Yesterday, Nick revealed the cards in his wallet. Now it’s my turn. Just like Nick, Amex had almost completely taken over my wallet in the past year thanks to promotions offering bonus points first at grocery stores and gas stations, then at small businesses and restaurants, and then an extra 4 points per dollar for all spend. And, like Nick, I’m nearing the end of all of those bonus opportunities and so it’s almost time to return my wallet to something approaching normal…

Please note that what follows are not recommendations for what you should do. Everyone’s circumstances differ. What’s best for me likely is not best for you. Further, I’m not arguing that what I have is necessarily best for me either (although I think it’s pretty good). It’s just a list of cards that I happen to have open at the moment of writing and which have made it into my day to day wallet.

Wyndham Rewards Earner Business Card for Gas

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Excellent earning rate at gas stations and Wyndham hotels. Diamond status plus 15K annual bonus makes this card a keeper. $95 Annual Fee Earning rate: 8X Wyndham & gas ✦ 5X marketing, advertising, and utilities (telecommunications, cable, satellite, electric, gas, heating oil and water) ✦ 1X everywhere else Card Info: Visa Signature issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 15,000 points each anniversary year ✦ Diamond status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

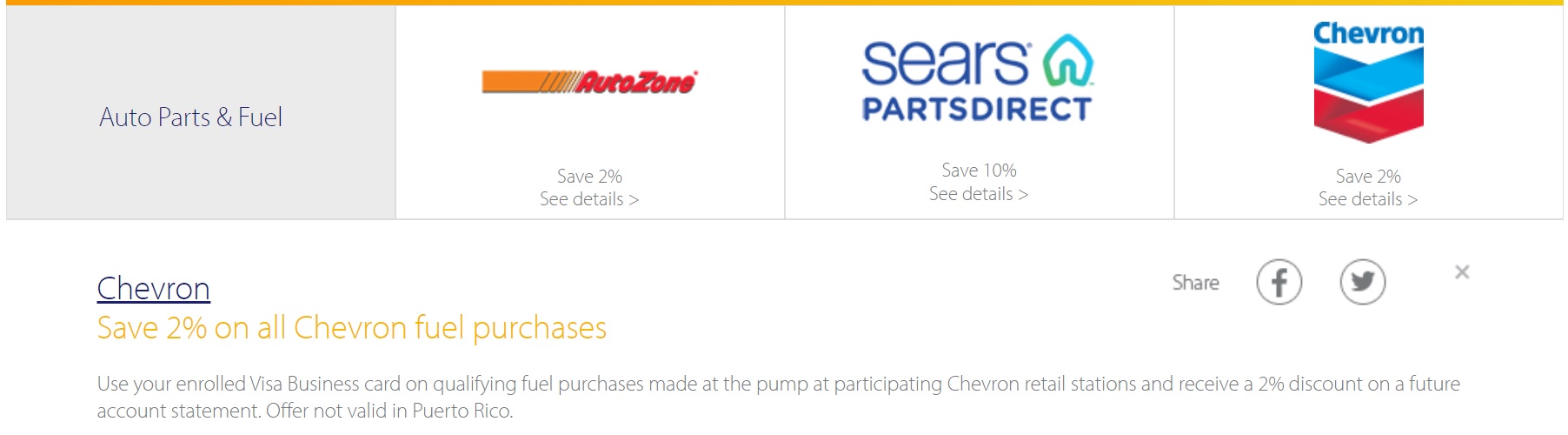

This card pays for itself with 15,000 bonus points each year upon renewal. And you can’t beat 8x earnings at gas stations. Plus, I’ve enrolled the card in Visa Savings Edge and so I get an additional 2% cash back at Chevron stations!

I’m happy to earn Wyndham points thanks to the great value that’s possible when using points to book Vacasa Vacation Rentals. See: Wyndham Vacasa – Great Value is Real!

