per $20 spend Noteworthy perks: 2 United Club passes per year on you anniversary ✦ Improved economy saver award availability ✦ Free first checked bag for primary cardholder and one travel companion when you pay with the card ✦ Up to $100 in credits for United Hotels ($50 each on your first two bookings per cardmember year) ✦ Up to $60 per year in rideshare credits (up to $5 per month) when using your card to pay for rideshare services.(requires annual enrollment) ✦ Up to $50 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 Instacart credit per month when you have Instacart+ membership ✦ Priority boarding ✦ One year of complimentary Dash Pass (Must activate by 12/31/27) ✦ Primary auto rental collision damage waiver ✦ Up to $120 Global Entry, TSA Pre-check or Nexus credit ✦ 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card |

ⓘ $1048 1st Yr Value Estimate$200 TravelBank cash valued at $170 Click to learn about first year value estimates 100K Miles + 3,000 PQPs ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K miles and 3,000 PQPs after $4K spend in the first 3 months. $350 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: None. Earning rate: 5X Renowned Hotels & Resorts for United Cardmembers ✦ 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 18,000 PQPs per calendar year: 1 PQP per $20 spend ✦ Earn an additional 10,000-mile award flight discount after $20K in purchases in a calendar year ✦ Earn 2 global Economy Plus seat upgrades after $40K in purchases in a calendar year ✦ Starting in 2026, 1,000 bonus PQPs each year Noteworthy perks: $200 in United® TravelBank cash each membership year - terms apply ✦ Up to $150 in statement credits per cardmember for Renowned Hotels and Resorts ✦ 10K award flight discount per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your MileagePlus number ✦ Up to $120 Global Entry, TSA PreCheck or Nexus reimbursement ✦ Up to $100 in rideshare credits per year (up $8 per month January to November and up to $12 in December, re-enrollment is required annually) ✦ Up to $80 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 and one $5 Instacart credit per month when you have Instacart+ membership ✦ 25% back on United inflight or Club Premium drink purchases |

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Quick Thoughts

Each of these offers awards an additional 10,000 miles after meeting minimum spend compared to the public offers, although the Quest offer requires $5,000 spend to receive the bonus, $1,000 more than the public one. The Explorer card’s spend remains the same at $3,000 and also has the first year’s annual fee waived as well.

Both are clearly better than the public offer, so if you were looking at either card and were on the fence, now might be the time to apply (if targeted for this offer). The Quest was at 100,000 miles for quite some time after launching, but that ended last September and I think it’s doubtful that we’ll see it again soon. This 80k offer is the best we’ve seen since then.

Each card falls under Chase’s 5/24 rule, so check out Greg’s post on ways to check your status if you’re uncertain of where you stand.

Does anyone else see the 80k Quest offer? I logged in a few days ago saw and now it’s gone.

Pretty sure the referral offer is the same or better

Edit: never mind only in 2p mode

DOC has a link on personal explorer for 70k pts (60+10 after $6k spend); wish the biz explorer had an offer for $0 fee in 1st yr