Citi Prestige Card for dining

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. $495 Annual Fee Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

I use this one to earn 5X at restaurants. My wife and I eat out a lot so this is big. We often eat out when traveling internationally too, so the Amex Gold Card (which earns 4X for dining) isn’t a great alternative since Amex isn’t widely accepted outside of the United States.

In the past I’ve tried to cancel my Prestige card because I don’t think it’s worth the $495 annual fee, but each time I’ve called to cancel I’ve accepted a retention offer to keep the card for another year.

Now, I’m kind of happy about that. I love that Citi points now transfer 1 to 2 to Choice Privileges (and 1 to 1 to Wyndham). This has unlocked value in Choice’s ability to book Preferred Hotels. And, yes, the booking process is a nightmare, but for me the results so far have been fantastic…

Amex Gold Card for grocery

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. $325 Annual Fee Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide (up to $50k in purchases, then 1x) ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, The Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month - must select Amex card as payment method to redeem) ✦ $7 monthly Dunkin' credit - enrollment required ✦ $50 twice-annual Resy credit ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

This is my wife’s old Premier Rewards card which was automatically converted to an Amex Gold Card (but we never ordered a new metal card). We use it to earn 4x at grocery stores. Plus, the card offers $10 per month in Uber credits which we use without fail. We also use it occasionally to order food through Grubhub since this card offers up to $10 back each month at certain restaurants, Grubhub, and Boxed.

Thanks to all of the recent Amex point promotions, my family is flush with Amex Membership Rewards points and so it doesn’t make a ton of sense to keep earning points this way. That said, my wife currently has the Schwab Platinum card, which allows us to cash out points at 1.1 cents each, and so we can think of the Gold card as earning 4.4% cash back at grocery stores on up to $25K spend. That’s certainly not bad!

Chase Sapphire Reserve for Travel

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review $795 Annual Fee Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 January to June and again July to December) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qulalified bookings through Chase Travel ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft creditPrimary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

The Sapphire Reserve card is an awesome choice for travel spend. It offers 10X for hotels & car rentals booked through Chase, 5X for flights booked through Chase, and 3x for other travel spend. Plus, it gives the cardholder $300 back per year on travel purchases. It also happens to offer best-in-class travel protections (see: Ultra-Premium Credit Card Travel Protections).

The Sapphire Reserve card earns Ultimate Rewards points that are transferrable to a number of airline and hotel partners (see: Chase Transfer Partners – Which are best? Which are worst?). The one that I turn to over and over again is Hyatt. I’ve been using Hyatt points like a madman lately for stays at Miraval, Ventana Big Sur, and more, and I’ve been getting incredible value compared to cash rates (sometimes over 5 cents per point!). In my recent analysis of Hyatt point values I found that it is easy with just a little cherry-picking to average over 2.3 cents per point. So, to me, earning 3x Chase points for travel spend is like getting 2.3 x 3 = 6.9% back towards Hyatt stays.

X1: My “Everywhere else” card

If writing about rewards cards wasn’t my career, I’d stick with my Bank of America Premium Rewards card as my “everywhere else” card. Thanks to my having Platinum Honors status with BOA, I get 2.62% cash back on all spend with that card. That’s terrific.

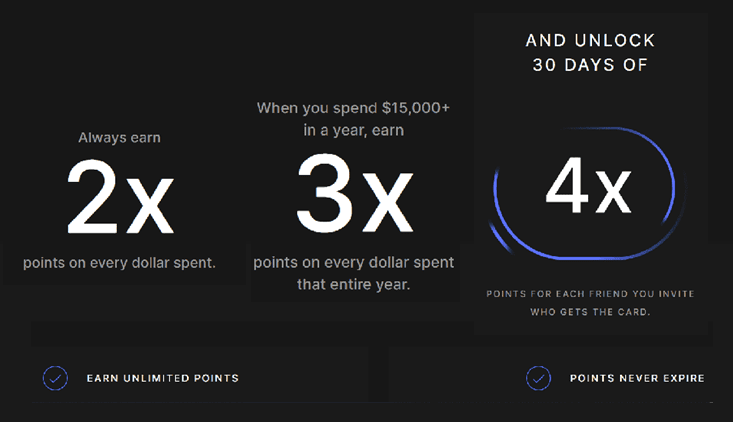

But my X1 card is more interesting. As long as I spend $15K per year on the card, I get 3x on all spend. And, as long as I redeem those points to offset charges at specific merchants (including many travel providers that I spend with frequently), points are worth a penny each. In other words, this is a 3%-ish cash back everywhere card. But, it gets more interesting: The X1 app lets me enroll in “Boosts” in order to earn more points on many types of transactions (dining, grocery, and Amazon boosts are examples that I’ve already taken advantage of). Plus, if I refer a friend to the card, I’ll earn a base 4x everywhere for 30 days.

One super cool feature of the card that I didn’t know when signing up is that there is no hard credit inquiry (they check your bank account instead) and the account never showed up on my credit report. The latter means that it doesn’t count against my 5/24 status (see this post for more).

Update: Joe K says that he did get a hard inquiry when signing up. We don’t yet know if it will also appear on his credit report.

For more about X1, see:

- X1 First Impressions: Fun, Rewarding, Scary

- X1 Card Review: Up to 4x Everywhere. It’s here. It’s real

Fee free debit card

Anyone who travels internationally should carry a debit card that waives ATM fees and doesn’t charge foreign transaction fees. That way, you can go to any country, withdraw cash via a local ATM, and not pay any fees. The most widely available account like this is probably the Schwab Bank High Yield Investor Checking account. In my case, I get the similar features through my Chase Private Client account.

Altitude Reserve 3X Mobile Wallet

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: With points worth 1.5 cents each towards travel, this card offers an excellent signup bonus. For ongoing use, this card is a winner for those who spend a lot on mobile payments (at 3X, rewards are worth 4.5%) Click here for our complete card review $400 Annual Fee Earning rate: 5x prepaid hotel & car rental through Altitude Rewards Center ✦ 3X travel and mobile wallet payments Card Info: Visa Infinite issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: $325 in travel/dining credits per membership year ✦ Points worth 1.5 cents each towards travel ✦ Real Time Mobile Rewards (redeem points at full value at time of purchase) ✦ Priority Pass Select airport lounge access (8 per year) ✦ Primary car rental coverage ✦ No foreign transaction fees ✦ Free authorized user cards |

The US Bank Altitude Reserve card isn’t in my physical wallet, but it’s my default mobile wallet (Apple Pay / Samsung Pay) card since it earns 3X (worth 4.5%) on all mobile wallet payments.

My Travel Wallet

My travel wallet is a wallet that never goes in my pocket. Instead, I keep it hidden away in my backpack. It contains all of the cards that I might need while traveling. Some of the non credit-card items in my travel wallet include my passport, my dive certification, Priority Pass (for lounge access), public transport cards, and travel related gift cards.

Credit cards found in my wallet include my Platinum card (for lounge access and emergency medical evacuation), my Chase Sapphire Reserve card for travel purchases, various hotel cards for in-hotel payments, and various airline cards for in-flight food discounts.

What’s not in my wallet (but is at home)?

I have a lot of cards that aren’t kept in either of the wallets shown above. I’m not going to list every card I have here, but there are some key cards missing from the story above that are worth noting:

Citi Double Cash: 2X Everywhere

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all spend with no annual fee makes this card a winner. Earn 2X everywhere and redeem for the equivalent of 2% cash back or 2X ThankYou points. Pair with the Premier or Prestige card to make points transferrable to airlines. Click here for our complete card review No Annual Fee Earning rate: 2% cash back everywhere (1% cash back for each purchase + 1% when paying your credit card bill for that purchase). ✦ Earn 5% total cash back on hotel, car rentals, and attractions booked on Citi TravelSM Portal through 12/31/25. Base: 2X (3%) Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: 1X when you make a purchase + 1X when you pay for those purchases ✦ 24 month extended warranty See also: Citi ThankYou Rewards Complete Guide |

This fee-free card offers 2X ThankYou Rewards everywhere. And, by holding a Premier or Prestige card (I have the latter), points are transferable to airline and hotel partners (such as to Choice at a favorable 1 to 2 rate). So, for situations where I need a Mastercard, this is a great alternative to my X1 card. For example, this is a great option for Plastiq bill payments for things like mortgage payments that can be made with Mastercards, but not with Amex or Visa cards. For full details see: Citi Double Cash Complete Guide.

One problem with this card is that it does incur foreign transaction fees so I recommend leaving it behind when traveling internationally.

Citi Rewards+

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The fact that you can get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year, makes this a great choice to pool with ThankYou Premier, Prestige, and/or Double Cash Click here for our complete card review No Annual Fee Earning rate: 5x on travel booked through Citi Travel℠ Portal through December 31, 2025 (excludes air travel) ✦ 2X at supermarkets and gas stations on up to $6,000 per year ✦ Round up to nearest 10 TY points on all purchases Card Info: Mastercard World issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Round up to the nearest 10 points on all purchases with no cap. ✦ Get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year. See also: Citi ThankYou Rewards Complete Guide |

This fee-free card is awesome because it offers a 10% rebate on rewards (capped at 10K points per year). By pooling this card with my Double Cash and Prestige, I automatically get up to 10,000 points per year without thinking about it. See: Citi Rewards+ is a great companion to Premier or Prestige.

Amex Blue Business Plus

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all spend (up to $50K per year) with no annual fee makes this card a winner. Click here for our complete card review No Annual Fee Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

This fee-free card offers 2X Membership Rewards points on all spend, up to $50K per year (then 1X). Since I’m currently flush with Amex points, this card isn’t getting much love these days.

Like the Citi Double Cash card, this card incurs foreign transaction fees so I recommend leaving it behind when traveling internationally.

Chase Ink Cash: 5X Office Supply

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review No Annual Fee Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

I use this card to earn 5X by automatically paying our phone, cable, and internet bills. And, since the Ink Cash also offers 5X at office supply stores, I take it on field trips to Staples and/or Office Depot / OfficeMax when they offer sales.

Delta Platinum and Reserve cards

I use these cards to manufacture Delta elite status (see this post for details). It’s past time for me to rethink this approach, but they’re still around for now.

Bottom line

The cards in my day-to-day wallet (and phone) offer an excellent rate of return for my in-person spend: 8X gas, 5X restaurants, 4X grocery, 3X Travel, 3X Apple Pay, and 3x to 4x everywhere else.

One card that I’d like to add to my wallet is the fee-free Citi Custom Cash which earns 5x Citi ThankYou Points on up to $500 in spend each billing cycle on the category which you spend the most: Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs and Live Entertainment. I could see myself dedicating the card to grocery stores only and that would leave me free to potentially ditch the Amex Gold card.

Aside from considering the Custom Cash card, I’m pretty happy with the selection of cards I have now. I know I could do marginally better in some cases, but I don’t really care. The difference in earnings from day to day spend are minor compared to the rewards I earn through credit card bonuses and increased spend techniques.

If you’re struggling to decide which cards to keep in your wallet, don’t forget that we’ve put together a resource to help you decide which of the expensive cards are worth keeping. See this post for details: Which Ultra Premium Cards are Keepers?

What about the Bank of America Premium Rewards card? I see the card pictured.

Quick data point on the X1 card. I opened mine a month ago and DID get an inquiry on my report. I don’t think they hit all credit agencies, but it is certainly showing as an inquiry on some monitoring services. I haven’t held it long enough to have a payment show up on my report yet.

Thanks. I’ll add a note to the post about that. Please let me know if the card ever appears as a new account on your report.

Curious if there is any follow up on this…

Just mentioned above….

Just got an alert today that X1 is now on my TU report. Reported on June 19. History back to Feb when I opened the card.

Just got an alert today that X1 is now on my TU report. Reported on June 19. History back to Feb when I opened the card.

Thank you for the Visa Savings Edge 2% off Chevron tip, Greg. I signed up for the program long ago but never added my Wyndham Biz card.

You are clearly set, but one category that might be bumped up is Entertainment? I assume it would currently earn 3-4% with your current strategy, but could earn 5x with Citi CC as a spend cat if you do decide to get one.

I really have enjoyed my Savor Rewards card for 4x Entertainment. I was grandfathered in with no annual fee from my SavorOne, so I can appreciate not wanting to pay $95 (& issuer is Cap 1 where that might also be an issue?). Most winery purchases code as 4x (not helpful to you but maybe other readers!) & many golf courses as well. Their Entertainment cat is much more far-reaching than the Citi Custom Cash (& even more so than their old Preferred card).

I routinely pull out the Savor Rewards for movie & concert tickets. It recently coded 4x at the Van Gogh Immersive exhibit & Monterey & Maui Aquariums. I have used the card a lot more than expected when I agreed to the card conversion & can now combine miles with my other Venture accounts, making it more a .06 card for Entertainment (nice extra discount on wine!) & .045 on Groceries & Restaurants (when I need an extra card to use).

Thanks for sharing your spend strategies, always helpful.

Thanks Pam. Good advice regarding entertainment purchases!

^ .06 Restaurants

Ok, I can see using the Wyndham card for the gas-bought-at-the-pump thing, but what card is good for people who do NOT buy gasoline AT ALL? Namely, us Electric Car owners!

Plus, the local electric utility and the gas company charges like 5% for using a card to pay and you have to go to the grocery for that. That’s no bueno, for sure.

Thoughts on this as more and more people slide to not using gasoline?

If your local utility charges extra for paying with credit then you may be out of luck. For those who can pay utilities with a card with no fee, ironically the Wyndham Biz card is still a great option at 5x for utilities (telecommunications, cable, satellite, electric, gas, heating oil and water).

Note that for tv/phone/internet I prefer the Ink Cash which earns 5x Ultimate Rewards (when paired with a premium card like the Sapphire Preferred, those points become transferrable to partners)

I think the excitement about 8x gas points are the inside purchases, not at the pump. The difference between earnings at the pump is often pennies but sometimes you can buy gift cards. Selection isn’t great, better at quickie mart locations.

Why do you say there is no hard inquiry on the Cap One Venture X card? I am assuming when you say that they check your bank account you mean your Cap One bank account, right?

Greg is not talking about Cap1 Venture X. Instead, he is referring to X1 card, issued by Coastal Community Bank. The card has no annual fee.

Yep, as AlexL wrote, the section you are referring to was about the X1 card not the Venture X. That is really confusing since “Capital One Venture X” has both the “X” and the “1” in its full name.

Oops, sorry.

Hi Greg, I’m still fairly new to travel/points space so apologies if this is a total newbie question. No hotel or airline branded cards? Or do you just use those cards when staying at that particular hotel or flying on that particular airline or is Chase Sapphire Reserve still your go to for travel? Thanks.

Airline cards are mostly good just for getting free checked bags and other perks like that, but they usually don’t offer great rewards for spend. The same is true for hotel cards: they’re good for things like annual free night certificates or to help earn elite status, but they’re usually not too rewarding otherwise for spend. So, while I have a lot of hotel cards, for example, most of them stay in my travel wallet and only come out when paying for a hotel stay.

I actually use the World of Hyatt card a lot, and not just for stays, because when you want to be a Globalist at 60 nights, getting night credits, especially for the first $15,000 that also gets you a free night (and 6 night credits). In other words, the “things like annual free night certificates or to help earn elite status” mean enough to me with Hyatt that I will often use it at 2x for restaurants. Cheaper than using it at 1x on tax payments!

Yep that makes a lot of sense

Hey Greg, thanks for sharing what’s in your wallet. I’m just curious if you’ve had a chance to book and stay at a Vacasa rental yet. If so, how does it fit in with your hotel strategy? My main issue with Vacasa is that every place I look at has a minimum 3 night stay which kind of stinks since there are places I would like to stay for 1-2 nights.

I converted 2 Citi ATTAM CCs to 2 Citi Custom Cash CCs. My plan is to use each for restaurants and grocery, but I’m waiting until Q1 grocery ends on the Chase Freedom Flex. I’m trying to reduce the amount I pay in CC AFs so I’m planning on ditching the AMEX Gold card when the next AF posts.

Hi Grant, I remember your post booking Kauai with Vacasa, how did those turn out?

I really like there are no addtl cleaning fees etc booking thru Vacasa with points (would’ve otherwise been an extra $160/stay) + addtl 10% off points using my Wyndham Biz card. For now, at least, only way I will book an airbnb-type rental, incredible value!

The Vacasa properties in Kauai were great, especially the rental in Poipu. The nice thing about Vacasa is that Vacasa does a good job managing them and making sure they are clean and they sent you the lock box code and wifi password in an email and viewable in your Vacasa account and on the app.

Avoiding the cleaning fee and taxes/fees is a great deal indeed!

Agreed on Vacasa’s strict standards. Was evident from booking thru check out. Great experience & would have been truly seamless had I not used points & thus had the hassle of communicating with Vancouver by phone/email to get the booking finalized!

I liked there was both a local Vacasa contact provided if needed anything as well as another general Vacasa number to call if the local number failed. As you point out, it’s great all the communication by cell but by the same token not sure what happens if the rental is in an area with poor coverage since little upfront info is provided!

Thanks too about Poipu, Grant, will def check it out!

No, I haven’t booked a Vacasa stay yet. I came very close to booking one during my recent stay near LA, but I ended up staying at the Hyatt Regency Huntington Beach instead. Then I looked for my next trip to Florida, but the units that looked good weren’t available when I needed them.

Good plan regarding carrying multiple Citi Custom Cash cards! The only reason I hadn’t yet converted some old Citi cards is laziness. I need to get on that!

For an upcoming trip to Maui, I looked at Vacasa rentals 4+ months in advance and there were probably 75+ options available, but when I looked about a month in advance, there were only 1-2 options available. I think you definitely need to plan in advance and keep in mind the 30 day cancellation window. Much different than booking hotels since you can book single night stays, last minute stays, and cancel for free within 48 hours.

Do you have a Citi premier and prestige? You could convert the prestige to a Citi Custom Cash and also get a prorated refund on the annual fee.

Hi Greg, will we be getting your review of the HR Huntington Beach? Have a stay there planned for later in the year.

Yes soon

Nice write-up, Greg. Gave me some good ideas for further research for my own wallet.

Did I not see any mention of the Venture X card? I think it competes well against the Chase Reserve from what I’ve read.

Cap 1 venture x is a good card which is better than csr imo . But unfortunately Greg had an unfortunate issue with a venture card which scared me into cashing out my own points due to the shutdown .

I like the Venture X, but Capital One doesn’t like me: https://frequentmiler.com/capital-one-shut-down-my-account-and-gave-me-only-a-half-cent-per-mile/

I may get rid of the venture x card unless they offer a juicy retention offer or allow sameday airfare purchases or improve functionality of car rentals and express pickup at National ,Avis,Hertz.

oh yeah, I forgot. what a bummer!

Csr used to be a good card but lost the chance to have their own lounges like cap 1 and amex .Cap 1 is shady company maybe trying to turn it around but the cap 1 lounge is very nice and any priority pass with restaurant access and 15 total guests is a good deal . Just pay the card in full each month which could get me banned too.